Everything you need to know about Kryll.io — Part 2.

All other parts here:

Part 1: Basic tutorial for kryll

Part 3: Adapt your strategies to the market

Part 4: How to make the best out of Kryll.io

Welcome back! In this article we are gonna talk about what’s possible within the kryll.io alpha, how to create a strategy, and how it works. From your first block to live-trading including backtesting, we’re gonna review it all!

It’s time to create your first strategy!

First of all, I highly recommend you to check out the first tutorial we made, it explains every block you will encounter on your journey. Now let’s get ready to drag and drop your way to success.

It begins!

Create your first strategy by clicking on “Create a Strategy” on the Dashboard. There is also a way of creating a strategy in the “Strategies” panel.

Now you are welcome with the almighty strategy editor! It’s time for you to add your blocks to create your own strategy. For the sake of this tutorial, I am simply going to create a very simplified scalper.

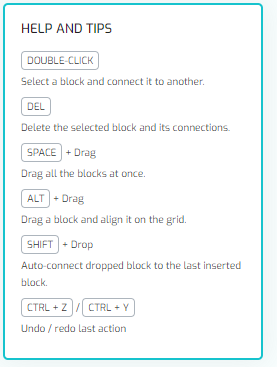

Few things to know before editing a strategy :

To place a block on the strategy, just drag it and drop it on the workbench.

To edit the property of a block, double-click on the property just below the actual button.

To know what a block is for, just drag over the mouse cursor.

Now let’s edit our first strategy!

Simply drag and drop the blocks you need for your strategy on the workbench. And edit the properties as you please.

Drag and drop your blocks on the workbench.

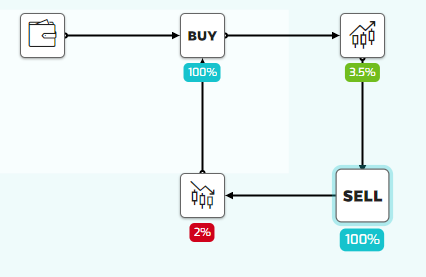

Now you can link them all to create your strategy flow! Kryll.io will take care of the rest, no coding needed! As said earlier, this is a very simple and basic scalper that will not work in every case. But here is what I have now!

Let’s save our strategy just in case our computer shuts down, or you need to go anywhere. Just press the save button and name your strategy as you please! You can even add a description. Once saved, you will see all your strategies in the strategy panel on the website.

You can even have favorite strategies that will be shown directly on your dashboard for easy and quick access.

Now let’s backtest our strategy!

One of the top features of kryll.io is its backtest. You can backtest your strategy from 01/01/2018 to now with a precision of 1 minute! That way you are able to optimise your strategy for a certain kind of market or for a certain coin before going for live trading!

To backtest your strategy, you must choose a period, an exchange and a pair. For my example, I will choose AION/BTC on Binance. To select your period you can either use the drop-down buttons, or you can drag and draw the zone you want to trade in. The period I chose for this tutorial will be from 23rd March to 23rd April.

It’s time to test it!

Choose how much you want to test with (I will choose 1BTC) and hit the Test button! Every Buy order and Sell order will be shown on the graph, and when the test is over, an analysis tab will show you how your strategy worked for this period of time with the pair you chose. You can backtest infinitely so have fun and optimize your way to the moon!

Our strategy did well!

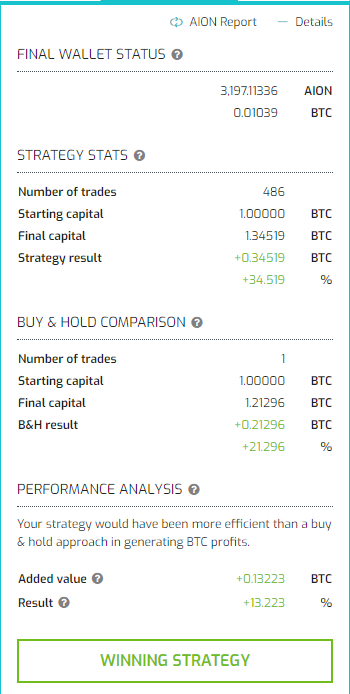

Indeed our strategy was 13%more effective than the Buy&Hold Approach. Click on “Details” to show more!

On the strategy Stats tab, you can see that there was a total of 486 trades and we earned 34.519% of our Starting Capital.

On the Buy & Hold tab, we see that we would have earned only 21.296% of our starting capital.

On the last tab we see how our strategy did compared to the Buy & Hold approach, that way you can determine how to improve your strategy.

But it will not be the case for every coin, and every period of time. Be sure to thoroughly test your strategy before going live!

Now it’s time to go live!

If you pay attention, on the first gif of this article you can see two strategies next to the “Create Strategy”. These are two live strategies!

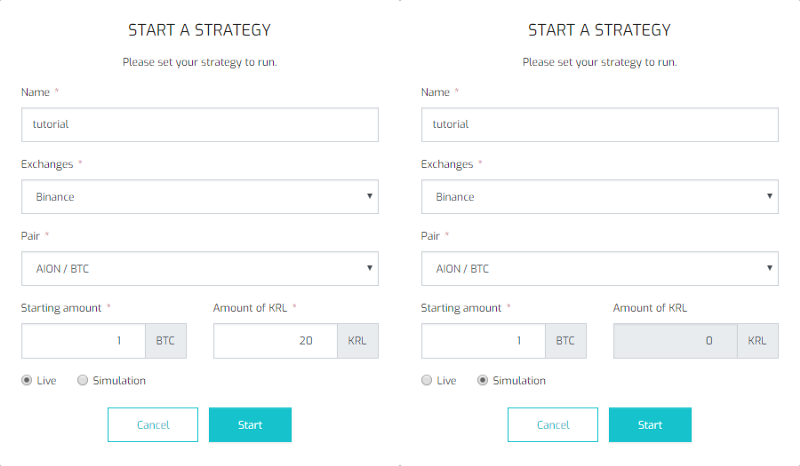

With Kryll.io when you decide to launch your strategy on the real market, you have two options.

1. Live Simulation. You will not spend any currencies, it will just simulate live with your strategy. So Kryll.io will indicate when a Buy order was made etc… Just like the Backtesting, but in real time!

2. Live Trading. Yes, it’s the thing you are looking for! With this option, Kryll.io will connect to your API (that you must enter in your profile before going live.) and trade for you! A graph will show in realtime what’s happening.

Now you can see your running strategies on your dashboard! Click on them to see how they are performing and take a look at the graph!

You are good to go!

Your imagination is the limit (And the alpha obviously)! Create and share your strategies as you wish! Don’t forget to spread the word when you will be making profits :).

Before you go…

Stay tuned on the telegram to participate in the development! Your voice does matter!

Just so you remember, the Kryll.io platform is coming with :

- No strategy creation limit, create and backtest as much as you need to optimize your brand new strategies!

- New blocks to make your strategies even more powerful.

- Pro Mode to enhance your designs.

- Kryll is cloud-based so live strategies are running as long as you need them to, even while sleeping, eating or even playing.

Be sure to follow us on all our social networks.

Our website: https://kryll.io

Twitter : @Kryll.io

Telegram : https://t.me/kryll_io

Facebook : https://www.facebook.com/kryll.io