On January 7, 2026, the entire Electric Coin Company team behind Zcash resigned en masse. An earthquake that caused the ZEC token to plummet 18% within hours. The timing makes the situation surreal: Zcash had just achieved the best crypto performance of 2025 with +800%, rising from $60 to $506. In the middle of a bull run, with Arthur Hayes positioning ZEC as the second largest position in his fund after Bitcoin, the entire development structure collapses.

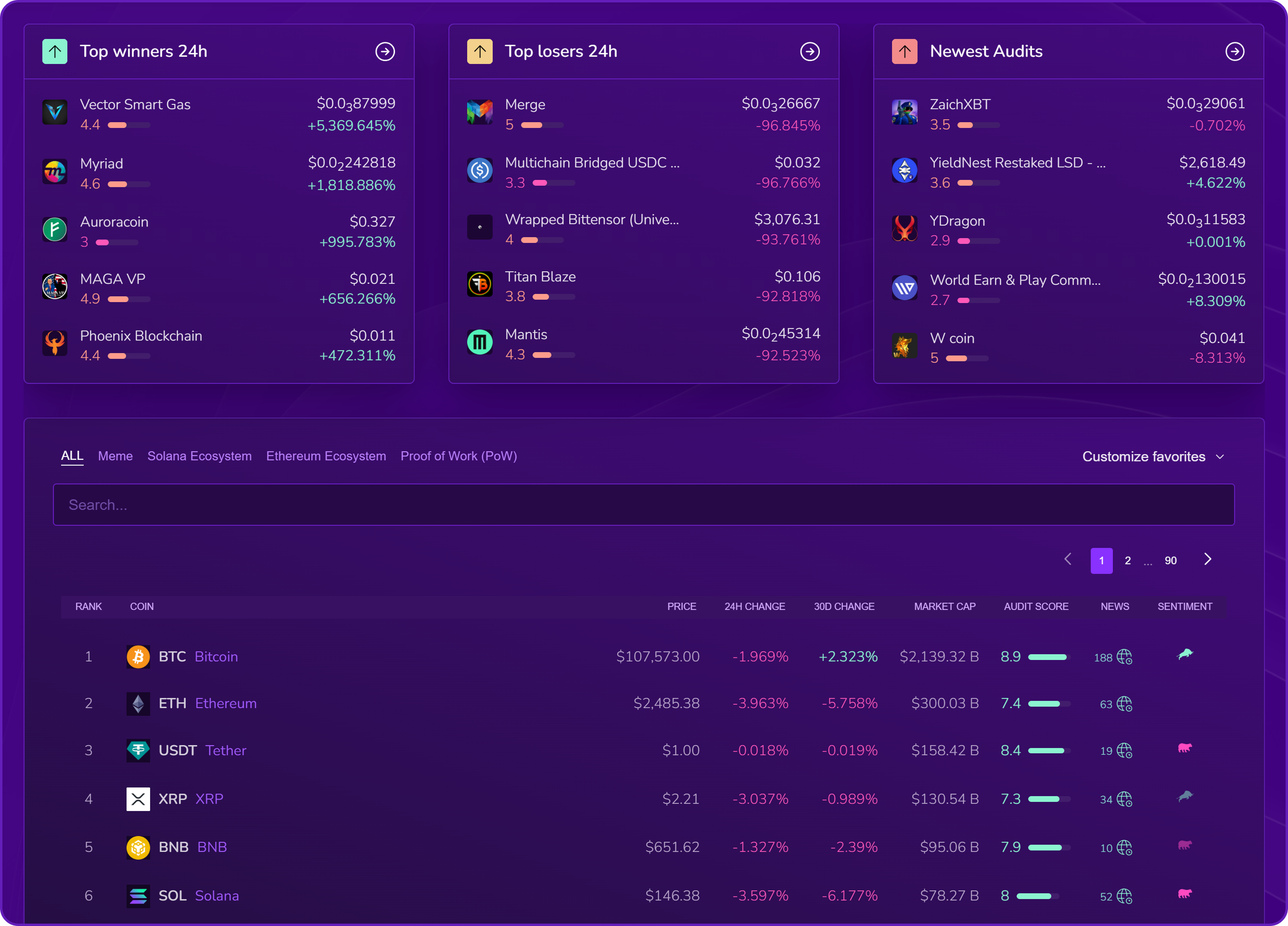

But behind the media chaos, what about the token's actual fundamentals? We had already conducted a complete audit of Zcash in the past, but this unprecedented crisis forces us to completely reassess the project. This is precisely what we'll analyze using Kryll X-Ray, our in-depth audit tool that examines every on-chain metric, security signal, and financial data to provide an objective and comprehensive view of the project.

Zashi and privatization: a deadly battle

The conflict opposes two irreconcilable visions. Josh Swihart and his team wanted to privatize Zashi, the mobile wallet, through external investments. Their argument: startups evolve quickly, non-profits are constrained. Bootstrap's board, the 501(c)(3) organization overseeing ECC, firmly opposes this: such privatization would violate their legal obligations and expose the organization to lawsuits.

The plot twist: Zooko Wilcox, Zcash founder and former CEO, publicly defended the board that ousted the team. A scathing disavowal. Swihart accuses the board of disguised dismissal, the board accuses Swihart of overstepping his mandate.

cashZ and uncertainty for ZEC

Less than 24 hours after their resignation, the team announces cashZ, a new wallet based on Zashi's code. A new startup, outside the non-profit structure. Result: two rival teams, potentially two competing wallets, and a nagging question about who will actually develop the Zcash protocol.

Market sentiment is in the red: score of 18/100 (very negative), Fear & Greed Index at 28. GitHub activity has plunged to its lowest since November 2021. Some analysts estimate that maintaining above $470 could allow a rebound toward $560-640, but volatility will remain high as long as governance isn't stabilized.

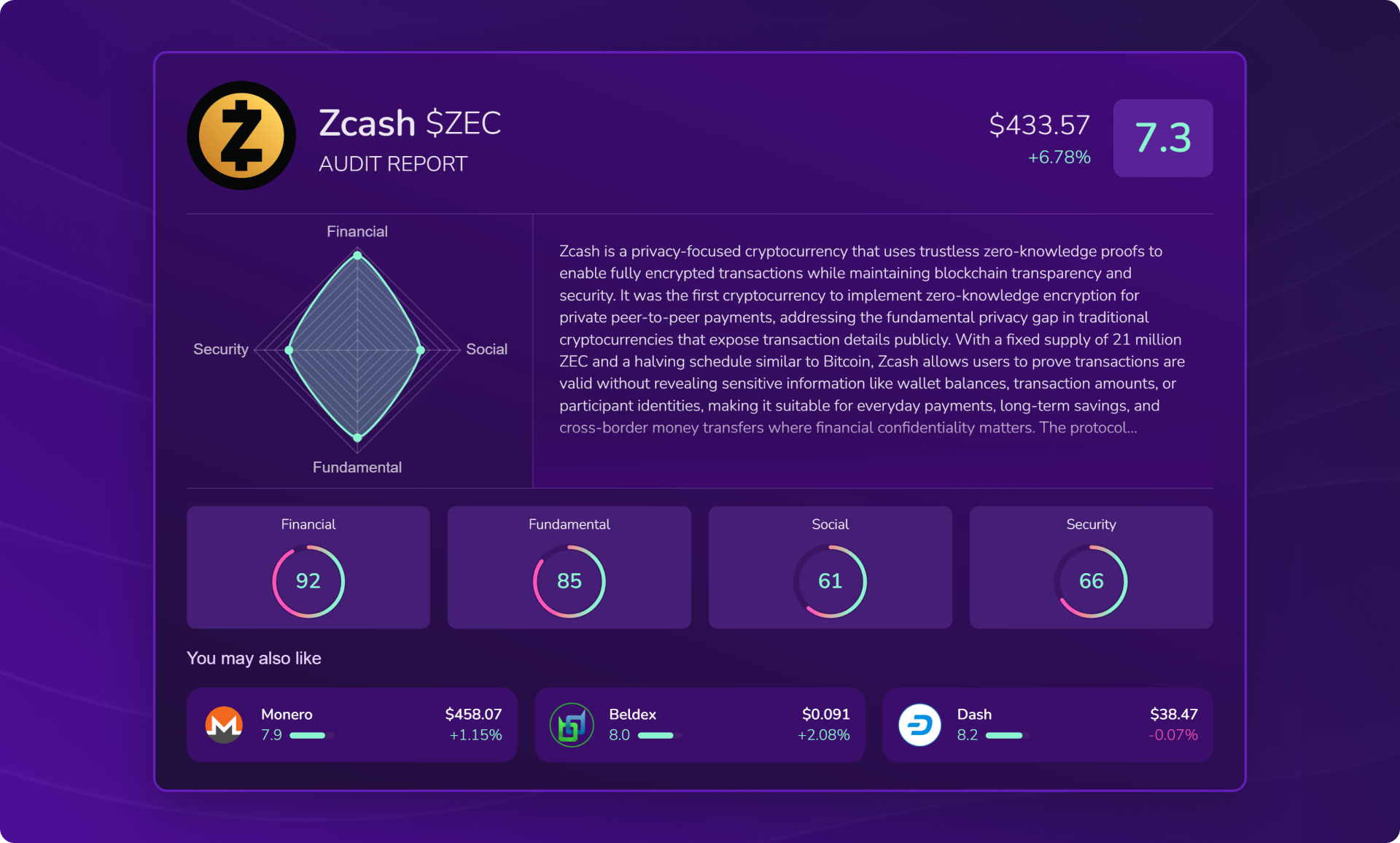

The X-Ray Audit of Zcash ($ZEC)

The governance crisis and mass resignation have shaken the Zcash ecosystem, but as always in crypto, media drama isn't enough to assess a project's solidity. To understand ZEC's real value in the face of this storm, we must go beyond the noise and analyze the fundamentals, security, on-chain activity, and technical structure of the protocol.

This is precisely Kryll X-Ray's mission: dissect every metric, identify strengths and weaknesses, and offer an objective and complete vision of the project. Our tool deeply analyzes finances, tokenomics, smart contract security, on-chain data, and social activity to detect weak signals and measure the project's real resilience.

Zcash comes with a solid heritage (reference privacy since 2016), proven technology (zero-knowledge proofs), and a loyal community. But the January 2026 crisis raises essential questions: can the protocol survive without its historic team? Are the technical fundamentals robust enough to withstand this chaotic governance? Does the token remain a viable investment? Here's what our in-depth analysis of Zcash reveals.

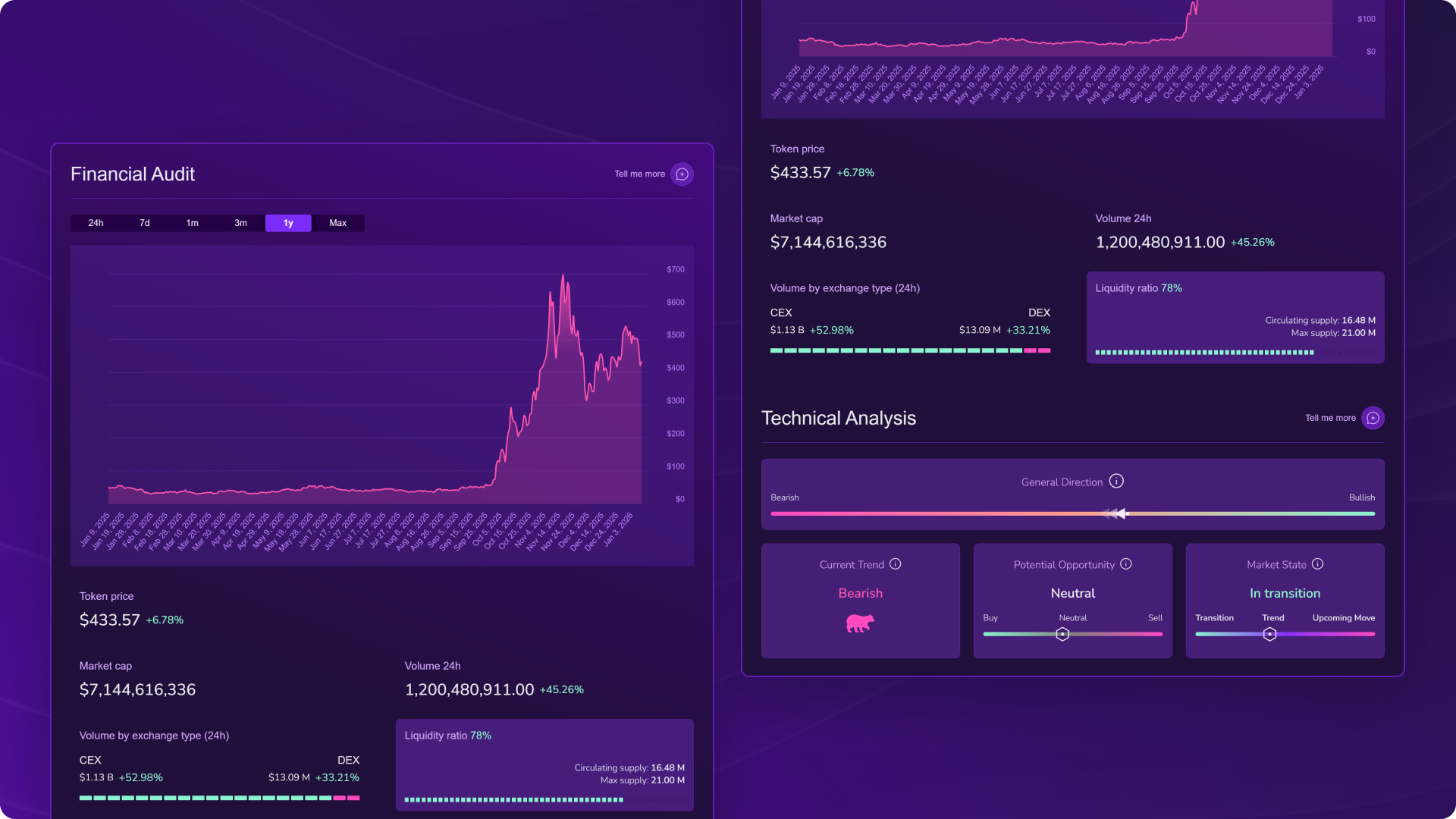

Financial Analysis: massive volumes despite the crisis

- Current price: $433.57 (+6.78%)

- Market cap: $7.14 billion

- 24h volume: $1.20 billion (+45.26%)

- Volume breakdown: largely dominated by CEXs, $1.13B vs $13M on DEXs

- Liquidity ratio: 78% → a large portion of tokens is already in circulation (16.48M out of 21M max supply)

👉 In concrete terms: ZEC remains highly liquid, meaning the price depends directly on exchanges between buyers and sellers, with no massive stock of hidden tokens that could flood the market. Despite the governance crisis, volumes remain exceptional with +45% over 24h, a sign of persistent market interest.

Technical Analysis: bearish trend and transition phase

- General direction: Bullish

- Current trend: Bearish

- Potential opportunity: Neutral (indecision zone)

- Market state: In transition

👉 Simple translation: after the euphoria of the 2025 bull run, ZEC enters a phase of technical uncertainty. The short-term trend is bearish, but the long-term direction remains bullish. The market is in transition, probably influenced by the governance crisis creating temporary selling pressure.

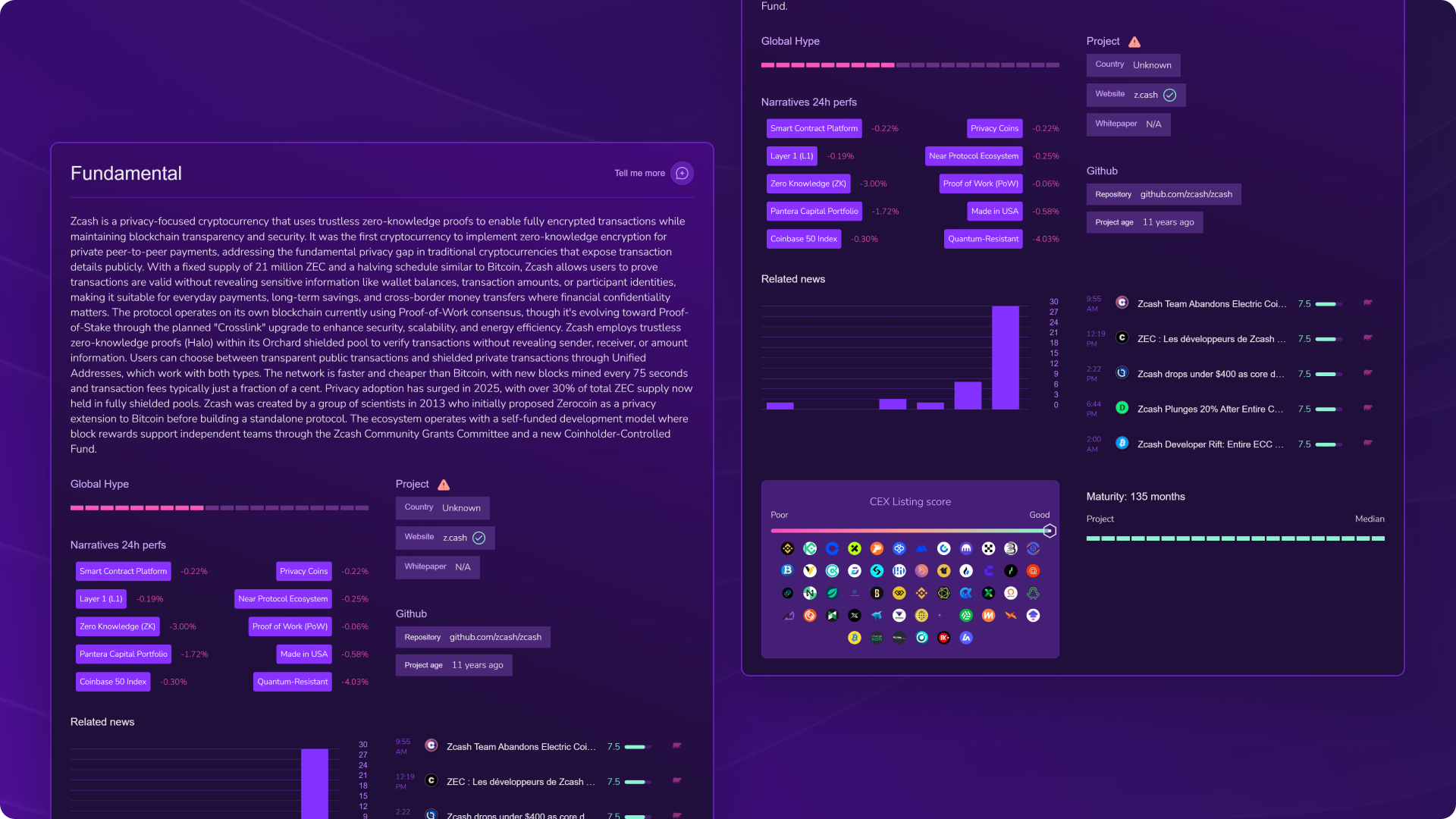

Fundamental Analysis: a technological veteran still influential

- Maturity: 135 months (11-year project)

- Whitepaper: N/A in the audit

- Country of origin: Unknown

- Github: active (official zcash/zcash repository)

- CEX Listing Score: excellent (presence on most major platforms)

- Rising narratives: Privacy Coins (-0.22%), Zero Knowledge (ZK) (-3.00%), Proof of Work (PoW) (-0.06%)

👉 Despite its age, Zcash maintains strong narrative relevance: as a pioneer of zk-proofs, it now benefits from renewed interest in privacy technologies and growing mistrust of financial surveillance. The project remains active on Github with a maintained official repository, although the current crisis raises questions about development continuity.

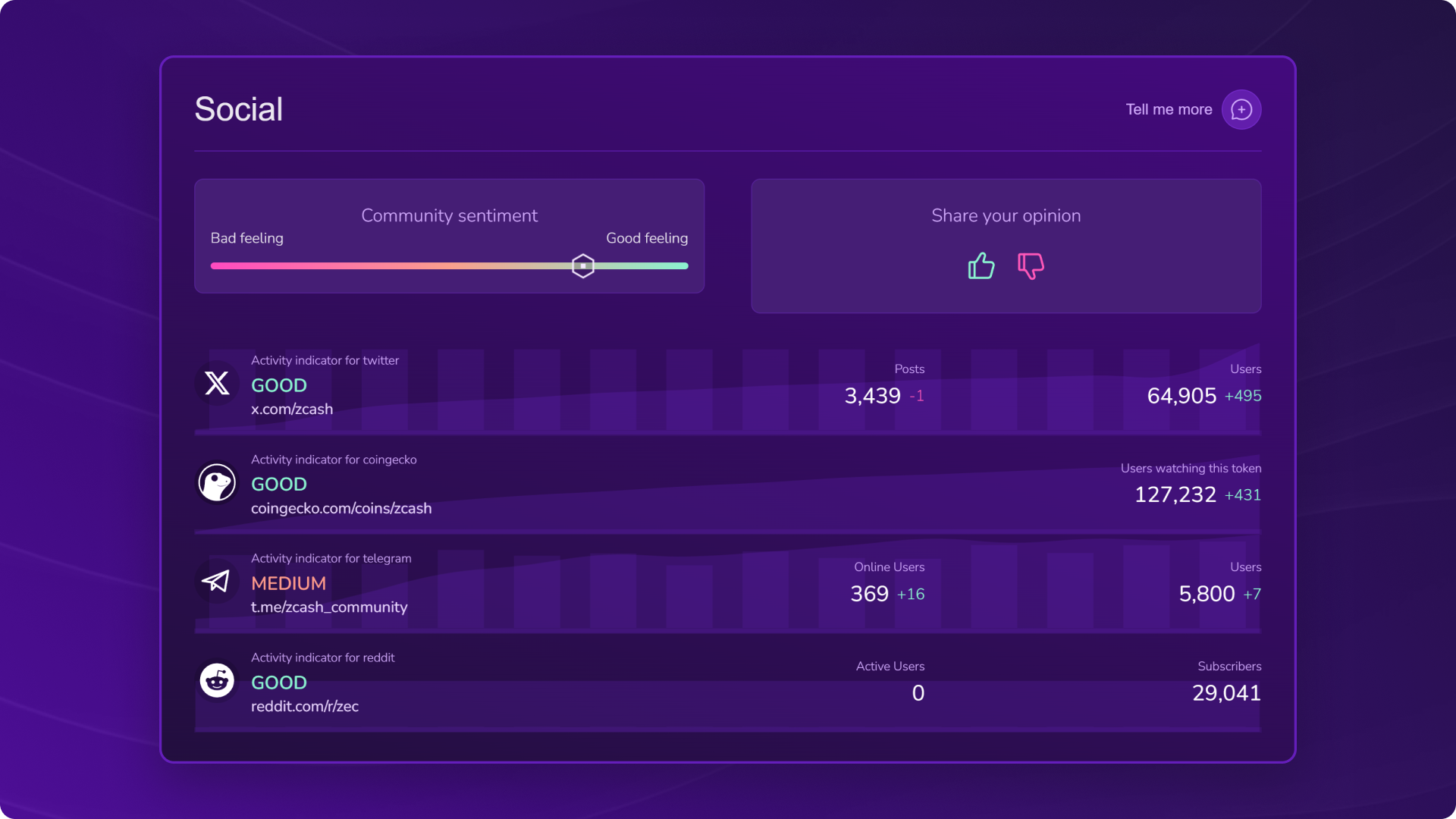

Social Analysis: solid traction but less massive than leaders

- The Zcash community shows decent activity with a score of 61/100:

- Twitter/X: GOOD (3,439 posts, 64,905 users, -1 post recently)

- Coingecko: GOOD (127,232 watchers, +431 recently)

- Telegram: MEDIUM (369 users online, 5,800 members, +16 recently)

- Reddit: GOOD (29,041 subscribers, 0 active users currently)

👉 Social traction exists, but remains modest compared to top 20 projects. However, we observe a rebound in activity correlated with recent events, a sign that the community remains mobilized despite the crisis. The number of Coingecko watchers is increasing (+431), suggesting growing interest in following the project's evolution.

Cybersecurity: notable flaws despite the A+ grade

- Application Security: Good (all critical headers enabled)

- Infrastructure Security: Good (no major weaknesses)

- DNS Security: identified problems → Name Servers Version Exposed, Mx Records Private IPs

- Email Security: multiple flaws → Missing SPF, Spf Softfail Without DMARC, Missing DKIM

👉 In concrete terms: Zcash obtains an excellent A+ grade, demonstrating a solid and secure web infrastructure. The few identified concerns (DNS version exposure, email configuration) are minor flaws that don't affect the blockchain protocol itself. These vulnerabilities only concern external communication infrastructure, not the network or transaction security. Overall, Zcash demonstrates a cybersecurity level above market average.

The verdict: Zcash's strengths and weaknesses

Strengths:

- Exceptional financial score (92/100) with massive volumes of $1.2 billion

- High liquidity ratio (78%), limiting dilution risk

- Pioneer of zk-SNARKs, key technology of modern crypto

- Mature project (11 years) with strong technological influence

- Massive presence on CEXs and privacy/zero-knowledge narratives

- Active and growing community despite the crisis

Weaknesses / Risks:

- Bearish technical trend short term, market in transition

- Major governance crisis with resignation of entire development team

- Uncertainty about protocol development continuity

- Decent social traction but inferior to market leaders

- Recurring regulatory pressure on privacy coins (delisting risk)

- GitHub activity declining since the crisis

- DNS and email security flaws (spoofing, exposure of sensitive info)

Conclusion

Zcash is not just a survivor of the first generation of privacy coins: it's a project that made crypto history by introducing a technology that has become central to the ecosystem, zk-SNARKs. Its market cap of $7.14 billion and massive volumes of $1.2 billion/day show that the privacy theme remains a powerful driver, especially in a global context where financial surveillance is strengthening.

With solid liquidity (78%) and still-relevant technological pertinence, ZEC demonstrates it still has cards to play. But web security flaws (DNS, email) and especially the governance crisis change the game. Certainly, volatility and regulatory pressure are part of the package for all privacy coins, but internal collapse adds an unprecedented layer of risk.

For investors, $ZEC is today a double-edged bet: technical fundamentals remain solid, but the organizational future is in the fog. In a crypto market where sleeping giants can wake up overnight, Zcash reminds us they can also collapse from within.

Why use X-Ray?

DYOR is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

- ⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

- 🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

- 🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

- 🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

- 💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

- 📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

With all these cross-analyses, X-Ray offers much more than a simple glance: it's a true intelligent dashboard, designed so everyone can understand, compare, and decide without getting lost in complexity.

| Criteria | Manual Audit 😩 | Audit with X-Ray 😎 |

|---|---|---|

| Ease | Complex | ✅ Ultra-simple |

| Time spent | Several hours | ✅ A few minutes |

| Risks detected | Variable | ✅ Automatically listed |

| Number of tools needed | Several dozens | ✅ All-in-one in X-Ray |

| AI Agent integration | None | ✅ Integrated |

How to access X-Ray?

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.