Decentralized finance can be difficult to understand for novices or even for some false beginners who are put off by the complex appearance and the network fees, especially on the Ethereum network during peak demand.

We are therefore going to demystify certain points in this article and facilitate general understanding by answering the following questions:

What are the main advantages of DeFi?

What are the risks with the solutions?

What are the potential use cases of DeFi?

Reminder:

Definition and main engine of decentralized finance

Decentralized finance (DeFi) is an ecosystem of financial applications (dapps) that are built on blockchain networks (Binance Smart Chain, Ethereum, MATIC). In most cases, these dApps are open source and operate without a central authority with a peer to peer network of validators (or miners) rewarded by network fees when there is an interaction between one or more smart contracts.

We can schematize this process at the level of the user who approves the smart contract when transferring funds from a personal wallet, when interacting with a dapp or even when creating a smart contact.

What are the main advantages of DeFi ?

The main advantage of DeFi is the easy access to financial services, especially for those who are isolated from the current financial system (banking people outside the banking system). Another advantage of DeFi is its modularity with interoperable DeFi applications adapting with rapid updates to new financial markets, products and services.

Traditional finance relies on trusted intermediaries such as banks and courts, which provide mediation.

Now, in DeFi, the engine and vector of this mediation is the smart contract, that is to say, a contract in digital form with a disconcerting ease for the customer to approve and apply it instantly. This is the huge advantage offered by DeFi, which can automatically lend a client a financial asset via the pledge of an asset (called collateralization) on an asset here altcoin like ETH, USDT, BNB).

In a sub-field of DeFi, we also have the development of dApps of the marketplace type (Rarible, Opensea, Niftygateway and or decentralized and specialized auction sites such as Auctionity (DomRider) with very often a simplified management of the dapps website (users transfer digital assets to each other via the rules of the smart contract pre-established and approved by the users). So we see here a potential DeFi business not censurable (or hardly) proposing mostly the sale of unique digital products or limited edition called NFT in the form of digital works linked or not to a decentralized game whose most known are Cryptokitties, Axie infinity, Godsunchained and Alienworlds (on Wax Blockchain) which is even closer to the classic DeFi with notions of farming and additional rewards that we will see further in the article.

Moreover, this type of "gaming" NFT associates a unique value to the item (called here Metaverse) of a game which is not necessarily associated to a company and its image (because here the NFT is decentralized) but integrated to a public decentralized network facilitating the trust and the spirit of the "gaming" community which reappropriates and refocuses itself on its favorite video game.

Gamification in the video game industry and potentially in other fields takes another dimension with the use of NFT and its commerce via DeFi.

Moreover, access to these dapps marketplaces is even facilitated via a simple approval and recognition of the address of one's personal wallet; which constitutes a major advance in the access to web services with a better user experience (increased and simplified branching in the gaming field) without spam and without risks of phishing by email.

The advantages of the DeFi are summarized here not to complicate the article, because they are very numerous with a correspondence in several sectors of activities (A.I, data storage, traceability of the goods, renting of computing powers for certain dApps) and are indissociable from their applications (dapps) of which we will see in some examples later in the article.

What are the risks?

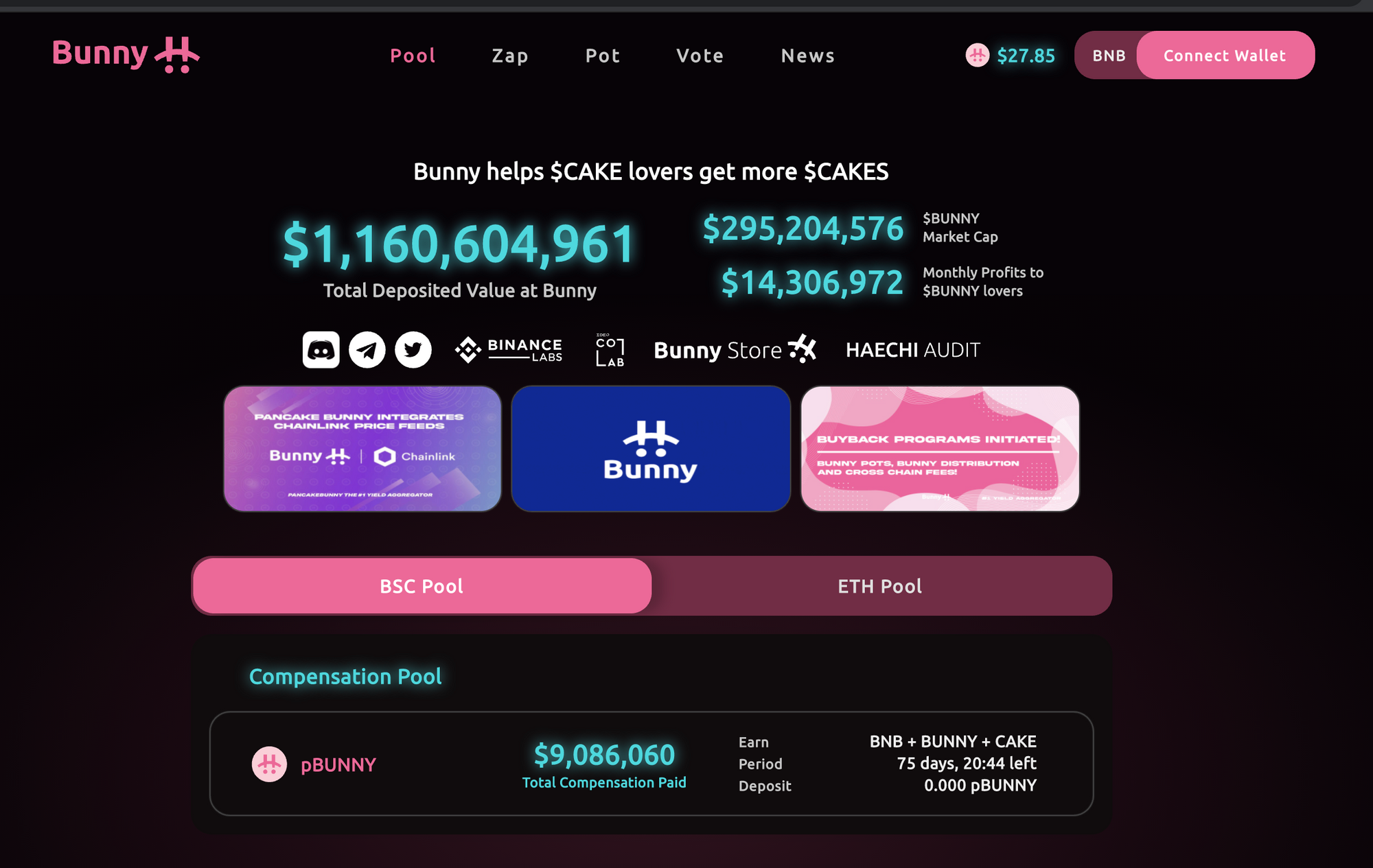

We have seen that the use of smart contracts reduces the boundaries between legislations as there is no central authority and it is faster than a classic contract. But they also introduce new types of risks in terms of computer security with potential bugs (example of PancakeBunny seen below in the article), hardware vulnerabilities but also human vulnerabilities such as phishing.

The solutions:

-Go on the Telegram channels (Defi France) "trusted according to you" and monitor the users' opinions and also check other media specific to ETH (https://defiprime.com/ethereum) and BSC Blockchain (https://www.defistation.io/)

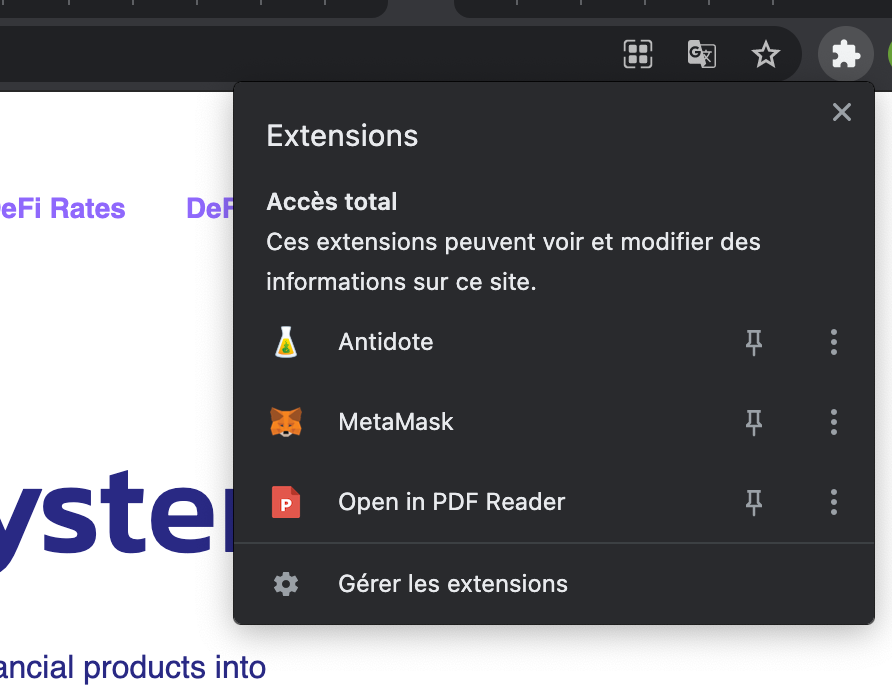

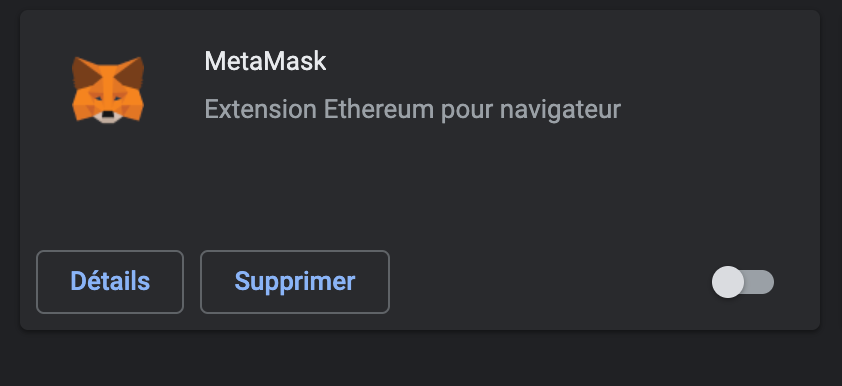

-Use a browser specially and only (in that avoids phishing from the email box) for operations on DeFi with deactivation of the Metamask tool after your main transactions (see pictures below).

-Do not lose the private key of your wallet when creating it or opt for a solution adapted to beginners with the Coinbase wallet and its backup on the cloud.

-Do not take risks on low liquidity that can be even more subject to the impermanent loss (significant imbalance between the prices of 2 assets of a pair in case of large variations). Thus, an investor could come out with less money than by simply doing "Hold". One of the solutions is to deposit your coins in a staking pool (PancakeSwap pool category) to block them via (Smart contract that you have approved) and be remunerated by the tokens often new (except CAKE) and put forward by the protocol.

Another possibility is to farmer on stablecoin pairs (crypto currency backed by fiat values like the dollar), but the returns are generally lower (but often more interesting than the Most of Bank rewards... because return very often remunerates the risk...

-Risk of flash loan with the recent hack of PancakeBunny (see photo below) The flash loan is assimilated to a very fast loan made by professionals in order to test or to harm with for consequence a decrease of the liquidity at least in the short term of the pair) where from the fact of making researches before launching (see the article on the monitoring of the dapps) with also a verification if the pair is liquid with a sufficient volume on Coingecko).

-Check if the dapps have had security audits (on their web pages or their communications via Twitter...see the article on dapp monitoring.

-Study the possibility to take an insurance in case of hack (Nexus Mutual being the most known) https://nexusmutual.io/token-model.html

-Beware of "Rugpull": This happens when developers leave with the cash via a backdoor in the smart contract of the protocol, hence the interest of the previous warnings.

What are the potential use cases of the DeFi?

Insurance policy

-As previously stated, we have the possibility to subscribe to an insurance policy via DeFi to protect ourselves from hacks (Nexus Mutual being the best known) https://nexusmutual.io/token-model.html

Farming

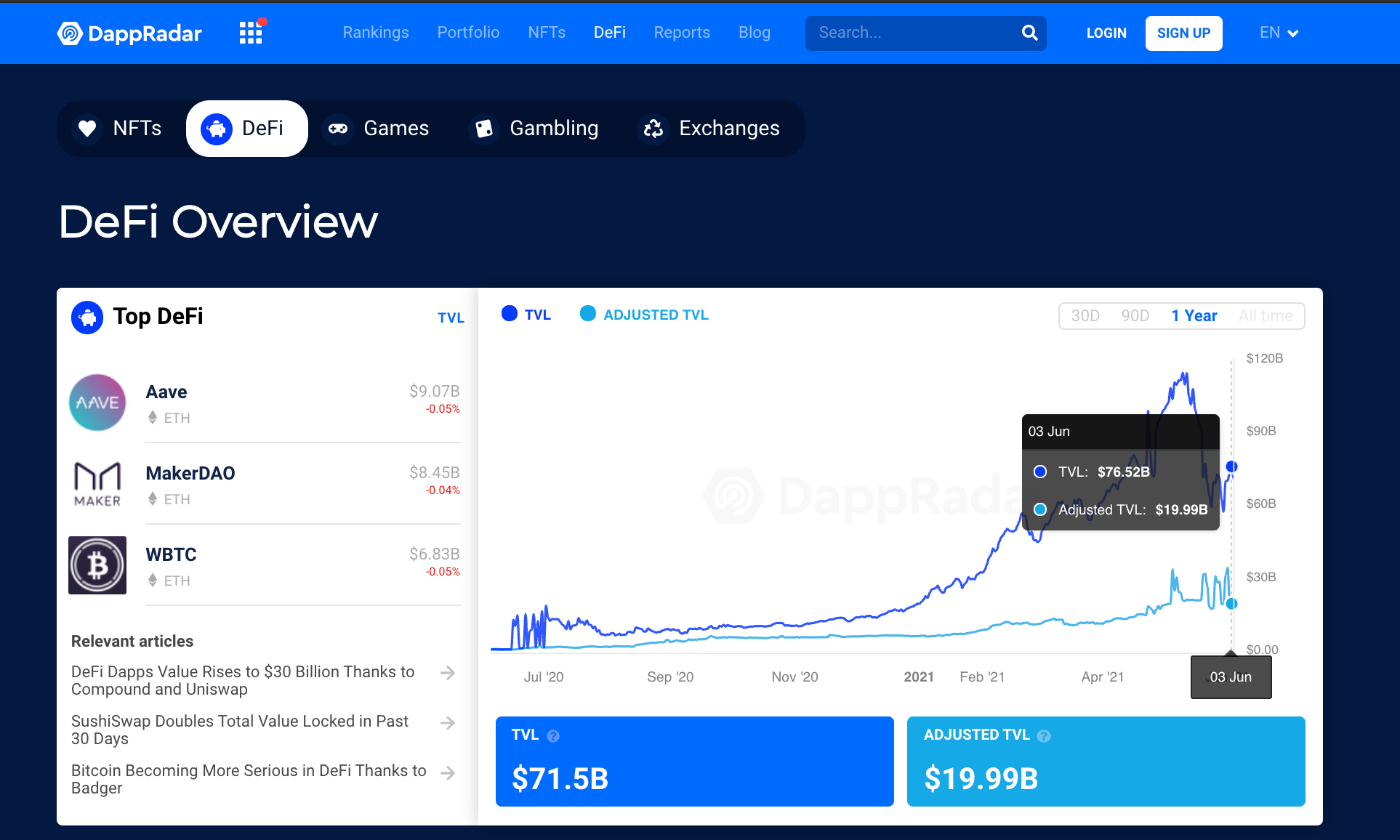

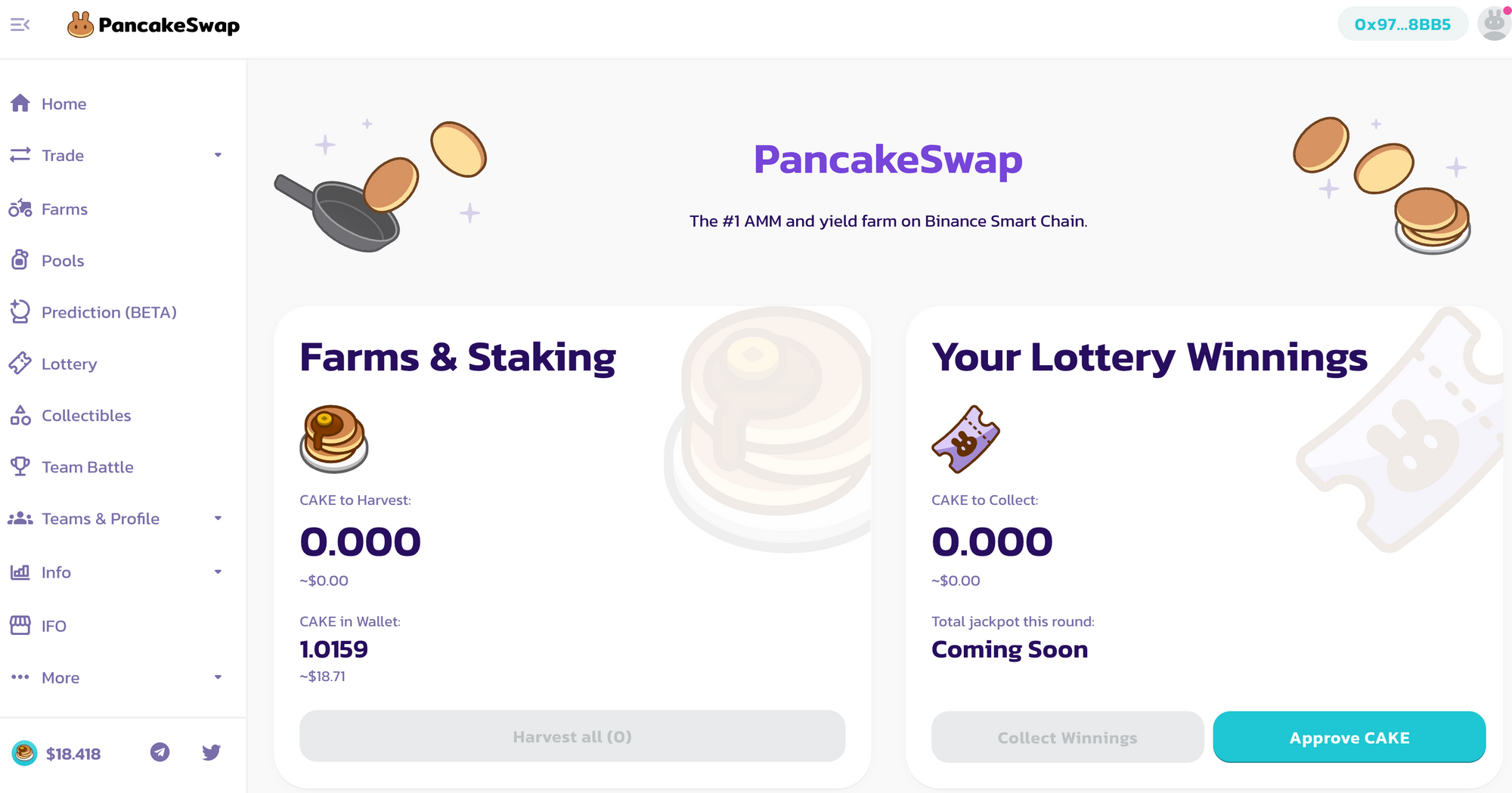

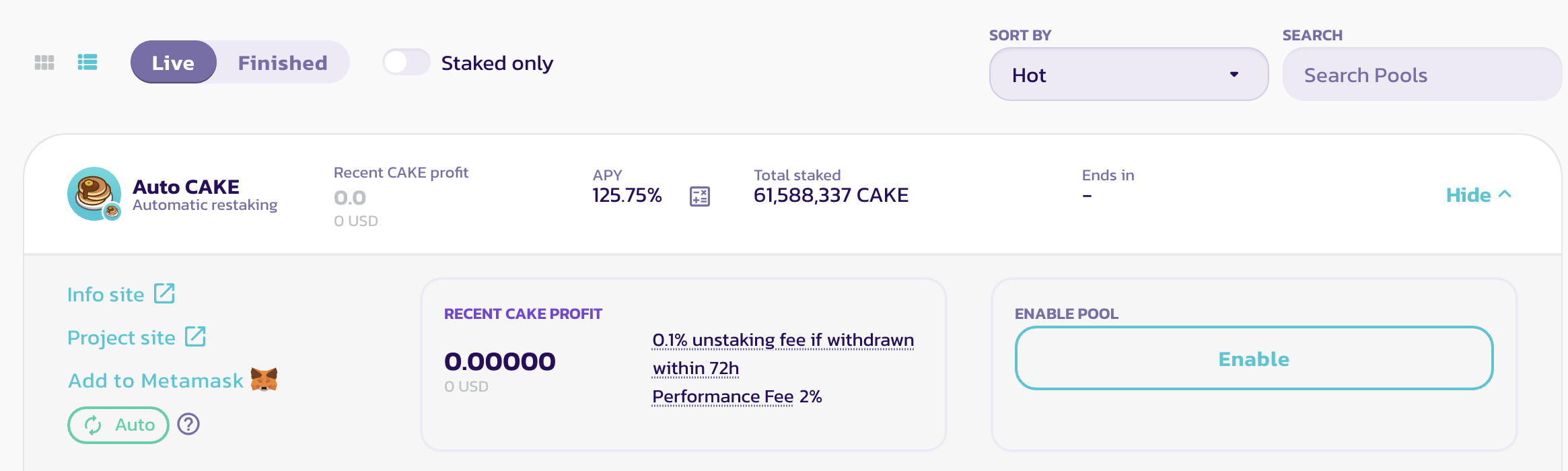

-In cryptocurrencies, farming consists of depositing units of a virtual currency into a pool of cash (token A/token B pair) on a DeFi protocol, in order to receive rewards. Lenders are rewarded in the form of tokens, governance tokens (CAKE, see photos below).

To simplify and better understand, the user(farmer) is his own exchange (in part) with rewards on portions of the fees generated by the transactions of the liquidity pool unlike the traditional exchange (Binance, Kucoin) which will collect and centralize the entire fees on the transactions.

Instead of having traditional order books on exchanges, AMMs (automated market makers), like the pancakeswap dapp protocol (see photo below), allow users to exchange (swap) crypto-currencies in peer-to-peer via liquidity pools deposited and acted digitally on smart contracts.

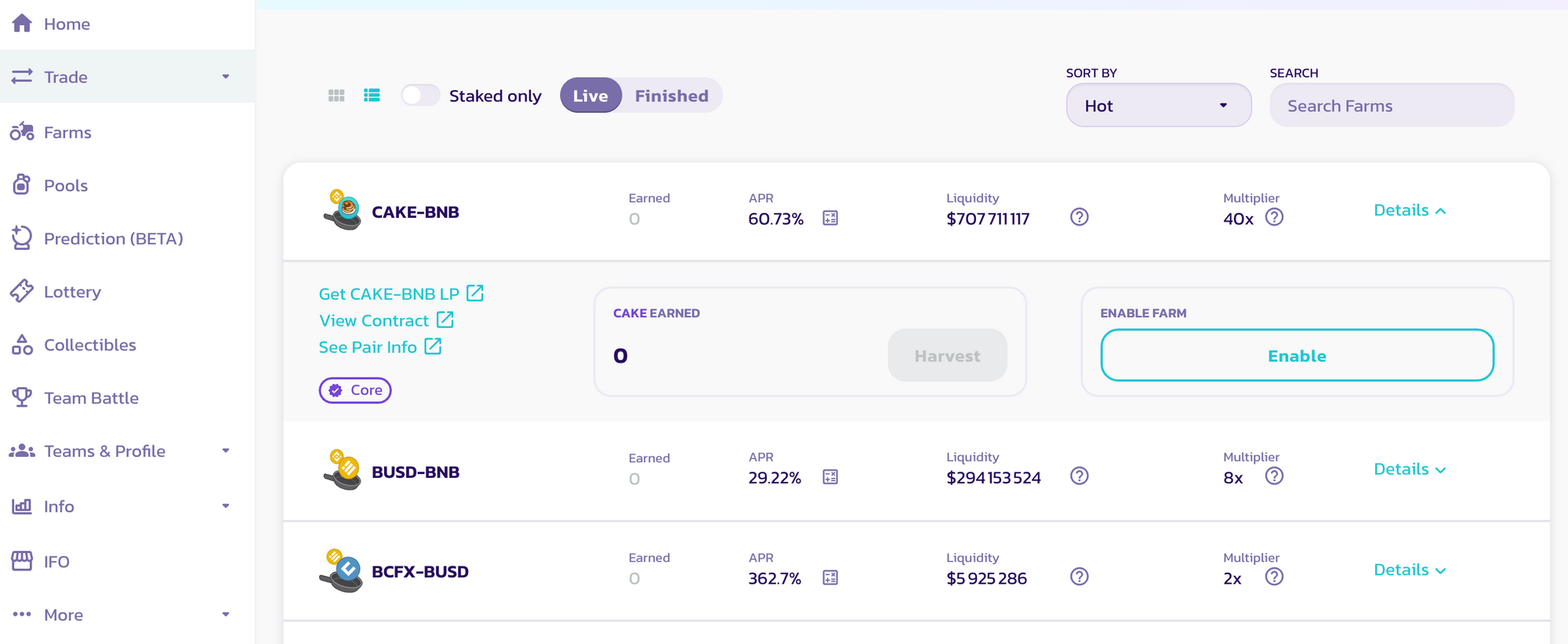

Normally, you are paid according to the following formula: (0.3% of the exchange volume on your pair) x (your % in the liquidity pool of the pair, e.g. ETH/COMP on Uniswap) but BSC (Binance smart chain), Ethereum's competitor, allows itself to boost the farming remuneration by targeting a high volume of users attracted by attractive and cheap transaction fees (see picture if below for returns).

A video tutorial of PancakeSwap is available via this link with descriptive pictures (below)

Example of Farming (see the "Farms" category on Pancakeswap):

Example: For a targeted global capital made available for farming ("Enable" if you approve this function after obtaining your special token "LP" (Liquidity provider) on CAKE-BNB.

In other words, this LP token provides the proof that you have acted on your intention to farm the CAKE-BNB pair in 50/50 proportion (As in the video tutorial, you can follow the first step of swapping your crypto into CAKE (50%) and then BNB (50%) in the swap part of the protocol, then approve, block the corresponding LP pair (here CAKE-BNB LP) and finally, you can "approve" this LP pair to activate the final farming ("Enable" on the picture).

To deactivate the farming ("Unstake"), follow the steps in the opposite direction knowing that you also have the option to approve the contract "harvest" to release your rewards in tokens and use them according to your money management.

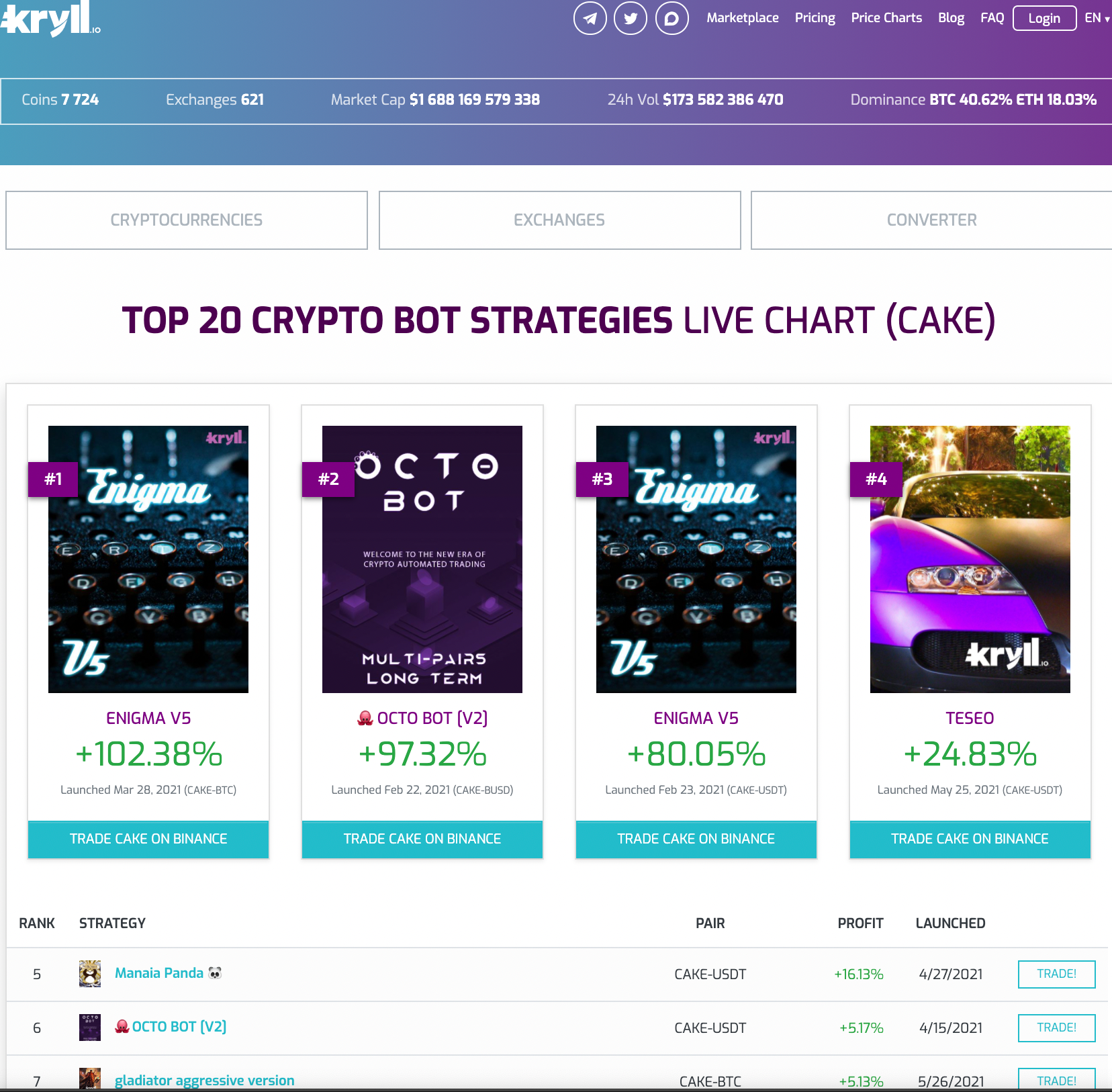

Concrete example of Monney management DeFi to Cefi with Kryll. io

The most concrete example related to Kryll is to harvest the farmed CAKE tokens and then transfer them to an Exchange(Binance) partner of Kryll.io in order to choose the strategy suitable for the CAKE token.

You can easily check the compatibility of the trading bots

👉 copy/paste the link: https://coin.kryll.io/strats/currency/cake and replace with the targeted coin(here CAKE).

You can see on the picture below, the current results of the strategies of the marketplace Kryll live and choose the most suitable for the market according to the description of the strategy and your objectives with the possible option of a Backtest and help on the Chan Telegram support dedicated and managed by the Publisher (link of Telegram Chan in the description of the strategy).

If you think the market is in a downtrend, you can Swap vs CAKE in USDT and then make a deposit on Binance with Bot trading on the strategy adapted to the CAKE/USDT pair.

Special case of Staking-Farming:

By selecting the "Pools" category (Syrup Pool), you have a special "staking" Farming (blocking of Cake tokens via a digital contract that you can approve) that automatically rewards you, via the smart contract rules, with continuity of production of new tokens as long as you don't approve the smart contract regarding the withdrawal.

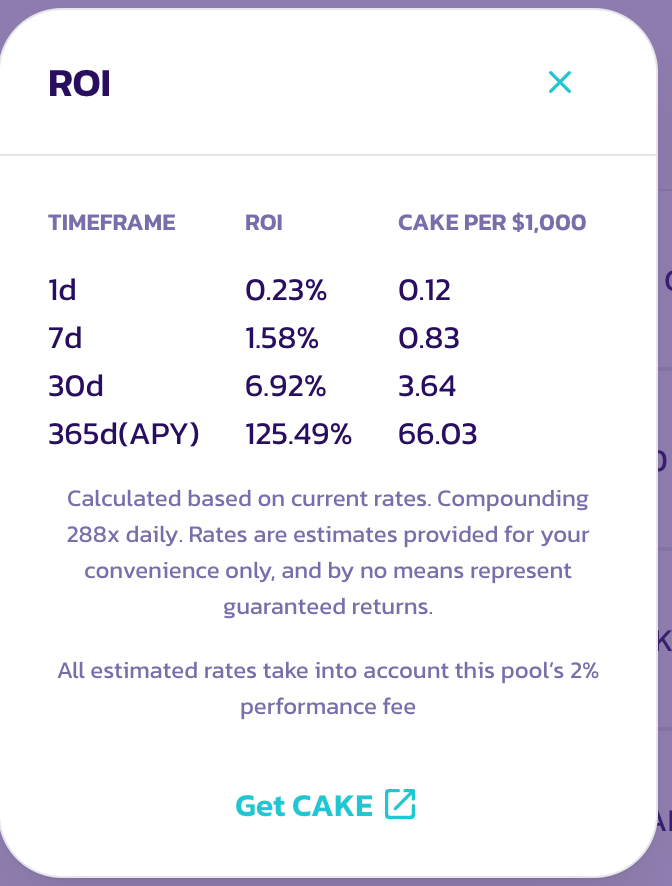

This is an example of return (ROI) "Auto Cake" knowing that this Staking-Farming of CAKE has the particularity to generate compound interest hence the mention "AUTO" with returns a little higher than the average (here, other proposals for staking-farming offers a smart contract link "harvest" to exchange the tokens produced in CAKE tokens and then manually approve again a staking of CAKE tokens and reproduce other tokens.

Requesting an automated loan (without proof of documents)

Practical case with pawn loan (here BNB via Compound, Aave on Ethereum or Venus on BSC more accessible and cheaper).

Example of the Venus protocol dapp on BSC

Without going into details here is the Dashboard (above) of the Venus dapps (XVS) with on the right the tokens you can pawn (called collateralization) of the tokens including USDC and BNB in order to have in return stablecoin VAI (via production also called "mint"). The amount you can mint depends on the market (see the picture of the "Low Credit Window" and rarely exceeds 60% of your collateral token), knowing that if the value of the collateral gets too close to 60% of the value of the VAI mint, you can be liquidated, hence the importance of monitoring the protocol in the event of a sharp drop and paying it back little by little via the capital gains made throughout the rise.

Here we have collateralized BNB and we have minted 1.4 VAI

We have minted VAI tokens that we can transfer to for example a Kryll bot or another type of investment by being careful to monitor the price of the BNB because your collateral can be liquidated in case of a very strong market decline.

A test version is proposed via this link if you want to familiarize yourself with the protocol without taking any risk.

Conclusion

Decentralized finance is disruptive to traditional financial and political services and potentially allows to bank certain populations (via this decentralized system) and thus avoid censorship and political and financial discrimination.

In practice, the DeFi already allows a great saving on transfer fees and on returns (compared to traditional finance) given that the trusted intermediaries are reduced to their strict minimum (the network being decentralized with open source code).

Nevertheless, like any new technology, the DeFi involves a risk with notably security flaws despite security audits and it is even more risky as the protocol is centralized and young like the BSC.

Hence the observation of an adapted risk management on the part of whales who do not hesitate to calculate the gain/risk of taking a position on BSC while keeping most of their wallets on the Ethereum network despite the costs but with a better decentralization and a higher security (with more hindsight than on BSC) especially on the most known protocols like AAVE and COMPOUND.

With a potential global scale-up for the mass market, DeFi can revolutionize traditional finance to be more transparent and fair but it can also challenge the psychology of users too often focused on the often free but centralized products of GAFAM with the digital data trade we know.

Happy trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.zendesk.com