Everything you need to know about the Kryll.io — Part 3.

All other parts here:

Part 1: Basic tutorial for Kryll.io

Part 2: Basic strategies and explanations

Part 4: How to make the best out of Kryll.io

Now that you know the technical aspect of Kryll.io, it’s time to decide how you want to use Kryll.io. Let’s deep dive in the Trading mindset.

Crypto-Trading : A reminder

As you may know by now, crypto trading is not a black or white thing, it has plenty of shades. A trading strategy, whether it’s automated or not will not be adapted to any coins or any market type, even if you have all the discipline the world, there is no golden strategy with 0% risk in trading. In short terms, trading is all about adaptation.

As a trader, you have plenty of possibilities to trade, two of the most commons are :

DayTrading : A short term approach to trading. In this category of trading you are constantly analyzing what the market is doing for the coin(s) that you are watching. All your trades will mostly be based on small time units where you will wait for a breakout or an indicator of your choosing to be “triggered” (For example a breakout of a symmetrical triangle) to sell your holdings. You will repeat these steps all day with small profits for each trade.

Long term Trading : A long term approach to trading. In this trading style, you are buying an asset and wait for strong indicators with large time units to sell or buy the coins. This approach can be considered as the “Holder strategy”. Because you are holding your coin until you can sell them. But it’s not just a buy and sell whenever approach. The trades you will make with a long term strategy are almost planned and are never done at a random moment.

Using Kryll.io to adapt to the market.

With kryll.io you can create as many strategies as you want, so you have no excuse not to make one for every type of situation there are.

Let’s start by a few examples of what you can do as a trader, and how Kryll.io can help you : (for the sake of this article, strategies used will be very simple)

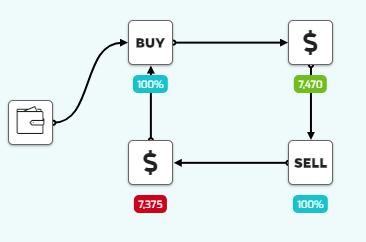

Scalping : Scalping is very common in trading, it is even more common when you are in a range. The principle is easy, buy low, wait for a small pump, sell all your belongings, wait for the price to lower, buy low, repeat. It is a good way to accumulate before a pump or just a great way to make daily earnings.

As a human it is quite hard to scalp because it requires to be 100% available at any time to buy and sell at the right price. But with Kryll.io, it is fairly easy ! Take a look !

For this strategy we’ve used a 1 hour time unit, so there are not a lot of trades in 3 days (even though ~7% is already a very good profit for only 3 days) . But keep in mind that you can change the time unit to the minute and do a lot more ! Now that you have accumulated 7% more BTC, you can either wait and sell high, or call it a day and come back at it tomorrow.

Bear Trading : During a bear market, nothing is more difficult than seeing your well earned money slowly disappear into the abyss. But you can defend yourself ! You just need to change your way of thinking and adapt your strategy to it. One of the best ways to earn money during a bear market (margin not included) is to capitalize on the small pumps. Don’t hesistate to use your technical analysis skills, and indicators to help you on that journey. With Kryll.io you can create a strategy that will deflect the effect of the bearmarket ! One simple way to get profit during a bear market, is to take profits off of the market bounces. Let’s see how, with kryll.io, we can accomplish that.

Keep in mind that what I’m about to show you is not the best optimization possible, we’ll let you find the best way to do so :)

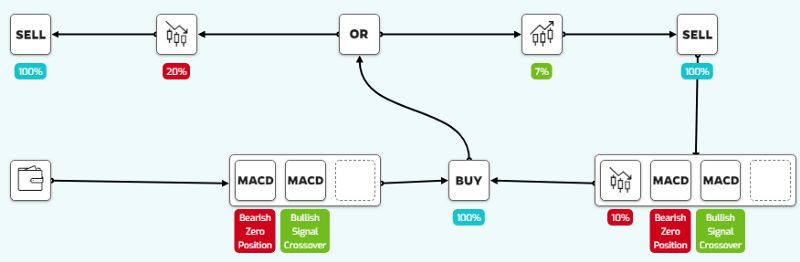

To trade in a bearmarket I like to use the MACD indicator, it helps me decide when to buy.

Here’s how my strategy works (MACD period : 4H):

- When the MACD is below the zero line AND a signal crossover happened, then buy.

-Either sell when the price goes up 7%, or stop loss if the price goes down 20%

-To continue after the sell, verify if the price has dropped at least 10% AND MACD is below the zero line AND a signal crossover happened.

-Repeat.

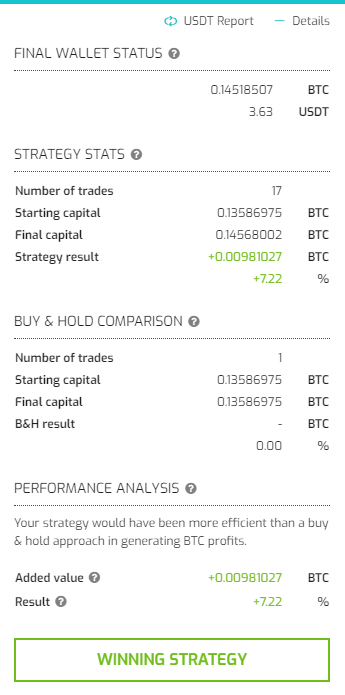

To test my strategy I backtested it from the 1st of may to the 1st of june. At this period, 1BTC went from ~9000 dollars to ~5800$. But with our strategy we still managed to do some profits !

There only have been 6 trades in a month because my strategy was very simple and did not take any major risk. But you can do way more !

But remember, in a bear market, you should NEVER be too greedy. It will cause your loss.

You can see that we made a 10% profit in one month, when the buy & Hold approach would have cost us 18.4% of our fortune.

So in the end we made a 28.2% profit compared to the buy & hold approach.

Here’s what’s the strategy looks like on the graph, you can see that we did not take all the bounces, but as I said in the begining, this strategy is not optimized to the max.

Prepare for a big pump ! : The last type of strategy I’m gonna talk about is the “prepare for a big green candle strategy”. Odd name, I know… The goal of this strategy is to accumulate the maximum of a currency to be prepared for a big pump. This kind of strategy works well on any type of coins, especially those with high volumes. It’s a strategy that I would recommend you to do in a bullmarket, or when you expect a bullrun. Let me show you how you can translate that in Kryll.io language.

Again, keep in mind that the strategy I’m about to show you is not optimized, it’s here to make you understand what we can do with kryll.io.

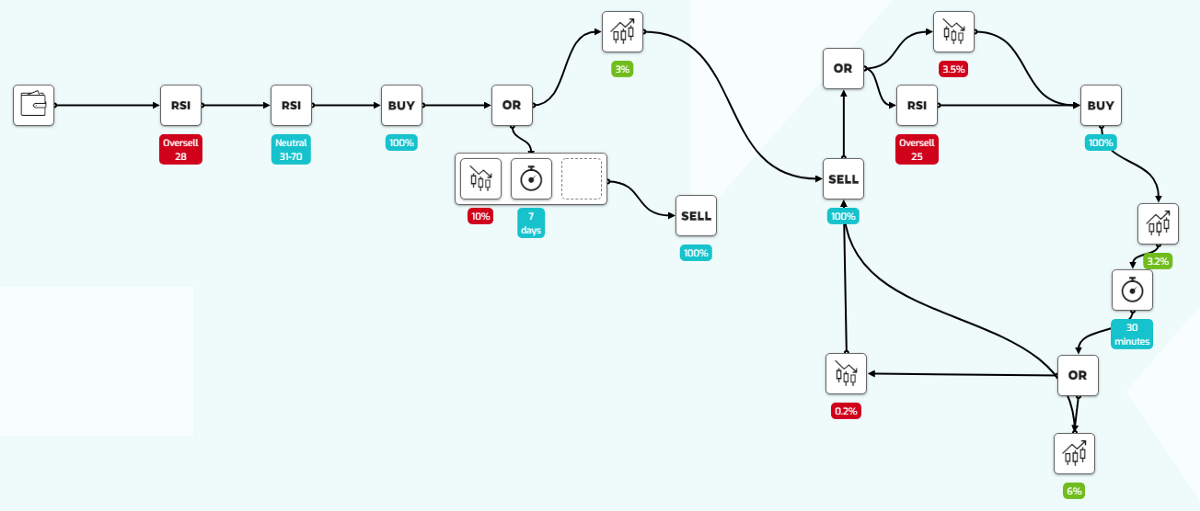

Here’s how my strategy works (period : 12h):

-Check the state of the RSI then BUY.

-Either Stop loss if the price drops 10% and 7 days has passed OR if the price goes up by 3%, sell.

(Now we are in the accumulating bit)

-If the RSI OR the price drops by 3.5% then buy.

-If the price goes up 3.2%, wait 30 minutes.

-If the price goes down 0.2% SELL OR if the price goes up 6% more, SELL.

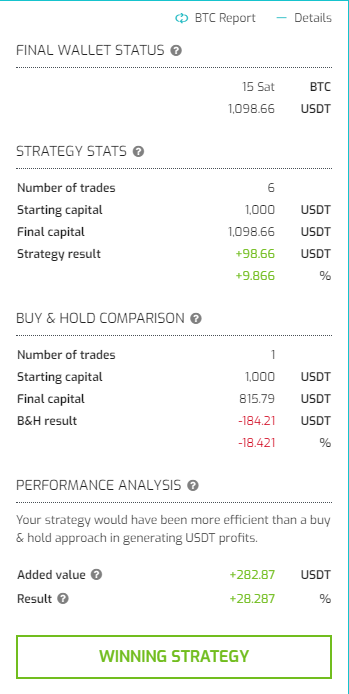

To test my strategy I backtested it from the 16th of June to the 17th of July. The goal was to accumulate so I chose a time window that could help me with that. And we managed to accumulate a lot !

With our strategy we sold at +15% in only a month. Which is very impressive.

We managed to accumulate enough to be able to sell more 5% XLM, so we actually made more profit without actually selling higher.

Conclusion

To conclude this article, we can see that it is very important to choose your strategy according to the market. And it is even more important to study the market for potential profit. And with; kryll, it’s easy to do so, you just need to create a strategy that will cover what you want to do, and you are all set ! You can go and spend your day at the beach while earning money.

In the next article, we will talk about how to make the best out of Kryll.io in a more general matter. Stay tuned for that !

Happy Trading!

Be sure to follow us on all our social networks.

Our website: https://kryll.io

Discord: https://discord.gg/jxQZKW

Twitter : @Kryll.io

Telegram : https://t.me/kryll_io

Facebook : https://www.facebook.com/kryll.io