Ichimoku Block - This block is a "conditional block" that is triggered based on the behavior of the Ichimoku Kinko Hyo (一目均衡表 Ichimoku Kinkō Hyō) indicator, usually abbreviated to "Ichimoku".

Reminder of the basics

Ichimoku is a famous (but complex) collection of indicators that form one big, multi-faceted indicator.

Ichimoku can be used as a trend indicator because it is mainly future-oriented (the cloud is always several periods ahead of the current price), but it is so comprehensive that you can use it in various ways and is quite a dynamic indicator.

Here is a quick guide/roadmap to better understand this indicator.

- SSA (Lead 1 on tradingview) and SSB (Lead 2 on tradingview) form the Kumo cloud, one of the most important elements of the Ichimoku Cloud indicator, SSA is the green line and SSB is the red line. If the price is below the cloud and the cloud is red (SSB > SSA) then logically there is a strong downtrend.

- Kijun (baseline on Tradingview) is the thin red line. With the default settings, it is calculated as (26-period high + 26-period low)/2

- Tenkan (Conversion line on tradingview) is the thin blue line. With the default settings, it is calculated as (9-period high + 9-period low)/2

As you may have noticed, Kijun and Tenkan are a bit like moving averages. And so they can be analyzed as such. For example, if the Tenkan crosses the Kijun, it means that there is a good chance that an uptrend is occurring (think of the golden cross of two MAs). - Chikou (lagging span on TradingView) is created by projecting the closing prices 26 periods into the past. This curve is not used in Kryll.io due to its very limited usefulness in a trading bot, it is indeed designed to allow traders to visualize the relationship between current and past trends, as well as to spot potential trend reversals.

To learn more regarding the Ichimoku indicator check out these tutorials from Investopedia and Tradingview wiki.

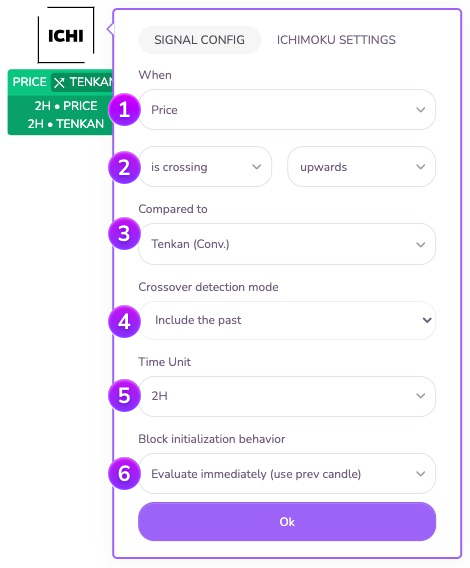

Block configuration

In the block parameters you can select the time unit you want to study and the signal configuration you are waiting for before proceeding.

This area allows you to select the item you want to study. You can choose between: price, Tenkan line (conversion), Kijun line (base), Chikou line (turnaround time), SSA line (Lead 1) or SSB line (Lead 2).

This area allows you to select the condition that will trigger the block. Here you specify which signal you want to use and you can choose between :

- Triggering on Position: the block is triggered when the studied element is in the expected zone (above or below) in relation to a reference value (another curve, see point 3)

- Triggering on crossing: the block is triggered when the studied element passes from one zone to another in a well determined direction (crossing upwards or downwards) with respect to a reference value (another curve, see point 3)

You specify here the reference value that will be used to validate or not the condition of triggering the block. This reference value can be : the price, the Tenkan line (conversion), the Kijun line (base), the Chikou line (turnaround time), the SSA line (Lead 1) or the SSB line (Lead 2).

In crossover waiting mode, an additional option is available: the taking into account of the past. This option allows you to take into account (or not) the previous candles for the validation of the block during its initialization.

Example: Suppose you set up a block to detect a crossing between the Tenkan and the Kijun line at 1 o'clock, and the strategy arrives on this block at 5:30. Let's further assume that the Tenkan line crosses the Kijun line at the close of the candle (at 6am)

- the block configured for 'Include the past' will be triggered because it detects a crossing between the 5 o'clock and the 6 o'clock candle.

- the block configured for 'Ignore past' will not be triggered because it will wait for a crossing only from the 6 o'clock candle and will ignore the past state of the indicator

You can specify the Time Unit on which you want the block to operate.

Behavior at initialization: Here you can define the behavior of the block at its initialization. You can either wait for the current candle to close (option "Wait for next close"), or instantly evaluate the block conditions on the last closed candle (option "Evaluate immediately"). This last option is particularly useful to perform analysis on several time units in parallel or to analyze an indicator on a macroscopic time unit (12H / Daily / Weekly...) without blocking the strategy by waiting for a candle to close.

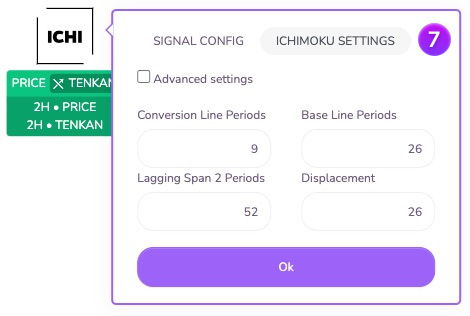

Configuration of the Ichimoku indicator

If you want to change the default value of the indicator, you can do so here:

Conversion line periods: Periods on which the Tenkan (conversion line) is based. Default value: 9

Base line periods: Periods on which the Kijun (base line) is based.

Default value: 26

Lagging Span Periods: Period on which the Lagging Span 2 is based.

Default value: 52

Displacement: Linked to the displacement of the Ichimoku indicator.

Default value: 26

Note that the settings on Ichimoku are extremely important, they don't just change the period of an MA. You can't expect it to "work" properly if you set random numbers. However, we strongly encourage you to try new settings, or search for new ones on the Internet. Feel free to share them on our Telegram Kryll.io channels as well.

Advanced configuration

By clicking on Advanced parameters, you will be able to change the parameters of another Ichimoku indicator in order to study the interactions between 2 different Ichimoku lines (example cross between a Tenkan built on a period of 9 and a Tenkan built on a period of 25).

Do not hesitate to join us on our Telegram and Discord groups as well as our other social networks to share your opinion and your feedback on the Kryll.io platform.

Happy Trading,

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io