The crypto world witnessed a seismic event when Donald Trump's World Liberty Financial project froze Justin Sun's WLFI tokens worth approximately $9 million. Within hours, the narrative of "patriotic finance" collided with the harsh reality of centralized control. The price held steady, the community stayed loyal, but beneath the surface, a proxy contract had just demonstrated its true power. This is the story of WLFI through Kryll X-Ray's lens, where hype meets hard data and where even crypto billionaires can get blindsided.

The Freeze That Shook Crypto: Justin Sun vs. WLFI

The incident unfolded like a thriller. On-chain trackers flagged Justin Sun's address moving approximately $9 million in WLFI tokens shortly after listing. The reaction was swift and brutal: WLFI's team activated their blacklist functionality, freezing Sun's entire position. Their justification? Risk mitigation against potential market dumping.

Justin Sun, the TRON founder and seasoned crypto veteran, found himself in an unprecedented situation. Despite his protests of innocence and claims that he had no intention to sell, his funds remained locked. The WLFI team, meanwhile, maintained radio silence, offering no detailed explanation for their actions.

This wasn't just another crypto drama, it was a masterclass in how proxy contracts can be weaponized, even against sophisticated investors. If Justin Sun, with all his experience and resources, could be caught off-guard, what does this mean for retail investors?

Who is Behind WLFI? The Trump Crypto Empire

World Liberty Financial represents Donald Trump's most ambitious venture into decentralized finance, but it's far from his first crypto rodeo. The Trump family has already made waves in the crypto space with previous token launches, including the TRUMP and MELANIA memecoins, which experienced explosive volatility and generated significant controversy.

WLFI positions itself as part of a "patriotic finance" ecosystem, complete with its own stablecoin USD1 and grand promises of financial sovereignty. The project leverages Trump's massive political following, transforming political sentiment into market cap. It's a fascinating experiment in celebrity-backed DeFi, where narrative value competes with technological merit.

The project's launch strategy was quintessentially Trumpian: maximum publicity, bold claims, and immediate market impact. Within hours of announcement, trading volumes exploded, and social media buzzed with excitement. But as the Justin Sun incident revealed, beneath the patriotic branding lies a technical infrastructure with significant centralized control mechanisms.

"When Data Meets Drama": Kryll X-Ray's Deep Dive

Analyzing WLFI through Kryll X-Ray is like switching from tabloid headlines to forensic investigation. No technical expertise required, the platform reveals everything: token distribution patterns, hidden contract functions, and the financial mechanics that determine who really holds the power. Suddenly, the Justin Sun freeze makes perfect technical sense.

What X-Ray's Financial Audit Reveals: Numbers Don't Lie

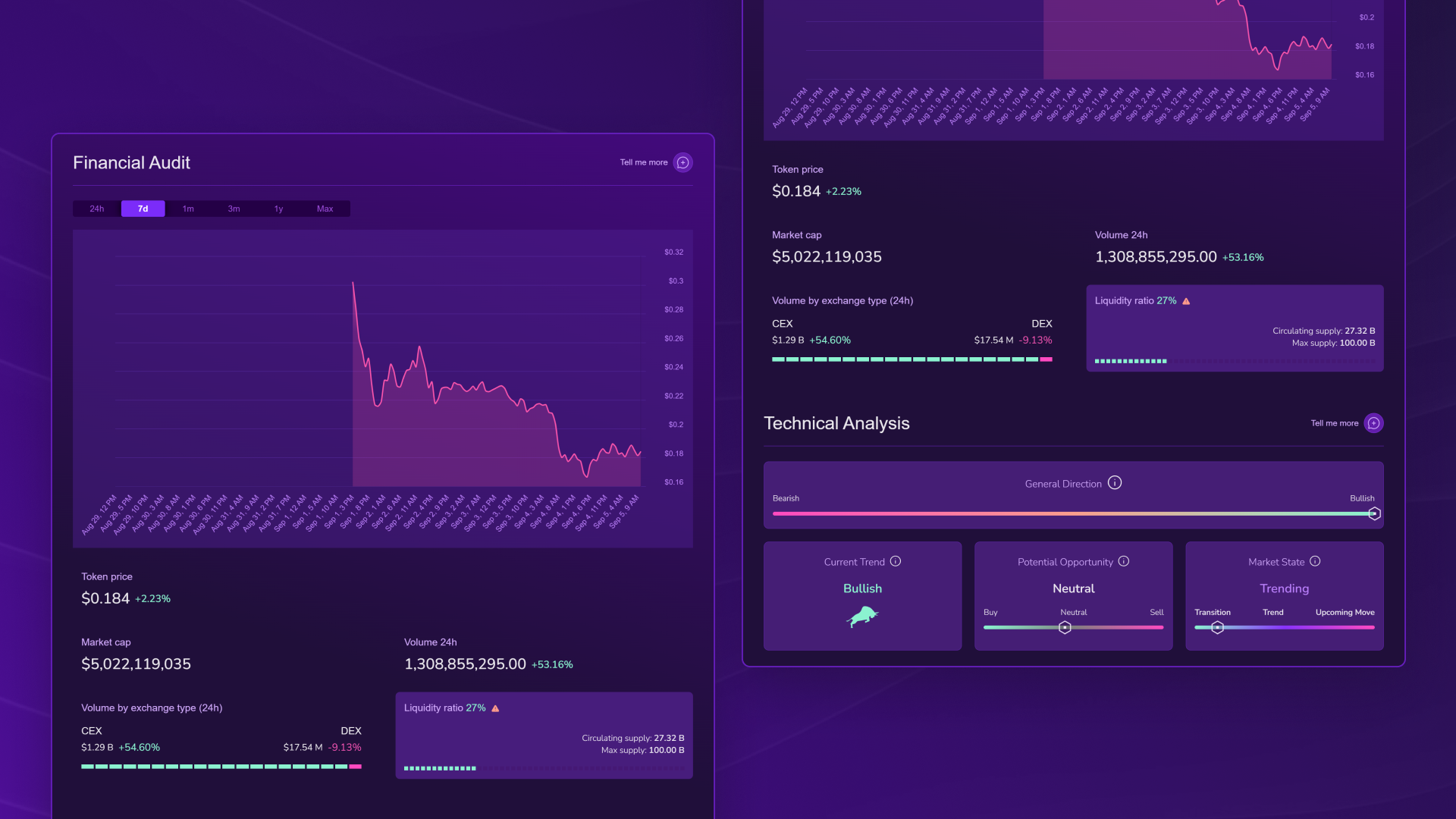

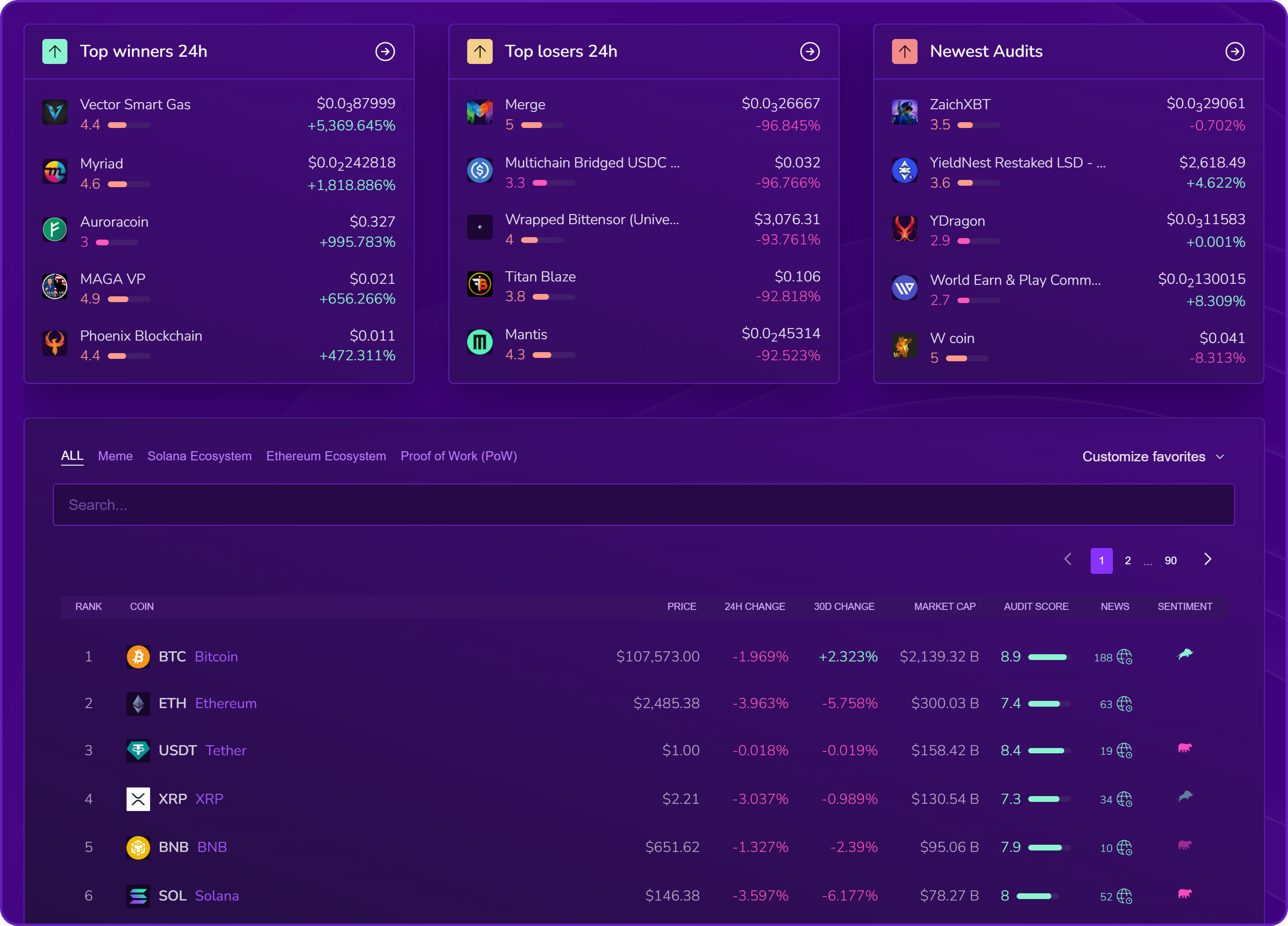

The financial audit dashboard paints a complex picture: impressive volume metrics shadowed by structural concerns. Price sitting at $0.184 with a market cap around $5.02 billion, daily volume hitting $1.3 billion, numbers that scream mainstream adoption. But dig deeper, and warning signals emerge.

The liquidity ratio tells the real story: only 27% of total supply actually floats in the market. This isn't just a technical detail, it's a fundamental risk factor. With 73% of tokens locked or controlled, current holders face massive dilution risk when restricted supply enters circulation.

The trading landscape shows heavy centralized exchange dominance ($1.29 billion vs. $17 million on DEX), indicating that despite DeFi branding, most activity occurs through traditional crypto platforms.

Technical Analysis: Riding the Political Wave

From a pure technical standpoint, WLFI demonstrates bullish momentum with sustained trending behavior. However, this isn't driven by fundamental innovation or utility, it's narrative-powered price action. The market loves the Trump story, but timing entries and exits becomes crucial when sentiment can shift overnight.

The opportunity assessment remains neutral, offering no clear technical edge for traders. This is momentum trading territory, where political news cycles drive price movements more than traditional technical indicators.

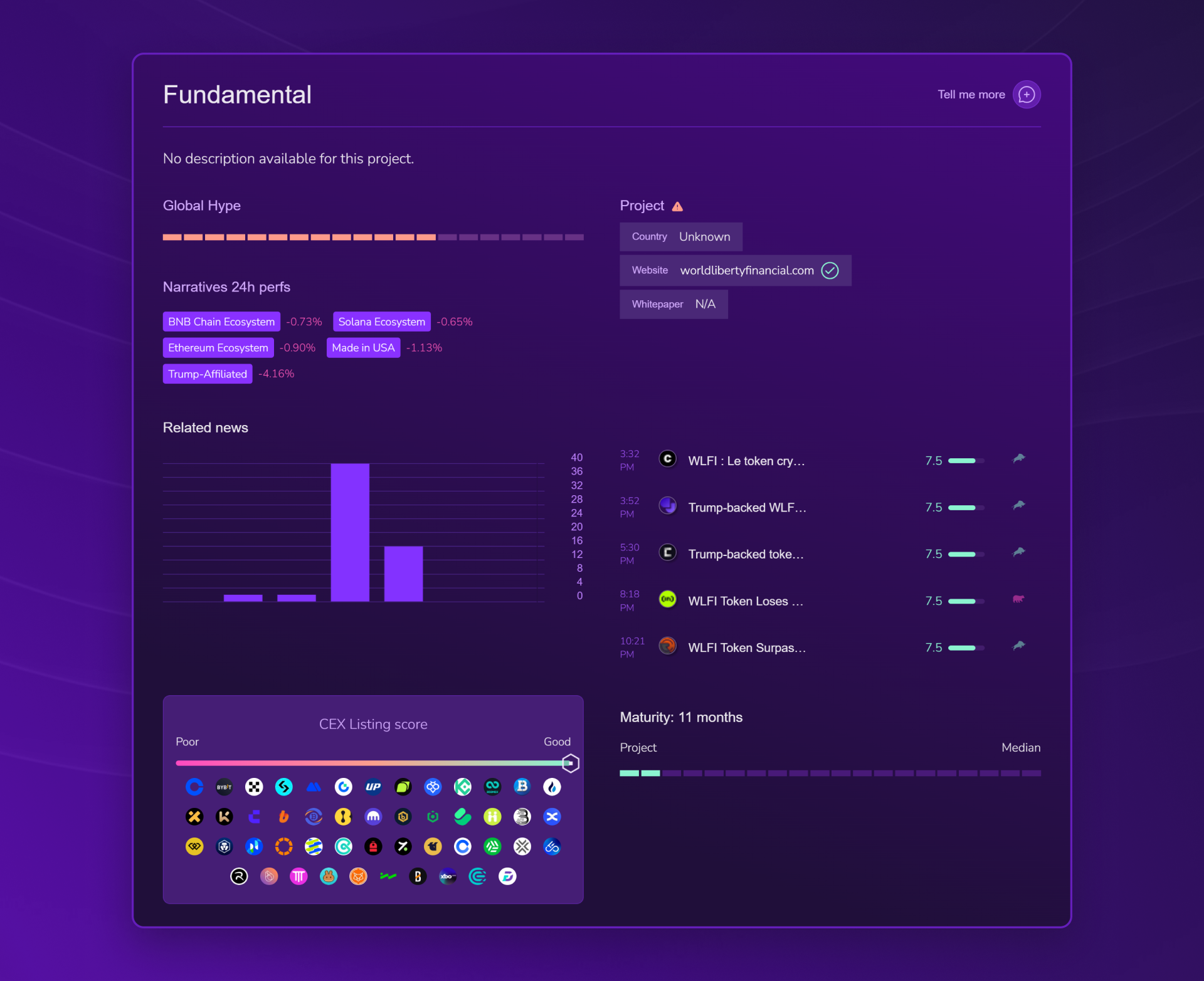

Fundamental Audit: Hype vs. Substance

The fundamental analysis reveals a project still in its infancy:

- Project Age: 11 months (relatively new)

- Documentation: No whitepaper available

- Geographic Base: Undisclosed

- Exchange Presence: Strong centralized exchange listings

The absence of comprehensive documentation raises questions about long-term vision and regulatory compliance. For a project backed by a former U.S. President, the lack of transparent operational structure seems particularly notable.

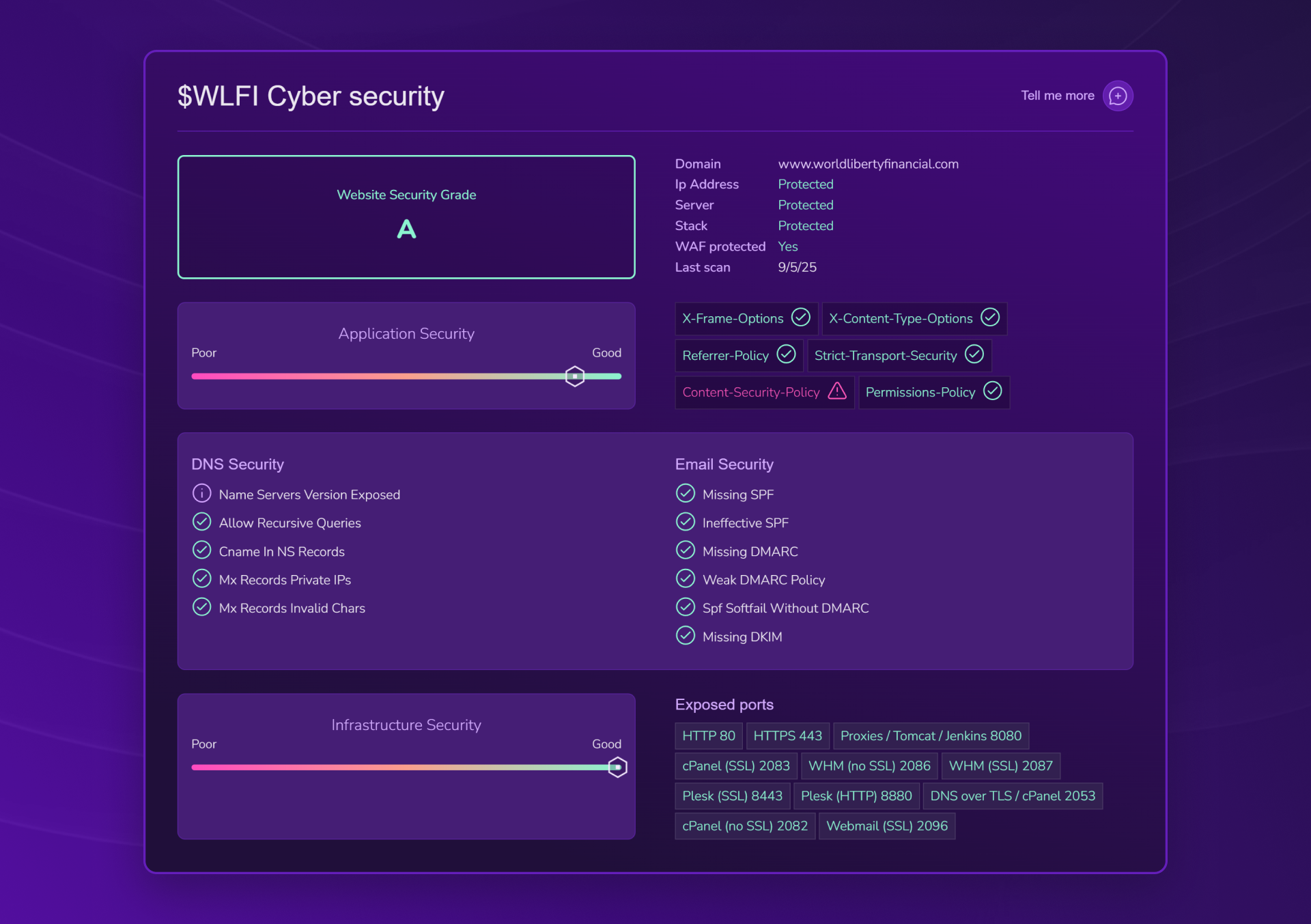

Cybersecurity: A Rare Bright Spot in Crypto

Surprisingly, WLFI demonstrates superior cybersecurity practices compared to most crypto projects. The website earns an "A" grade with strong application and infrastructure protection, a rarity in the meme token space where security often takes a backseat to rapid deployment. The overall security posture represents a significant improvement over typical celebrity-backed tokens.

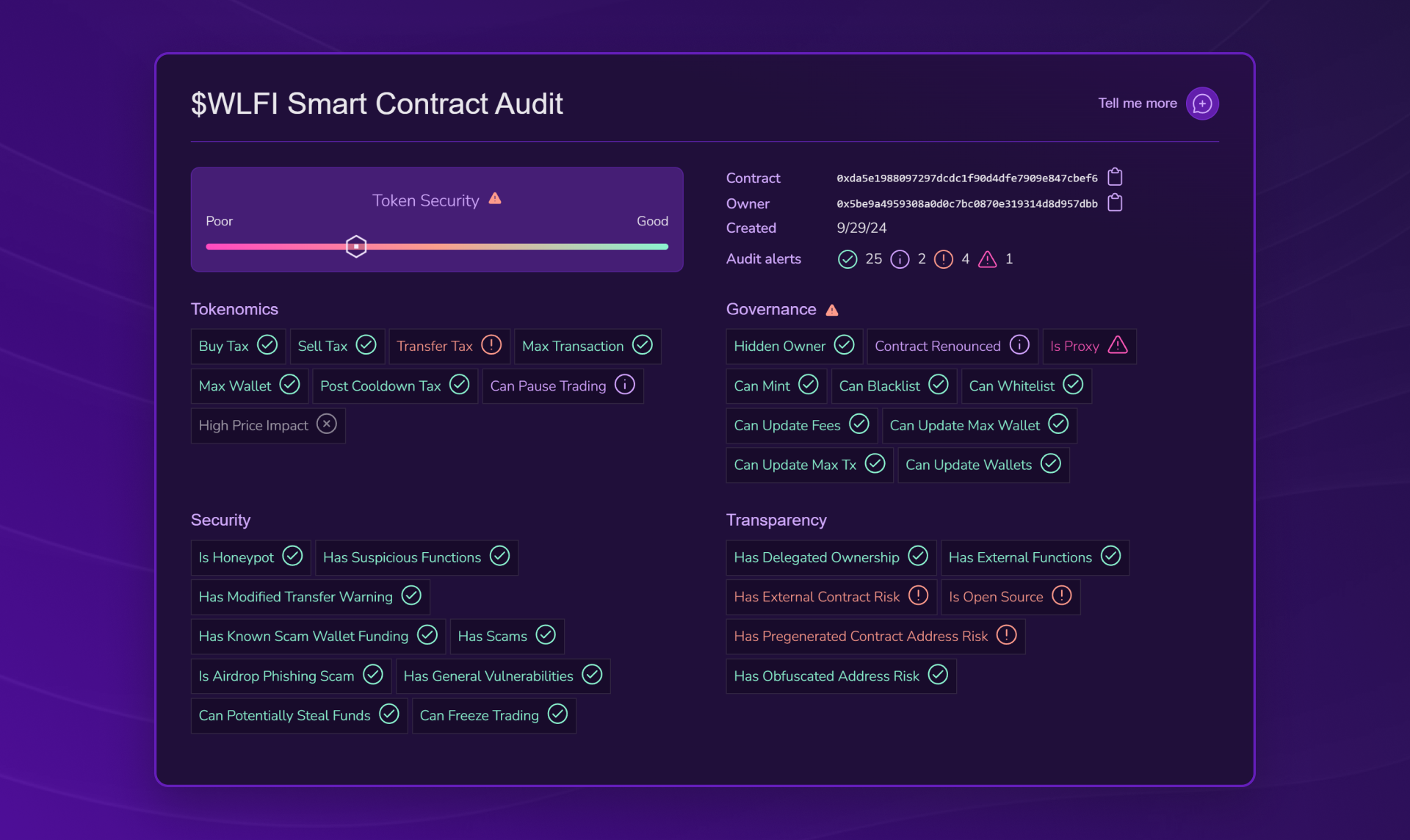

Smart Contract: Where the Real Power Lives

Here's where X-Ray's analysis becomes critical. The smart contract appears clean at surface level, no obvious honeypot mechanisms or exit scam functions. But beneath this veneer lie several concerning elements:

- Transfer taxes on transaction

- External contract dependencies

- Pre-generated rather than custom-built code

- Closed-source implementation

- Proxy contract architecture

The proxy contract represents the smoking gun in the Justin Sun incident. This structure allows the development team to modify core token logic without deploying new contracts, maintaining administrative privileges that can freeze accounts, modify fees, or alter other critical functions. It's not a bug, it's a feature that proved its effectiveness when Sun's funds were frozen.

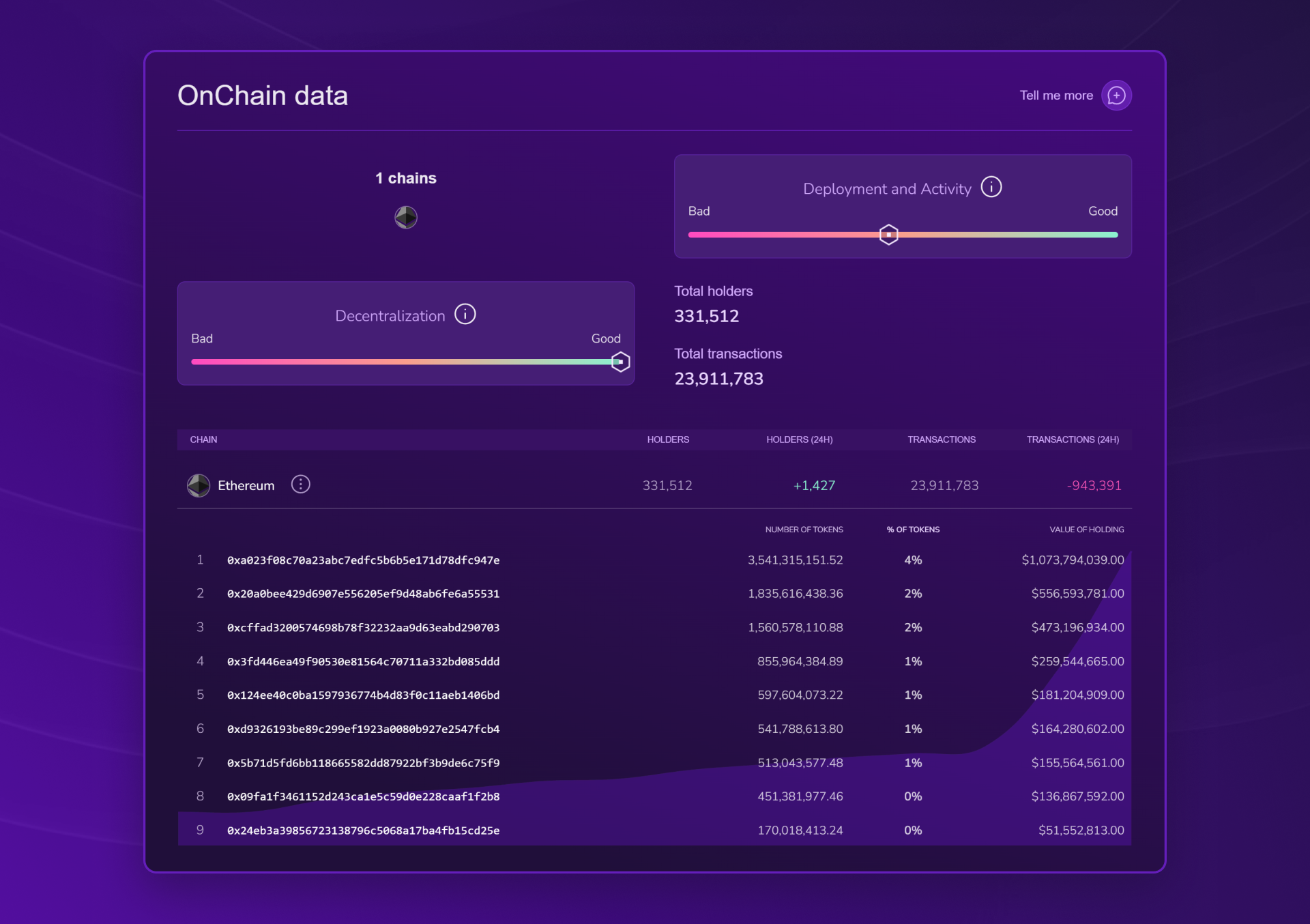

On-Chain Data: When Numbers Tell Stories

X-Ray's on-chain analysis reveals perhaps the most alarming statistics. The top 10 holders control 74% of total supply, with the largest single holder possessing 40% and the second holding 16%. Despite having over 90,000 holders, this extreme concentration means a handful of wallets can single-handedly manipulate market dynamics.

With current transaction volume at 23.9 million, the token shows active usage. However, the concentration risk overshadows adoption metrics, wide distribution matters little when such a small group controls the majority of supply.

The Verdict: Strengths and Weaknesses

WLFI Strengths:

- Massive trading volumes ($1.3 billion daily)

- Bullish trend with strong narrative backing

- Superior website security implementation

- Strong centralized exchange accessibility

Critical Weaknesses:

- Proxy contract enabling account freezing (proven with Justin Sun)

- Extreme whale concentration (top 10 = 74% supply)

- Limited liquid supply creating dilution risk

- External dependencies with closed-source code

- Missing fundamental documentation

- Heavy reliance on political narrative rather than utility

Beyond X-Ray: The Governance Reality

Independent analysis reveals additional concerning structural elements. The Trump family's "co-founder" designation appears largely ceremonial, potentially shielding them from legal liability while maintaining significant financial benefits, reportedly 22.5 billion WLFI tokens plus 75% of platform revenues.

The governance structure shows similar centralization patterns:

- Administrative filtering of community proposals

- Multisig override capabilities

- Vote concentration limits that don't apply to founding allocations

These mechanisms ensure that despite community governance appearances, ultimate control remains centralized.

What This Means for Crypto Investors

WLFI delivers a masterclass in narrative-driven tokenomics and the risks of centralized control in supposedly decentralized projects. When celebrity status meets blockchain technology, speed becomes paramount, those who master information asymmetry profit, while late arrivals chase market movements.

The Justin Sun incident isn't an anomaly, it's a demonstration of designed functionality. The proxy contract architecture, whale concentration, and governance centralization create multiple vectors for administrative intervention. This doesn't necessarily indicate malicious intent, but it does describe a risk profile that investors must understand.

What is Kryll X-Ray Exactly?

X-Ray is the all-in-one crypto audit tool developed by Kryll³, designed for everyone who wants to invest more wisely in the Web3 universe. Thanks to embedded artificial intelligence, X-Ray provides a complete and readable analysis of any token, whether you're a beginner or experienced investor.

Why Use X-Ray? DYOR Gets an Upgrade

DYOR (Do Your Own Research) is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

How to Access X-Ray

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.

Want to conduct your own comprehensive WLFI analysis or audit any other cryptocurrency project? Access Kryll X-Ray at app.kryll.io/x-ray. Connect your wallet, enter any token name, and get instant professional-grade analysis covering smart contracts, financial metrics, cybersecurity, and on-chain data, all in one comprehensive dashboard.