In crypto, sharp drawdowns rarely come with a single, tidy explanation. Sometimes it’s a macro wobble, sometimes it’s a liquidity squeeze, and sometimes it’s something more specific: a narrative that suddenly breaks, or a distribution model that runs into friction.

KAITO has been on the radar of the “InfoFi” conversation, where attention, distribution, and social platforms can matter as much as code. But when price moves fast, the real question isn’t “who said what on X today?” It’s what the measurable signals say when you zoom out.

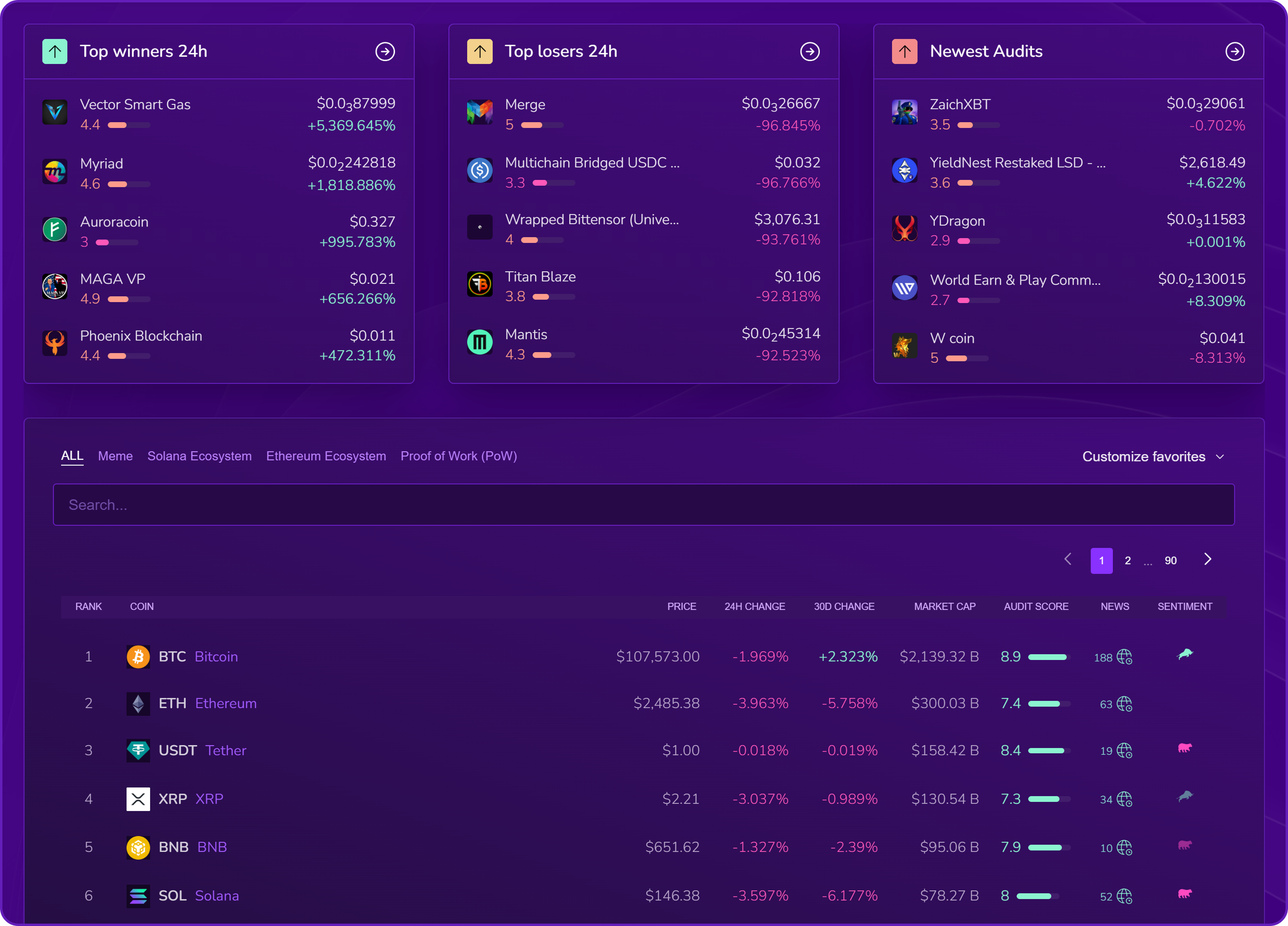

That’s what Kryll X-Ray is useful for: turning scattered indicators, market data, on-chain structure, social traction, and security posture, into a structured, section-by-section audit.

What is KAITO ($KAITO)?

KAITO is positioned as the native token of an AI-powered “InfoFi” network, an attempt to productize attention and information flows into something that can be measured, routed, and rewarded.

In practice, projects in this lane tend to live at the intersection of three forces:

- Information (who creates it, who amplifies it, and how it spreads)

- Incentives (how participation is rewarded, whether financially or reputationally)

- Platforms (where distribution happens, and what rules those platforms enforce)

That mix can create strong growth loops when conditions are friendly, but it can also make tokens unusually sensitive to policy changes, friction, or shifting sentiment on the very channels that fuel awareness.

Why KAITO slid ~20%: the platform-risk catalyst behind the move

A selloff that clusters around “platform risk” tends to have a specific feel: the market isn’t repricing a single feature, it’s repricing dependence.

When a token’s narrative is closely tied to social distribution mechanics, changes in what a major platform allows (or discourages) can quickly spill into price. Even without perfect information, traders often react first to the possibility that a key growth loop becomes harder, more expensive, or less reliable.

The important nuance is that this kind of move doesn’t necessarily “prove” something is broken. It signals uncertainty, and uncertainty usually widens volatility.

When a token sells off on headlines: what to watch beyond the chart

In headline-driven drawdowns, three questions matter more than the day’s candle:

- Liquidity and turnover: Is the market deep enough to absorb large repositioning without cascading slippage?

- Holder structure: Is supply broadly distributed, or concentrated in a few wallets that can amplify moves?

- Security posture: Are there configuration or contract-level signals that can compound risk when attention spikes?

The sections below pull those threads together using the measurable indicators shown in the Kryll X-Ray dashboard.

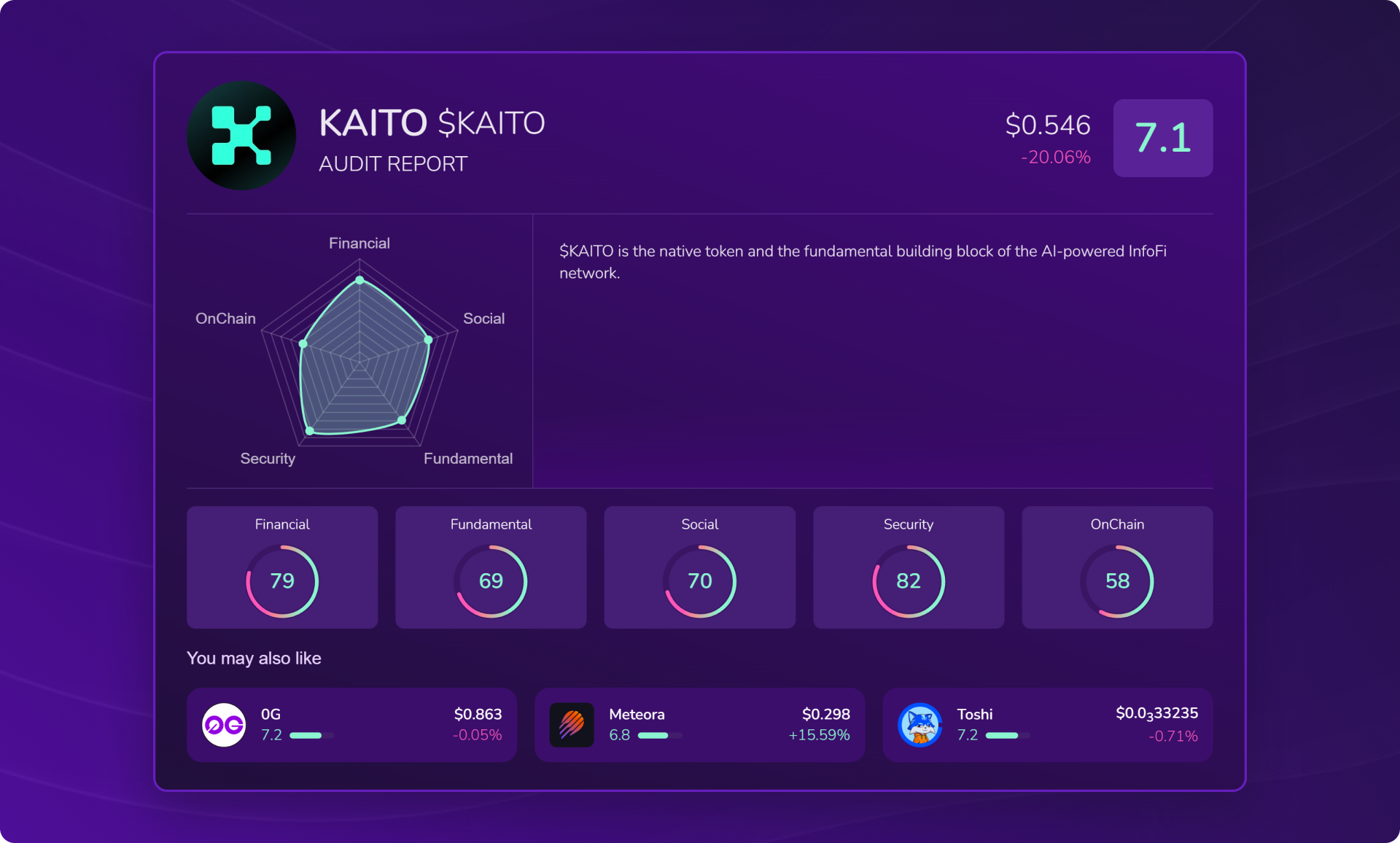

The X-Ray audit of KAITO ($KAITO)

Headlines can explain why attention moves, but they don’t reliably describe what the asset looks like under stress. To get past the surface narrative, the Kryll X-Ray audit breaks KAITO into concrete signals, financial, technical, fundamental, social, and security, so the risk picture is built from indicators you can actually verify.

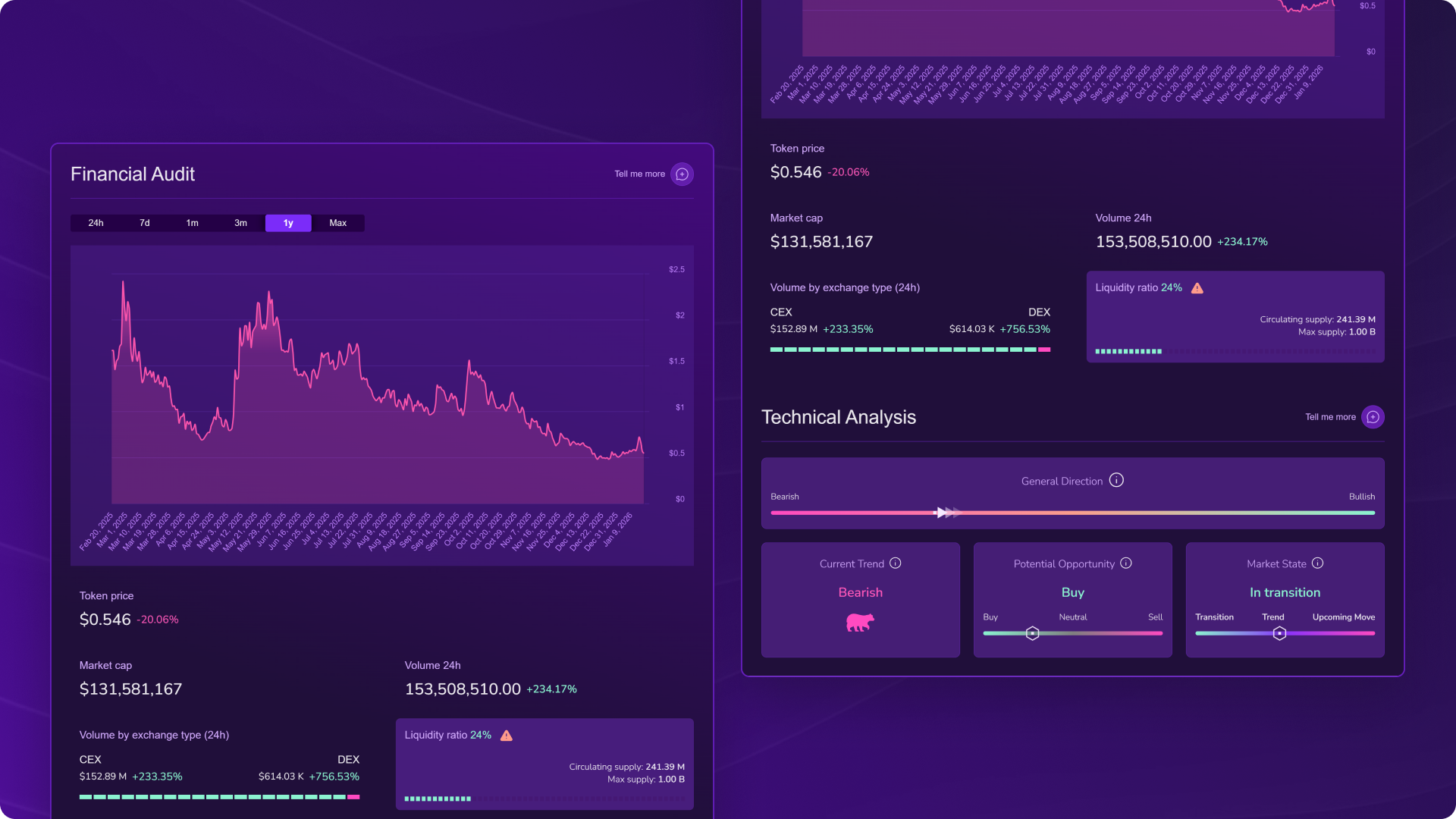

Financial analysis of KAITO ($KAITO): Market activity is elevated, but liquidity looks comparatively thin.

- Financial subscore: 79

- Token price: $0.546

- Price change: -20.06%

- Market cap: $131,581,167

- Volume 24h: 153,508,510.00 (+234.17%)

- Liquidity ratio: 24%

- Circulating supply: 241.39 M

- Max supply: 1.00 B

👉 To break it down: the standout here is the jump in trading activity alongside a 24% liquidity ratio. High volume during a drop often means heavy repositioning (or forced selling), and a thinner liquidity profile can make those moves feel sharper. The supply figures also frame longer-term dilution constraints, but the immediate story is turnover versus depth.

Technical analysis of KAITO ($KAITO): The dashboard reads bearish, while opportunity is tagged as “Buy.”

- General direction: indicator positioned slightly toward Bearish

- Current trend: Bearish

- Potential opportunity: Buy

- Market state: In transition

👉 In simple terms: the technical snapshot is describing a market that’s still under pressure, even if it’s entering a phase where mean-reversion setups can appear. “In transition” is a useful label here, it suggests the system isn’t calling a clean continuation or reversal, but a zone where whipsaws are common and confirmation tends to lag.

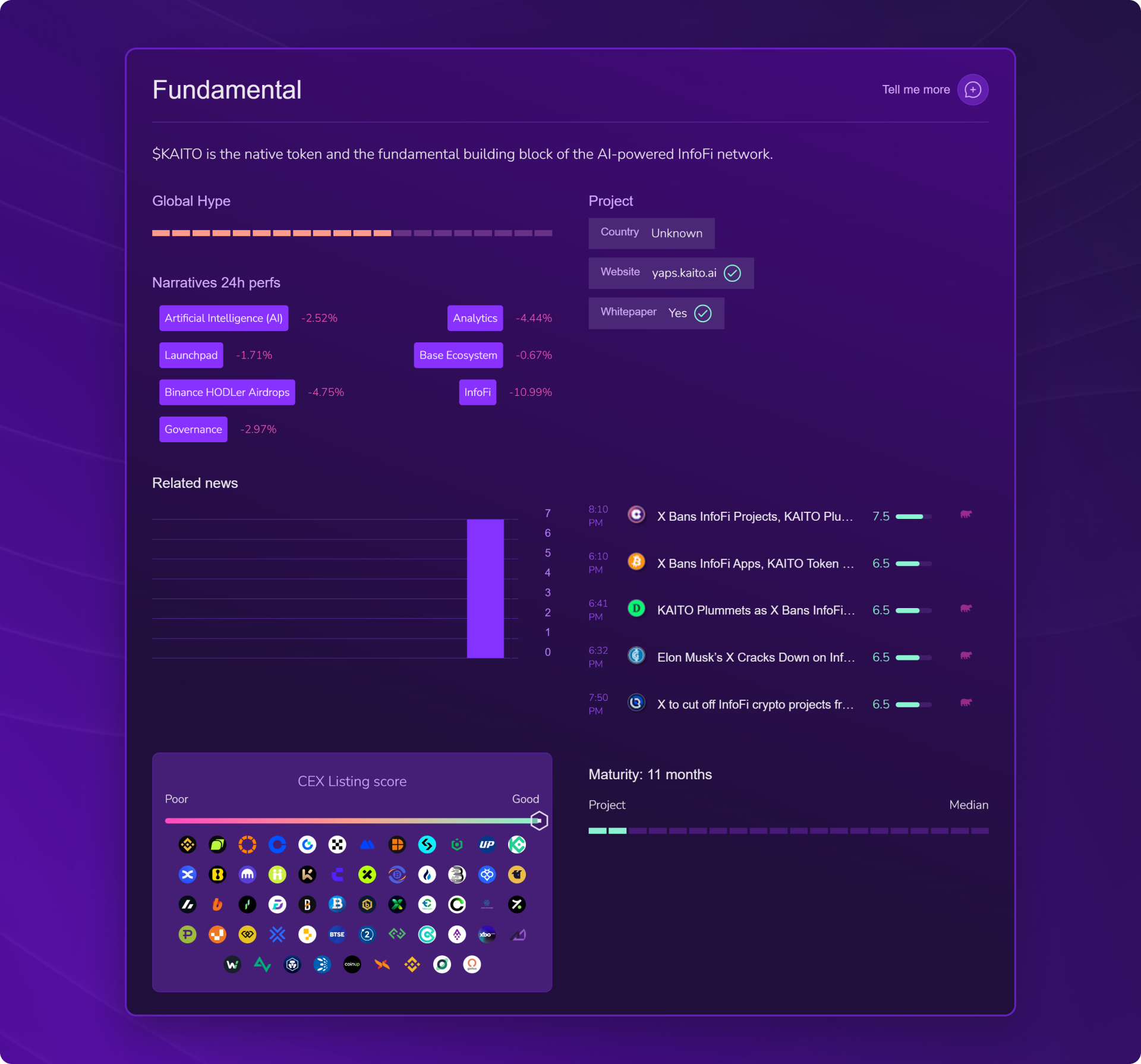

Fundamental analysis of KAITO ($KAITO): Mid-range fundamentals with visible narrative pressure in the 24h tape.

- Fundamental subscore: 69

- Country: Unknown

- Whitepaper: Yes

- CEX listing score: indicator positioned near Good

👉 Put simply: fundamentals land in the middle of the pack, with a relatively positive-looking CEX listing signal, but the narrative tape is broadly negative over the last 24 hours, especially the InfoFi bucket. That doesn’t “invalidate” the project, but it does show that the segment’s sentiment is working against price at the moment.

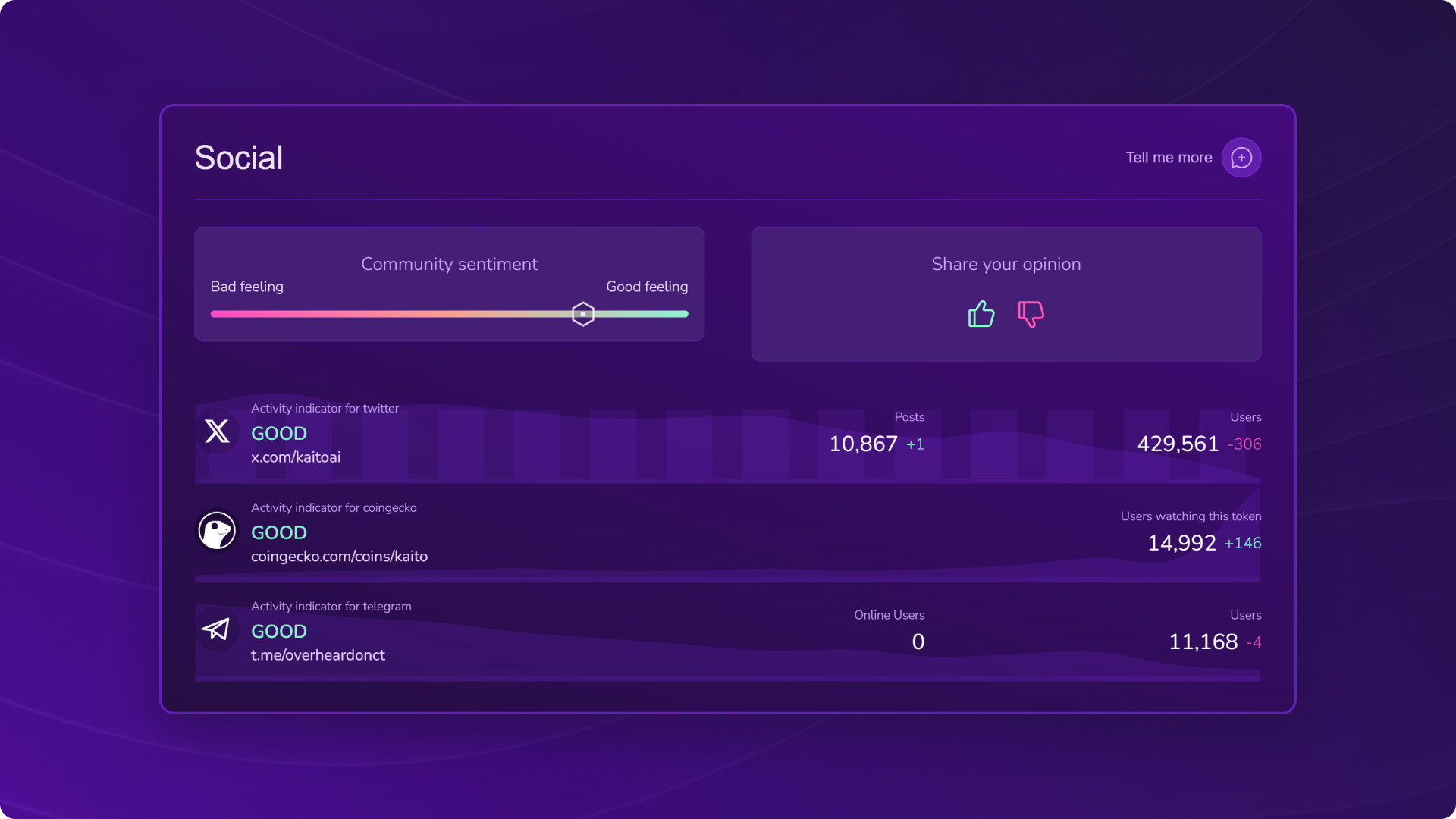

Social analysis of KAITO ($KAITO): Sentiment looks positive, with strong platform visibility signals.

- Social subscore: 70

- Community sentiment: indicator positioned near Good feeling

- Twitter/X: 10,867 posts, 429,561 users

- CoinGecko: 14,992 users watching $KAITO

- Telegram: 0 online users, 11,168 users

👉 The takeaway is: despite the drawdown context, the dashboard shows resilient sentiment positioning and strong surface-level visibility (X activity marked “GOOD” and a sizable watchlist). The key limitation is that social strength doesn’t automatically translate to price support when liquidity is thin or holder concentration is high, so social signals are best read as “attention is present,” not “risk is low.”

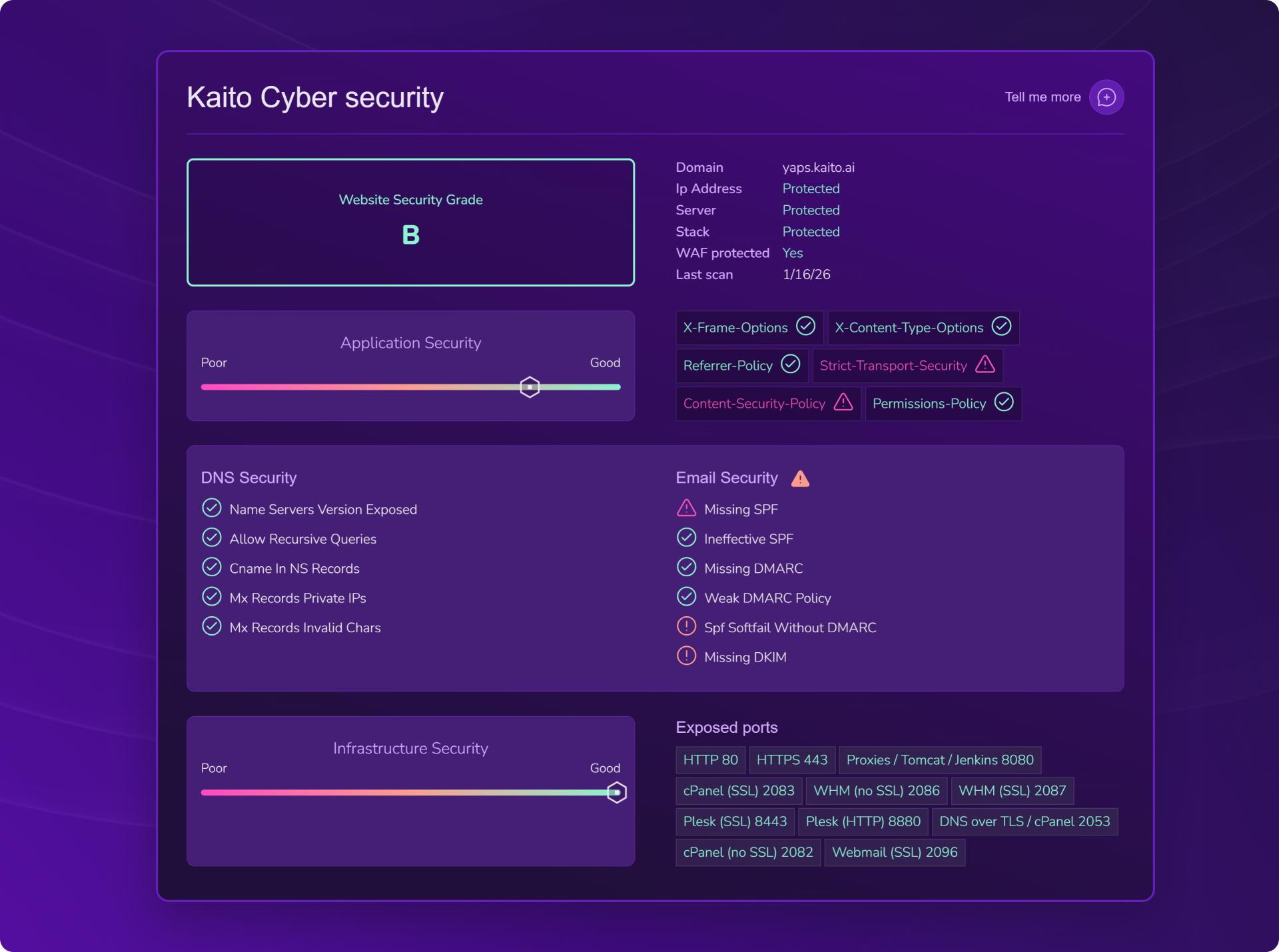

Cybersecurity of KAITO ($KAITO): A decent baseline grade, but several configuration and email-auth flags are raised.

- Website security grade: B

- ⚠️ Strict-Transport-Security

- ⚠️ Content-Security-Policy

- ⚠️ Missing SPF

- ⚠️ Spf Softfail Without DMARC

- ⚠️ Missing DKIM

👉 In practical terms: none of this is an automatic “critical issue,” but it’s a meaningful operational signal. Missing or weak email authentication (SPF/DMARC/DKIM posture) can increase phishing and impersonation risk, while web header gaps (HSTS/CSP) can widen the attack surface for certain classes of browser-based exploits. The grade is respectable, yet the flagged items are the kind you’d typically want tightened for a high-attention project.

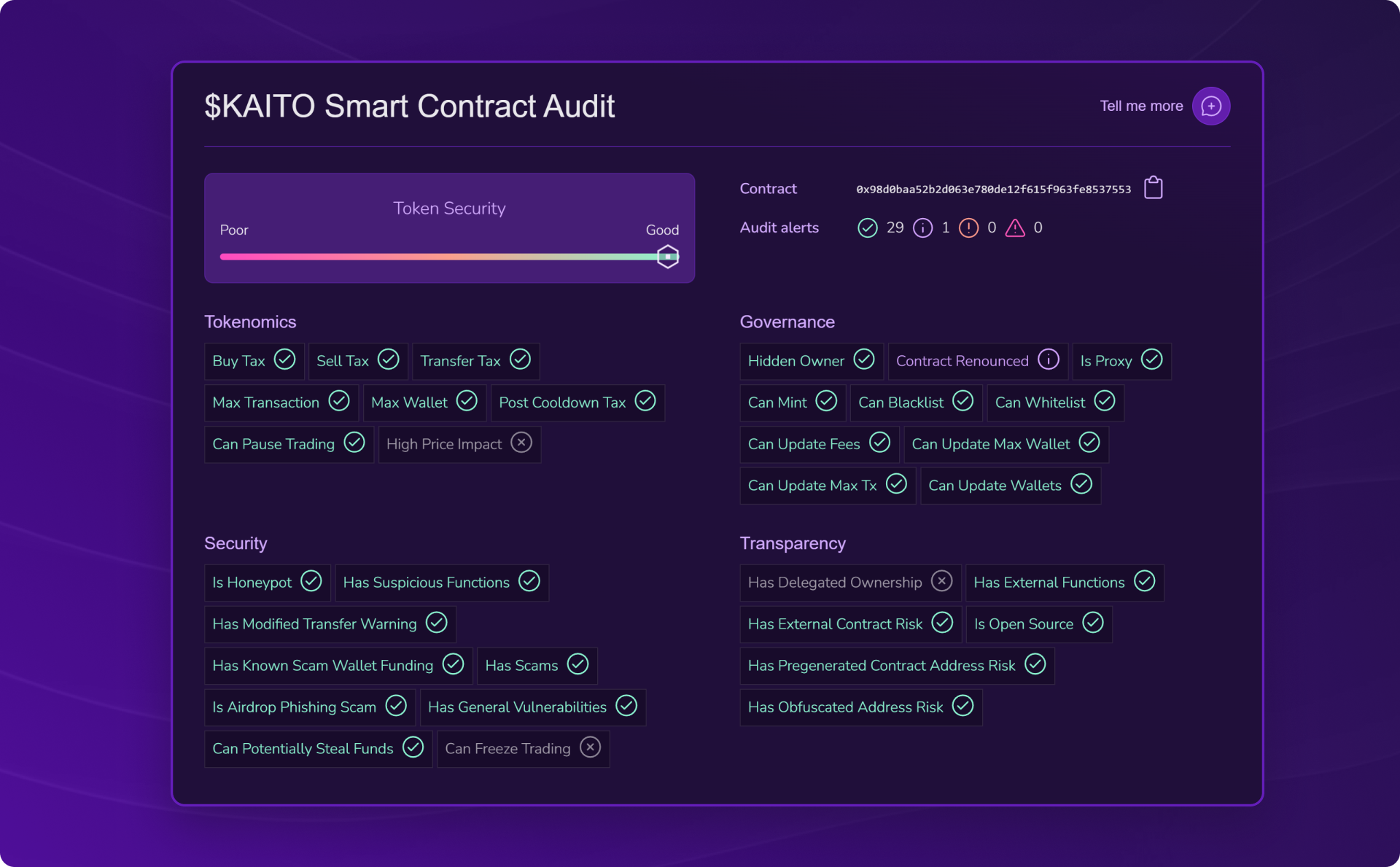

Smart Contract audit of KAITO ($KAITO): The contract checklist surfaces extensive controls and status checks.

- Contract: 0x98d0baa52b2d063e780de12f615f963fe8537553

- Token security: indicator positioned near Good

- Safe contract

👉 In summary: this module is best read as a surface map of permissions and risk checks, not a full code review. The presence of many administrative capability labels (minting, blacklisting, fee updates, etc.) means governance and control assumptions matter: even when a system is functioning normally, market participants often price “who can change what” as part of risk, especially during volatile periods.

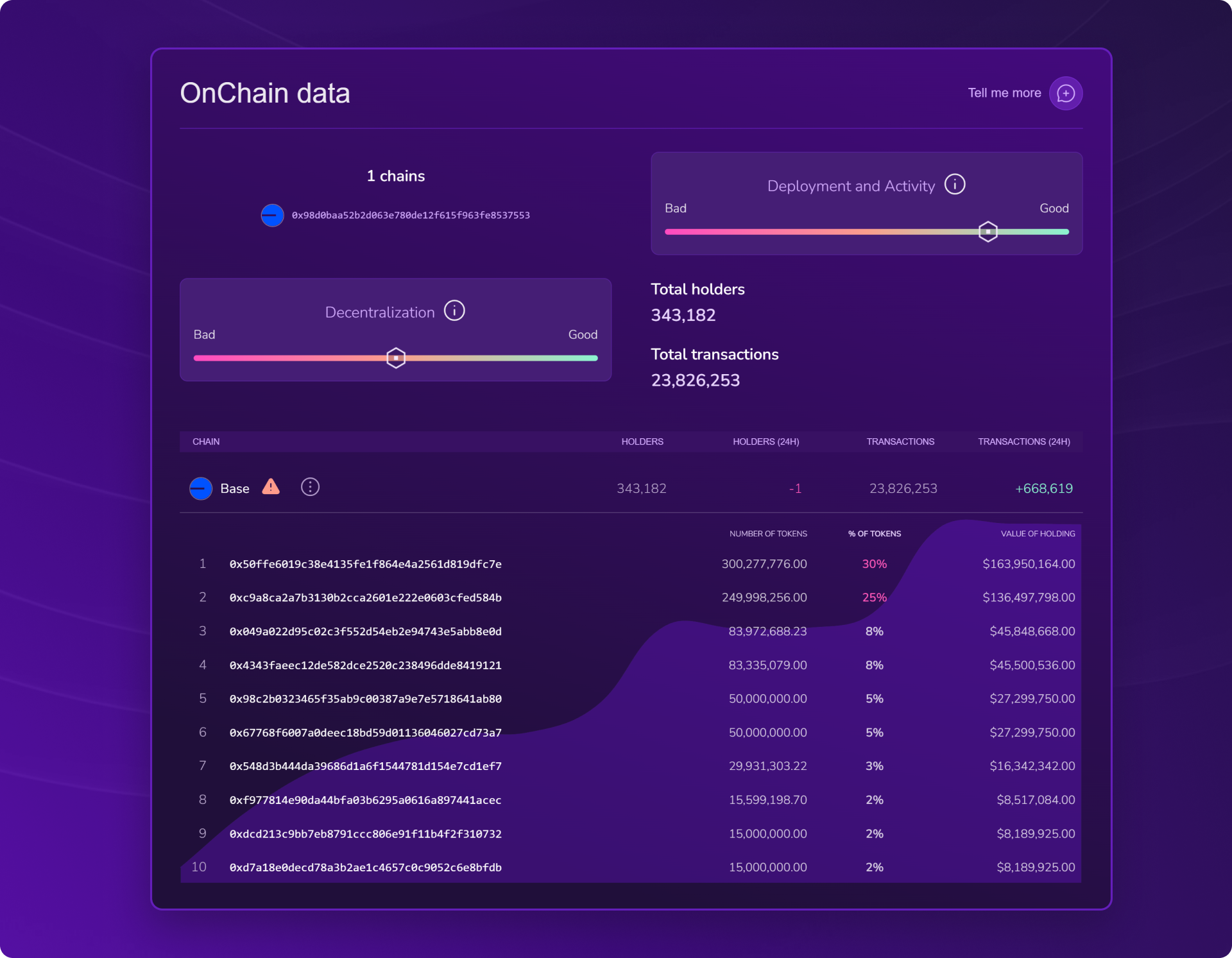

On-chain data of KAITO ($KAITO): Holder concentration is extremely high, which can amplify volatility.

- OnChain subscore: 58

- Number of chains: 1

- Total holders: 343,182

- Total transactions: 23,826,253

- Deployment and Activity: indicator positioned near Good

- Decentralization: indicator positioned around mid-range

- ⚠️ Top 10 holders concentration: 90%

👉 To simplify: a 90% top-10 concentration is a structural volatility amplifier. It doesn’t prove those wallets will sell, but it does mean that a small number of entities can move supply dynamics materially, whether intentionally or simply through rebalancing. In sharp drawdowns, that concentration can make liquidity feel even thinner, because the market is effectively negotiating around a smaller set of large holders.

The verdict: strengths and weaknesses of KAITO ($KAITO)

Strengths:

- Solid X-Ray score (7.1), with a very high "Security" pillar (82/100) and robust financial score (79/100).

- Massive volumes despite the decline: ~$153.5M over 24h (+234%), indicating a very active market and ongoing speculative interest.

- Strong "surface-level" social traction: Social 70/100, positive community sentiment, significant X presence, notable CoinGecko watchlist.

- Market accessibility: CEX listing score close to "Good", which supports "access" liquidity (although actual depth remains another matter).

- High on-chain activity: 343,182 holders and 23.8M total transactions, with a 24h activity spike (+668,619 tx), evidence of significant on-chain usage/flow.

Weaknesses / Risks:

- Bearish short-term technical trend, with a market "in transition": environment prone to false starts and violent swings.

- Low relative liquidity (liquidity ratio 24%): during stress phases, this can amplify movements (rapid slides, slippage, cascades).

- Major structural risk on the distribution side: Top 10 wallets = ~90% of tokens → extreme concentration, potentially amplified volatility (and dependence on a few entities' decisions).

- "Platform / narrative" risk: the InfoFi positioning and its proximity to social mechanics makes the token sensitive to policy changes (political, access, restrictions) on distribution channels.

- Adequate but not "premium" cyber posture: grade B with WAF enabled, but alerts on HSTS/CSP and especially email weaknesses (SPF/DMARC/DKIM) → greater exposure to spoofing/phishing.

- Short maturity (11 months): still a young project, therefore less track record on product resilience and governance under extreme conditions.

Conclusion

Kaito presents itself as an "InfoFi" token, a segment where value is built as much through attention and distribution as through pure technology. The X-Ray dashboard shows a paradoxical but fairly typical profile for this category: strong security signals (82/100), enormous market activity (exploding 24h volumes), and real social traction, while displaying very concrete weaknesses when the market enters panic mode.

The crux of the $KAITO case isn't just the ~20% decline: it's the combination of three volatility amplifiers. First, modest relative liquidity (24%) that can transform a selling wave into a rapid drop. Second, extreme on-chain concentration (90% top 10) that creates structural risk for stability (a small number of actors can shift the balance). Finally, a dependency risk on platforms and narrative, which can brutally re-price the token when the rules of the game change.

For an investor, $KAITO therefore looks like a double-edged bet: the asset remains highly "tradable" (volumes, presence, accessibility), but the ownership structure and liquidity depth require strict risk management. In short: Kaito can bounce back quickly... but it can also drop quickly. In a market where attention is fuel, Kaito reminds us that this fuel can also become a source of fragility when the environment tightens.

Why use X-Ray?

DYOR is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

- ⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

- 🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

- 🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

- 🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

- 💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

- 📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

With all these cross-analyses, X-Ray offers much more than a simple glance: it's a true intelligent dashboard, designed so everyone can understand, compare, and decide without getting lost in complexity.

| Criteria | Manual Audit 😩 | Audit with X-Ray 😎 |

|---|---|---|

| Ease | Complex | ✅ Ultra-simple |

| Time spent | Several hours | ✅ A few minutes |

| Risks detected | Variable | ✅ Automatically listed |

| Number of tools needed | Several dozens | ✅ All-in-one in X-Ray |

| AI Agent integration | None | ✅ Integrated |

How to access X-Ray?

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.