Price Up Block - This block is a "conditional block" that is triggered when the price increases by the percentage you set.

Block configuration

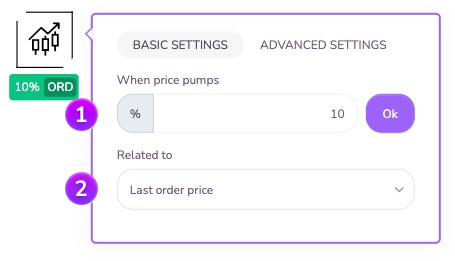

In the parameters of the block, you can select the conditions that will drive its triggering.

"When the price increases by" is the main condition of this block. It allows you to define the price increase threshold (expressed as a percentage) at which the block will be validated. For example, go to the next block if the price increases by 10%.

The percentage of change defined in the block is relative to a particular context. This context can be:

- "Market" evolution: The block will be validated if the market price has increased by x% since the lowest point recorded by the block. This option is ideal for creating trailing stops.

Example: If you choose a 10% increase over the market and the monitored asset goes from $100 to $90 and then back to $99 the block will be triggered ($90 + 10% increase = $99). - Evolution in relation to the price of the "last trade": The block will be validated if the price increases by x% in relation to the last Sell or Buy block executed in the strategy flow.

Example: If you choose a 10% increase from the price of the last trade, and you bought the asset in question at $10, the block will validate when the asset reaches $11. - The evolution in relation to the "last block" price: The increase configured in this way will be calculated on the recorded value of the previous block. Indeed, at each block executed by the flow of your strategy, the price of the asset is read and recorded. Understand this block as a "X% increase from now on".

Example: If you choose a 10% increase from the last block price and the monitored asset goes from $100 to $90 and then back to $110 the block will be triggered ($100 + 10% increase = $110). - Evolution in relation to the average purchase price: The block will be validated if the price increases by x% in relation to the average price at which the strategy bought the assets it currently holds.

Example: If your strategy has bought 0.01 BTC at $20,000 and 0.02 BTC at $18,500, and you expect a 10% rise from the average purchase price, the block will be validated when the asset reaches $20,900 (i.e. 1/3 of the assets at 20,000 + 2/3 of the assets bought at $18,500 = $19,000 + 10% rise = $20,900). - Evolution in relation to the average sale price: The block will be validated if the price increases by x% in relation to the average price at which the strategy sold the assets it currently holds.

Example: If your strategy has sold 0.01 BTC at $20,000 and 0.02 BTC at $18,500, and you expect a 10% rise from the average purchase price, the block will validate when the asset reaches $20,900 (i.e. 1/3 of the assets at 20,000 + 2/3 of the assets purchased at $18,500 = $19,000 + 10% rise = $20,900).

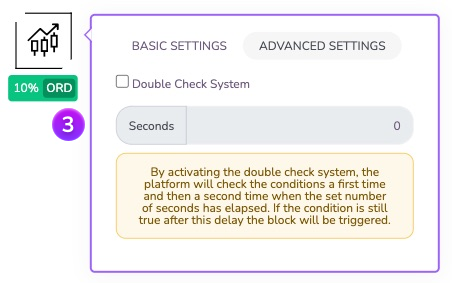

Advanced Options

To protect yourself from important market movements during phases of high volatility, it is possible to set up a double price check. This double check allows you to wait for a second validation of the price condition after a given time (expressed in seconds). This prevents the block from being validated on a few seconds wick, however your strategy will lose reactivity on fast market movements.

Do not hesitate to join us on our Telegram and Discord groups as well as our other social networks to share your opinion and your feedback on the Kryll.io platform.

Happy Trading,

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io