Understanding the nuances of Bitcoin market cycles and strategies of bull runs is essential for both novice and seasoned investors. This piece sheds light on the intricacies of Bitcoin's halving events, market dynamics, and the psychological aspects of trading during fluctuating market conditions. We explore key strategies to thrive in the volatile landscape of cryptocurrency investing, particularly during the exhilarating yet challenging phases of a Bitcoin bull run.

Manouvering the highs and lows of Bitcoin's market cycles demands more than just financial acumen; it requires a blend of rational decision-making, psychological resilience, and a deep understanding of market trends. From recognizing the signs of an impending bull run to effectively managing the fear of missing out (FOMO), this guide offers valuable insights and practical tips for investors looking to optimize their strategies in the dynamic world of Bitcoin trading.

Now let's unravel the complexities of cryptocurrency market cycles and equip you with the knowledge to make informed decisions in this swiftly changing domain.

Understanding the Crypto Market Cycle: Key Insights

1. Bitcoin Halving Cycle and Price Movements

The Predictable Yet Dynamic Nature of Bitcoin Halving

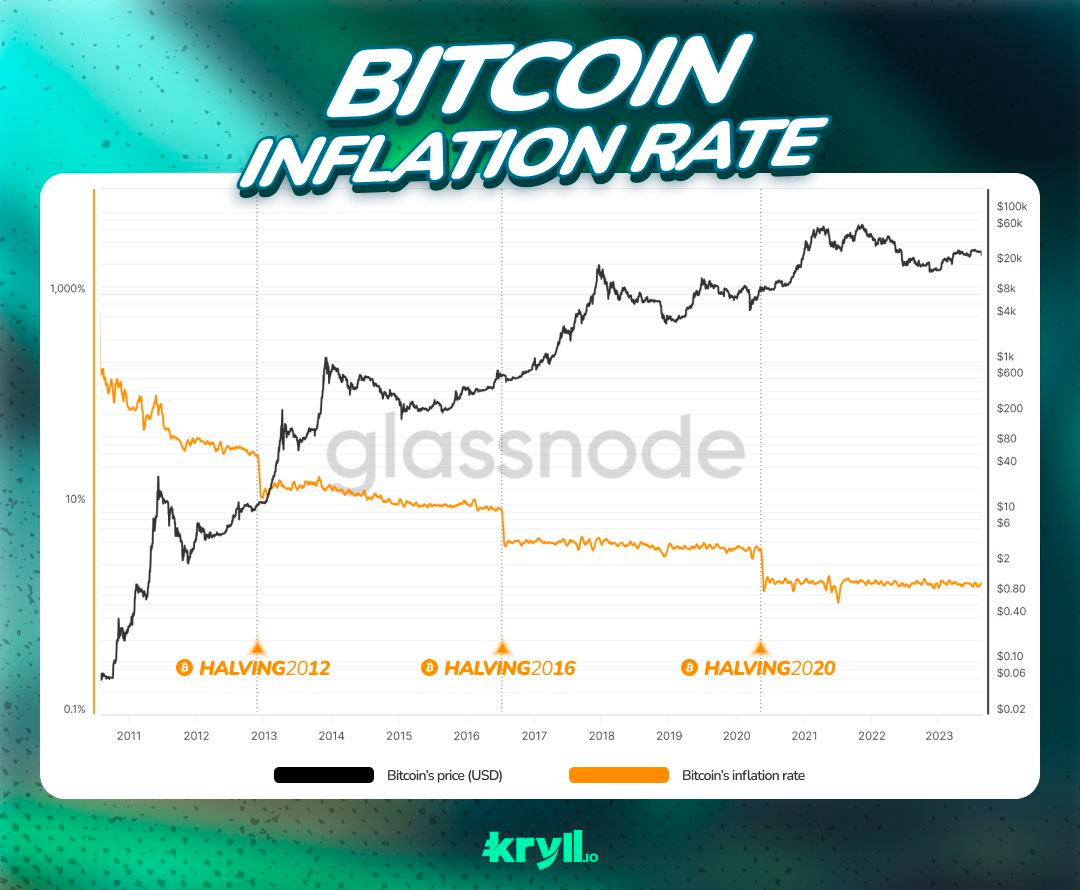

The Bitcoin halving event, which occurs approximately every four years, is a significant driver of Bitcoin's price cycle. This event, where the reward for mining new blocks is halved, thus reducing the rate at which new Bitcoins are generated, has historically led to a pattern of a one-year bull market. This bullish phase is typically followed by a bearish trend lasting a year, and then a two-year phase of relative stagnation. This cycle is remarkably consistent, highlighting Bitcoin's unique behavior compared to other financial assets. The halving events, by reducing the new supply of Bitcoin, create a scarcity effect that has been a key factor in driving price increases.

Understanding the Market Dynamics Post-Halving

The halving-driven cyclicality thesis suggests that these price increases post-halving garner further attention for Bitcoin, leading to increased investment as more people become informed about its properties and potential. Each halving serves as a market-broadening catalyst, spreading Bitcoin's ideas and narratives through society and unlocking new tranches of demand. However, it's important to note that the data points are still few (with only three halvings so far), and a clear causal link between Bitcoin’s decrease in supply and broadening demand is yet to be firmly established. Despite this, the halving events have historically been followed by periods of substantial price appreciation.

The Role of Investor Behavior and Market Psychology

The cyclical nature of Bitcoin's price movements also reflects the behavior of its investors. Long-term holders often accumulate more supply during the most volatile phases of rapidly appreciating and depreciating markets, restricting supply in times of hardship, and then releasing supply in times of prosperity. This dynamic supply behavior, coupled with the halving events, contributes to the cyclical price patterns observed in Bitcoin markets. As Bitcoin matures and its adoption rises, these behavioral patterns among holders suggest that the cyclicality might continue, with each cycle potentially bringing in a new class of long-term investors.

2. Embrace Profit-Taking Strategies in Bull Markets

In the exhilarating rush of a bull market, it's crucial to remember that the intrinsic value of a 2x gain remains consistent, regardless of market conditions. This principle holds true whether in the throes of a bull run or the depths of a bear market. The challenge, however, lies in overcoming the psychological barriers that often cloud judgment during these high-energy periods. The temptation to hold out for even larger gains can be overwhelming, leading to missed opportunities to secure profits.

The key to navigating this terrain is a disciplined approach to taking profits. Establishing clear targets and adhering to them can help in capitalizing on gains while they are available. This strategy not only safeguards your investments but also provides a buffer against the inevitable market corrections. Remember, the market's generosity is not endless, and the tides can turn swiftly. By securing profits at predetermined intervals or thresholds, you can ensure that your investment journey is marked by prudent decision-making rather than regret over missed opportunities.

3. Maintain a Balanced Portfolio with a 'Moonbag'

A common dilemma for investors in a bull market is the fear of missing out on potential future gains from assets they've sold. To mitigate this psychological burden, consider keeping a 'moonbag' – a small portion of your investment in a particular asset, even after taking significant profits. This approach allows you to benefit from any potential future upswings without the regret of having sold your entire position.

The concept of a moonbag is not just a financial strategy but also a psychological one. It helps in maintaining a balanced emotional state, knowing that you still have a stake in the game. This small, retained portion of your investment can provide disproportionate psychological comfort, even if it represents a minor part of your overall portfolio. It's a way to stay connected to a potentially high-growth asset while still practicing sound financial management by securing profits and reducing exposure.

4. Focus on Selective Investment Strategies

In the dynamic and often overwhelming world of cryptocurrency investments, it's crucial to maintain a focused approach. The temptation to diversify into numerous projects can be strong, especially when the market appears to be favoring almost every token. However, historical and analytical insights suggest that spreading investments too thinly across a wide array of tokens often dilutes potential gains.

Investors should consider concentrating on a select few projects that not only show promise but also align with their investment philosophy and risk tolerance. This approach not only simplifies portfolio management but also allows for a deeper understanding of each investment, enabling more informed decision-making. It's about quality over quantity – investing in a few well-researched projects is often more profitable than scattering funds across many. Incorporating on-chain metrics analysis can also help in investment decision making.

5. Understanding Money Flows in Crypto

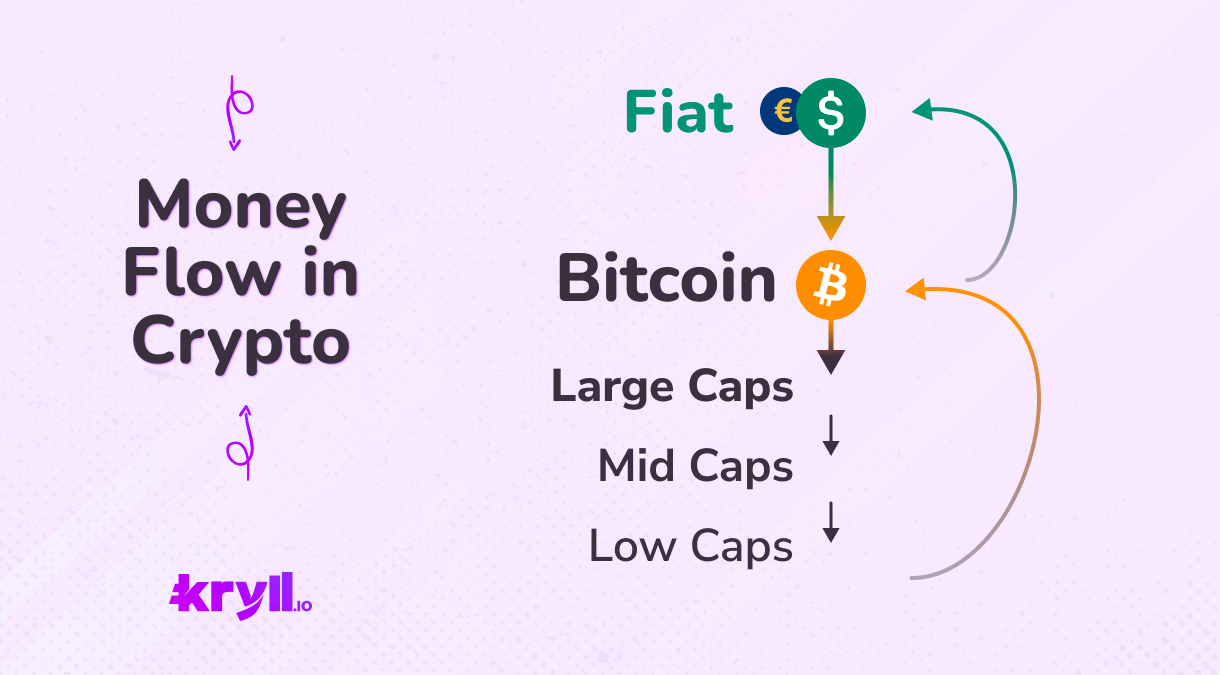

Tracking the flow of money provides a map to understand market cycles. Money typically enters through Bitcoin, the bedrock of the crypto economy, where surges in its price often signal the onset of a bull market. From there, investment currents flow to Ethereum, the leading altcoin, which occasionally challenges Bitcoin for dominance in a phenomenon known as "the flippening."

As the market matures, funds cascade into large-cap altcoins, signaling investor confidence beyond the top two. This is where the magic of diversification begins to unfold. Seasoned investors will then navigate further downstream to mid and low-cap coins, often riding the waves of speculation for potential high returns. This stage, known colloquially as "altseason," is marked by a frenetic energy where even the smallest coins can see parabolic growth. However, savvy investors keep their sights on the cycle, often redirecting profits back to Bitcoin as a stabilizing anchor when market exuberance peaks. Thus, the ecosystem maintains a cyclical rhythm, driven by investor behavior, market sentiment, and a quest for balance between risk and reward.

6. Prioritize Security and Vigilance

The heightened activity in bull markets doesn't just attract investors; it also becomes a prime time for hackers and scams. As investment activities intensify, the need for stringent security measures becomes paramount. Investors should be vigilant in scrutinizing smart contracts and consider using hardware wallets for enhanced security.

In a market where new projects are constantly emerging, due diligence is key. Avoiding projects with unclear team backgrounds or overly ambitious value propositions can save investors from potential scams. Remember, in the rush to capitalize on market movements, safeguarding your investments is as important as growing them. Protecting your funds isn't just about avoiding losses; it's about ensuring the longevity and sustainability of your investment strategy.

7. Rigorous Activity Tracking

It's crucial to maintain a meticulous record of all your transactions and investments. This practice is not just about organization; it's a strategic move to ensure you don't lose track of potentially lucrative investments.

Why It Matters: The crypto landscape is replete with stories of individuals who misplaced or forgot about their digital assets, only to realize their value had skyrocketed. In an environment where investments can rapidly appreciate, losing track of an asset can mean missing out on significant gains.

How to Implement: Take advantage of digital tools and platforms that allow for comprehensive tracking of your crypto activities. This includes monitoring wallets, especially those used for specific transactions or investments. Regularly update and review your investment portfolio to ensure all assets are accounted for and properly managed.

8. Selective Information Consumption

The influx of information in the crypto world can be overwhelming, especially during a bull run. It's vital to be discerning about the sources of your information, as the market is often flooded with self-proclaimed experts who may lack depth in their understanding or experience.

Why It Matters: Misinformation or superficial analysis can lead to poor investment decisions. During bull runs, the hype can cloud judgment, making it even more important to rely on credible, well-researched information.

How to Implement: Choose your information sources carefully. Prioritize those with a proven track record and deep involvement in the crypto market, especially those who have weathered both bull and bear markets. Search for sources that offer balanced, data-driven insights rather than sensationalist predictions.

9. Develop a Strategic Exit Plan

In the calm before the storm of a Bullrun, it's crucial to have a clear exit strategy. This involves setting aside time to outline your goals and objectives for the upcoming Bullrun. Determine your target profits, your exit points, and the kind of investor you aspire to be. This preparation isn't just about maximizing profits; it's about ensuring you're not swayed by the heat of the moment. A well-thought-out exit plan can be the difference between making calculated decisions and getting caught up in the frenzy of a market peak. Remember, in the world of cryptocurrency, timing is everything. Your exit strategy should be a blend of market analysis, personal financial goals, and an understanding of your risk tolerance.

10. Maintain Liquidity

Always keep a portion of your portfolio in stablecoins or other liquid assets. This ensures that you have the flexibility to capitalize on sudden market opportunities, without disrupting your other investments. Having about 15-30% of your portfolio in liquid assets is often advisable. This liquidity not only provides a safety net in volatile market conditions but also allows you to take advantage of potential buying opportunities that may arise. In a Bullrun, where asset prices can skyrocket, having quick access to capital can be a game-changer. It enables you to pivot and adapt to market changes swiftly, ensuring that you're always in a position to make the most of the bullrun.

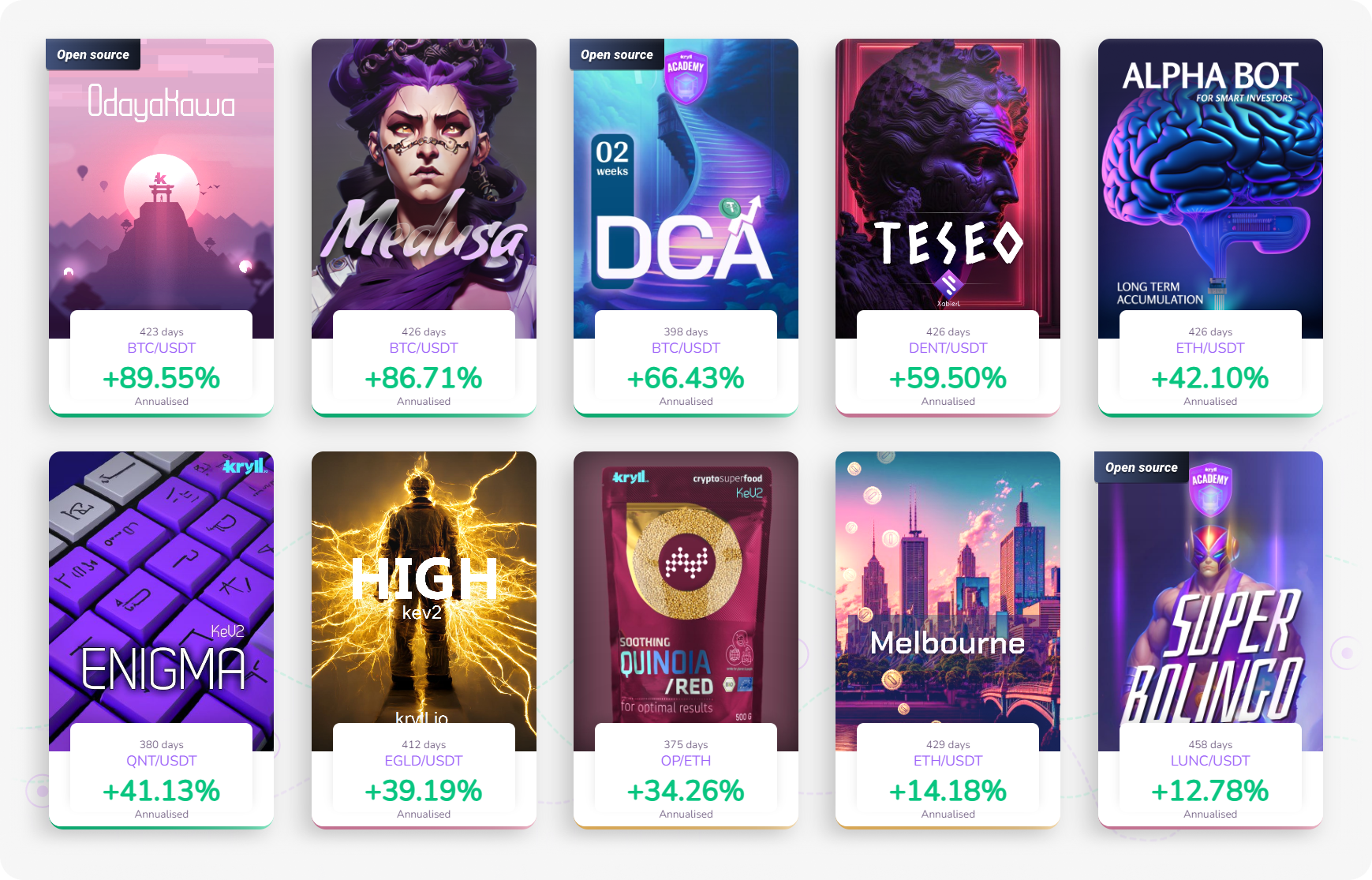

11. Embrace the Efficiency of Kryll.io Trading Bots

In the dynamic realm of cryptocurrency trading, utilizing automated tools like Kryll.io bots can be a strategic advantage. These bots, designed for both beginners and seasoned traders, automate trading based on set criteria, ensuring continuous market engagement and leveraging opportunities even when you're away. They offer the dual benefits of removing emotional bias from trading decisions and executing transactions with a speed and efficiency beyond manual capabilities.

Happy Trading,

Website: https://kryll.io

Twitter: @Kryll_io

Telegram EN: https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord: https://discord.gg/PDcHd8K

Reddit: https://reddit.com/r/Kryll_io

Facebook: https://www.facebook.com/kryll.io

Support: support@kryll.io