As you know, the Kryll.io team has been working on the total redesign of the Marketplace in 2022, to offer you an easier to use, clearer and above all, a more complete version.

In this article you will find the user guide of the Kryll.io Marketplace V2!

Retrouvez ce tutoriel en Francais : ICI

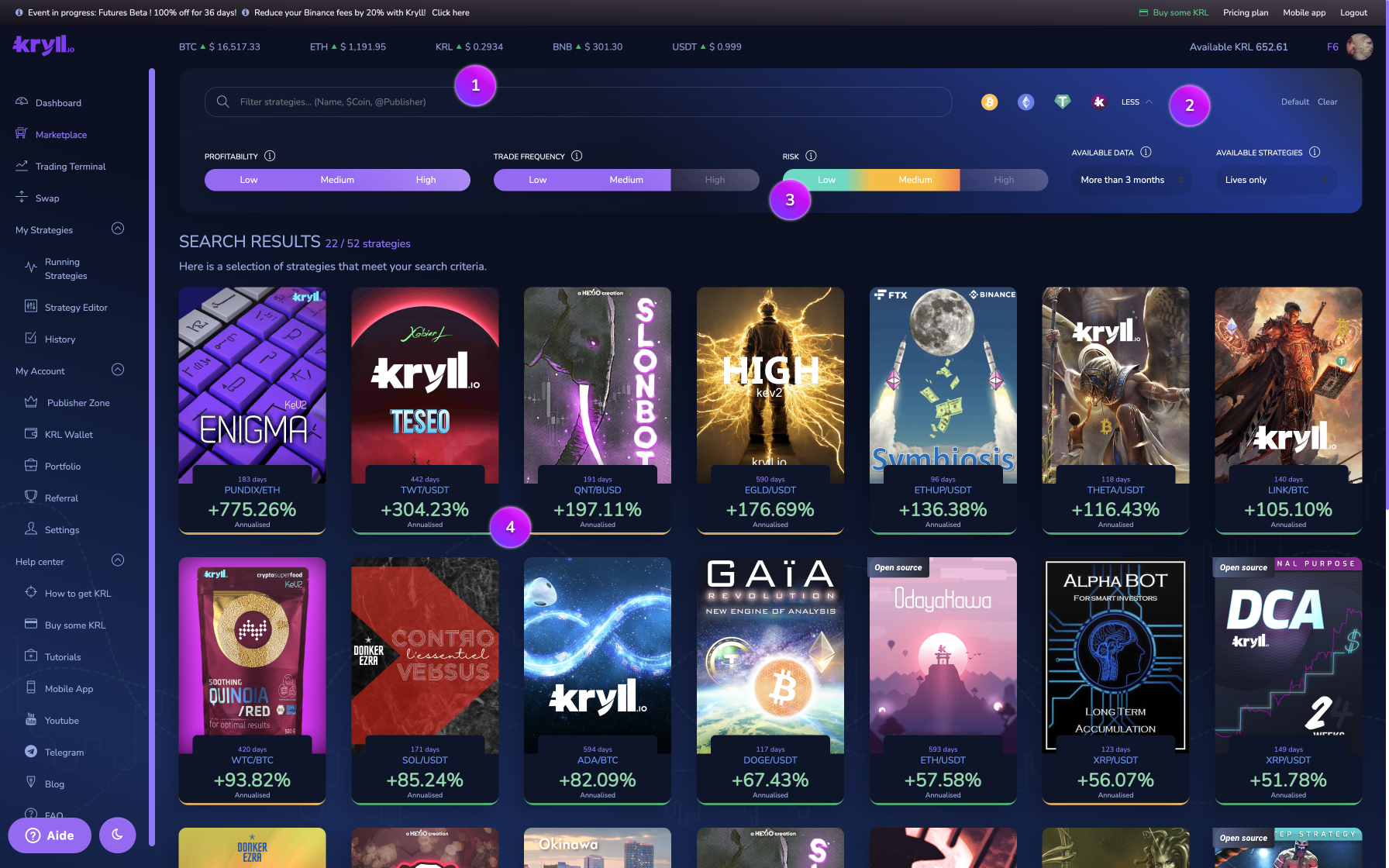

I. THE SEARCH ENGINE

The great novelty is the appearance of an advanced search engine that will allow everyone to find the strategies that suit them.

First of all, you will find the search bar which will allow you to search according to several criteria: name of the strategy, $token, pair, @pseudonym of a Publisher. As you can see, the search bar allows you to go deeper into the details of what you want to find.

In this section you can click on a selection of tokens to filter the strategies: operating on BTC, ETH, USDT and KRL.

In order to push the personalization of your search to the maximum, we have set up a filtering section allowing you to display only the strategies that correspond to your expectations through 5 options:

- The Profitability filter which allows you to filter strategies according to their profits, here you will have the choice between Low, Moderate and High.

- The Trade Frequency filter which allows you to classify strategies according to the frequency with which the strategy will place orders on the market. So if the frequency is set to low, you will only see strategies that have a low trading frequency.

- The risk option allows you to classify strategies according to the risk that the strategy has taken in the past. The risk indicator takes into account both the initial capital loss and the possible lack of security of the profits generated by the strategy over time.

- The filtering by available data allows you to filter the strategies according to the history of the available data. You will thus be able to see in your list only the strategies that have been running for more than 3 or 6 months and thus hide the strategies that are too recent or on the contrary display all the strategies, even those with a short life span.

- The option available strategies allows you to filter the strategies according to their type. You will be able to display only the "Live" strategies (in use by the community), the Open Source strategies (strategies with open-source code which is not hidden), or both.

Here you will find all the strategies that correspond to the specifics of the previously selected filters.

II. STRATEGIES

After selecting a strategy, you will be shown a set of information about its behavior and performance.

Upon viewing you will notice the generic information such as the name of the strategy, its current performance, as well as a summary of its profitability, its type (price or long term) and its risk exposure. You will also find the list of pairs on which the strategy is executed, its cost and the user satisfaction rate.

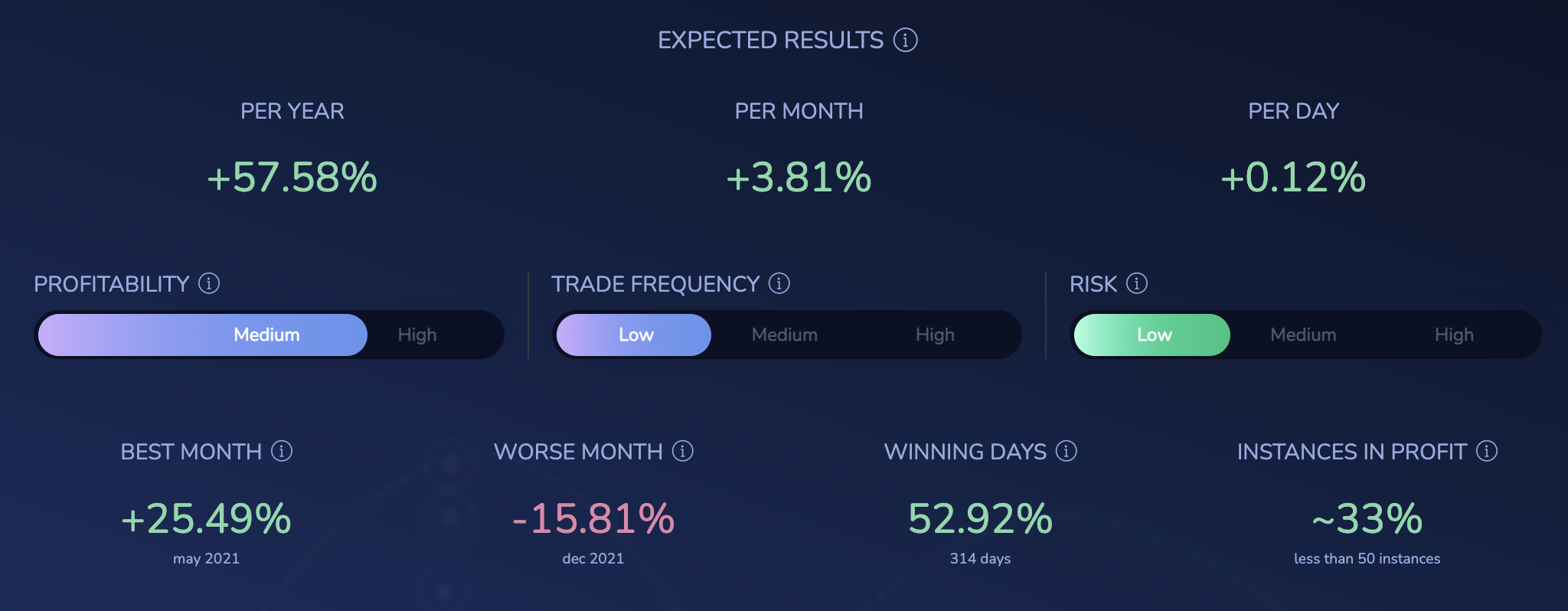

This part is surely the one that will interest you the most. It is composed of a set of indicators on the historical behavior of the strategy on the selected pair.

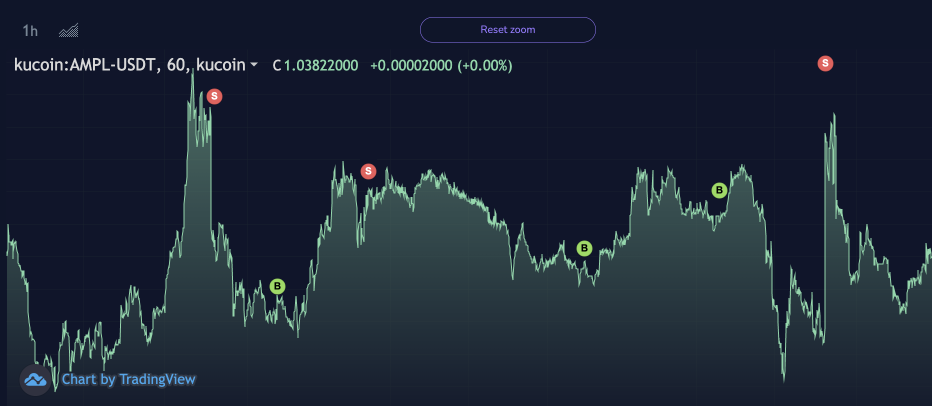

First of all, you will find the graph representing the historical performance of the strategy since its launch. You can view its behavior by changing the chart mode:

If you click on the "performance mode" button at the top right of the chart, you will switch to the behavior mode, which will show you the history of the strategy's buy and sell orders.

Under the charts, you will find the average expected gain percentage per day, per month as well as per year, as well as the score of the strategy on the categories of profitability, trade frequency and risk.

Other indicators available in the "show more" section, yo u will find a wealth of information such as the performance of the strategy, so do not hesitate to take a look before launching your strategy:

- Expected results represent the result that can be expected from this strategy per day, per month and per year according to its behavior and its past performances on the selected pair.

- You will find the Best month of the strategy, that is to say the month during which, since its launch, the strategy has generated the most profits.

- On the other hand you will also find the Worst month which reflects the month during which the strategy has performed the worst since its launch.

- If you want to know how many Days in Gain the strategy has had since its launch, this is where you will find it.

- The Instances in Profit indicator shows you the percentage of current running bots on this on Kryll in profit over the selected pair.

- The Max Capital Loss indicator represents the maximum capital loss the strategy has suffered since its inception and the number of days it will take to recover that loss.

- The Max DrawDown tells you the maximum loss the strategy has experienced on the selected pair. It doesn't always show the original capital loss because it also takes into account the loss of unrealized gains that the strategy may have generated (gains that the strategy failed to preserve).

- The average gain per trade reflects the average gain that the strategy has generated per trade since its launch.

- The Risk/Return ratio measures the ratio between the risk taken and the gains generated by the strategy on the selected pair. It represents the gain that the strategy was able to extract from the market during its past execution for each dollar risked.

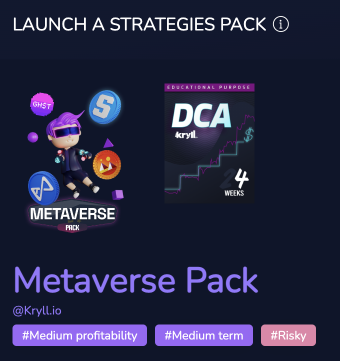

III. THE PACKS

Uncertain which to trading strategy to launch? We've provicded Strategy Packs which can be an easy method for diversifying and getting into a group of assets to trade that you would be interested in accumulating.

You will find here a whole range of thematic packs with accumulation strategies. Whether you want to invest in large-cap (BTC / ETH) or accumulate thematic tokens such as DeFi, NFT, Metaverse, Gaming, the packs are here to make it easy for you.

How does it work? By launching a pack, a set of strategies will be deployed on your account and will distribute the capital you have defined.

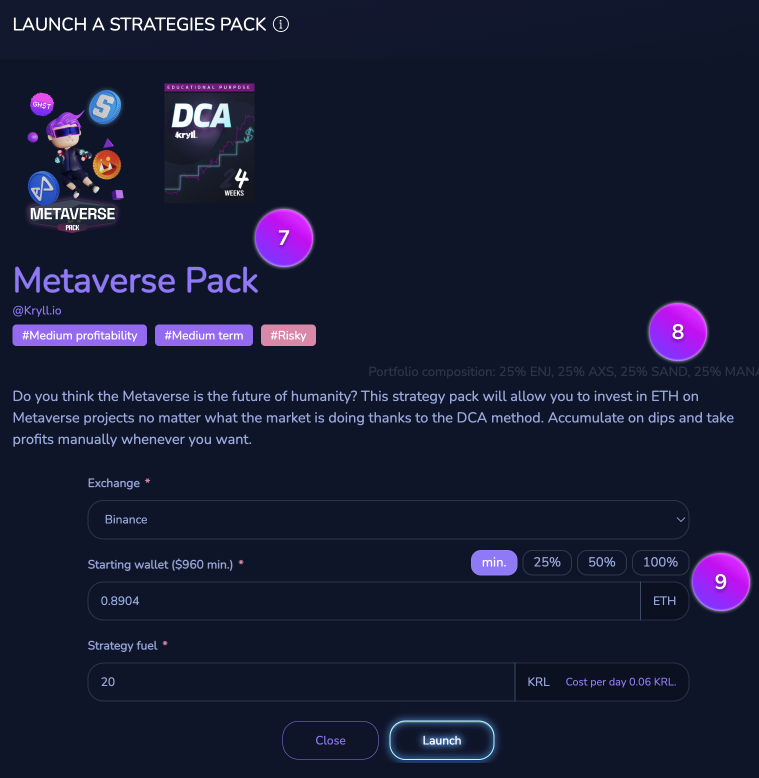

Let's take the example of the "Metaverse" pack. When you launch it, it will allocate your budget in the following way: 25% ENJ, 25% AXS, 25% SAND, 25% MANA that it will buy in DCA with a periodicity of 4 Weeks and this for 1 year.

For each pack launch you will be able to allocate a fraction of your available capital. The launch popup will give you access to a set of basic information such as: the name of the pack, the profitability, the risk exposure.

Here you will find the composition of the pack, i.e. the set of tokens on which the pack will be positioned, followed by a short description of the objectives of the pack.

This is where you will set up the launch of your package: the exchange involved, the starting portfolio, as well as the KRL fuel you wish to allocate to the strategies.

Major changes in this new version

There are two major changes in this new version, and we think it is important to point them out.

- First of all, all the indicators and curves displayed are from Live strategies currently trading (actually active on the market). The data does not comes from Backtests (simulations).

- The other important improvement of this new Marketplace V2 is that it is no longer necessary to install the strategies to launch them. The new Marketplace will allow you to directly access the configuration and launch your strategy with a single click.

Now that you have all the information about the changes introduced in our new Marketplace V2, you are ready to launch your fully automated trading strategies!

Feel free to join us on our Telegram and Discord groups as well as on our social networks to share your opinion and feedback on the Kryll.io platform.

TO YOUR STRATS.... READY, SET, GO!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io