Bitcoin's Rally: A Testament to Market Optimism

In a stunning display of market resilience, Bitcoin has soared to a remarkable 18-month high, surpassing the $38,000 mark and eyeing the elusive $40,000 threshold. This surge, a culmination of several bullish indicators, has injected a wave of optimism into the cryptocurrency market.

The Driving Forces Behind the Surge

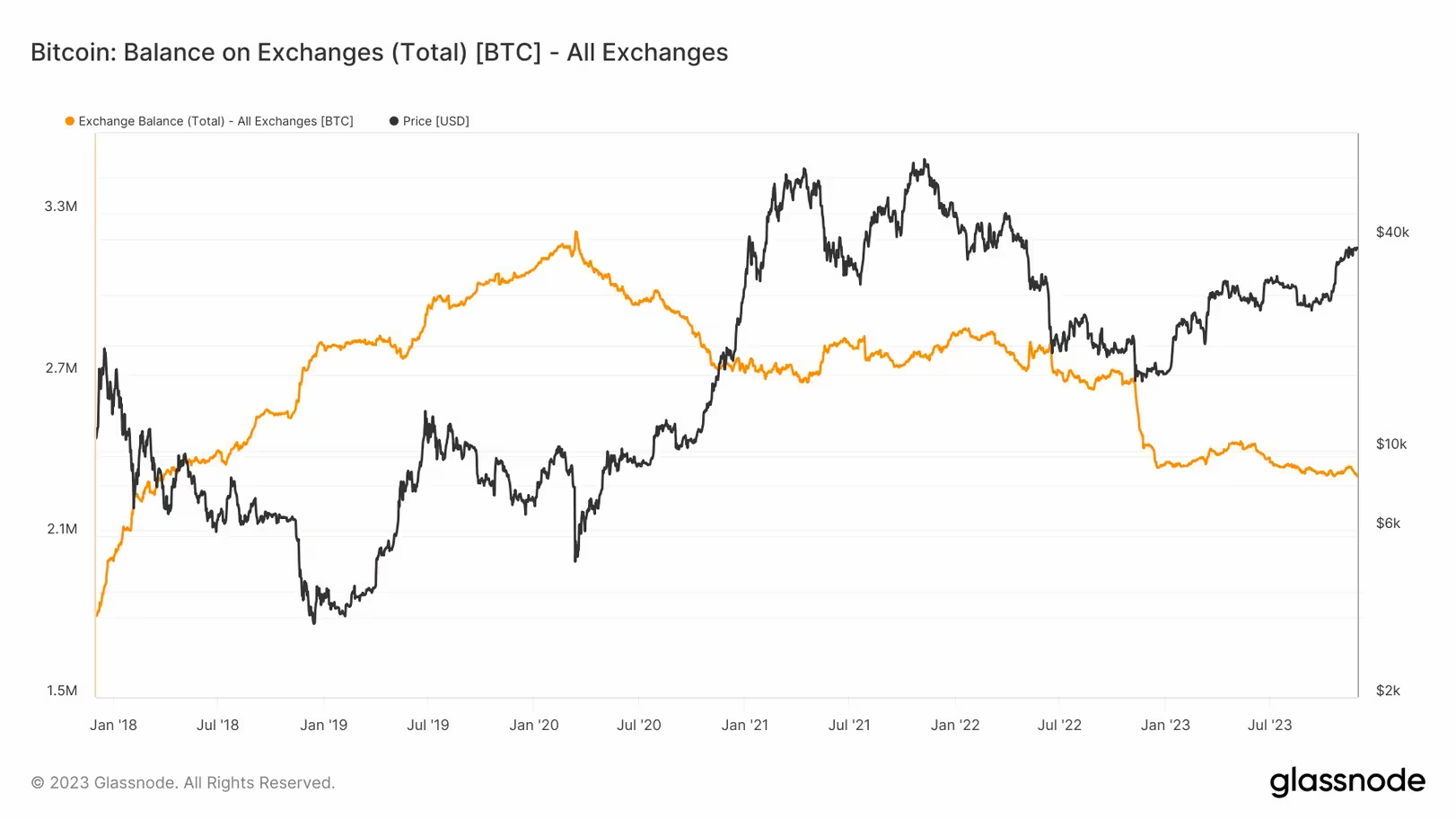

Several key factors have contributed to this meteoric rise. Firstly, data from Glassnode reveals a significant outflow of Bitcoin from centralized exchanges, amounting to over 37,000 BTC (worth approximately $1.4 billion) since November 17. This trend indicates a strong investor preference for long-term holding, diminishing sell-side pressure in the market.

The anticipation of a spot exchange-traded fund (ETF) in the U.S. has further fueled this bullish sentiment. Historically, such exchange outflows have often heralded a rise in Bitcoin prices, suggesting a robust medium-term upward trajectory.

Macro-Economic Factors at Play

The broader economic landscape has also played a pivotal role. Market expectations are leaning towards Federal Reserve interest rate cuts in 2024, a move that traditionally benefits risk assets like cryptocurrencies. This shift in monetary policy, coupled with a pause in the Federal Reserve's rate hiking cycle, is seen as a harbinger of more capital flowing into markets, including the volatile crypto sector.

The Impact of Bitcoin Halving on Market Prices

A pivotal factor in Bitcoin's price dynamics is the phenomenon known as 'halving.' Occurring approximately every four years, this event cuts the reward for mining new blocks in half, effectively reducing the rate at which new bitcoins are generated and entered into circulation. This scarcity mechanism has historically triggered significant bullish trends in the Bitcoin market.

The halving reduces the supply of new bitcoins, and if demand remains steady, the reduced supply often leads to a price increase. The anticipation of this event tends to create a surge of investor interest, as seen in previous cycles. With the next halving scheduled for 2024, market analysts and investors closely watch its potential impact on Bitcoin's valuation, often viewing it as a precursor to a new era of valuation highs and increased market activity.

Wall Street's Bullish Outlook

Adding to the fervor, Standard Chartered's forecast posits Bitcoin reaching a staggering $100,000 by the end of next year. Technical analysts, like Katie Stockton, also predict a potential surge in Bitcoin's value in the coming weeks, further bolstering investor confidence.

The Role of Institutional Players

The growing interest of institutional players in a spot Bitcoin ETF and the upcoming Bitcoin halving in April 2024 are also significant bullish events. These developments are expected to attract more investment into Bitcoin, potentially leading to even higher price levels.

Kryll.io Traders Catching the Wave

Amidst this bullish scenario, savvy traders using Kryll.io bots have managed to capitalize on this pump. These automated trading strategies have enabled them to navigate the market's volatility effectively, catching the upswing and contributing to the dynamic trading landscape.

Conclusion

Bitcoin's current trajectory is a confluence of favorable market conditions, optimistic economic forecasts, and strategic trading maneuvers. As the crypto giant continues its ascent, the market watches with bated breath, anticipating its next milestone in this exhilarating journey.

Happy Trading,

Website: https://kryll.io

Twitter: @Kryll_io

Telegram EN: https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord: https://discord.gg/PDcHd8K

Reddit: https://reddit.com/r/Kryll_io

Facebook: https://www.facebook.com/kryll.io

Support: support@kryll.io