Many of our users have questions before launching strategies. They may have some difficulties to choose the trendy coin or to start the right strategy with the right timing.

Not to mention the desired objective, rather short term from a few days to a few weeks of trades, rather long term from a few weeks to a few months of trades...

It is also necessary to decide which coin you want to accumulate, BTC, USDT ...

This article is therefore here to quickly answer your main questions before launching an automated trading strategy.

Choose your coin(token)

- What is my short/long term objective?

- What do I want to accumulate?

- Beware of overbought

- To be informed of the news

Choose your strategy according to your needs

- Check the coin suggested by the creator in the marketplace

- Ask questions to the creators and the community

- Check the live strategies for the chosen coin

- Optional backtest

Choosing your coin (token)

We'll see that even in automated trading, it's important to know your needs and to set a short-term/long-term goal. It is also important to know what you want to accumulate. In addition, we can stress the importance of paying attention to the health of the coin when starting the strategy.

What is my short/long term profit objective?

Depending on your objectives, the strategies of the Kryll marketplace can be adapted to your needs.

For example, the GAIA is a short-term strategy, from a few days to a few weeks. The creator recommends to stop the strategy between +5 to +15% depending on your personal objectives.

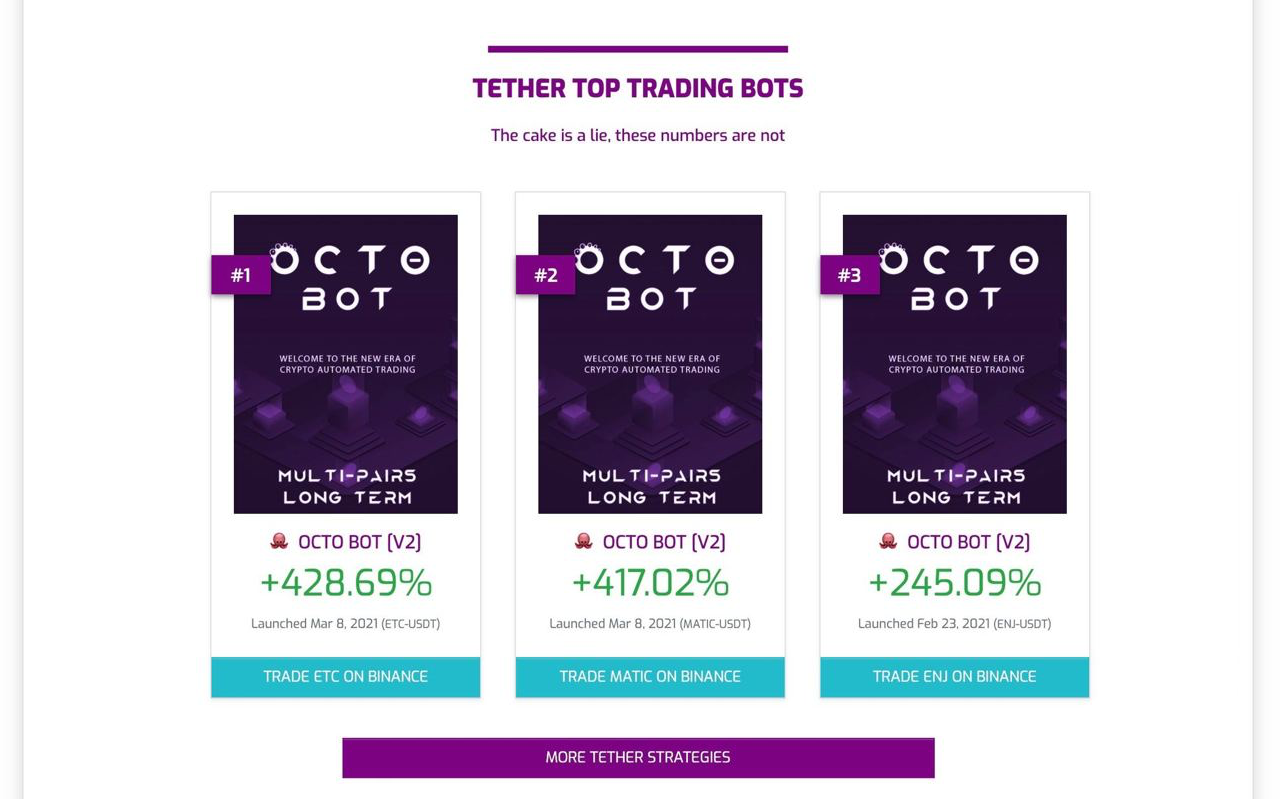

On the contrary, the OCTO BOT strategy is long term oriented. So don't expect daily trades but weekly ones. This bot will only take position on significant long term buy or sell signals. You will have to be more patient with this type of strategy.

What do I want to accumulate?

Many users prefer to use only USDT market strategies: you should know that in this case you are accumulating USDT!

If you choose the Bitcoin (BTC) market as your base currency, then you will be accumulating BTC. You will therefore choose strategies on ALTCOIN/BTC. (As a reminder, any cryptocurrency other than Bitcoin is commonly referred to as Altcoin).

Here is an example: At the beginning of 2021, I have a feeling (personal research, community opinion, etc.) that ETH is well on its way to rising. So instead of accumulating USDT, I will try to accumulate ETH in order to benefit doubly from the rise. On the one hand because my strategy will have allowed me to earn more ETH, and because the price of ETH will have risen! I will therefore choose an ALTCOIN/ETH type strategy.

Beware of overbought conditions

In order to check the health of a coin, it is important to check the position of its RSI with different thresholds. We find the overbought zone above 70 and the oversold zone below 30. They are shown on the chart below:

The starting zone extends from 30 to 70 (purple zone of the graph) with an ideal between 30 and 50 with a rising RSI.

In other words, the wedge is leaving a sell zone and moving into a buy zone.

Be careful above the 70 zone, it is the overbought zone. This means that the wedge is currently very bought. There is a good chance that it will move to the sell zone and the price will fall.

Speaking of the RSI, be aware that it can be influenced like the price of the asset by the News of major players.

Monitoring the news

The cryptoasset market is heavily reported on Twitter, Telegram and YouTube. It can be important to monitor the major players in the "Cryptosphere". Here are some of them:

Press

twitter.com/Cointelegraph

twitter.com/BitcoinMagazine

Exchange

twitter.com/coinbase

twitter.com/binance

Influencers

twitter.com/elonmusk

twitter.com/APompliano

Example: It can be helpful to follow Elon Musk's Tweets. Remember on May 13 when he announced that he was no longer accepting payments in Bitcoin, deemed too polluting, for his company Tesla. The Bitcoin had fallen sharply.

Choose your strategy according to your needs

Check the corners suggested by the designer in the marketplace

In the Kryll marketplace, it is easy to find the coin recommended by the creator. These are indicated in the description of the strategy. If you already have an idea of the coin on which you want to launch a strategy, you can type the name of the coin in the search bar to see the suggested strategies.

Ask questions to the creators and the community

If you have any doubts about a startup or to understand the trading mechanics of the strategy, don't hesitate, after reading its description, to ask questions to the community. The Kryll community is our greatest strength with passionate people and an army of developers who can help you! Join the official English Kryll chan Telegram via: this link

Check the live strategies for the chosen coin

Feel free to visit our live monitoring tool which checks in real time the best strategies of our users according to the chosen coin, this will allow you to have a quick overview of the strategies that are successful!

For example, we have below the best strategies on the coin USDT:

Free backtest option

After you have chosen your coin and strategy, you can proceed to the ultimate verification: the Backtest! This will allow you to observe the behavior and results of the strategy on the selected coin in the past.

Here is the link to the article to read and understand the backtest results.

Conclusion

Through this article, we have managed to draw up a quick list of rules to follow when launching a Kryll strategy.

To choose your coin according to the news and above all, except in exceptional cases, not to start a strategy with a coin that is overbought on a daily basis as we have explained. As the saying goes, "patience is the mother of virtues" and this is even more crucial in automated trading. It depends of course on your short and long term targets.

If you have any doubts, don't hesitate to ask the community whose Telegram address can be found in the description of each strategy.

Our community is our pride and our greatest strength!

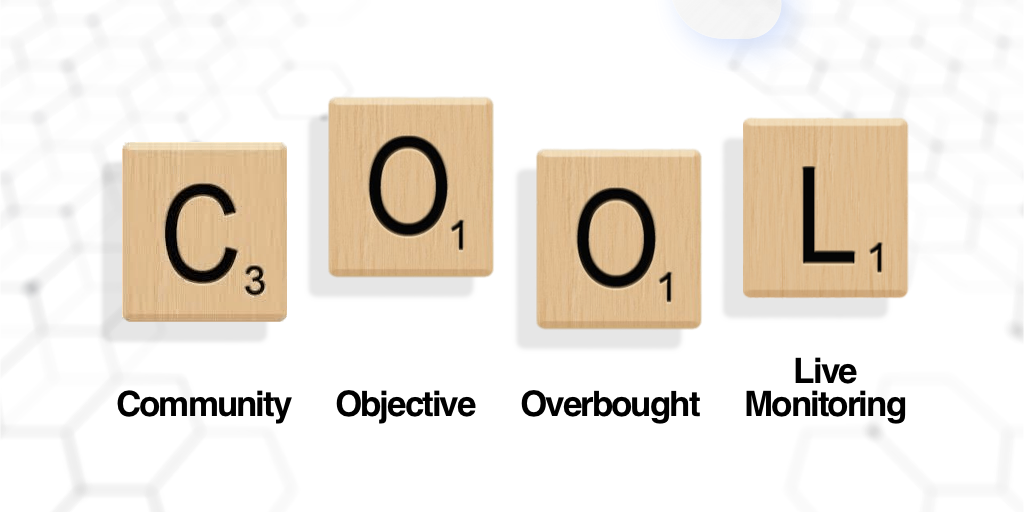

We can summarize the key points to remember with the acronym C.O.O.L as a reminder:

C. Community (community with questions and feedback)

O. Objective (short term objective? Which coin do I accumulate?)

O. Overbought (check if the chosen coin is overbought)

L. Live monitoring (check the Lives of our users with the chosen coin)

Go further

We have seen that we can use the rsi to avoid starting a strategy on an overbought coin. You can go further and monitor some main pairs like ETH/USDT in order to follow your medium/long term objectives.

ETH/USDT on Binance (spot) in daily price:

https://fr.tradingview.com/chart/IZZAD9S1/

Happy Trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io