AI agents have been moving from a meme to a product category, with a simple promise: stop clicking through dashboards, and start expressing intent. In that context, HeyElsa has recently attracted extra attention through new exchange availability and trading campaigns, a pattern that often amplifies visibility even when the underlying product is still being discovered by the broader market.

But beyond the headlines and the short-term noise, what is HeyElsa actually building, and what do the measurable signals say about its profile today?

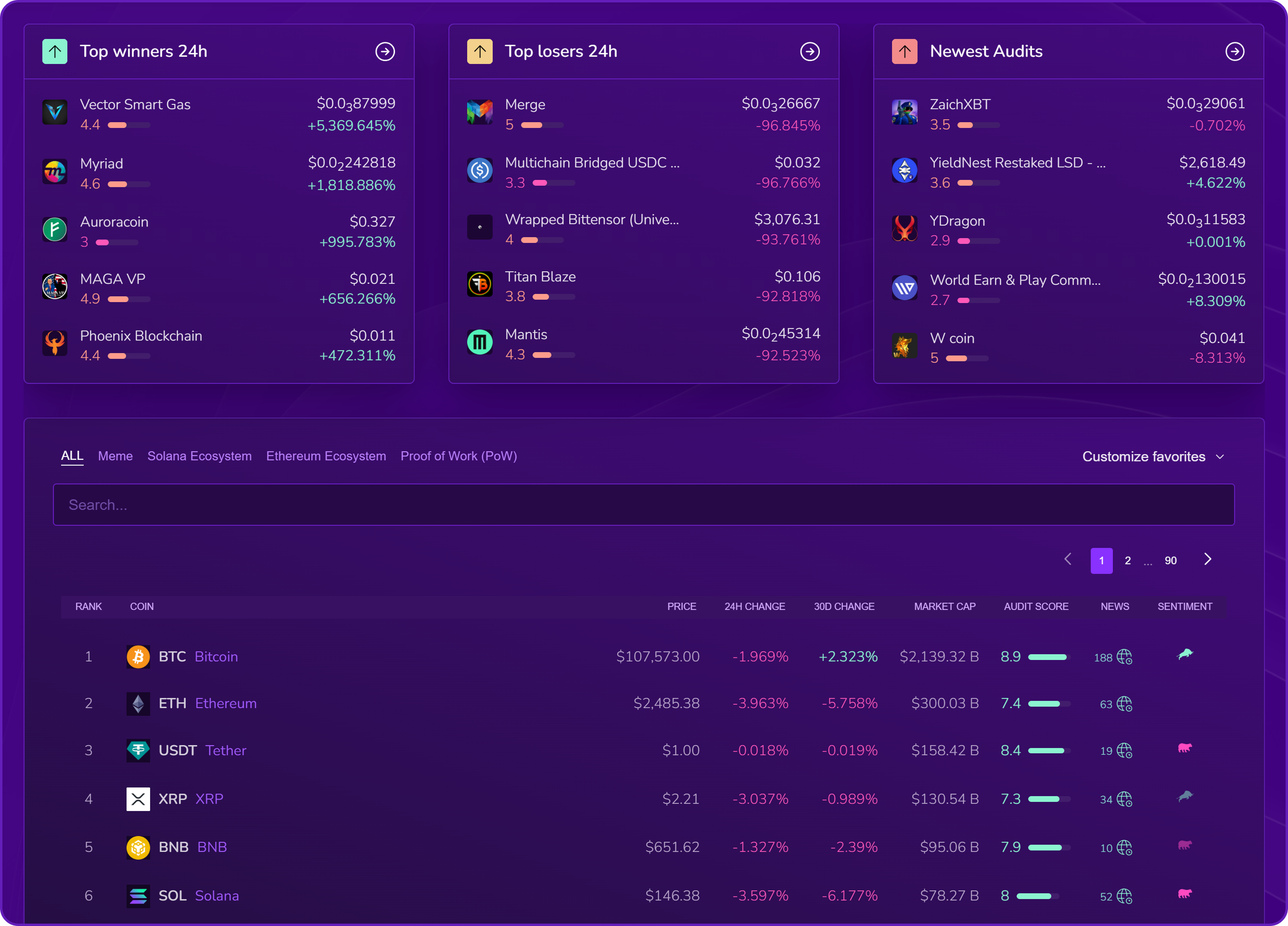

This is where Kryll X-Ray is useful, because it breaks a project down into auditable indicators, and forces the conversation to shift from narrative to structured signals.

What is HeyElsa ($ELSA)?

HeyElsa presents itself as an “AI crypto copilot”, a conversational interface designed to help users execute crypto actions without navigating multiple dApps and dashboards. In plain terms, it aims to turn “what you want to do” into an on-chain transaction flow.

What it is trying to simplify in DeFi and crypto execution

DeFi execution is often fragmented across chains, bridges, protocols, and wallets, with a UX that assumes users know exactly what to click and where. HeyElsa’s positioning targets that friction directly: compress decision and execution into a single intent layer, so that discovery, execution, and portfolio actions feel closer to “one conversation” than to a multi-step workflow.

How does HeyElsa work, from intent to execution?

The core idea is an intent layer: a system that interprets a user prompt, maps it to a set of explicit actions, and then executes those actions on-chain. Conceptually, the goal is to make “thought becomes transaction” more than a slogan, by compiling intent into a deterministic execution path.

The typical workflows associated with this category include swapping, bridging, staking, and automation of portfolio actions, all expressed as intent rather than manual navigation. The value proposition is less about inventing new DeFi primitives, and more about reducing the cognitive load of using the ones that already exist.

The X-Ray audit of HeyElsa ($ELSA)

Narratives help you understand why a project exists, but they rarely tell you how robust it looks under pressure, or where weak signals hide in plain sight. To move past the surface story, the Kryll X-Ray audit breaks the project into section-by-section indicators, and translates scattered signals into measurable metrics that can be reviewed with a colder eye.

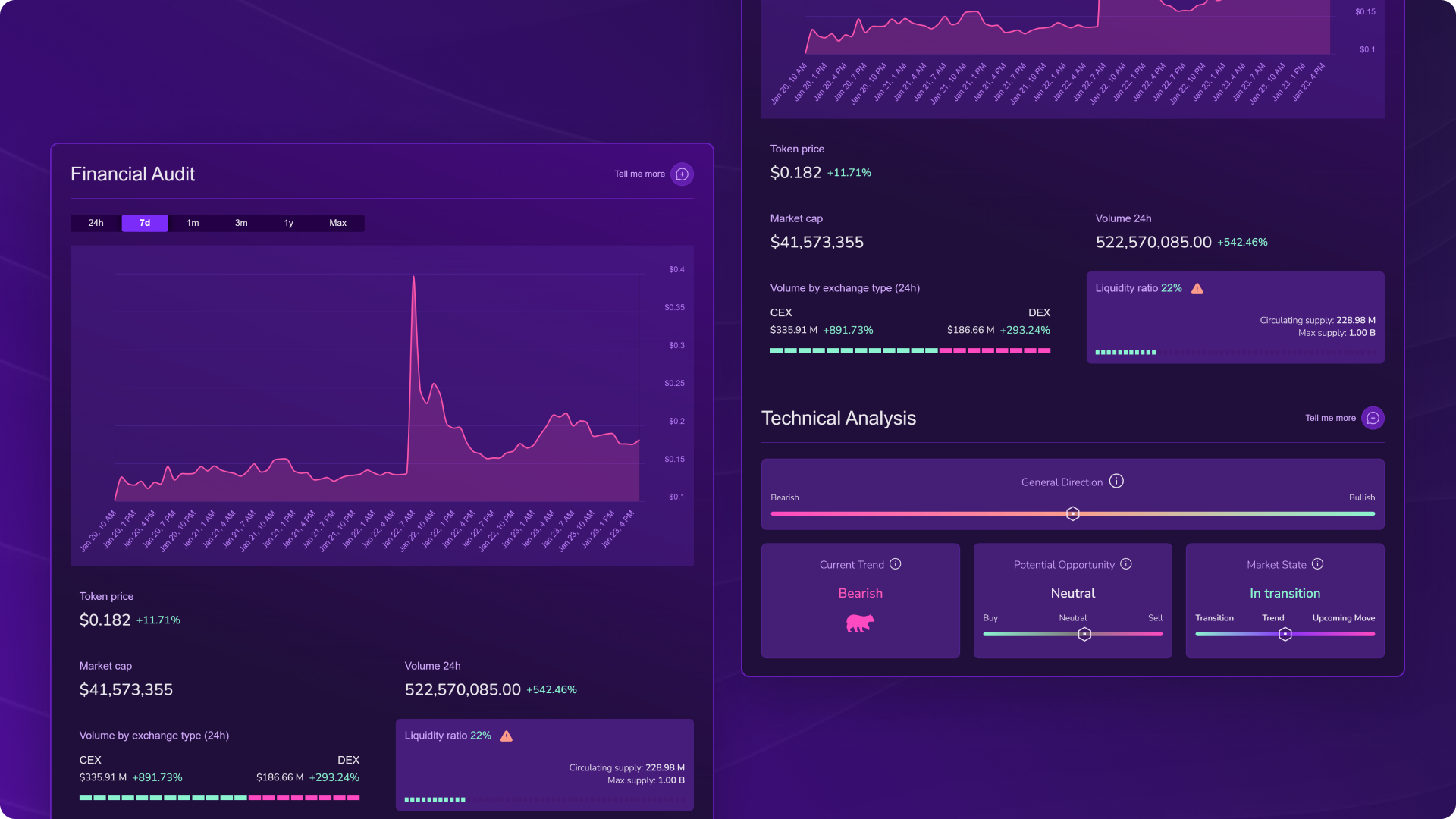

Financial analysis of HeyElsa ($ELSA): High activity, but liquidity looks thin.

- Financial subscore: 73

- Token price: $0.182

- Market capitalization: $41,573,355

- 24h volume: 522,570,085.00

- Liquidity ratio: 22%

- Circulating supply: 228.98M

- Maximum supply: 1.00B

👉 To simplify: the audit shows very strong recent activity through volume, split across CEX and DEX, but the liquidity ratio at 22% signals that depth may not match turnover, which can make price action more sensitive to flow than it looks at first glance.

Technical analysis of HeyElsa ($ELSA): The trend is bearish with a transitional setup.

- General direction: indicator positioned near the middle of the bearish to bullish scale

- Current trend: Bearish

- Potential opportunity: Neutral

- Market state: In transition

👉 In practical terms: the KPIs read like a market that is not in a clean trend, with bearish momentum still present, while the “in transition” state and neutral opportunity indicator suggest conditions may be shifting without a clear directional confirmation.

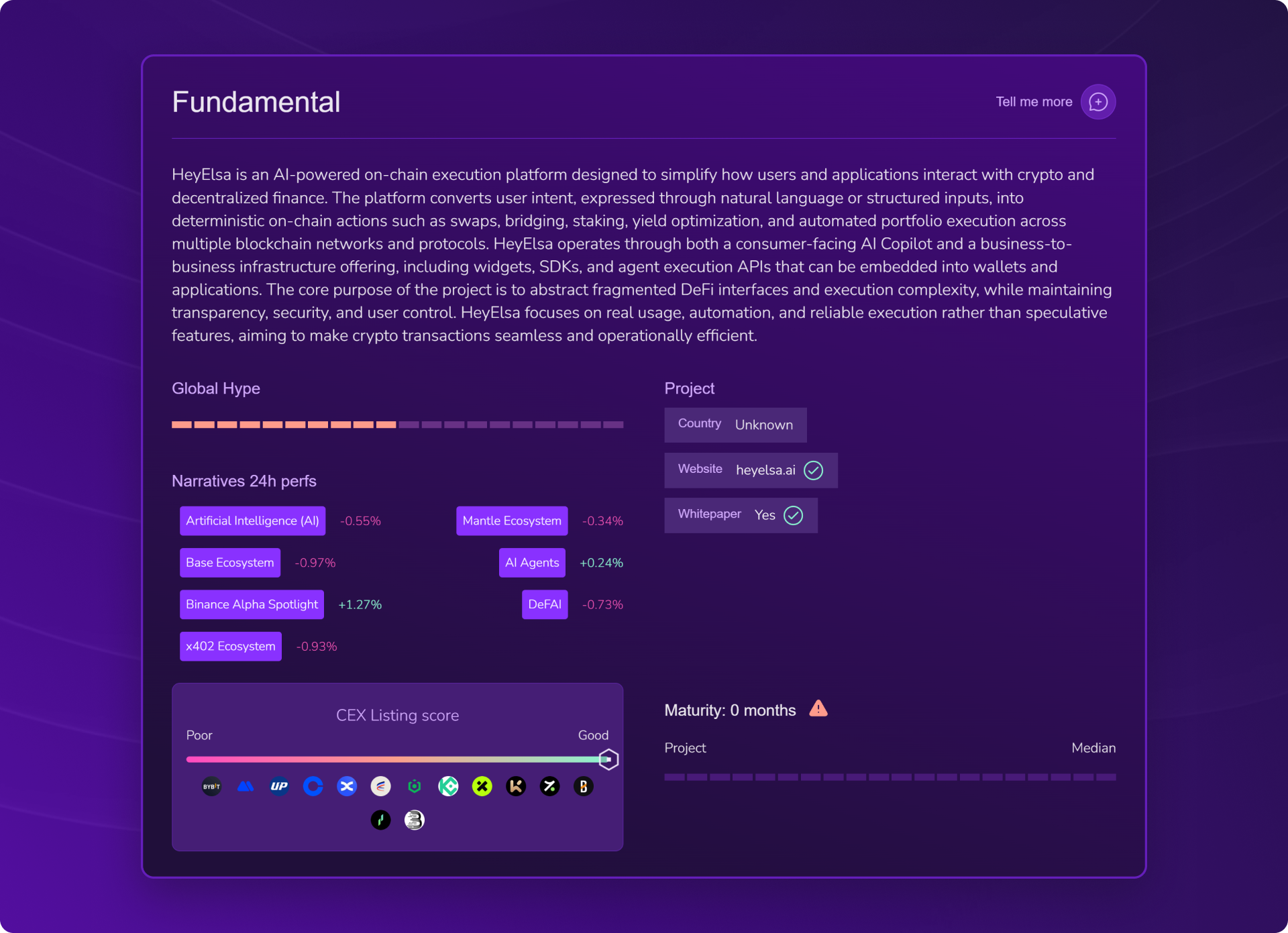

Fundamental analysis of HeyElsa ($ELSA): Early maturity with partial transparency signals.

- Fundamental subscore: 61

- CEX listing score: indicator positioned near “Good”

- Maturity: 0 months

- Country: Unknown

- Whitepaper: Yes

👉 The takeaway is: the audit frames fundamentals as early-stage, with a whitepaper present, but an “0 months” maturity signal and an unknown country field highlight that some baseline context remains thin or unresolved at the time of the scan.

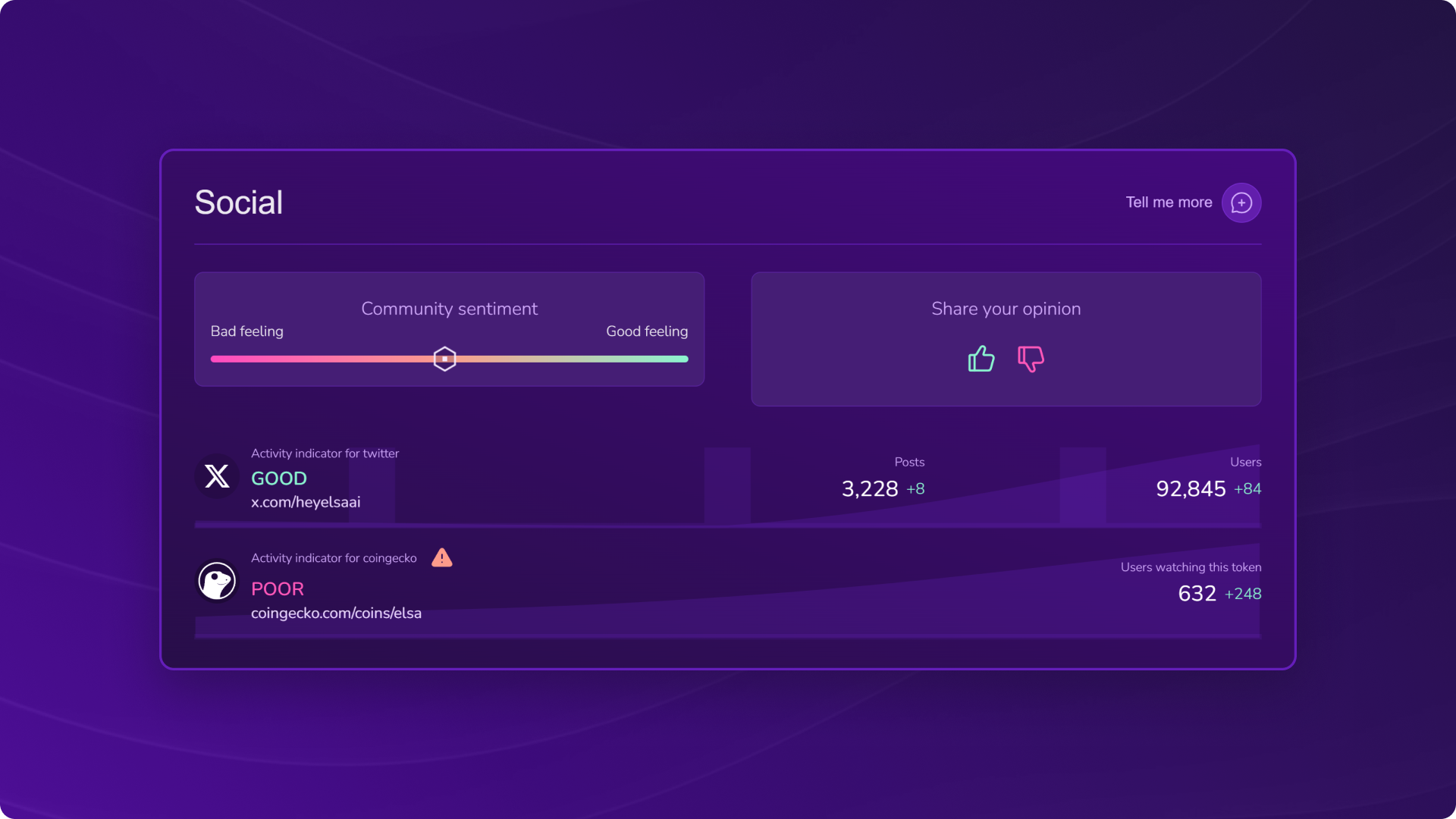

Social analysis of HeyElsa ($ELSA): Solid X activity, weaker CoinGecko activity signal.

- Social subscore: 68

- Community sentiment: indicator positioned near the middle

- Twitter/X: 92,845 followers

- CoinGecko: 632 users watching $ELSA

👉 Put simply: the audit shows meaningful visibility on X and a moderate sentiment read, while the CoinGecko activity indicator being poor, despite a visible watchlist count, suggests attention may be uneven across platforms.

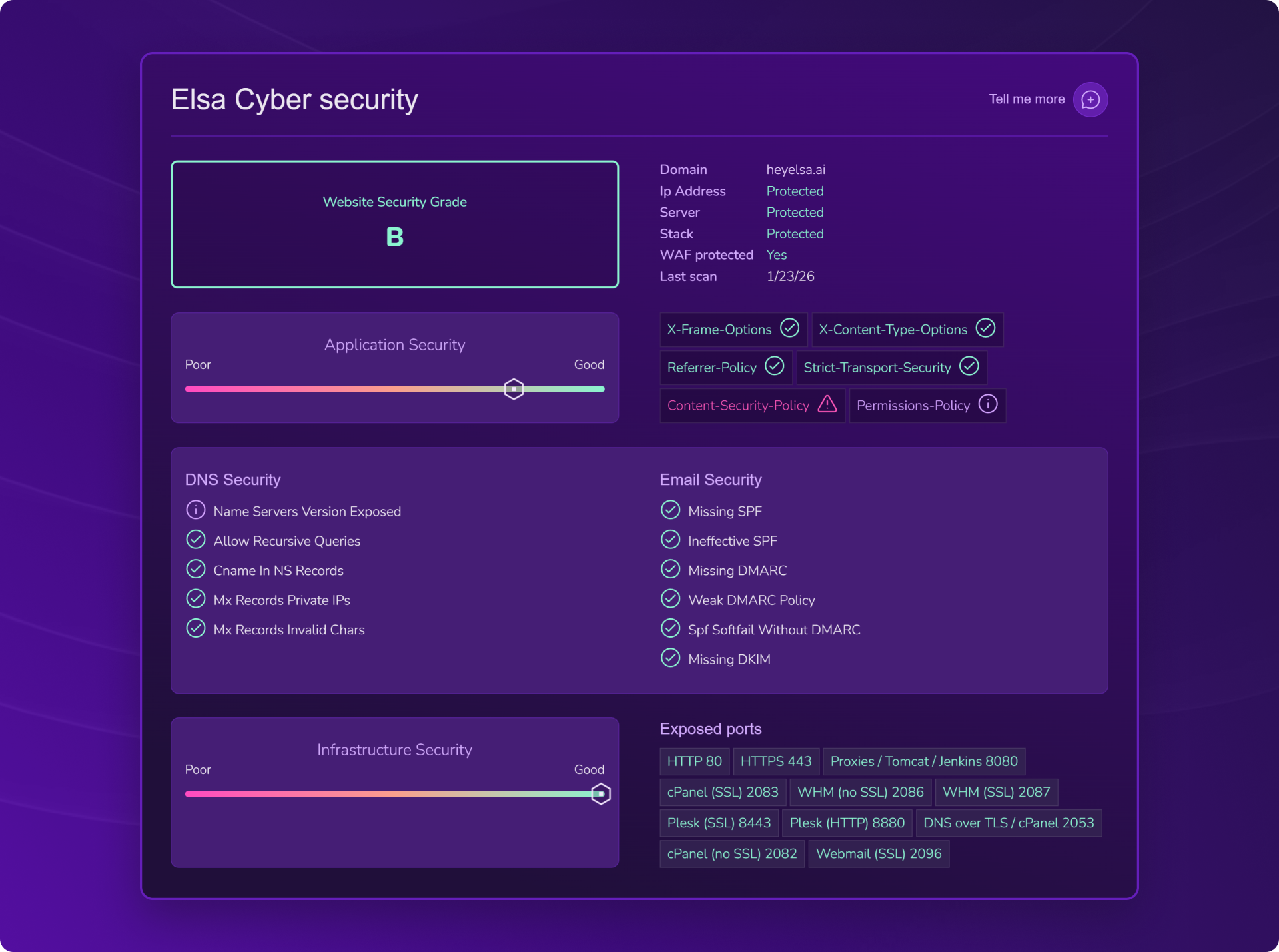

Cybersecurity of HeyElsa ($ELSA): Grade B, but several configuration risks appear.

- Security subscore: 76

- Website security grade: B

- ⚠️ Content-Security-Policy

👉 In summary: a B grade is a decent baseline, but fix of Content-Security-Policy flag can matter for reducing certain classes of web injection and content risks.

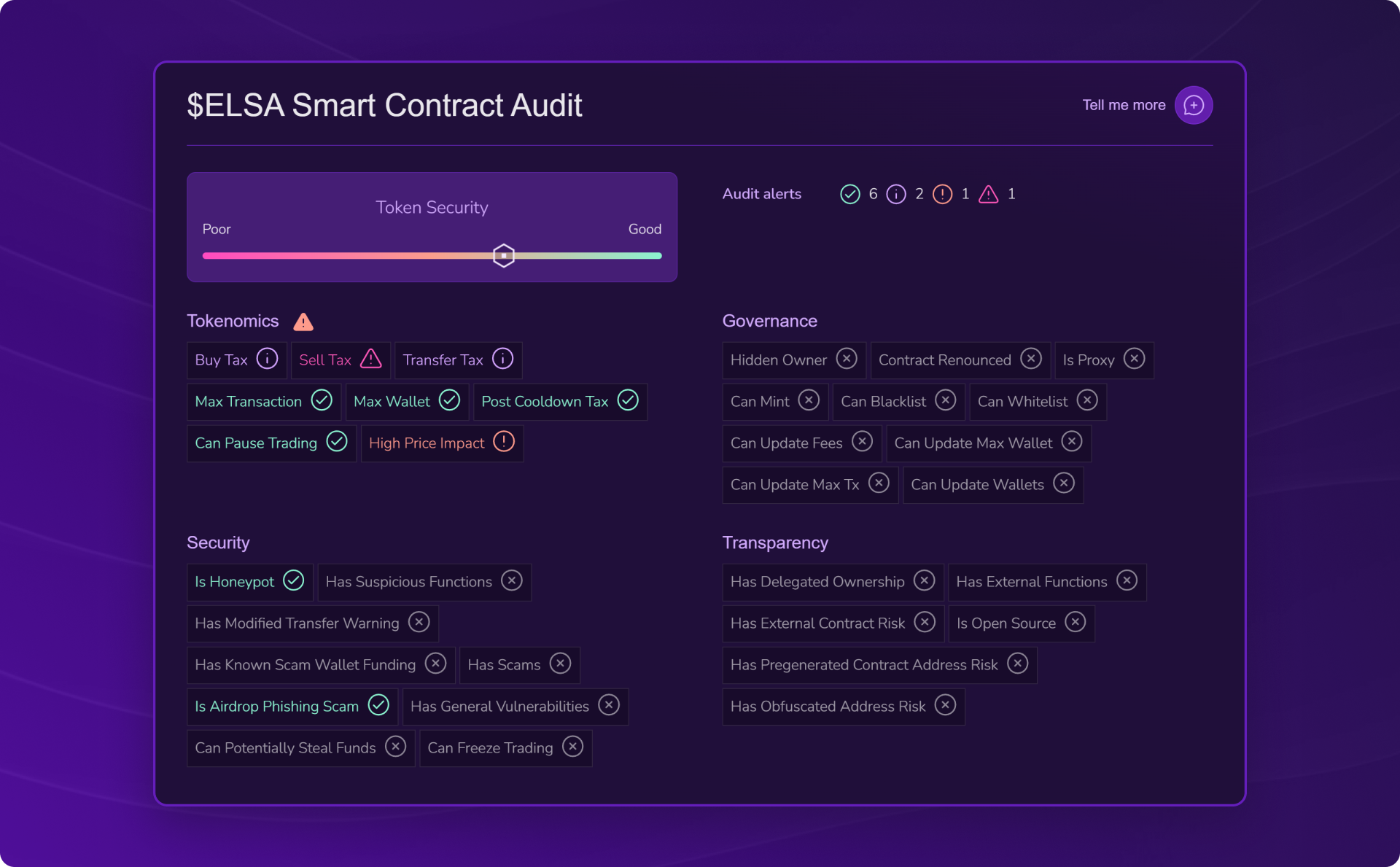

Smart Contract audit of HeyElsa ($ELSA): Token mechanics flags show friction points.

- Security subscore: 76

- Token security indicator: marker positioned around the middle of the “Token Security” scale

- ⚠️ Sell Tax

- ⚠️ High Price Impact

👉 To break it down: the audit highlights token-mechanics related friction, with a sell tax flag and a high price impact flag, which can affect trading conditions and user experience during execution, especially when liquidity conditions are not robust.

On-chain data of HeyElsa ($ELSA): Concentration dominates the distribution picture.

- On-chain subscore: 60

- ⚠️ Top 10 holders supply concentration: 96% (computed from the percentages shown for the top holders)

- Total holders: 89,345

- Total transactions: 231,320

- Number of chains available: 2

- Deployment and Activity: indicator positioned close to the “Good” end of the scale

- Decentralization: indicator positioned around the middle of the scale

👉 In simple terms: the activity and deployment indicators look strong, but a 96% top-10 concentration is an extreme distribution signal that can outweigh many other metrics, because it implies supply control and liquidity dynamics may be heavily dependent on a small set of holders.

The verdict: strengths and weaknesses of HeyElsa ($ELSA)

Strengths:

- Financial subscore at 73, with 24h volume shown at 522,570,085.00 (+542.46%).

- Security subscore at 76, with a Website security grade of B.

- Twitter/X activity indicator marked GOOD, with 3,228 posts and 92,845 users.

- CEX listing score indicator positioned near the “Good” end of the scale.

Weaknesses:

- Liquidity ratio shown at 22%

- Maturity shown at 0 months, with Country listed as Unknown in the fundamentals panel.

- Smart contract flags include Sell Tax and High Price Impact.

- Top 10 holders supply concentration of 96%, with an On-chain subscore of 60.

Conclusion

HeyElsa reads like a product-led attempt to compress DeFi execution into an intent layer, which is a compelling direction if the execution is reliable and the trust model holds up. The Kryll X-Ray signals, however, sketch a profile where activity exists, but structural risks remain visible, especially around liquidity depth, token mechanics flags, and extreme holder concentration. If the project continues to gain attention, the most useful stance is not hype or dismissal, it is vigilance, and a willingness to let measurable indicators lead the story rather than sentiment.

Why use X-Ray?

DYOR is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

- ⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

- 🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

- 🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

- 🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

- 💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

- 📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

With all these cross-analyses, X-Ray offers much more than a simple glance: it's a true intelligent dashboard, designed so everyone can understand, compare, and decide without getting lost in complexity.

| Criteria | Manual Audit 😩 | Audit with X-Ray 😎 |

|---|---|---|

| Ease | Complex | ✅ Ultra-simple |

| Time spent | Several hours | ✅ A few minutes |

| Risks detected | Variable | ✅ Automatically listed |

| Number of tools needed | Several dozens | ✅ All-in-one in X-Ray |

| AI Agent integration | None | ✅ Integrated |

How to access X-Ray?

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.