Trading algorithms have been around for many years in the financial markets. This is obviously also the case in the field of cryptocurrencies. But why use these algorithmic bots? We will try to answer that in this article.

1. Avoiding external pressure (FOMO)

2. Avoid being subjected to your own emotions

3. Save time with more disciplined

1. Avoiding External Pressure (FOMO)

"FOMO" is an acronym for "Fear of Missing Out".

This can literally be translated as "Fear of Missing Out" on an opportunity.

In other words, the possible consequence is a frustration with a feeling of being excluded from those who have followed the trend.

This frustration can be "calmed" either:

- Giving in to temptation without weighing the pros and cons

- Going for a consultation if you are chronically tempted

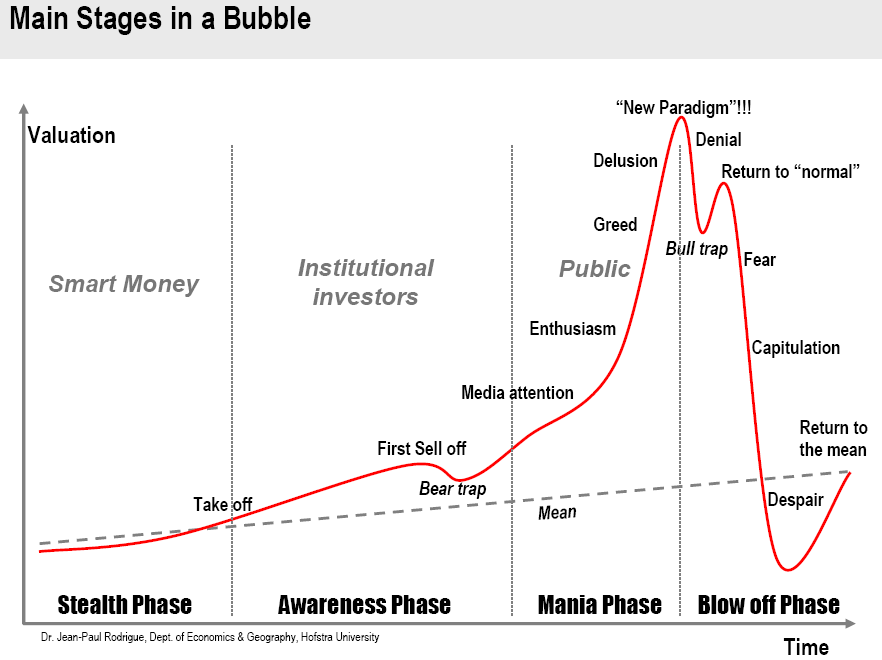

- Convincing yourself that the asset might have less potential than expected given that the price has risen by a factor of 10 in the space of a few days; this is the "mania" phase (see figure below):

While the buying signal is already well underway, some influencers do not hesitate to promote their favorite corners often at the 3/4 of the Mania phase as we can see on the diagram above.

Practical case with the doge:

So we can say that there was a very brief opportunity not obvious knowing that the price of Dogecoin had already had a nice increase at the end of January which corresponded to the Mania phase but this one finally continued.

Moral of the story:

Trusting influencers without doing your own research can be risky.Don't forget that these people are sometimes paid. If it sounds too good to be true, it probably is.

Tools exist to complement the automated strategies Kryll, we have Lunarcrush seen in the article on decentralized applications and which can filter a good part of the coins and result in a favorable launch (not late) of one of our strategies adapted (here to Dogecoin).

Illustration of the movie The Wolf of Wall Street based on real facts: the main character "Belfort Jordan", played by Leornardo Dicaprio, will convince by phone investors on "unlisted" assets on the Wall Street stock exchange....

We find the same situation with today's altcoins of small capitalizations little or not listed on the stock exchanges but decentralized (DeFi) with a better reward for the influencer highly paid by the crypto project in exchange for a promotional campaign on Twitter, Instagram or even TikTok; social media much faster, effective and viral than the phone.

2. Avoiding your own internal emotions

We have seen the external influences but these are subject to our own emotions and judgments.

The typical example is to fall "in love" to your favorite crypto asset and never sell it even when 99% of the coins have a sell signal.

You can love the long term vision of the project, interact with the team and the Telegram community, but you can do a monthly or weekly review and step back. You have to be ready to jump ship if something goes wrong. There is no shame in this, in trading, your self-interest comes first.

Another point to raise is compulsive trading with a lack of patience. "The stock market is a device for transferring money from the impatient to the patient". This quote from Warren Buffet is perfectly relevant to cryptocurrency trading.

Solutions to explore:

Don't rush your decisions and use the tools highlighted in our articles to filter corners, strategies and the "FOMO" trend.

You cross-reference these aids with your research and with some answers and opinions from the Kryll community in order to forge a solid opinion of the current situation.

Even more so with these few habits, you will gain confidence in your analysis and start strategies adapted to the market and to the chosen coins.

On the other hand, beware of overconfidence

A succession of winning trades can lead to a period of euphoria catalyzed by social networks that bring a succession of positive news.

We can then feel "overpowered" and think that future trades will also be winners.

Reflection lines:

Question each transaction with why not an analysis of past risks (with backtests and history of lives) with reduction or not of the exposure of your capital to the chosen crypto asset.

You can do a weekly and monthly review with a logbook; you can also report the historical data of the trades from the Kryll platform.

Talk with the community on Telegram, you can also realize that your gains may be "out of name" and that it is likely that you are taking too much risk by exposing too much of your capital.

Why not in this case, choose a less risky strategy adapted to the large gains you have accumulated.

3. Save time with better discipline

We have seen the emotional part with "right brain" dominance, but the part concerning the reason part "left brain" is just as important to make good decisions.

Some discipline is required for manual trading, but automated trading puts as many people as possible at that same level of discipline with several means and tools:

- Internal strategy blocks that make buy/sell decisions for you

- Strategy descriptions that describe potential strategy goals and behaviors

- Publisher's customer support Telegram groups that answer questions with help on goals and diversification, moral support if launch mistakes... etc

Trade while you sleep:

The other very important advantage of automated trading is that your bot/strategy will monitor the market 24/7, regardless of the time zone.

You are sleeping, your bot will still react to the slightest market movement, without needing you. You just have to monitor via the Kryll apps your short term strategy, but medium/long term strategies need less monitoring.

In conclusion, we can say that human emotions will have much less effect with the use of automated strategies.

The bot can stick to internal objectives to the strategy developed upstream by the Publisher and the latter can even give additional indications to reassure the user. Thus, Kryll offers an ambitious automated trading tool that "bypasses" most of the emotions, but makes up for it with the human side of the craftsmen-Publisher, easily accessible and reassuring the users.

Happy trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.zendesk.com