Ready to dive into the world of perpetual trading on dYdX? Whether you’re here to take your first steps or just need a quick refresher, this guide has you covered. We’ll walk you through everything—from getting familiar with the trading interface to opening, managing, and closing your positions with essential tools like take-profit and stop-loss orders. No fluff, just the essentials to get you up and running in no time. Let’s get started!

Summary

- What is dYdX?

- Trading Terminal Interface Overview

- Set Up dYdX and Deposit Funds

- How to Trade on dYdX

- How to Set a Take Profit and Stop Loss on dYdX

- How to Close a Trading Position on dYdX

- Frequently Asked Questions

What is dYdX?

dYdX stands as the leading decentralized exchange (DEX) for perpetual contracts, offering traders the flexibility to take long or short positions on a wide range of cryptocurrencies with leverage up to 100x. Unlike spot markets, perpetual trading enables you to capitalize on price fluctuations in both bullish and bearish conditions—allowing for strategic positioning in any market trend.

dYdX Trading Terminal Interface Overview

Navigating a trading platform should be as smooth as executing a perfect trade. The dYdX Trading Terminal is designed to give you all the tools you need—right at your fingertips. Mastering this interface is the first step to mastering the market, so let’s dive in!

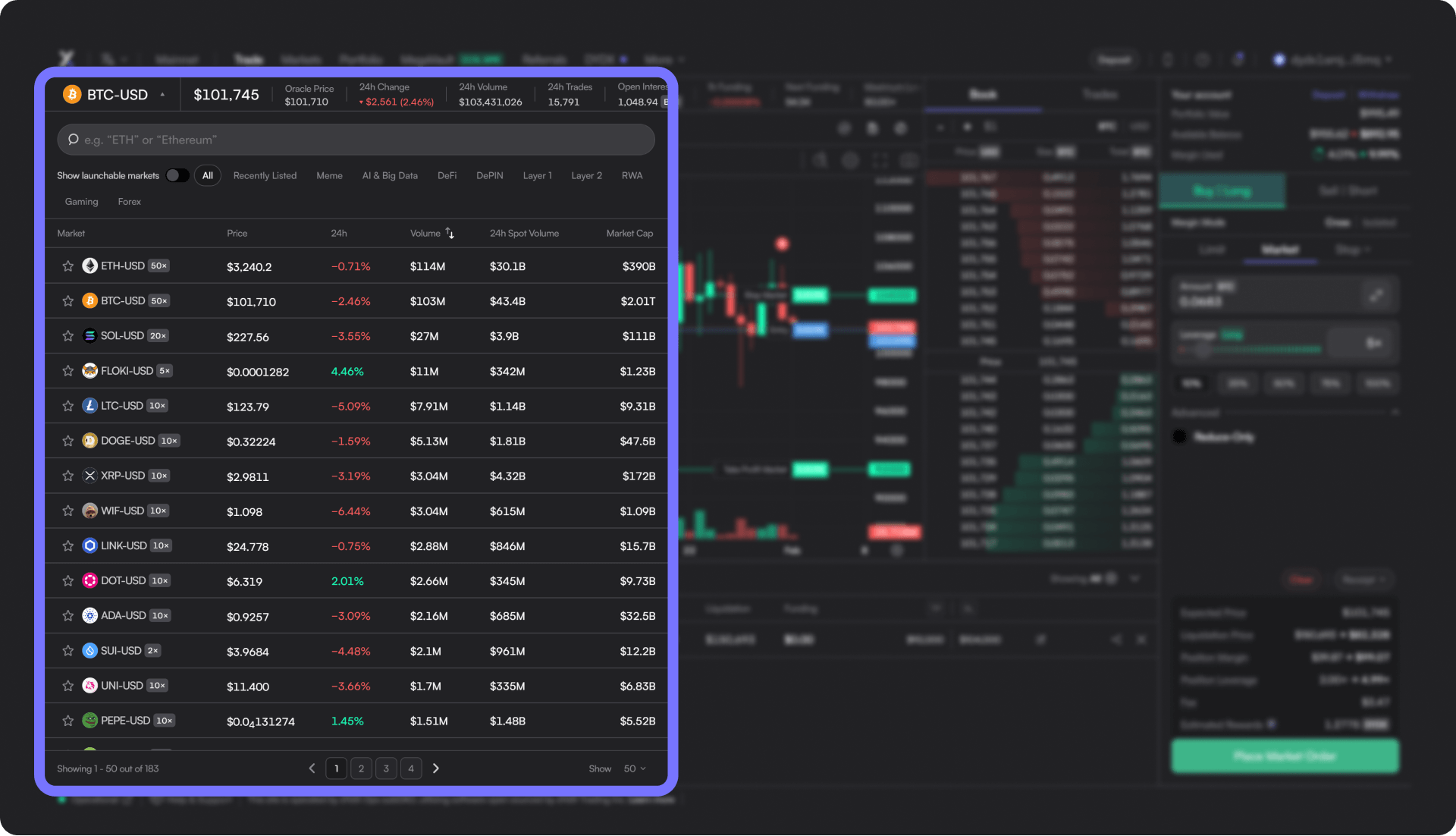

Asset Selection Panel

This is where you pick your favorite assets! By default, dYdX drops you into the BTC-USD contract, but a whole range of cryptos is just a click away. Simply click on the asset at the top left of the screen to expand the full list, browse the available markets, and take your pick before the market moves!

Asset Chart & Data

This section offers a clear view of the selected trading contract, displaying the asset's price chart along with key contract metrics such as open interest, funding rate, and the maximum available leverage. It also provides a visual representation of your position’s entry price, liquidation price, as well as take profit and stop loss levels directly on the chart, ensuring better clarity and risk management.

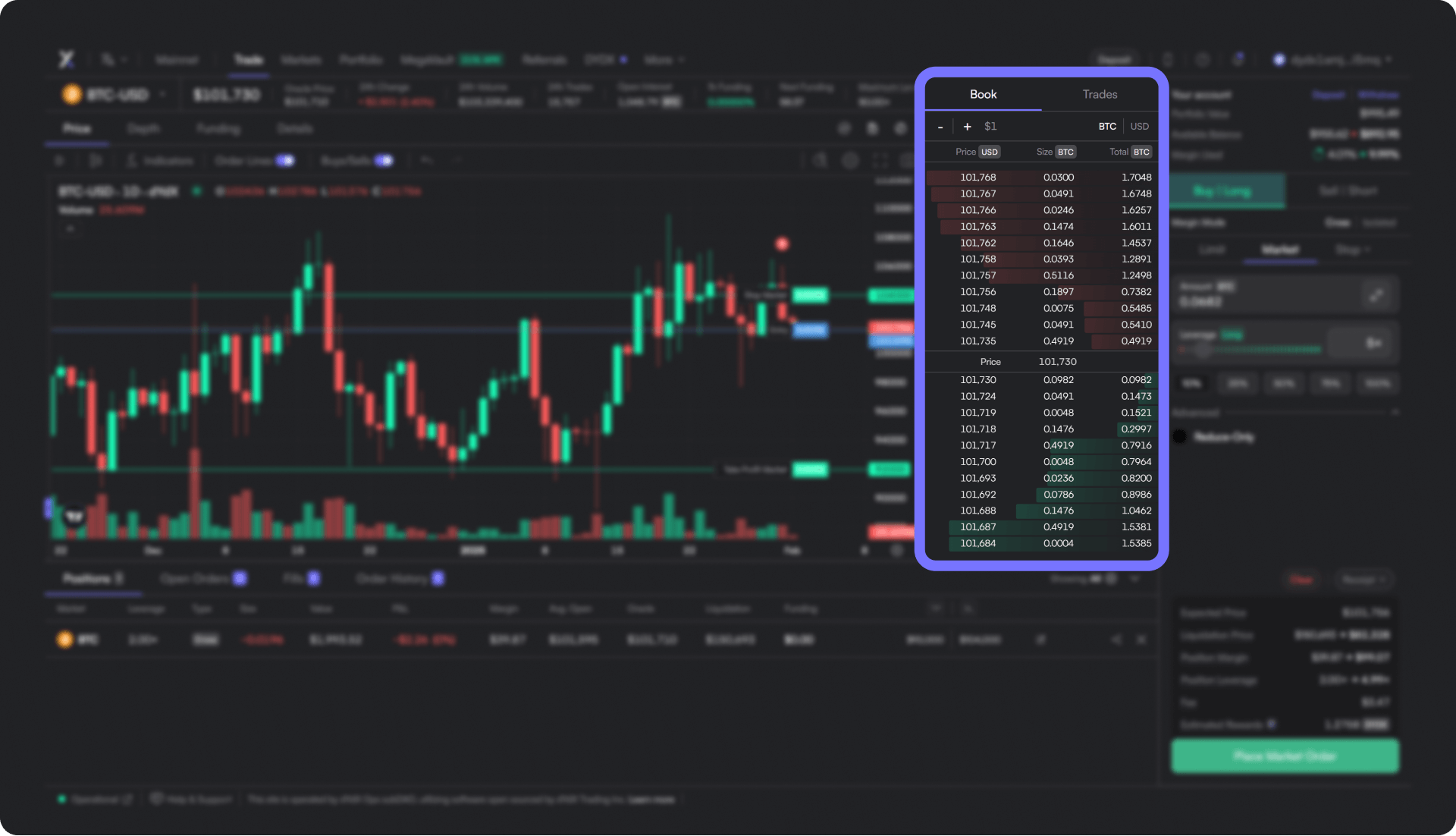

Order Book

The order book is a real-time registry of buy and sell orders, organized by price level, showing market depth and liquidity for the selected contract. If you're familiar with trading on centralized exchanges, the setup will feel instantly familiar. What's even better is that, unlike centralized exchanges, trades on dYdX are recorded on-chain, ensuring full transparency and allowing you to review all executed trades in the "Trades" tab of the order book.

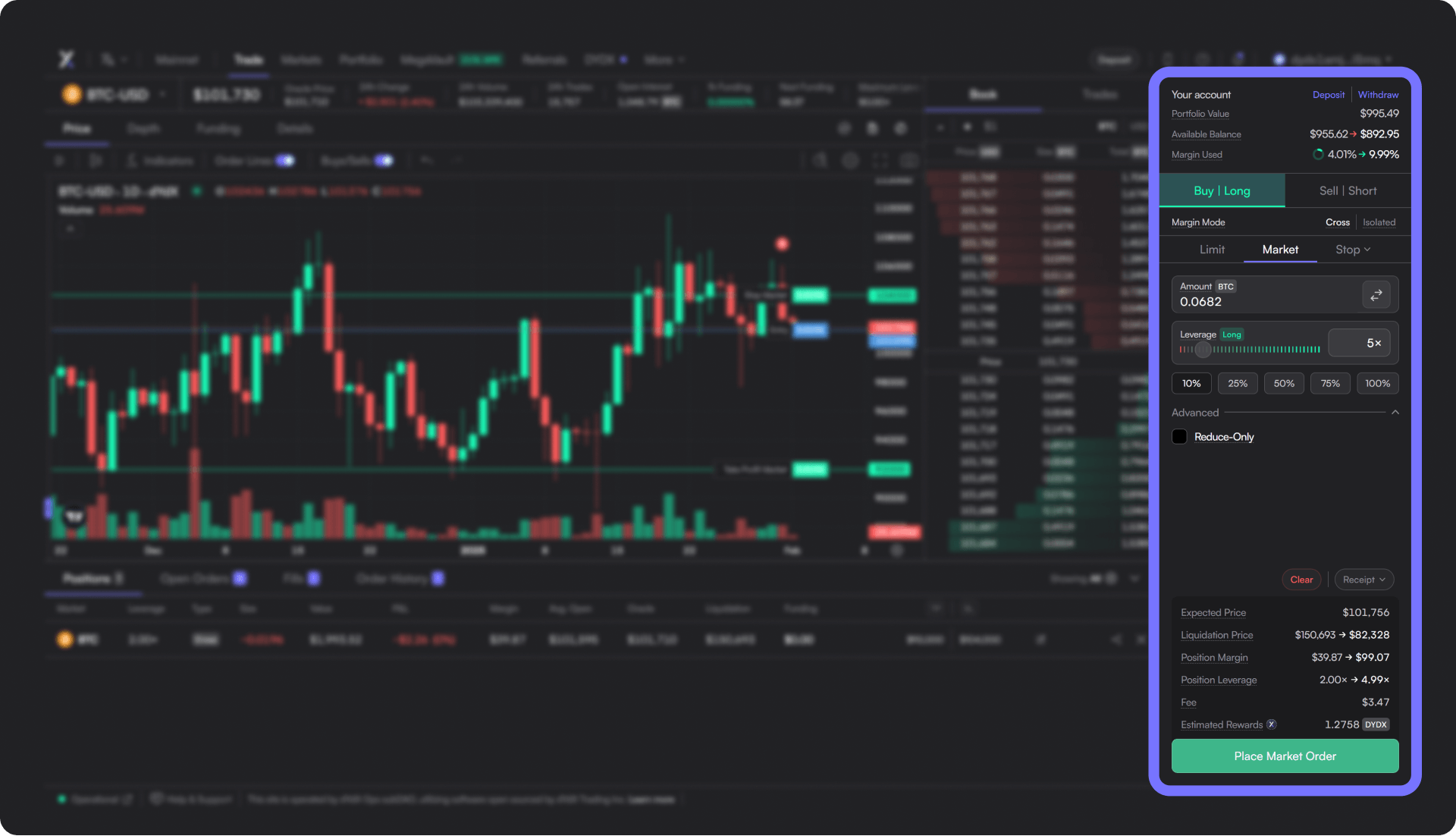

Trade Setup Panel

This is where seasoned traders rack up the most clicks! This panel is all about setting up and executing your trades. Choose your position—long or short—adjust your trade size, and fine-tune your entry price. Everything you need to launch your next move is right here.

Trade Management Panel

This is where all your open positions are listed, allowing you to manage them efficiently and track your P&L in real time. Set a stop loss, take profit, or close positions manually—all from here. Additional tabs let you review pending orders, check the history of executed trades, and access a complete record of all your trading actions.

Set Up dYdX and Deposit Funds

Now that you’re comfortable with the interface, it’s time to take things to the next level and start trading. However, before you can begin, you’ll need to set up dYdX and deposit funds as collateral. Luckily, we've got a tutorial to guide you through it: How to Set Up dYdX and Deposit Funds

How to Open a Long or Short Trading Position on dYdX

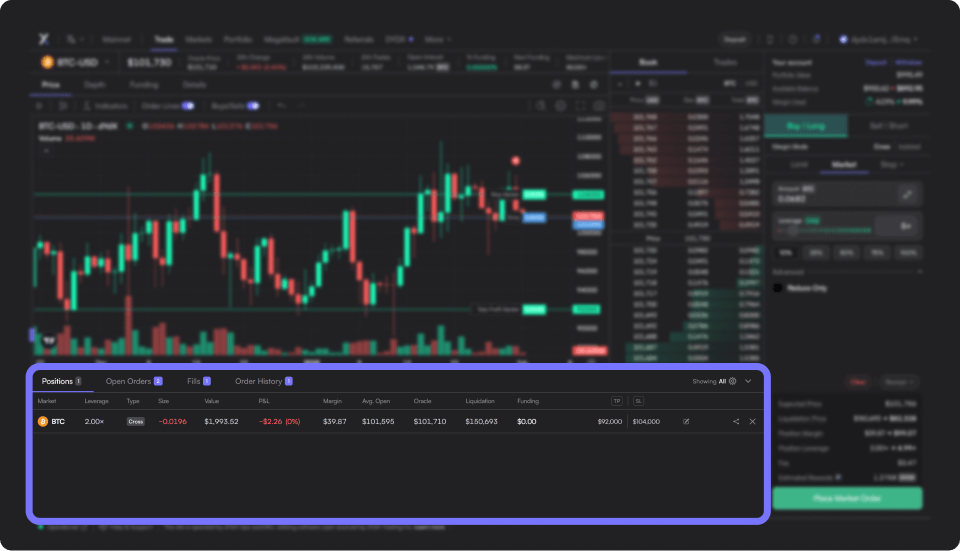

Ready to place your first trade on dYdX? Opening a position is quick and easy—just follow these steps to get started.

- Choose the position type – Long or Short (in this tutorial, we select Long)

- Select the margin mode – Cross or Isolated (here, we use Cross)

- Choose the order type – Market or Limit (we opt for Market in this example)

- Enter the desired position size – Specify the amount you want to trade

- Review the order details – Check key information, including the estimated margin usage

- Click the button to place the order – Confirm your trade execution

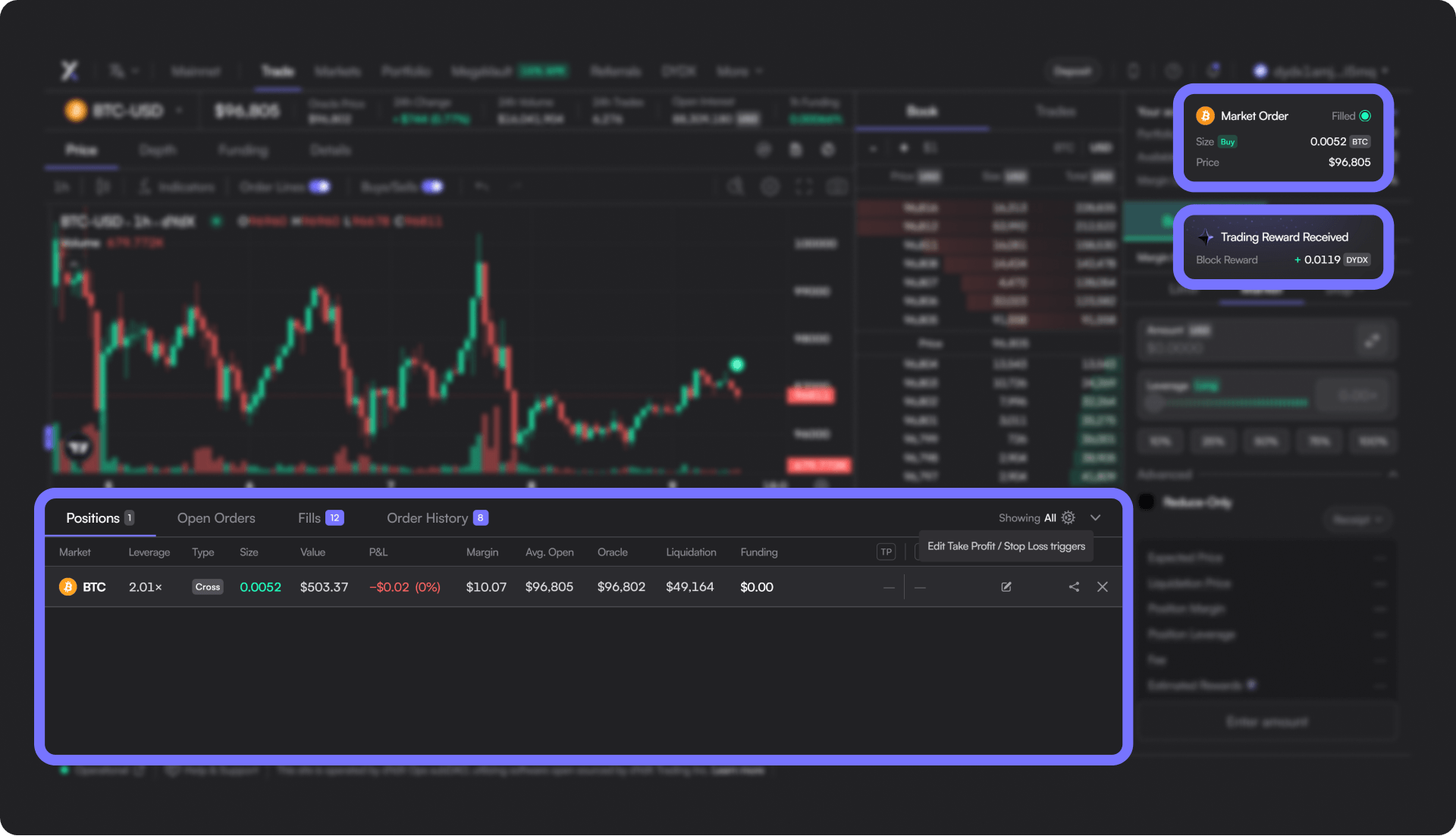

✅ Your trade is now open! You can now view it in the Trade Management Panel. Additionally, two confirmation messages will appear to notify you of the successful execution of your position and the receipt of your $DYDX token rewards.

How to Set a Take Profit and Stop Loss on dYdX

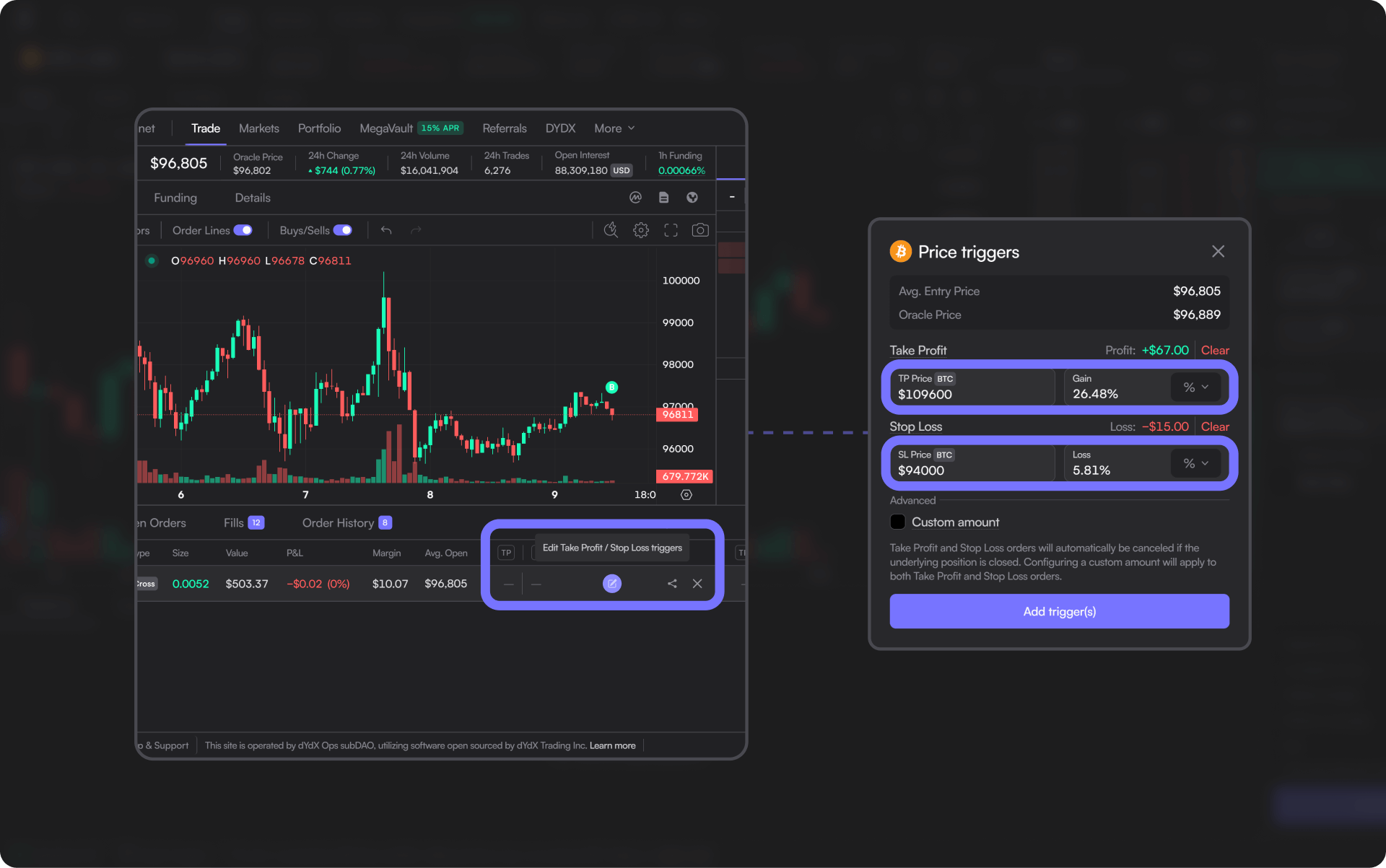

Opening a trade is just the beginning—managing it effectively is what sets skilled traders apart. Setting a Take Profit and Stop Loss helps you stick to your strategy and manage risk effortlessly. Here's how to do it:

- In the Trade Management panel, click "Edit Take Profit / Stop Loss triggers" for the position you want to update

- Set your Take Profit and Stop Loss in the designated fields

- Confirm by clicking "Add trigger(s)"

✅ Your Take Profit and Stop Loss are now applied and active. Congratulations, you just unlocked the “Not a Reckless Trader” achievement!

How to Close a Trading Position on dYdX

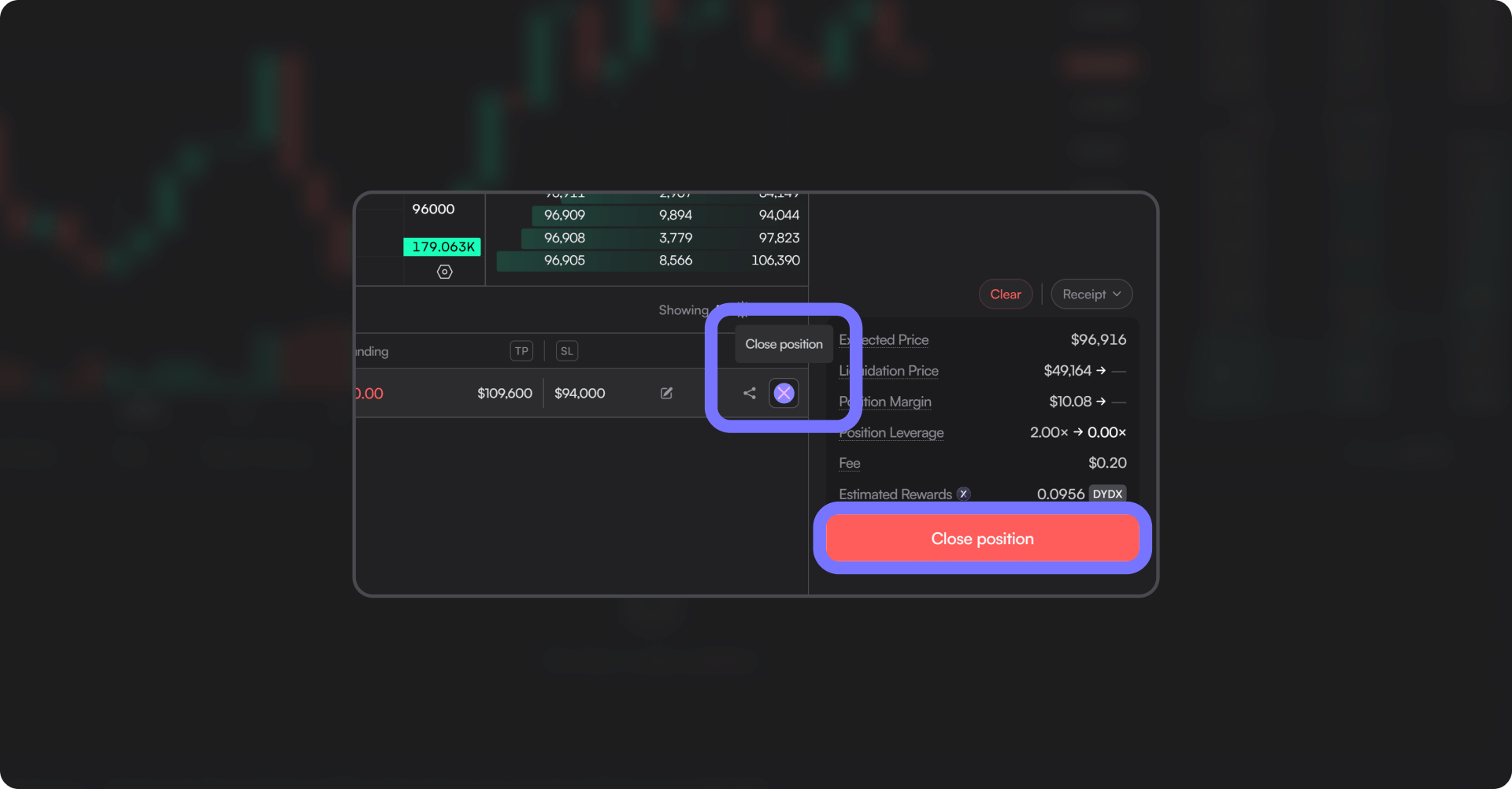

Sometimes, you’ll need to manually close a position—whether to lock in profits, cut losses, or simply manage your trades efficiently. Whatever the reason, closing a position on dYdX is quick and straightforward. Here’s how to do it:

- In the Trade Management panel, click "Close Position" for the position you want to close

- Click the red "Close Position" button to confirm

✅ Your position is now closed! Time to analyze, adjust, and prepare for your next trade.

That’s it! You’ve now learned the basics of trading on dYdX—how to open, close, and manage your positions with ease. With these fundamentals in hand, you’re ready to explore the platform and execute your trades confidently. Now, it’s your turn to take action and put your knowledge to use!

Who holds custody of my funds on dYdX?

You do. dYdX is a non-custodial exchange, meaning you control your funds through your private keys.

Does dYdX charge trading fees?

Yes, dYdX has a tiered fee structure based on your 30-day trading volume, making it one of the most competitive DEXs for perpetual trading.

- Maker orders typically have lower fees or even rebates, incentivizing liquidity provision.

- Taker orders incur slightly higher fees but remain cost-efficient compared to many other platforms.

- Trading fees can be further reduced thanks to $DYDX token rewards, which are earned with every trade.

Bonus for new users: You can get up to $550 in fee discounts when signing up through this special link.

What is the maximum leverage available on dYdX?

dYdX offers up to 100x leverage on select trading pairs. However, the actual leverage available depends on the specific asset and your margin balance.

What is the difference between cross margin and isolated margin on dYdX?

- Cross Margin: Uses your entire account balance as collateral. Losses from one trade can affect your total balance, but it helps prevent liquidation.

- Isolated Margin: Limits the collateral to a specific trade. If the trade gets liquidated, only the margin allocated to that trade is lost.

Cross margin is useful for long-term positions, while isolated margin is better for managing risk on individual trades.

What is the difference between a limit order and a market order?

- Market Order: Executes instantly at the current market price. Ideal for quick trades but may result in slippage.

- Limit Order: Executes only at a specific price or better. Useful for precision but may not fill if the price doesn’t reach the limit.

Limit orders are great for strategic entries, while market orders are best for instant execution.

What is a Stop Loss on dYdX?

A stop-loss order is a trading tool that automatically closes your position when the price reaches a specified level. It helps limit losses and protect capital in case the market moves against your trade.

On dYdX, you can easily set a stop-loss from the Trade Management Panel to minimize risk.

What is a Take Profit on dYdX?

A take-profit order is a trading tool that automatically closes your position when the price reaches a specified profit or price target. This allows you to secure gains without needing to monitor the market constantly.

On dYdX, you can set a take profit directly from the Trade Management Panel, ensuring that your trade closes at the right moment to lock in your profits.

What types of collateral does dYdX accept?

dYdX currently accepts USDC as the primary collateral for trading perpetual contracts. Other assets may be introduced in the future based on liquidity and demand.

What happens if my position gets liquidated on dYdX?

If your position reaches the liquidation price, dYdX will automatically close it to prevent further losses. The liquidation process helps maintain system stability by ensuring positions remain properly collateralized.

To reduce liquidation risk:

- Use stop-loss orders

- Maintain a healthy margin balance

- Avoid excessive leverage

How can I reduce my liquidation risk when trading on dYdX?

To avoid liquidation, you should:

- Use lower leverage to reduce exposure.

- Set stop-loss orders to minimize potential losses.

- Monitor your margin usage and deposit more collateral if needed.

What is the order book, and how does it help with trading?

The order book on dYdX is a real-time list of buy and sell orders for a specific trading pair. It shows:

- Market depth: How much liquidity is available at each price level.

- Bid prices (buyers) & Ask prices (sellers): The demand and supply for an asset.

- Recent trades: A history of executed trades.

By analyzing the order book, traders can identify potential price movements, liquidity levels, and entry/exit points for their trades.

Are my trades recorded on-chain?

Yes, all trades on dYdX are recorded on-chain, ensuring full transparency and verifiability.