Lesson #2 : Stop-loss/Take-profit

Following our Masterclass #1, we were asked if kryll.io could be of interest in day trading, without necessarily requiring the design of “complex strategies” … So, let’s see…

Let’s go back to the basics:

When taking positions in a typical market, the trader’s objective is usually to make profits in the short or medium term. To do this, he sets profit targets and loss limits. Most traders therefore use predefined orders to manage their open positions: the “Stop-loss / Take-profit” orders.

The idea behind it is quite simple:

- If the asset price reaches the profit taking point, the Take Profit (T/P)order is executed and the position is closed for gain.

- Conversely, if the asset price falls to the Stop-Loss point, the S/L order is executed and the position is closed to minimize losses.

The difference between the purchase price and these two points allows the trader to define the risk/return ratio of the transaction. So, before starting to develop more complex trading strategies in these Masterclasses, we are going back on one of the basic trading mechanics.

“Ok, so… what’s the point?”

Each of these orders has its own interests (which are relatively symmetrical in the end) and can be used independently:

- The main interest of the T/P is that, once planned, the trader does not have to worry about the manual execution of his order or to question it. He defines his profit threshold upstream (10% for example) and knows that if the market reaches this position, the profit will be earned.

- The S/L allows you to predefine an acceptable loss threshold and no longer worry about it… What’s the point of taking your losses? First of all, it preserves the major part of the your capital so that ite does not find itself trapped in a bearish position. This “quick” loss capture will therefore make it possible to keep a maximum of funds to bet on another opportunity. Moreover, the S/L allows to put aside the emotional facet of the trader: the order will be executed as decided, no existential questions to ask (selling at a loss always sucks).

However, it is when these types of orders are set up jointly that they are most effective. Indeed the trader will only have to determine the potential of his trade, define his threshold of gain, plan his risk taking and start trading. He can then move on something else, knowing that whatever scenario happens, he will have foreseen it.

Let‘s take a concrete example.

Let’s imagine that I came across this technical analysis of the TRON of January 12 (just after its huge pump of January 5). We can see here that a “Symmetrical Triangle” has emerged, suggesting an imminent market change (up or down) depending on the pressure the market will be under. The downward supports levels identified by the analyst are 690 satoshi and 400 satoshi.

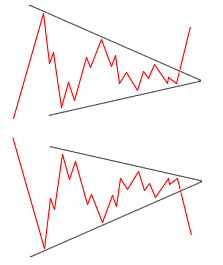

Wait… what’s the hell is this “Symmetrical” thing?

Oh, yeah, sorry.

A “Symmetrical Triangle” is a chart pattern used in technical analysis. It represents a period of market consolidation before the price is forced to breakout or breakdown to the next support /resistance level. A breakdown from the lower trend line marks the start of a new bearish trend, while a breakout from the upper trend line indicates the start of a new bullish trend.

Let’s go!

Well, back to the TRX… The supports are identified, the position should be reached in a few days, the token is quite known (more than 280k followers) but there is no big news in the next days. The first support seems easy to break due to the low volume… at the same time support 2 should hold a little longer..… Mmm not so easy to decide… Well, let’s try to anticipate both scenarios :

1We’re going to bet on a breakout if support 1 is reached, hoping on the fact that several traders will think like us and decides to pump up the price… But as there is no big news planned (except the arrival of a security expert in the team… not a big deal) I’ll limit my losses quickly if it breaks down. The same goes for the breakout eventuality… It can/will be contrived so I’m not going to be greedy on this one :

Buy Price : 690 satoshi

Target: 750 satoshi (10% take profits)

Stop-Loss : 5%

2In case of a new fall, I will play again on the second support. It should happen around the 17th and there’s a better chance it’ll come up again. Then I’ll be a little more greedy…

Buy price : 420 satoshi

Target: 550 satoshi (30% take profits)

Stop-Loss : 10%

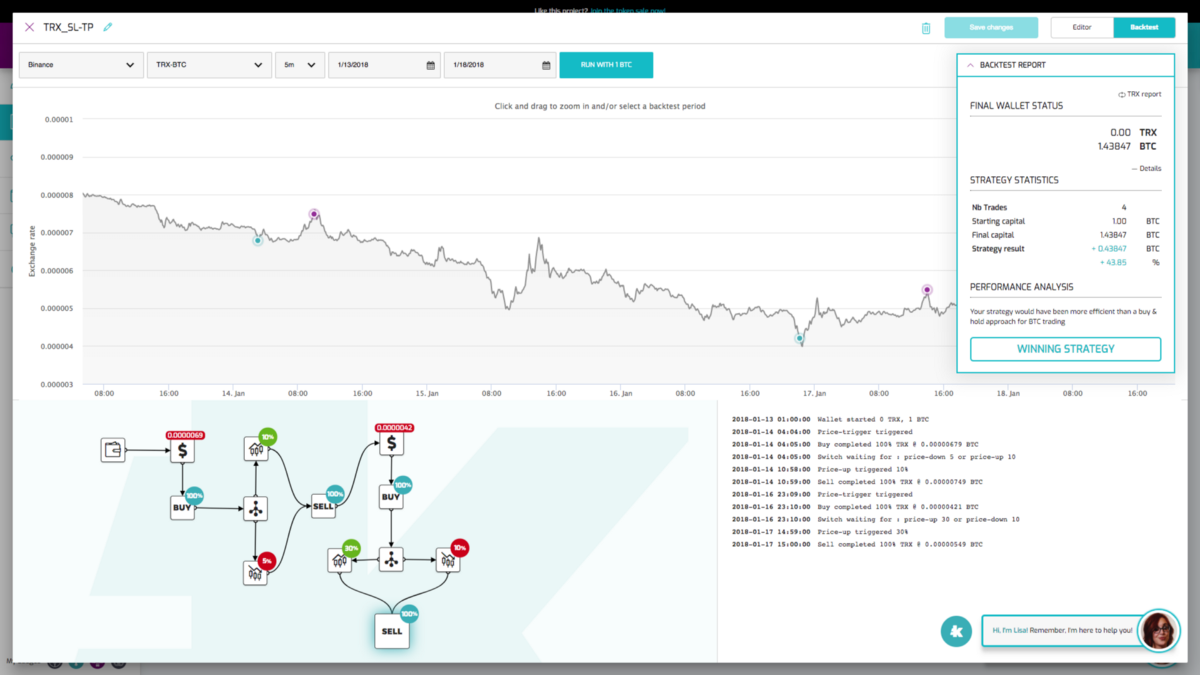

As we can see below, we had a good intuition and our two assumptions proved to be right!

Well, we had a bit of luck but our two “Take Profits” have been reached and we just made a 43% profit in 4 trades over 4 days… That’s cool.

Yes, but…

…the reality is not that simple :(

First of all, trading platforms tend not to offer (or remove) Stop-loss/Take-profit tools and especially do not allow their joint use! So you have to buy, place your stop-loss, wait until the price has risen enough to cancel your stop-loss, place a buy order to take your profits, quickly cancel-it and enter again a stop-loss if the price fall again… All this manually of course. In short, it’s a real plague.

Moreover, if we look closely at the times of our TRX trades, we quickly realize one thing: either I’m lying or I have no life…

Indeed, my first buy took place at 4:05 am on the 14th and the first Take-Profit took place at 10:59 am; then my second trade took place on January 16th at 11:10 pm and the T/P at 3:00 pm on the 17th. So you need alerts, availability, not being at a friend’s house for a BBQ, having your computer close at hand, etc… etc…

It’s a mess !

It would be a great tool in theory, but it eats your life!Too bad..

Wait, but we can automate this with kryll.io, right?

YES WE CAN!

Not only can… we’ll have to do it! Indeed, setting up a custom Stop-loss/Take-profit strategy on Kryll.io can be done in a few minutes. In addition, the platform allows the setup of behavioural Stop-loss/Take-profit flows at once and last but not least, will do its job automatically whatever the time of day or night!

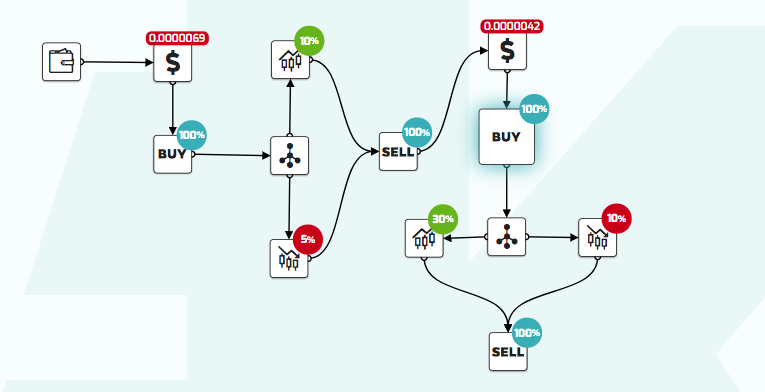

Here is the strategy that was implemented following the assumptions and constraints we had previously defined:

- Purchase of some TRX if the price goes below 690 Satoshis

- Conditional trade with Stop-loss at 5% and Take-profit at 10%

- Repurchase if the second support is reached (420 Satoshis)

- Conditional trade 10% Stop-loss and 30% Take-profit

The implementation of this flow took me less than 3 minutes and was launched on January 12. This ad-hoc strategy automatically carried out the market monitoring as well as the execution of all actions that we should have done manually at completely improbable hours, while we were quietly enjoying our weekend and our beginning of the week.

As a result, our ‘tiny’ 43.8% profit is there, without stress; all this thanks to a relevant technical analysis, a small study of the situation and the adapted tool!

Curious ? Sceptic ?

Your own experience will be better than long explanations… If you want to discover our tools, we warmly invite you to try our demo, it’s FREE and WITHOUT any REGISTRATION!

In addition, we have just delivered the strategy creation for all mode! Our developers have worked hard to offer you these new features, and if you haven’t tested it yet, feel free to do so! We hope you enjoy it.

Twitter : @Kryll_io

Telegram : https://t.me/kryll_io

Facebook : https://www.facebook.com/kryll.io

Our website: https://kryll.io