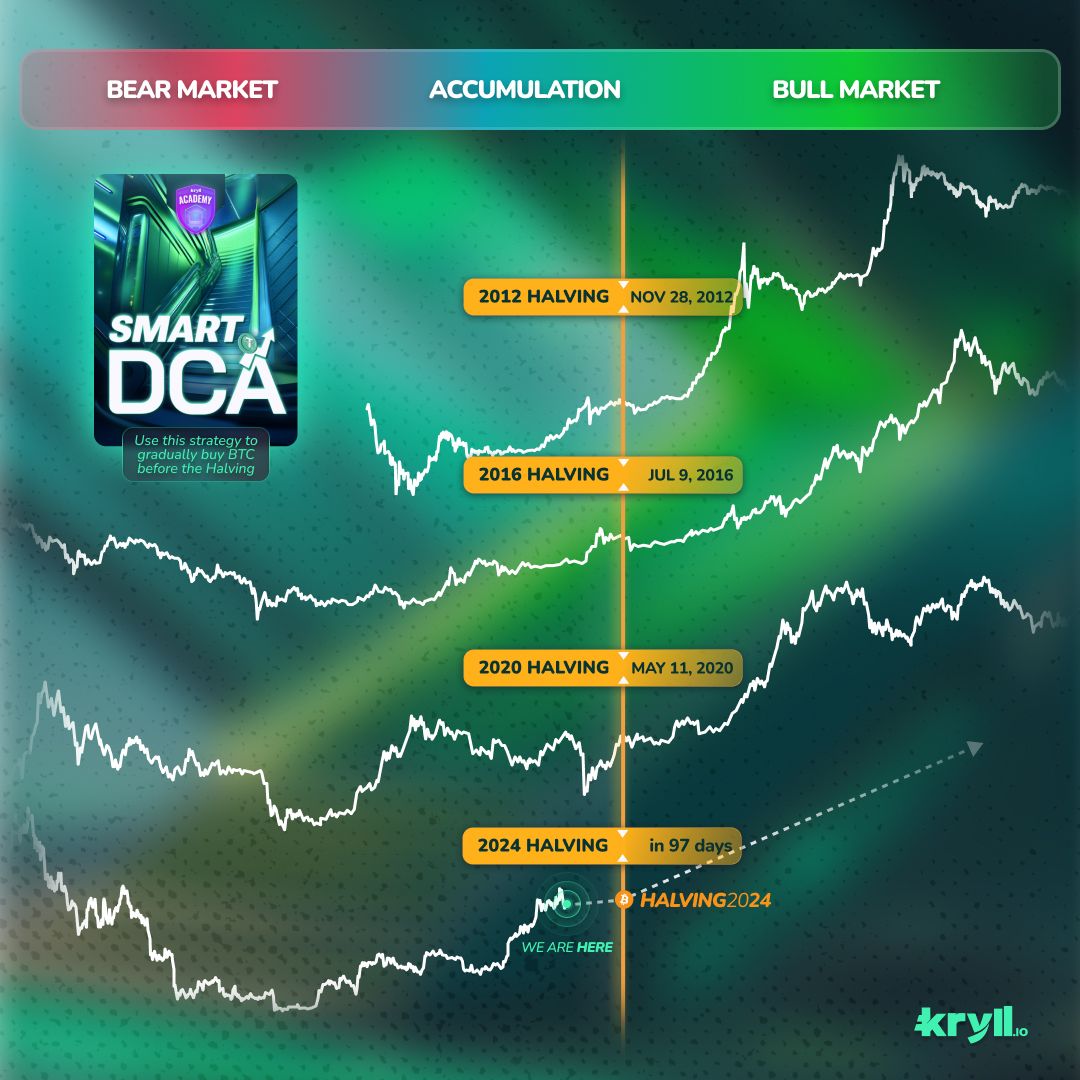

An unmissable event in the world of crypto-currencies, the Bitcoin Halving attracts increased attention every four years. It marks a reduction in the reward for miners by half, highlighting the pre-programmed nature and finite supply of this digital currency.

More specifically, this event consists of reducing the number of new Bitcoins issued over time to reach a maximum supply of 21 million Bitcoins. Imagine a gold mine where, every four years, the quantity of gold extracted is halved. Initially, miners would obtain large quantities of gold, but over time this quantity would diminish. This is essentially what is happening with Bitcoin, where the reward per block was previously set at 50 BTC. The current reward is 6.25 BTC per block and this will be halved to 3.125 BTC at the third Halving in 2024.

Why could Halving once again have an impact on the price of Bitcoin?

- Reducing inflation: Each Halving reduces the creation of new Bitcoins by half, rather like a gold source that gradually supplies less gold. At first, this source would pour in gold in abundance, but over time, the quantity mined would diminish, making the gold more precious. Similarly, the number of new Bitcoins in circulation does not increase at a constant rate. In fact, inflation is halved every 4 years, making Bitcoin an increasingly rare currency. If the supply of new Bitcoins decreases and demand remains stable or increases, the value of Bitcoin could, in theory, increase as a result of this scarcity.

- Halving Reduces Sell Pressure: Miners are the primary force of selling pressure on Bitcoin's price since they obtain all the freshly mined Bitcoin. With every Halving, the pressure from miners selling reduces by half, mirroring their halved rewards.

- Halving Brings New Demand: As the number of new Bitcoin mined decreases, the only factor left to influence Bitcoin's price is demand. Many in the market grasp the supply shifts triggered by the Halvings. This understanding has typically driven an increased demand in the post-Halving months, as seen in the blockchain records.

What is the best way to invest in Bitcoin?

Dollar-Cost Averaging (DCA) is one of the most tried and true strategies for investing in Bitcoin and crypto-currencies. It involves investing fixed amounts at regular intervals, regardless of the price of an asset.

This method can be compared to building a house brick by brick. Imagine that each brick you buy represents an investment at regular intervals. If you were to build a house all at once, you might be concerned about the fluctuating price of the bricks. Buying all the bricks on a day when they are expensive would be costly and risky. However, by buying the bricks a little at a time, at regular intervals, you smooth out the total cost, building your home at an average price, rather than the highest or lowest price for a brick. DCA works in the same way, allowing you to invest regularly, without worrying about the exact price of Bitcoin that day, and ultimately balancing the total cost of your investment.

The Kryll team has created a more efficient DCA strategy called "Adaptive Smart DCA", which adjusts the frequency of investment in line with market trends by investing at predefined times. By adapting the frequency and size of trades to our average buying price, the strategy prevents over-investment during upturns.

Learn how to build a Smart DCA strategy in 2 min or launch the Adaptive Smart DCA strategy from the Kryll Marketplace.

Using the Kryll.io Adaptive Smart DCA strategy will give you the following advantages:

- Minimising the risk of bad timing and optimising the average price: The DCA reduces the risk of entering the market at the top or the bottom. By buying regularly, you average your entry price over a longer period.

- Full automation: Kryll.io allows you to automate your DCA strategy, which means you don't have to worry about placing manual orders at regular intervals. Automation also ensures that you stick to your investment plan, even if emotions would lead you to do otherwise.

- Psychology: Investing a fixed sum on a regular basis can reduce the stress associated with market fluctuations. You don't have to worry about choosing the "right moment" to invest.

- Kryll.io for everyone: Whether you're a beginner or an experienced investor, Kryll.io's Adaptive Smart DCA strategy is suitable for anyone who wants to invest in Bitcoin. It is a turnkey solution that facilitates access to the cryptocurrency market.

- Analytical tools: Kryll.io also offers analytical tools that can help you understand the performance of your DCA strategy.

- Security: The Kryll platform offers a secure environment for your transactions thanks to the API key system, minimising risk.

By combining the strength of DCA with the efficiency of Kryll.io, investors can adopt a strategic approach to investing in Bitcoin. This methodology, which is both structured and automated, allows investors to navigate the volatile crypto market with confidence, optimising their chances of long-term success.

Happy Trading,

Website: https://kryll.io

Twitter: @Kryll_io

Telegram EN: https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord: https://discord.gg/PDcHd8K

Reddit: https://reddit.com/r/Kryll_io

Facebook: https://www.facebook.com/kryll.io

Support: support@kryll.io