Launch date is a crucial factor

You may sometimes think that your Kryll strategy is not working well because other users share different results (or different BUY/SELL actions) while using the same strategy.

This is explained by a simple fact: the date and time of launch and other parameters of your strategy directly affect the actions it will take. That’s why you may not get the same results as someone who uses the same strategy. Keep in mind that even a small difference in the parameters or the launch situation can lead to completely different results.

Parameters that can influence the results of a strategy :

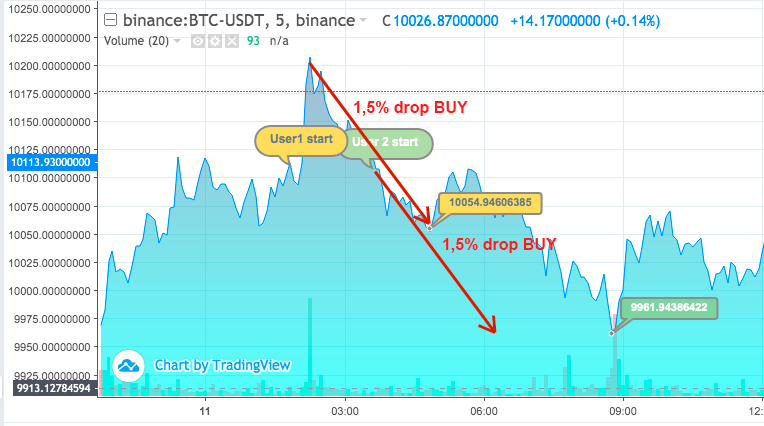

— Date/Time of launch: Many strategy creators use market evolution to conceive their strategies, whether they are upwards or downwards, the strategy will need to wait for the trigger designed by the developer of the strategy to be reached to continue its course.

— Entry point: As you probably know, in trading you have to buy from someone and sell to someone, it’s not like in video games where you just buy and sell to the computer. Thus, not all entry prices are the same, especially on low-volume pairs. Two same users will therefore be able to buy assets at the same time at slightly lower prices. This can ultimately lead to different behaviour and results. Note that this rarely happens if you have small amounts or use high volume pairs on a high volume exchange (such as $1000 on BTC/USDT in Binance).

— Allocated funds: On Kryll.io you can choose the funds you want to allocate to a strategy, but you can also choose to use both currencies in a pair. For example on KRL/ETH, you can start with 1 ETH and 0 KRL or 0.5 ETH and 69420 KRL. These launch parameters are important. They can profoundly modify the behavior of a strategy if the creator has used a “balance” block, which allows the strategy to behave differently depending on the starting wallet. It should also be noted that on a strategy not using this block, a mixed starting wallet can induce differences in terms of results.

— Pair volume: If the volume is really low and a dozen people use the strategy, it may happen that the price rises or falls suddenly, so that some people will not be able to buy or sell their assets on time. Kryll has no power over this and it’s just due to the fact that to trade a crypto, once again, you have to buy it or sell it to an existing entity. And these entities have limited funds at certain target prices. So be careful when choosing a strategy on a very low volume pair.

— Skipped orders: As we have already mentioned, sometimes orders cannot be processed because you do not have the necessary funds to complete the transactions (whether it is an insufficient amount or simply no funds at all). However, Kryll.io does not stop the strategy, it continues to work because sometimes it is also what the strategy developer wanted. But if the strategy skips a few orders, you won’t be able to have the same flow as those who didn’t have their orders skipped. This does not mean that the strategy is not working. It simply means that the flow is different because of the circumstances.

Example

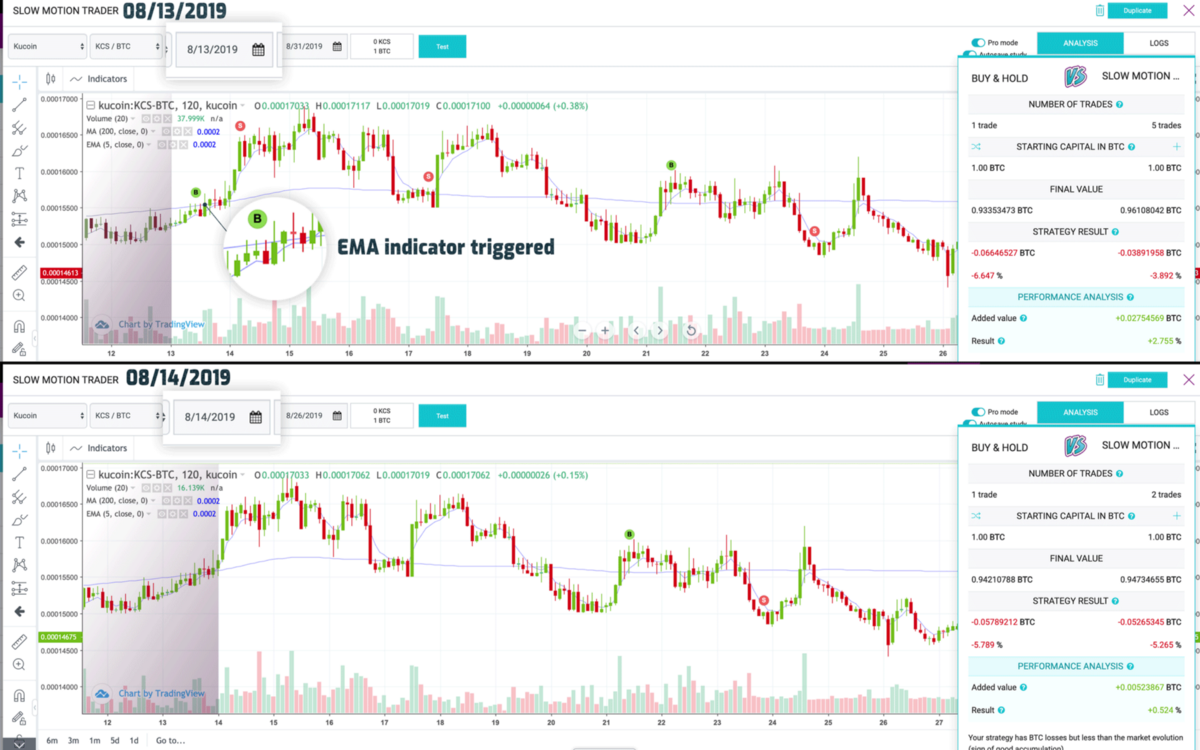

(with the screenshot below) : Let’s say you launched the Slow Motion Trader strategy in live trading on 8/13/19 on KCS/BTC pair. EMA indicator is triggered and initiates a BUY.

If you had launched the same strategy, on the same pair a few hours later (on 8/14/19) then the indicator would not have been triggered and your strategy would have followed another path with different actions and results for more than a week.

Be sure to follow us on all our social networks.

Our website: https://kryll.io

Twitter : @Kryll.io

Telegram : https://t.me/kryll_io

Discord: https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.zendesk.com