RSI Block - This block is a "conditional block" that is triggered based on the behavior of the RSI (relative strength index). This allows you to identify the entry into the oversold zone, the return to the neutral zone and combine this block with other indicators to make your decisions.

Reminder of the basics

The Relative Strength Index (RSI) is an oscillator based on price momentum, and thus measures the speed (velocity) and change (amplitude) of price movements.

The RSI operates on a scale of 0 to 100. An RSI of 50 indicates that the market is finding a point of equilibrium over the time unit in question. The closer the RSI is to its high zone (usually >70) the more the market is said to be overbought and it is possible that it will encounter a downward correction in your time unit.

Conversely, the lower the RSI (usually <30) the more oversold the market is. An upward correction could occur.

Configured on large time units, the RSI block can be used to give a macro picture of the market. Configured on small time units, the RSI block can be used to identify interesting buying or selling areas:

Since the RSI reflects the state of the market over a well-defined time frame, it is appropriate to use it correctly: If you use an RSI 12 on a 5-minute chart, the RSI number will correspond to the average of the last 60 minutes (12*5=60). Logically, if you trade on this configuration, it means that you are willing to hold your position between 5 and 60 minutes.

For more information on what the RSI is, please visit Investopedia and to read Tradingview wiki tricks . This block can be very useful for many strategies.

Block configuration

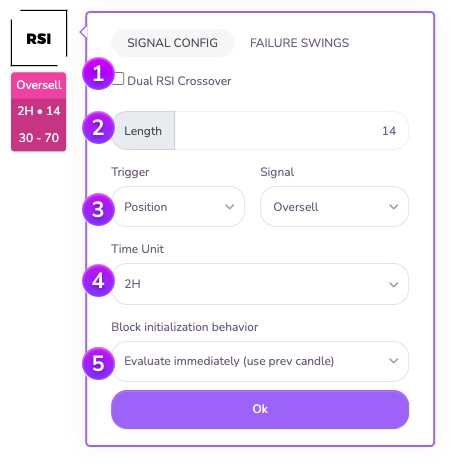

In the parameters of the block you can select the unit of time you want to study, its length (the number of candles studied) and the signal configuration you expect before moving on.

RSI crossing: By default, the block allows to check an instantaneous value of the RSI. However, the block also offers the possibility to check the crossing of two RSI curves with different lengths by activating this option.

Note: This option is intended for advanced users.

Length: Here you can set the duration (length) of the calculation for the RSI value that will be used by the block. A value of 14 means that the RSI will study the last 14 candles of the selected time unit.

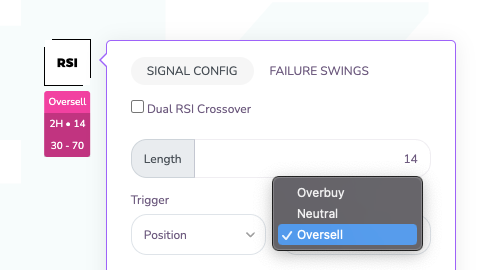

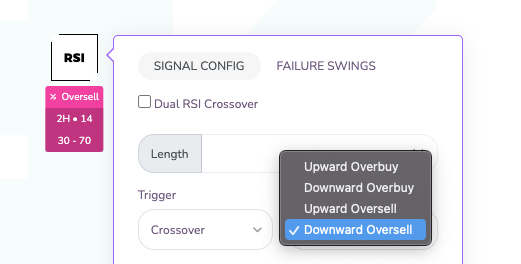

Type of signal: Here you can configure the type of signal you want to wait for in order to trigger the block. It is thus possible to trigger the block according to the position of the RSI (its current state) or according to its behavior (passage from one zone to another):

- Position triggering: the block is triggered when the RSI is in the expected zone: Overbought (zone above the overbought threshold, above 70 by default), Neutral (zone between the oversold and overbought thresholds, by default from 30 to 70, limits included) and Oversold (zone above the oversold threshold, below 30 by default)

- Triggering on Crossing: the block is triggered when the RSI crosses from one zone to another in a certain direction: it is thus possible to trigger the block when the RSI crosses the overbought limit upwards (crosses from the neutral zone to the overbought zone) or downwards (crosses from the overbought zone to the neutral zone). Similarly when the RSI crosses the oversold limit on the downside (moves from the neutral zone to the oversold zone) or on the upside (moves from the oversold zone to the neutral zone).

In crossover waiting mode, an additional option is available: the taking into account of the past. This option allows you to take into account (or not) the previous candles for the validation of the block during its initialization.

Example: Suppose you set up a block to detect an overbought cross at 1:00 and the strategy arrives on this block at 5:30. Let's further assume that the RSI crosses the overbought at the close of the candle (at 6am).

- the block configured for 'Include the past' will be triggered because it detects a crossing between the 5 o'clock and the 6 o'clock candle.

- the block set to 'Ignore the past' will not be triggered because it will wait for a cross only from the 6 o'clock candle and will ignore the past state of the RSI.

You can specify the Time Unit on which you want the block to operate.

Behavior at initialization: Here you can define the behavior of the block at its initialization. You can either wait for the current candle to close (option "Wait for next close"), or instantly evaluate the block conditions on the last closed candle (option "Evaluate immediately"). This last option is particularly useful to perform analysis on several time units in parallel or to analyze an indicator on a macroscopic time unit (12H / Daily / Weekly...) without blocking the strategy by waiting for a candle to close.

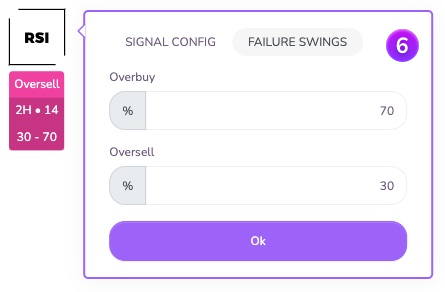

Tipping point configuration

If you want to change the default values of the RSI switch points, you can do so here:

Overbuy allows you to specify the threshold above which the block will consider the instantaneous percentage value to be overbought.default value: 70

Oversold allows you to specify the threshold below which the block will consider the instantaneous percentage value as oversold.default value: 30

Do not hesitate to join us on our Telegram and Discord groups as well as our other social networks to share your opinion and your feedback on the Kryll.io platform.

Happy Trading,

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io