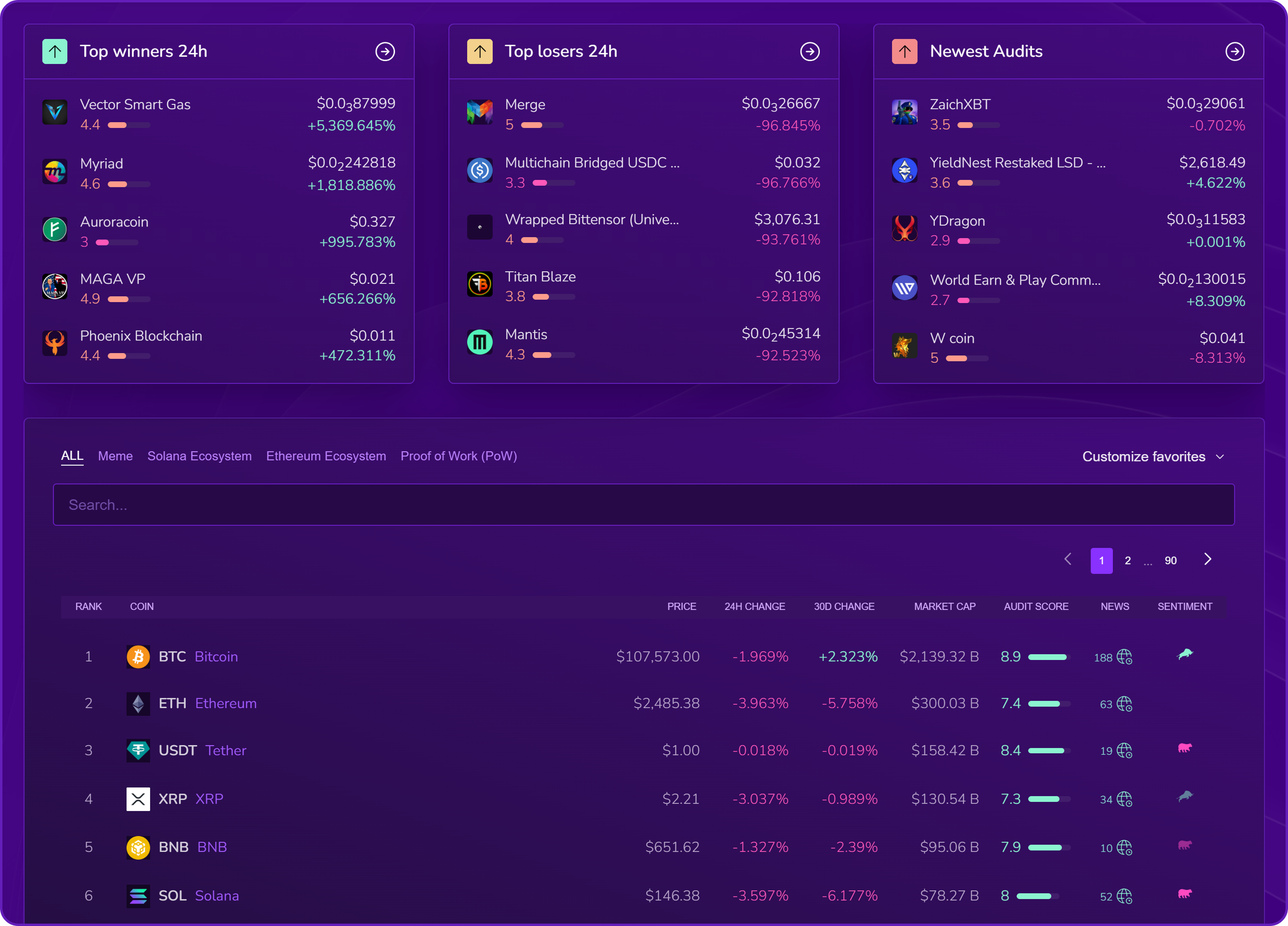

In recent days, Aster has made headlines in the crypto world. Formerly APX, the project completed its migration to the $ASTER token, generating colossal volumes from launch. In just a few hours, over one billion dollars in market capitalization was reached, driven by massive enthusiasm and visibility boosted by notable support: CZ, Binance's founder, publicly congratulated the team for this lightning-fast start.

Against Hyperliquid, already considered a leader in decentralized perpetuals exchanges, Aster now emerges as a credible competitor, capable of rallying a massive community in very little time. But behind the excitement, what about the fundamentals?

Here's Aster's story through the lens of Kryll X-Ray: where hype meets data reality, and where even crypto giants can be caught off guard.

What is Aster and why is it compared to Hyperliquid

Aster is a next-generation decentralized exchange (DEX). Its particularity: offering both spot trading and perpetual contracts, with advanced features like:

- MEV-free execution (protection against malicious arbitrage)

- Hidden orders to avoid exposure

- Simple mode for beginners and pro mode for experienced traders

Deployed on BNB Chain, Aster aims to expand to other major blockchains (Ethereum, Solana, Arbitrum...). Its rapid rise, community support, and legitimacy provided by YZi Labs put it in direct competition with Hyperliquid, which currently dominates the perpetuals DEX market.

When data replaces promises: the Kryll X-Ray audit

Storytelling and hype are one thing, but on-chain and contractual data often tell a completely different story. This is where Kryll X-Ray comes in, the all-in-one audit tool that analyzes a crypto project in depth: finances, fundamentals, cybersecurity, smart contracts, and on-chain data.

Financial audit: the numbers speak

According to X-Ray data, Aster displays:

- Token price: $0.613 (recent change: -3.47%)

- Market cap: approximately $1.016 billion

- 24h volume: $409.6 million (+37.34%)

- Volume breakdown: CEX (centralized exchanges): $409.54M DEX: $81.9k

⚠️ Liquidity ratio: 20% – this figure is important. This means only a fraction of tokens is actually available for trading. In concrete terms, a low liquidity ratio exposes to high volatility: the price can rise very quickly... but also drop brutally if large holders decide to sell.

For an investor, this indicates a project that's still young, where market movements can be amplified.

Technical analysis: a dynamic in transition

According to Kryll X-Ray:

- General market direction: slightly bullish

- Current trend: bullish (optimistic)

- Potential opportunity: neutral

- Market state: in transition

👉 Simple translation: Aster is in a very positive launch phase, but the market hasn't yet decided between continued upward movement and consolidation. Technical signals show potential, but no solid confirmation yet.

For an investor, this means the opportunity exists, but timing remains risky.

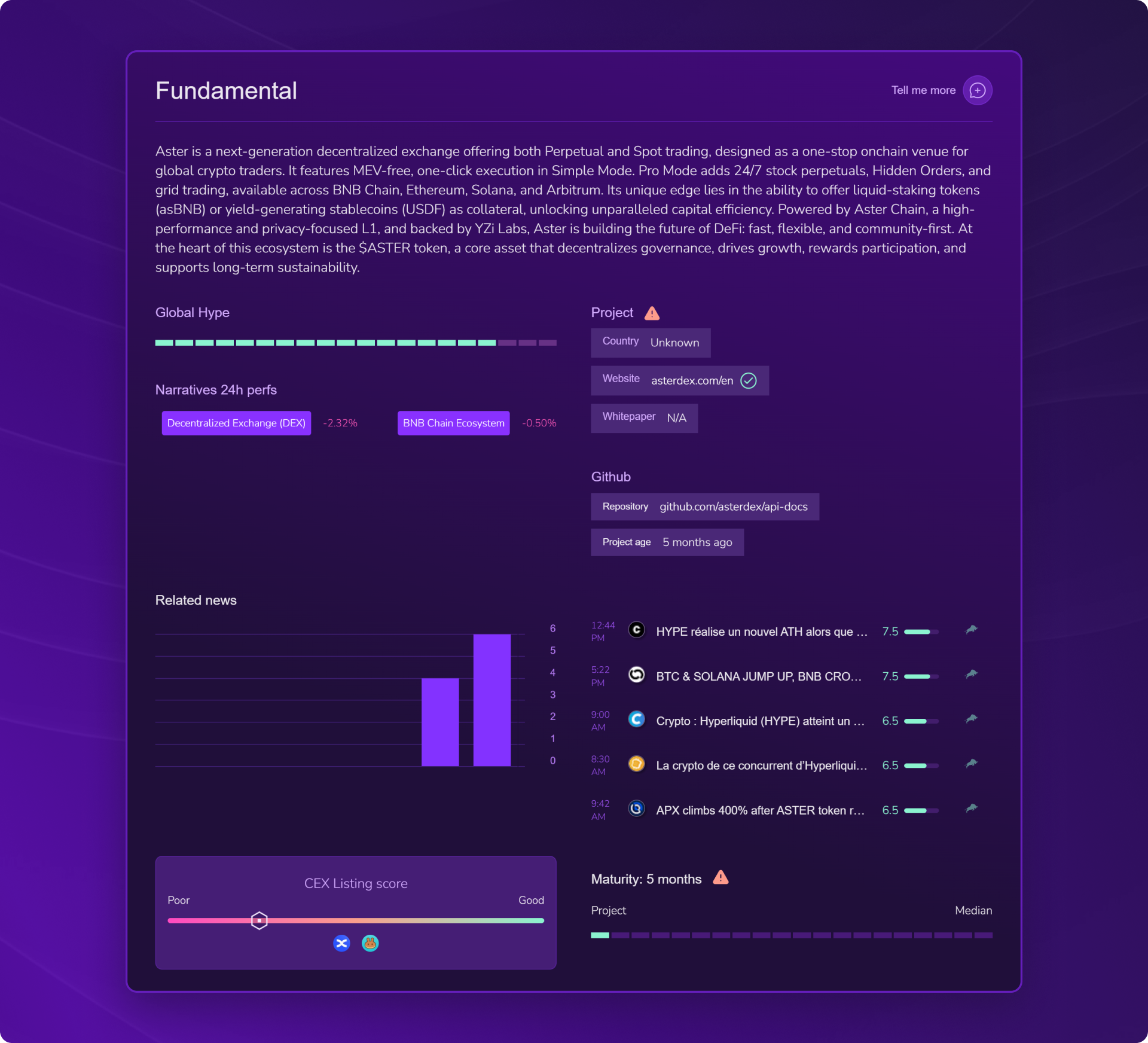

Fundamental audit: between youth and potential

X-Ray reminds that Aster is a young project, with only 5 months of existence. This is reflected in its indicators:

- Maturity: low (5-month score)

- CEX Listing Score: still low

- Documentation / Whitepaper: not available at this stage

- Project country: unknown

This doesn't mean Aster is fragile, but that the project is still being built. For an investor, it's a double-edged sword: on one side, youth means growth potential; on the other, it also implies gray areas and strong dependence on investor confidence.

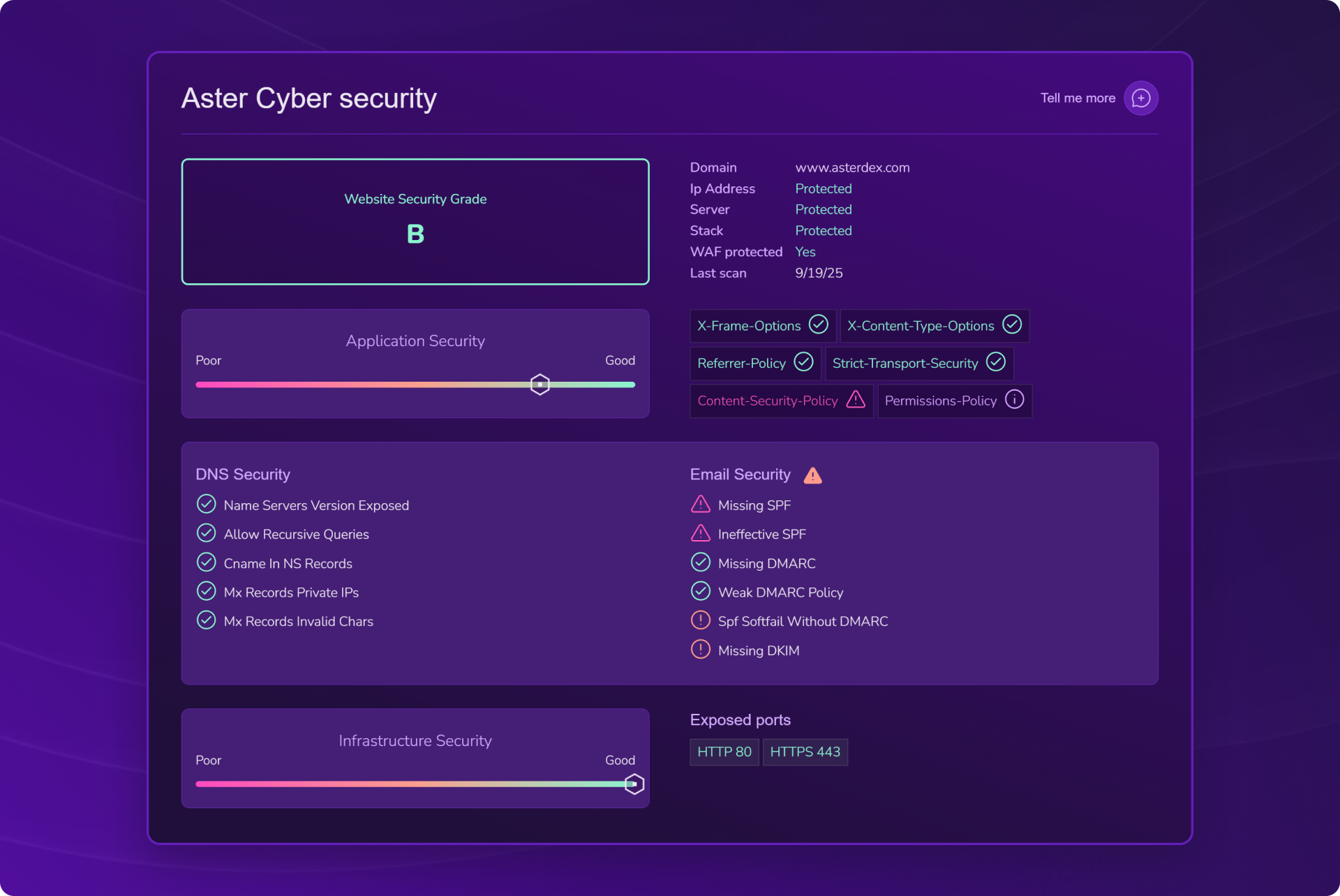

Cybersecurity: a strong point but gaps to fill

Good news, the Kryll X-Ray audit gives Aster a B security rating.

Application & infrastructure: protected by a web application firewall (WAF), with several protections activated (X-Frame-Options, Strict-Transport-Security...).

Weak points:

- Missing or ineffective SPF

- Weak DMARC

- Missing DKIM

👉 In simple terms: the site is well protected against direct attacks, but flaws in email configuration open the door to phishing risks. Investors could receive fake emails appearing to come from Aster, a classic in the crypto ecosystem.

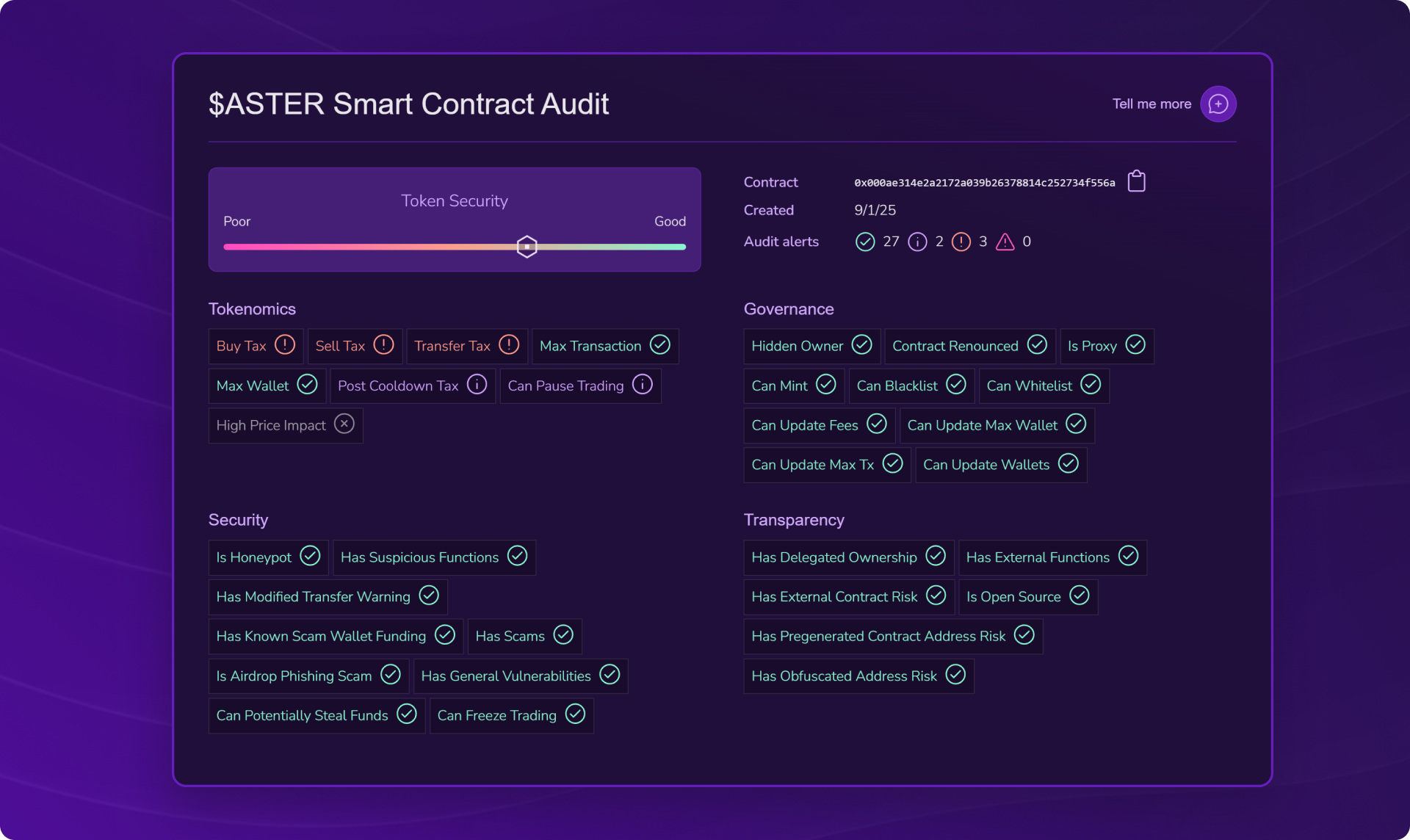

Smart Contract: where the real power lies

The Kryll X-Ray audit shows a globally solid contract: no honeypot, no fraudulent functions, with usual safeguards (wallet and transaction limits, update possibilities in case of emergency). The real shadow comes from taxes applied to purchases, sales and transfers.

👉 Concretely, these fees increase entry and exit costs, and may discourage some active investors or arbitrageurs. Nothing prohibitive, but a factor to consider before taking a position.

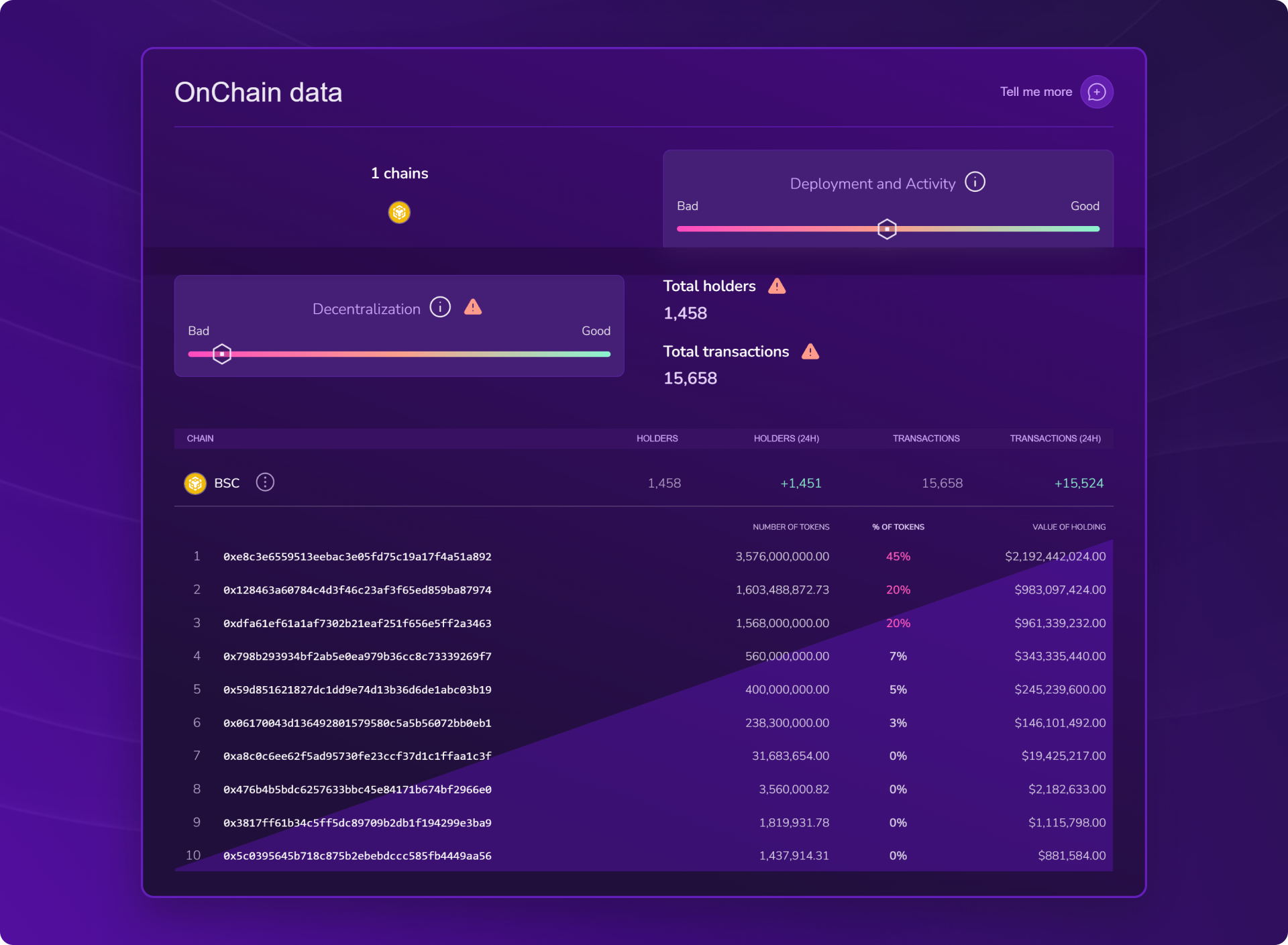

On-chain data: concentration, to be nuanced

The X-Ray audit reveals an interesting snapshot of Aster token distribution. At first glance, the figures might seem concerning: a handful of addresses controls almost the entire supply. But we must remember that a significant portion of the supply (over 53.5%) is destined for the community via airdrops and incentive programs. In other words, a good part of these "big wallets" likely corresponds to reserves planned for distribution, not actual speculative whales.

To give a more concrete overview:

- Total number of holders: 1,458 recorded addresses

- Total transactions: 15,658, including over 15,000 in just 24h, showing lightning-fast adoption at launch

On the side of the largest holders, concentration is clear:

- The main wallet holds approximately 45% of the total supply

- The second controls nearly 20%

- The third also owns around 20%

Taken literally, this would paint the picture of a project centralized between three hands. But in reality, these wallets are linked to community distribution mechanisms and management of reserves planned by the project. The real unknown therefore lies less in current concentration than in how these tokens will be released and redistributed over time.

👉 For an investor, the point to watch will be the unlocking speed and transparency of this distribution: if redistribution is done correctly, centralization risk will decrease rapidly; if it drags on, market confidence could suffer.

The verdict: Aster's strengths and weaknesses

Strengths:

- A spectacular launch, with record volumes and hype from the first hours

- Public support from CZ and anchoring in the Binance / BNB Chain ecosystem

- Advanced trading features (perpetuals, MEV-free, hidden orders)

- Decent web security (B rating) and solid infrastructure protections

- Strong on-chain activity growth, with immediate and massive adoption

- Significant community reserve (over 50% of supply) showing a desire for broad redistribution and community involvement

Weaknesses / risks:

- Still very young project (5 months): lack of maturity and documentation

- Apparent token concentration: over 80% in three wallets, even though a large portion is planned for airdrops and community → heavily dependent on distribution timeline

- Smart contract with taxation (buy, sell, transfer), which increases entry and exit costs for investors

- Email configuration flaws (SPF, DMARC, DKIM) that expose the community to phishing risks

Conclusion

Aster made a strong impact from its launch, combining hype, record volumes, and heavyweight strategic support. The project displays attractive fundamentals: modern features, deep integration into the BNB Chain ecosystem, and above all a massive distribution planned for the community, which could, if conducted with transparency and consistency, significantly strengthen long-term decentralization.

But this initial success shouldn't mask the challenges: project youth, current high token concentration (even if linked to airdrop reserves), and contract with taxation that increases transaction costs. These elements make Aster a high-potential project, but still in its testing phase.

👉 For investors, the opportunity is real, but it requires caution: everything will depend on how the team manages token distribution and community trust in the coming months.

Why use X-Ray?

DYOR is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

With all these cross-analyses, X-Ray offers much more than a simple glance: it's a true intelligent dashboard, designed so everyone can understand, compare, and decide without getting lost in complexity.

| Criteria | Manual Audit 😩 | Audit with X-Ray 😎 |

|---|---|---|

| Ease | Complex | ✅ Ultra-simple |

| Time spent | Several hours | ✅ A few minutes |

| Risks detected | Variable | ✅ Automatically listed |

| Number of tools needed | Several dozens | ✅ All-in-one in X-Ray |

| AI Agent integration | None | ✅ Integrated |

How to access X-Ray?

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.