Short Block - This is the block of orders to take a short position in the drift markets.

Block configuration

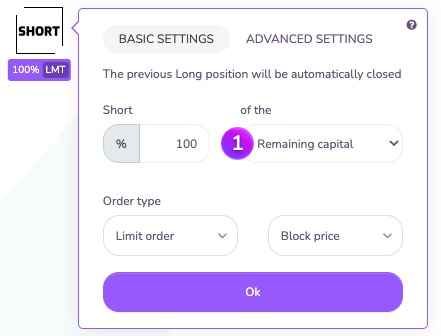

In the block parameters you can configure the type of order and the amount you want to allocate to this position.

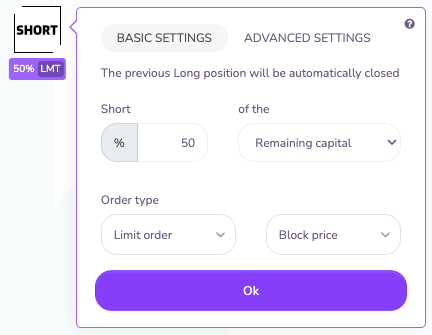

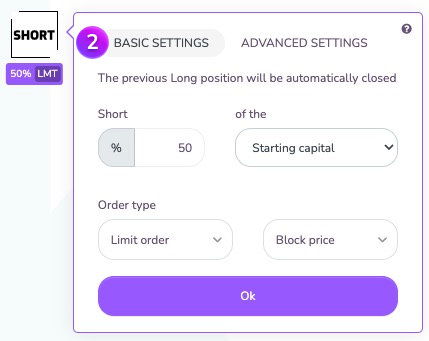

First of all, you will be able to define the amount of funds you want to allocate to the short position. This quantity can be expressed as a percentage of the strategy's remaining capital or as a percentage of the strategy's starting capital.

Examples

Let's suppose that your strategy has $300 free from the initial $500. It will take a short (selling) position of $150 if you configure the block in mode 50% of the remaining capital (50% of $300 remaining).

Similarly, still assuming that your strategy has $300 free from the initial $500. It will take a selling position of $250 if you configure the block in mode 50% of the starting capital (50% of the initial $500).

Note: in 'Starting Capital' mode, if the strategy does not have enough funds to take the requested position, it will take one with the maximum margin available from the remaining capital. For example, if we ask our strategy to take a SHORT with 90% of the starting capital while it only has $300 left out of the $500 we initially allocated to it, the strategy will only use the remaining $300 instead of the requested $450 (90% of $500).

In the Basic Settings you can also select the type of orders to be sent to the exchange:

- Market orders, which allow you to take a position "no matter the cost".

- Limit orders, which allow you to take a position at a fixed price.

Limit orders have more than 3 modes:

- The "Block price" mode: mode that allows you to take a position at the price of the asset at the moment the block is triggered

For example: "Take a short position on BTC at the current price" - The "Custom Price" mode: mode that allows you to take a position at a pre-determined price.

For example: "Take a short position on BTC at $17,000". - The "Deviation" mode: mode that allows you to take a position at a price deviated by X% from the current price.

For example: "Take a short position on BTC at current price -0.5%".

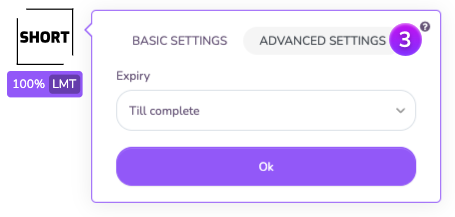

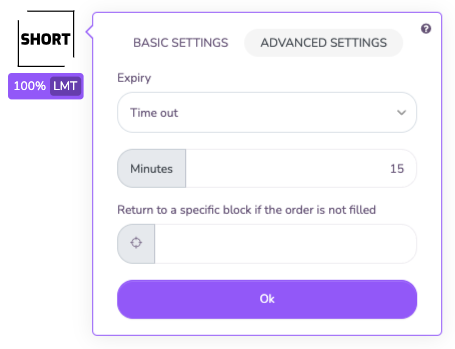

The "Advanced Settings" tab allows you to set the lifetime of your order. An order can be valid until its completion or it can have a validity period.

- Valid "until completed" means that the block will wait indefinitely for the order to be completed before moving on.

- Valid "until expiry" means that the order will have an expiration date. This means that if the order is not fully completed by the end of its validity period, it will be aborted and the strategy will continue.

Note : it is possible to tell your strategy to change its behavior in case of expiration, for example to execute a particular action, to repeat the purchase, to take another path etc... To do this, select a failover block by clicking on the small viewfinder and selecting the desired block.

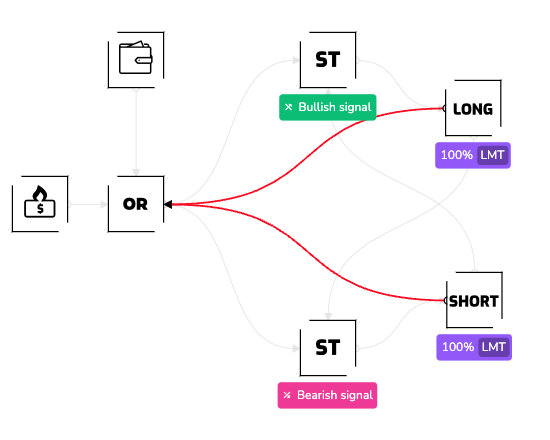

Visualizer

You can press the "F" key to display the paths of the links in case of expired orders (failover).

Do not hesitate to join us on our Telegram and Discord as well as our other social networks to share your opinion and your feedback on the Kryll.io platform.

Happy Trading,

Website: https://kryll.io

Twitter: @Kryll_io

Telegram EN: https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord: https://discord.gg/PDcHd8K

Reddit: https://reddit.com/r/Kryll_io

Facebook: https://www.facebook.com/kryll.io

Support: support@kryll.io