Bollinger Block - This block is a "conditional block" that is triggered based on the price's behavior with respect to the Bollinger Bands®. This indicator is mainly used in technical analysis to study and capture volatile price movements.

Reminder of the basics

Bollinger Bands consist of a central line (a moving average) and two lines placed at a fixed distance above and below this central line (standard deviation) forming a channel.

This indicator allows you to know when prices are moving too far away from an average by taking into account its volatility. When the price leaves the upper band, we can say that the value is growing with strength. The opposite is true for the lower band.

Moreover, the faster the price moves in both directions and gains in volatility, the more the bands move apart. Conversely, the more volatile it becomes and the more stable the price becomes, the tighter the bands become. It is therefore possible to use the Bollinger Bands as an indicator of volatility or of an asset's decline.

To learn more follow these tutorials Investopedia and Tradingview wiki.

Block configuration

The drop-down menu brings here the possibility to define the trigger of the block: by analyzing the evolution of the closing prices, by analyzing the candles and by analyzing the gap of the bands.

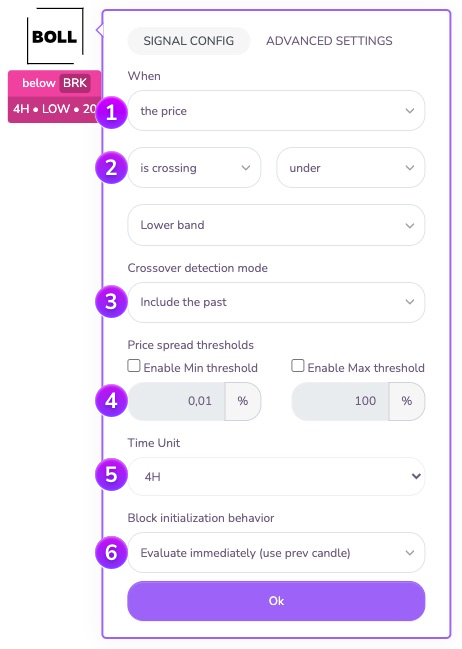

1 - Price Mode / Candles

This mode allows you to trigger an action based on the behavior of the price with respect to the Bollinger bands.

The difference between the analysis of the closing prices and the analysis of the candlesticks is invisible on a default configuration of the block, however it reveals all its interest in the case of using the validation thresholds (thresholds explained below in n°3).

When using thresholds, the block configured in price mode will be validated if the price evolution crosses the chosen band by X% on one or more candles (left image). On the other hand, the block configured in candle mode will be validated ONLY if the price evolution crosses the chosen band by X% on a single candle. This is a subtle difference, but it can be important.

This area allows you to select the condition that will trigger the block. Here you specify which signal you want to use and you can choose between :

- Position triggering: the block is triggered when the closing price is within the expected range (above or below) of a reference value (high, low or median band)

- Triggered by a cross: the block is triggered when the closing price moves from one zone to another in a specific direction (upward or downward cross) with respect to a reference value (high, low or median band)

In crossover waiting mode, an additional option is available: the taking into account of the past. This option allows you to take into account (or not) the previous candles for the validation of the block during its initialization.

Example: Suppose you set up a block to detect a cross between the price and the low band at 1 o'clock and the strategy arrives on this block at 5:30. Let's further assume that the price and the low band cross upwards at the close of the candle (at 6:00)

- The block configured for 'Include past' will be triggered because it detects a crossing between the 5 o'clock and the 6 o'clock candle.

- The block set to 'Ignore past' will not trigger because it will wait for a cross only from the 6 o'clock candle and will ignore the past state of the indicator.

In the case of the analysis between two curves, Kryll provides by default a set of threshold tools to erase false signals. These tools are available for the Bollinger block

Minimum threshold: This threshold allows you to define the minimum percentage above which the block will validate the crossing or the position. It is thus possible to erase the "false signals" which can appear in period of range, when the curves cross frequently on very small variations.

Maximum threshold: This threshold allows you to define the maximum percentage beyond which the block will no longer validate the crossing or the position. It is thus possible to avoid validating a condition on movements of extreme amplitude or too late.

You can specify the Time Unit on which you want the block to operate.

Behavior at initialization: Here you can define the behavior of the block at its initialization. You can either wait for the current candle to close (option "Wait for next close"), or instantly evaluate the block conditions on the last closed candle (option "Evaluate immediately"). This last option is particularly useful to perform analysis on several time units in parallel or to analyze an indicator on a macroscopic time unit (12H / Daily / Weekly...) without blocking the strategy by waiting for a candle to close.

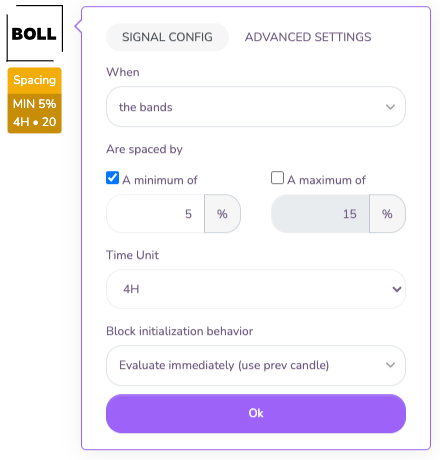

2 - "Bands" mode

This mode allows you to trigger an action based on the spacing of the Bollinger bands between them. This mode is useful to identify high volatility movements, impulsive movements and range zones (trading zone, horizontal channel).

In this configuration, you can define the minimum and/or maximum strip spacing at which you want to trigger the block.

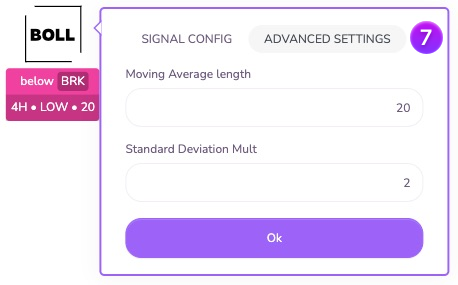

Configuration of the BOLL indicator(s)

If you want to change the default value of the indicator, you can do so here:

Moving Average Length: Allows you to set the length (number of candles taken into account) for the calculation of the Moving Average (MM or MA).default value: 20

Standard deviation: Represents the number of deviations observed between the Moving Average (MA) and the upper and lower bands for the block to be triggered. Default value: 2

Do not hesitate to join us on our Telegram and Discord groups as well as our other social networks to share your opinion and your feedback on the Kryll.io platform.

Happy Trading,

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io