An effective risk management process in automated trading will identify weaknesses in certain strategies and provide guidelines, such as portfolio diversification.

The old adage "DON’T PUT ALL YOUR EGGS IN ONE BASKET" has never made as much sense as it does when it comes to putting your money into trading strategies. In this article, we will see how useful it is to diversify your crypto-assets in order to maximize your gains or amortize your losses more effectively.

All-in on a strategy that has performed well in the past, or how to get screwed by the market.

Many new traders choose a strategy that has performed well in the past and put all their capital (all-in) into a pair. This is done with the intention of making maximum profits in record time.

Wrong!

A strategy, it lives, it will perform well on some periods and be weak on others, you can't always be in the green. Very often this trader profile consults the results of his strategy several times a day and hopes for a maximum gain in record time (we are talking about days, but yes the impatience of the beginner...) When our "trader" realizes that the strategy that has performed so well in the past is in the red, he panics, stops it, liquidates everything and blames the whole world for having made him lose money.

There is strength in numbers!

As said in the introduction, don't put all your eggs in one basket. A seasoned trader will first of all spread the risk over several pairs.

Case studies

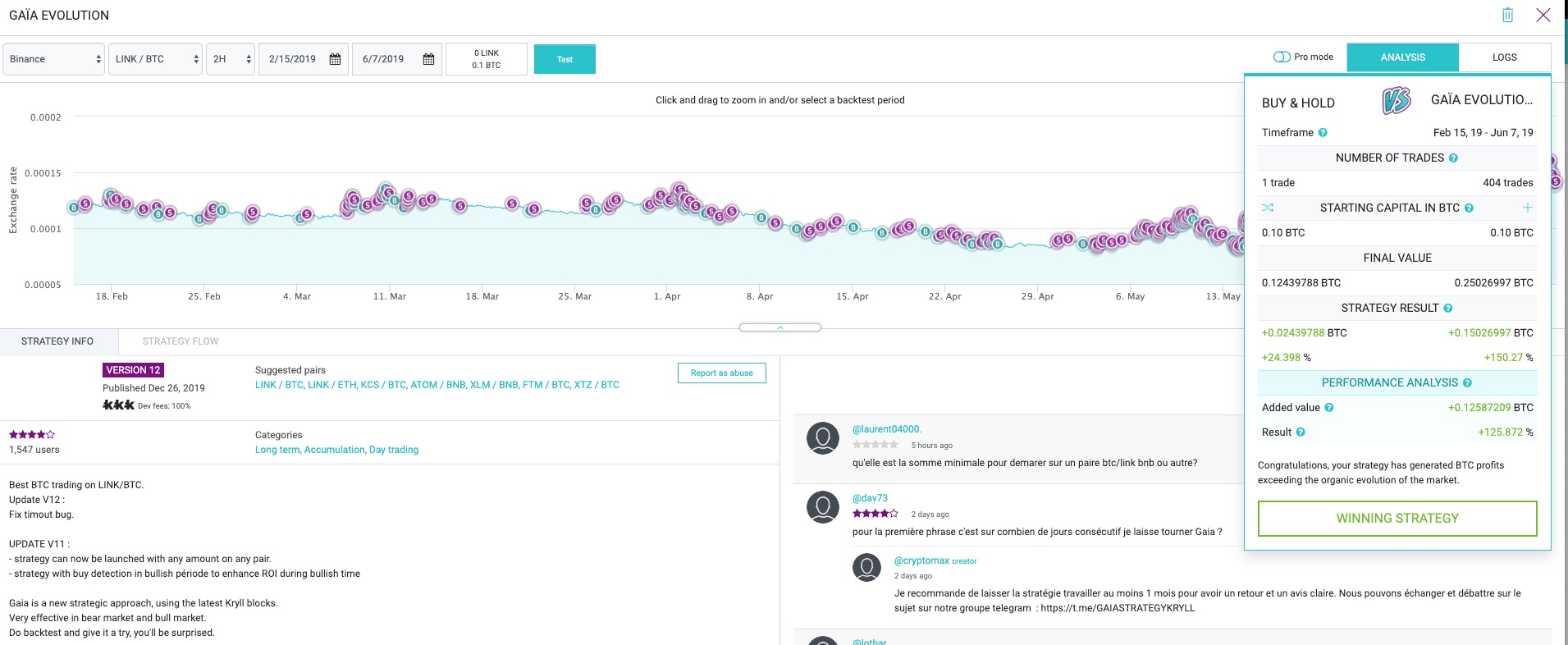

The Gaïa, a strategy quite well known to users of the Kryll.io platform available here, was launched on several pairs recommended by the creator of the strategy for one week. We will analyze the results.

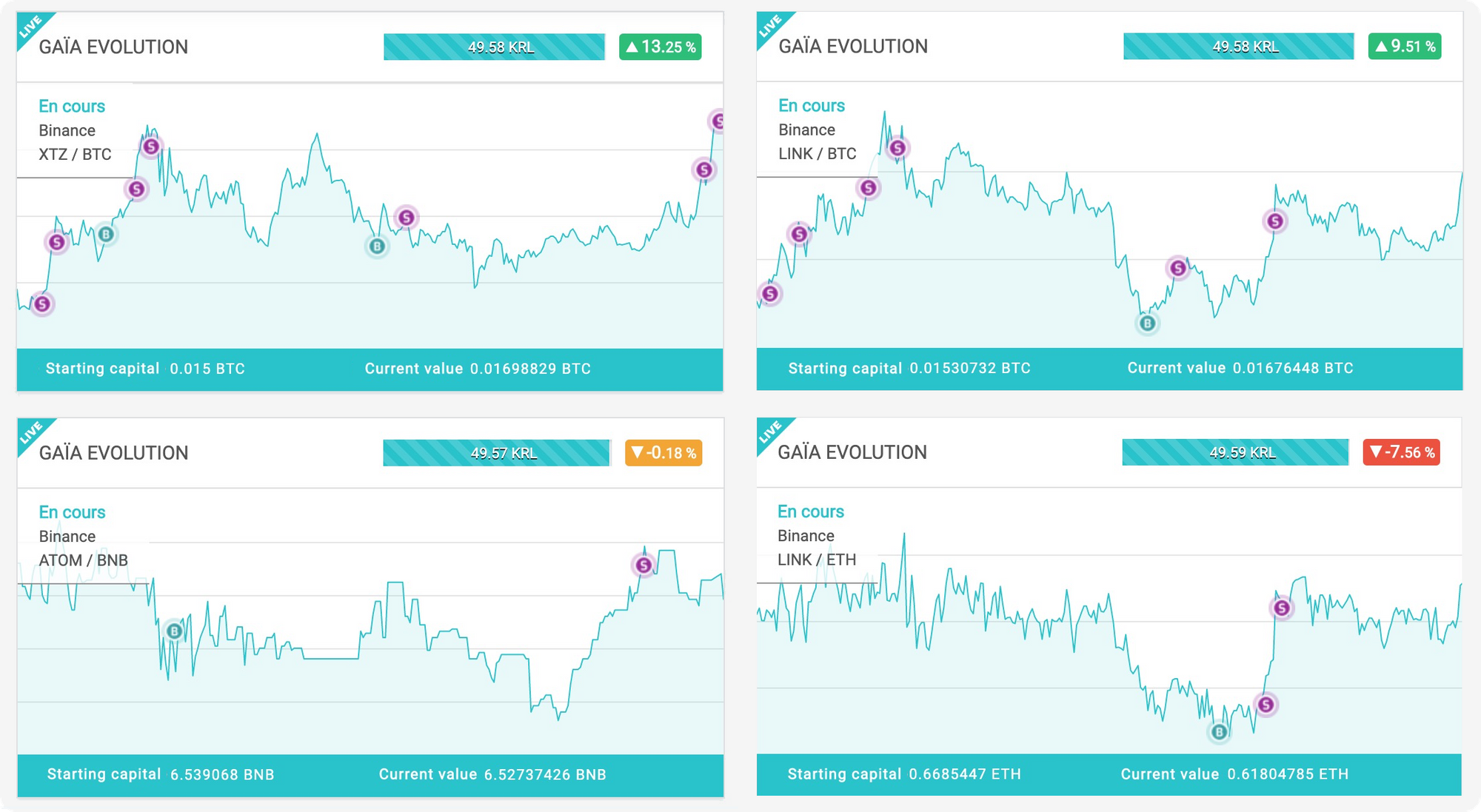

Starting from a capital of $600, it will be wiser to split this capital into 4 (or more) equal shares of $150 (or their equivalent in crypto asset) and to launch the strategy on several pairs - those recommended by the creator and available in the strategy information sheet on the marketplace - in order to spread the risks.

Let's have a look at the results above

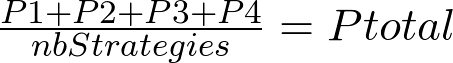

Since the initial stakes are equal, it is easier to add the percentages, so the final result can easily be deduced using the formula below:

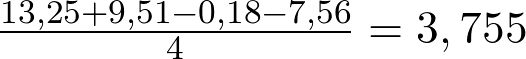

Which gives:

3,755% profits which is 600 x 0,03755 = $22,53 (in a week)

The weakest link LINK-ETH

The losses of the instance on the LINK-ETH pair (fig.1) were absorbed by the gains of the other 2 instances of the Gaia. Diversification has minimized the risks.

We should not stop this instance because as said above, a strategy have tops and bottoms, and there will come a time when it will probably go positive and make up for the losses of one or more other instances.

Not everything is green

In the example above we are winning by 3.755% but this is not always the case, it can happen that the market will deviate and even a good strategy will not be able to do anything about it, however there is a good chance that this method will reduce the losses in these conditions.

It is also possible to combine several strategies on several pairs that will respond to different markets (bearish, bullish) and thus ensure a greater spread of risk.

Patience! A strong ally

A lot of novice traders make the mistake, it's human. You can't expect miraculous results in a few days, let alone hours. Patience will be your best ally. Let your strategies do the work for a few weeks (run them in LiveTest first if necessary) or even a few months before drawing conclusions.

Diversify! Diversify! Diversify!

It is very risky to launch a single instance of strategy unless you know exactly what it is going to do. It's often better to play the diversification card in order to secure your trades as much as possible.

How to choose the right strategy?

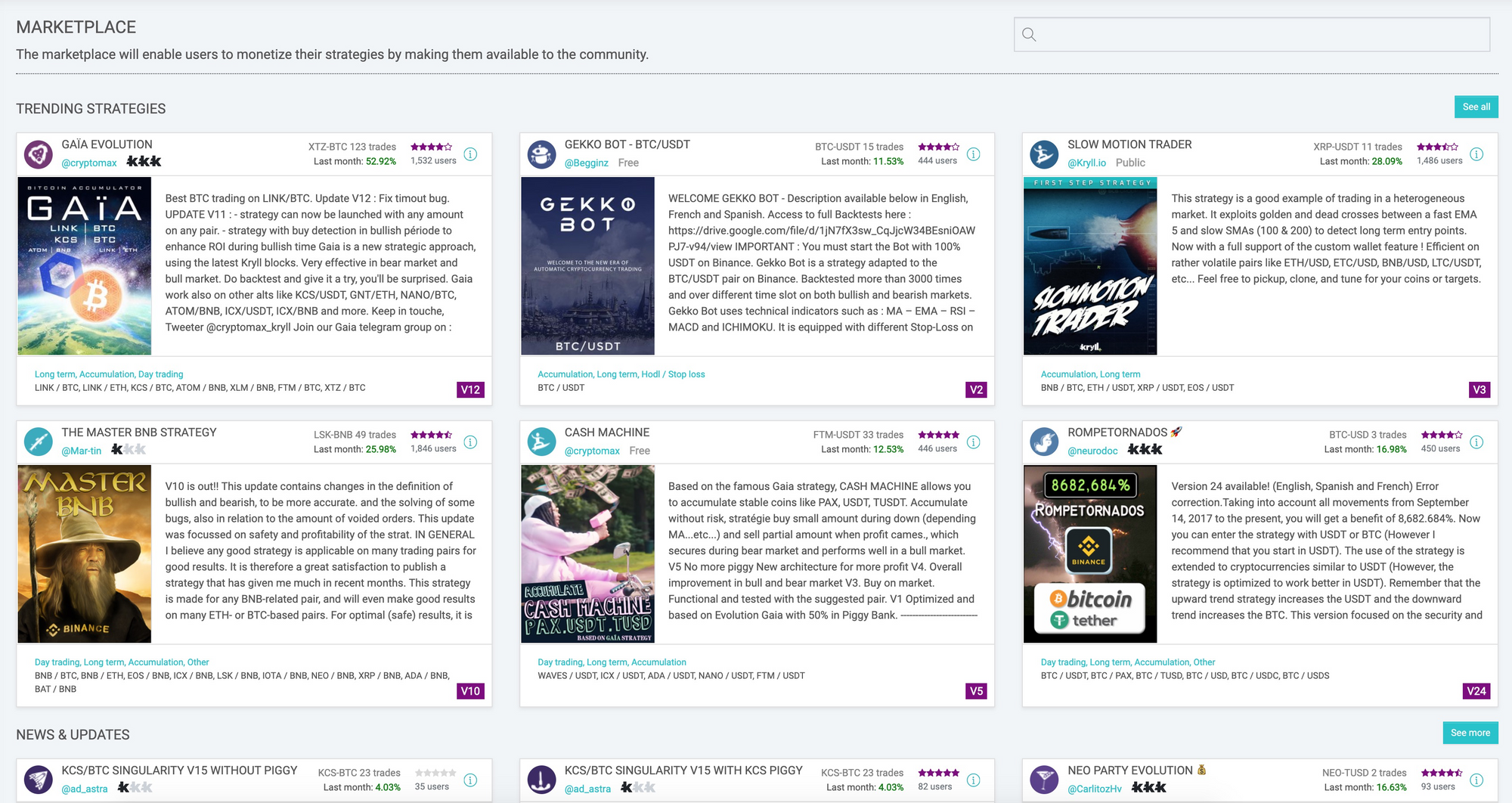

The MarketPlace available at this address https://platform.kryll.io/marketplace offers a plethora of strategies, you can sort them by recommended pairs, creator, behavior, etc..

If you are not in a hurry, choose a long-term strategy, the risks are usually lower but you must be patient. Conversely, if you want action, prefer Day Trading.

The right reflex is also to go to Telegram https://t.me/kryll_fr and ask for advice from the community and the creator of the strategy if he is available.

Test! Test! Test the strategies!

Another common mistake among starters, they do not test the strategies of the MarketPlace. The Backtest of strategies is free and unlimited! When you have installed a strategy, remember to test it on the recommended pairs in order to get an idea of its possible performance.

Learn more about:

- The MarketPlace https://blog.kryll.io/kryll-v1-the-marketplace/

- Hwo Backtests works https://blog.kryll.io/how-to-read-and-understand-your-backtest-results/

Conclusion

Trading is a very risky "sport", it is necessary to know how to adopt an efficient and safe mindset, having a plan and sticking to it is essential.

The automated strategies of the Kryll.io platform can help accomplish much of this task, but don't throw them just anyhow, on any pair and stop them without having set a limit.

Join the community on https://t.me/kryll_io

Disclaimer: This article does not constitute investment advice, and the services of a duly authorised professional should be sought for investment advice.

Happy Trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram : https://t.me/kryll_io

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.zendesk.com