In crypto, obscurity can last for years… but the awakening is sometimes brutal. That's exactly what happened with Zcash (ZEC). Long relegated to the background of the market, the famous privacy coin experienced a genuine shock in recent days: its price went from $50 to over $150 in less than a week, representing a surge of more than +200%, propelling its market cap to nearly $2.5 billion.

A movement that reminded many of ZEC's historical volatility: launched in 2016 amid massive enthusiasm, it had quickly reached peaks before falling back into the shadows, victim of ruthless market cycles. Today, its spectacular return places it back at the heart of a broader dynamic: that of privacy coins, alongside projects like Dash or Monero, which are also benefiting from renewed interest.

The privacy coin paradox

Privacy-focused tokens live in constant tension. On one hand, they embody the very essence of the crypto ideal: protecting user privacy in a world where every transaction can be traced, and offering an alternative in the face of rising CBDCs and financial surveillance policies.

On the other hand, they are regularly targeted by regulators and exchanges, accused of facilitating illicit uses. The result: many exchanges have already delisted them, limiting their adoption and liquidity.

And yet, with each bull cycle, privacy coins return to center stage, driven by a simple conviction: the demand for privacy never truly disappears. It only strengthens as regulatory pressure intensifies.

Zk-SNARKs: Zcash's secret weapon

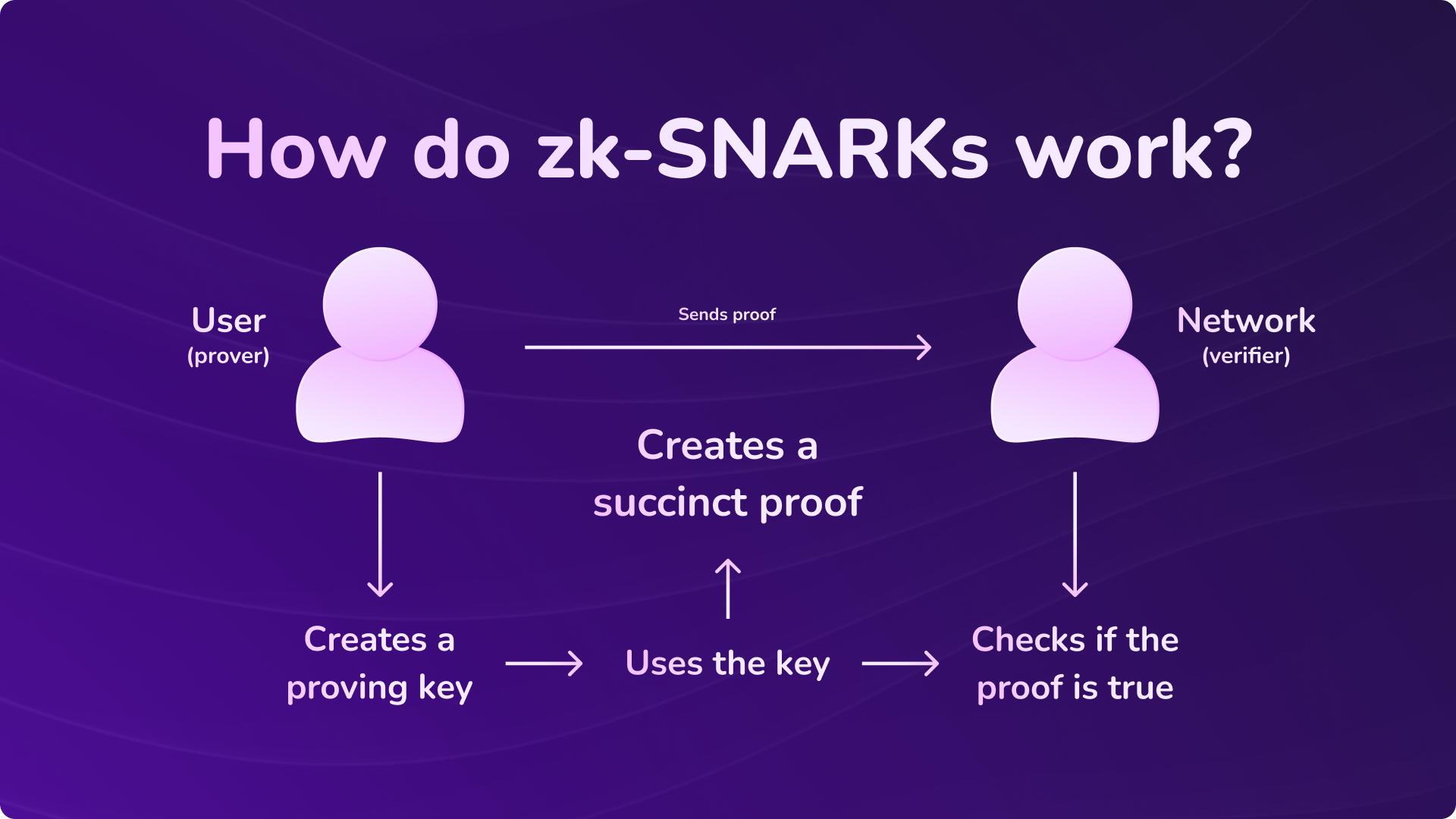

Beyond the hype, Zcash possesses a technological asset that has left its mark on the entire industry: zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge).

This is a cryptographic process that allows proving the validity of a transaction without revealing its content (amount, sender, recipient).

This mechanism made Zcash one of the pioneers of blockchain privacy, and has inspired numerous projects since. Even today, zk-proofs are at the heart of crypto innovation, used in Ethereum scalability solutions like zkSync or Starknet. In other words: Zcash hasn't just been a privacy player, but a technological precursor whose influence extends far beyond its own network.

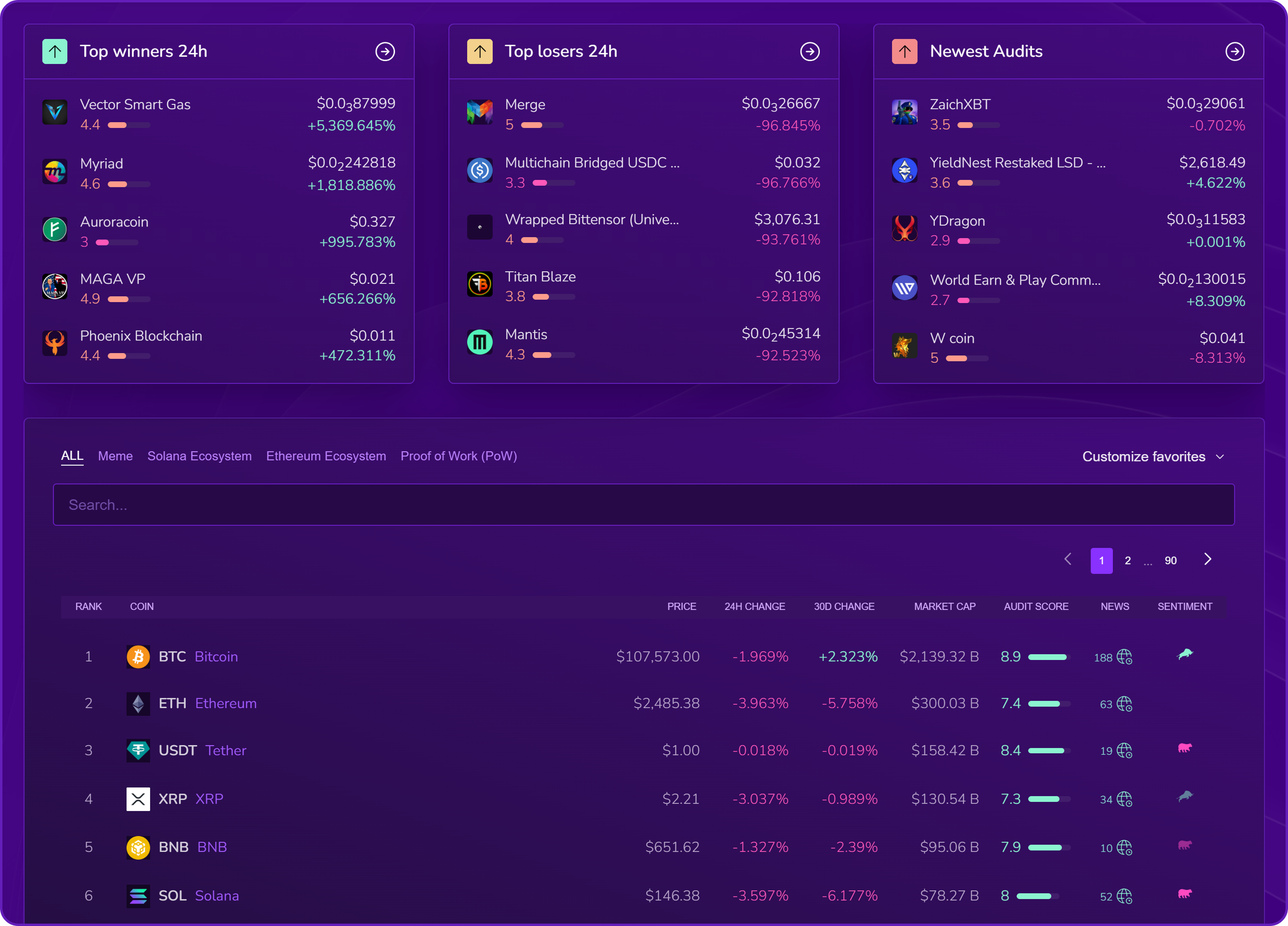

Beyond the pump: Zcash $ZEC's comprehensive X-Ray audit

Between spectacular surge, regulatory dilemma and technological legacy, Zcash is once again in the spotlight. But while the narrative is appealing, an investor cannot stop there. You need to scrutinize the real data: adoption, capital flows, on-chain signals, liquidity, and even the weaknesses that could undermine the trend.

That's exactly what Kryll X-Ray enables: putting each element under the microscope to conduct proper DYOR and evaluate $ZEC with full knowledge of the facts. Below, discover the complete audit of Zcash, section by section.

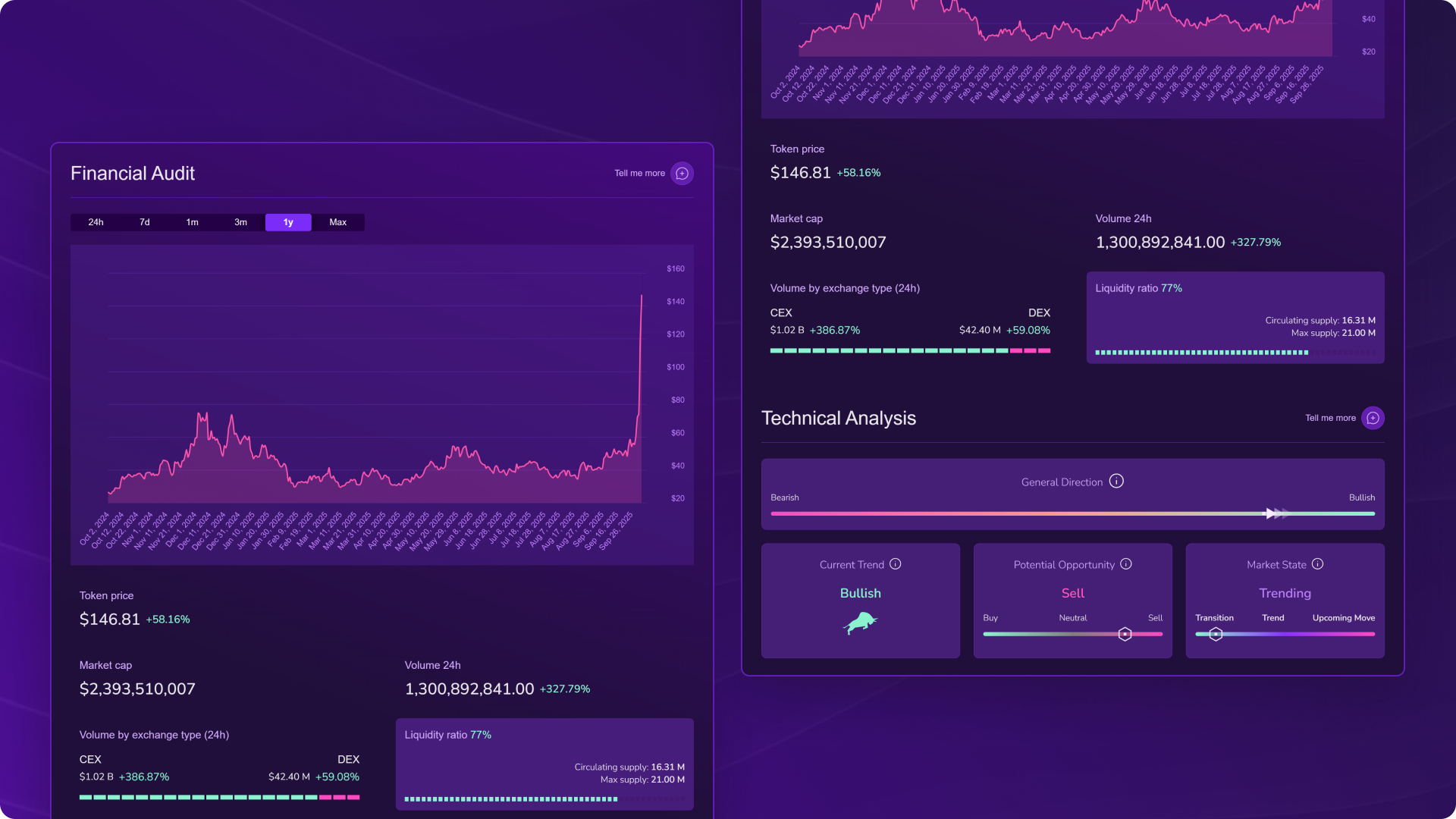

Financial Analysis: an explosive awakening driven by massive volumes

According to X-Ray, $ZEC displays impressive financial metrics:

- Current price: $146.81

- Market cap: $2.39 billion

- 24h volume: $1.30 billion

- Volume breakdown: largely dominated by CEXs, $1.02B vs $42.4M on DEXs

- Liquidity ratio: 77% → a large portion of tokens is already in circulation (16.31M out of 21M max supply)

👉 In concrete terms: ZEC is highly liquid, which means the price depends directly on exchanges between buyers and sellers, with no large stock of hidden tokens that could suddenly flood the market.

Technical Analysis: bullish trend but limited opportunity

Technical indicators reveal:

- General direction: bullish

- Current trend: upward

- Potential opportunity: sell signal (short-term overbought zone)

- Market state: trending, with ongoing movement

👉 Simple translation: the momentum is decidedly bullish, but after a +200% surge in a few days, the market could enter a consolidation phase or profit-taking.

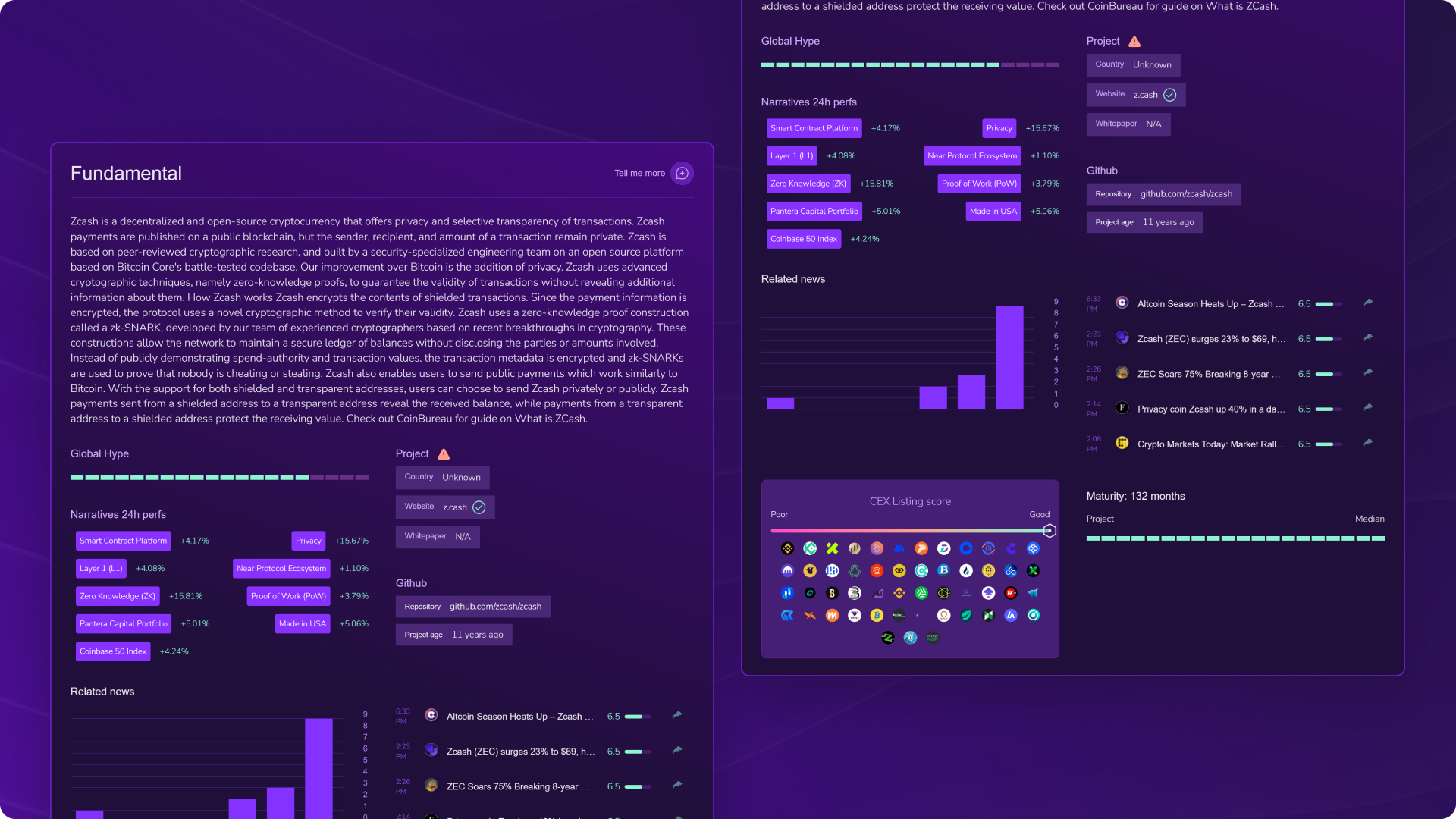

Fundamental Analysis: a technological veteran still influential

Zcash is not a newcomer: launched in 2016, it's based on a unique model combining transparent addresses and shielded addresses, and especially on its key innovation: zk-SNARKs. These cryptographic proofs allow validating transactions without revealing their content, a technology that has inspired numerous blockchain projects, including in the Ethereum ecosystem.

- Maturity: 132 months (11 years as a project)

- Whitepaper: unavailable in the audit

- Country of origin: unknown

- Github: active (official repository

zcash/zcash) - CEX Listing Score: excellent (presence on most major platforms)

- Rising narratives: Privacy (+15.67%), Zero Knowledge (+15.81%), Proof of Work (+3.79%)

👉 Despite its age, Zcash maintains strong narrative relevance: as a pioneer of zk-proofs, it's now benefiting from renewed interest in privacy technologies and growing mistrust of financial surveillance.

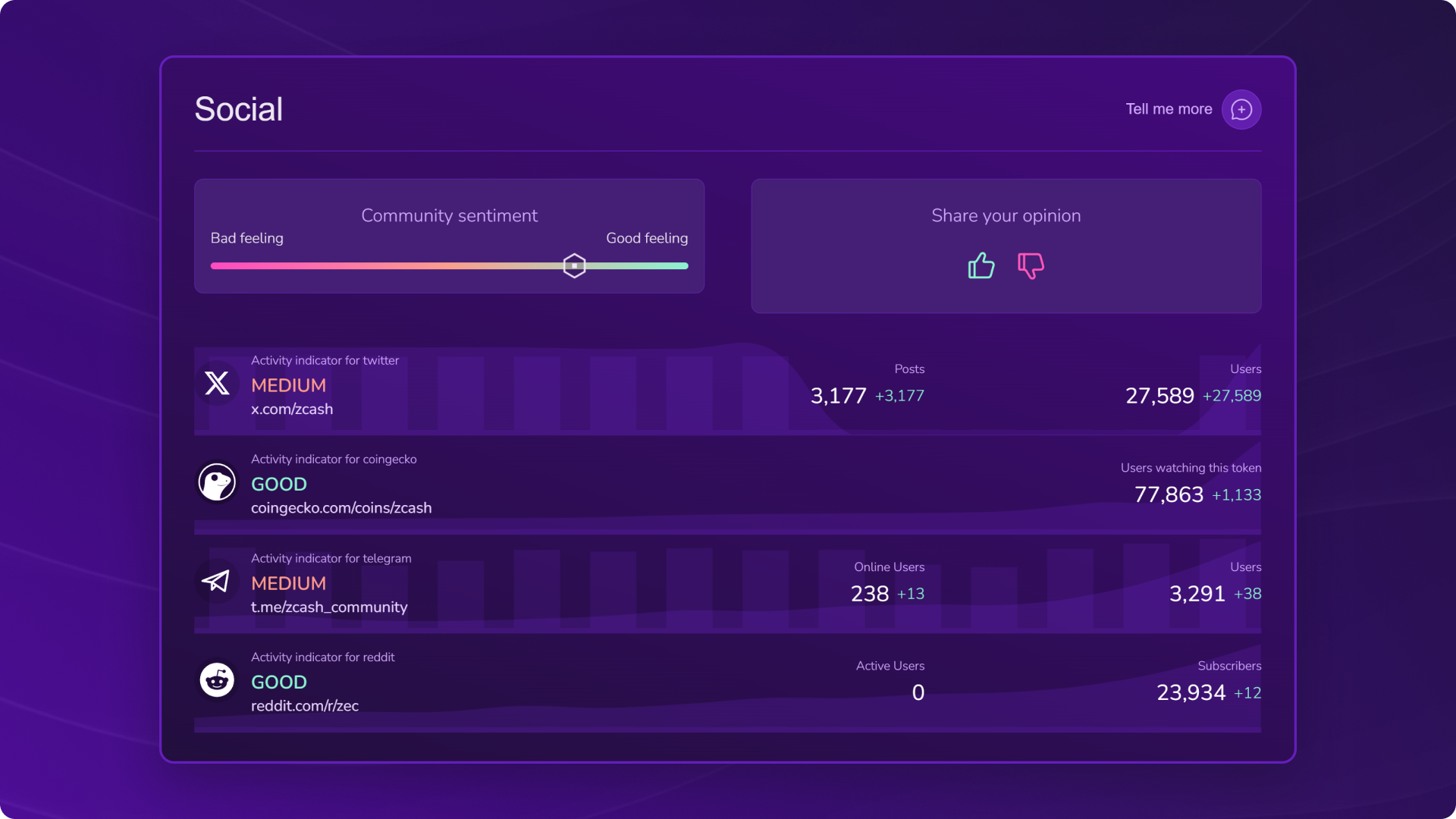

Social Analysis: solid traction but less massive than the leaders

The Zcash community shows decent activity, although lower than market giants:

- Twitter/X: average activity

- Coingecko watchers: 77,863

- Telegram: average activity

- Reddit: 23,934 subscribers

👉 Social traction exists, but remains modest compared to top 20 projects. However, we observe an activity rebound correlated with the pump, a sign that the community is waking up with the market.

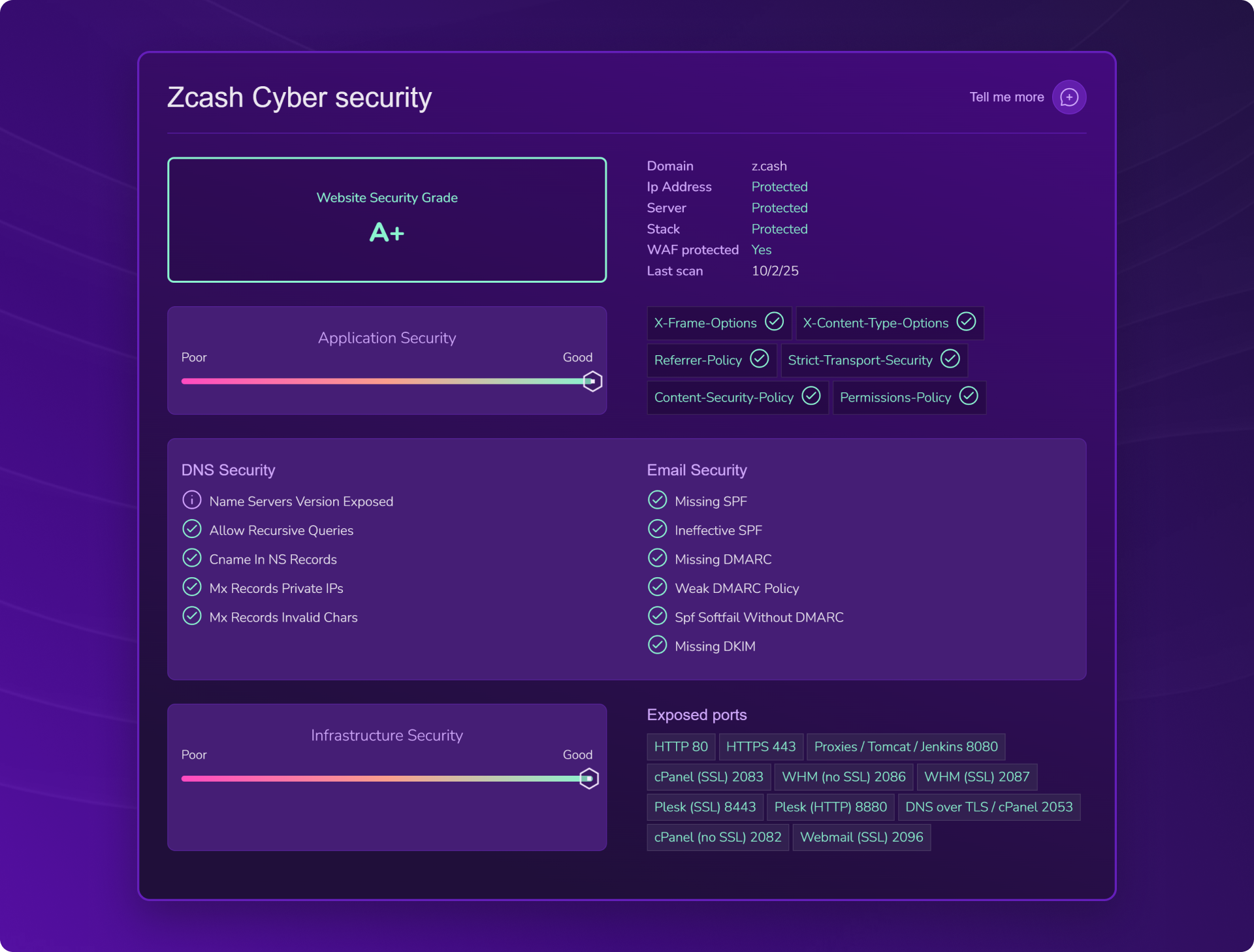

Cybersecurity: an exceptional A+ score

Zcash obtains an overall A+ grade, the best possible score, extremely rare in the ecosystem.

- Application Security: excellent (all critical headers enabled, such as CSP, HSTS, X-Frame-Options).

- Infrastructure Security: solid, no identified weaknesses.

- DNS Security: clean and transparent configuration

- Email Security: fully compliant, with operational SPF/DMARC/DKIM.

👉 In concrete terms: no major weaknesses emerged. Zcash demonstrates very high-level cybersecurity, a standard rarely achieved even by the most established projects.

The verdict: Zcash's strengths and weaknesses

Strengths:

- Spectacular pump with +200% in one week, supported by over $1.3 billion in 24h volumes

- High liquidity ratio (77%), limiting dilution risk and favoring a "real" price

- Pioneer of zk-SNARKs, a key technology of modern crypto

- Mature project (11 years) with strong technological influence

- Massive presence on CEXs and privacy/zero-knowledge narratives in full resurgence

- A+ Cybersecurity (very rare in the crypto ecosystem)

Weaknesses / Risks:

- Technical overbought signal: risk of correction after the pump

- Decent social traction but far behind market leaders

- Recurring regulatory pressure on privacy coins (delisting risk)

Conclusion

Zcash is not just a survivor from the first generation of privacy coins: it's a project that made crypto history by introducing a technology that has become central to the ecosystem, zk-SNARKs. Its spectacular +200% return in one week and nearly $2.5 billion market cap shows that the privacy theme remains a powerful driver, especially in a global context where financial surveillance is strengthening.

With solid liquidity, exemplary cybersecurity (rarely seen in the industry) and still-current technological relevance, ZEC demonstrates it still has a card to play. Certainly, volatility and regulatory pressure are part of the package, but those are the rules of the game for all privacy coins.

For investors, $ZEC is both a historical relic and a bet on the future of privacy in crypto. Its recent surge is a reminder that in crypto, some sleeping giants can wake up overnight… and challenge all market certainties.

Why use X-Ray?

DYOR is good. DYOR with X-Ray is better. Here's why this tool will drastically change your approach to the crypto market:

- ⚡ Instant complete audit: Get a clear overview of a token in seconds: smart contract, on-chain data, financial metrics, and social signals all in one place.

- 🔐 Enhanced risk detection: X-Ray immediately spots warning signals: trapped contracts, unlimited mint, concentrated holders, or security flaws on the project's website.

- 🧭 Considerable time savings: No more endless hours of research: X-Ray centralizes all critical data in one click.

- 🗣️ Accessible to everyone: The intuitive interface, clear visuals, and simplified explanations make the audit understandable regardless of your level.

- 💬 AI integration: Ask a question to the Kryll³ AI Agent to trigger an audit or deepen a point, without even opening the interface. 100% conversational, as if you were talking to a crypto expert with infinite knowledge.

- 📚 Continuous learning: Explore data and develop your crypto skills with each use. Every audit is a lesson.

With all these cross-analyses, X-Ray offers much more than a simple glance: it's a true intelligent dashboard, designed so everyone can understand, compare, and decide without getting lost in complexity.

| Criteria | Manual Audit 😩 | Audit with X-Ray 😎 |

|---|---|---|

| Ease | Complex | ✅ Ultra-simple |

| Time spent | Several hours | ✅ A few minutes |

| Risks detected | Variable | ✅ Automatically listed |

| Number of tools needed | Several dozens | ✅ All-in-one in X-Ray |

| AI Agent integration | None | ✅ Integrated |

How to access X-Ray?

Want to audit a token or do a quick check before investing? The X-Ray module from Kryll³ is here to simplify your life. Here's how to access it in seconds:

- Go to the X-Ray tab on the Kryll³ platform

- Connect your Web3 wallet to unlock all X-Ray features (Don't have a Web3 wallet? Click here)

✅ You're now on X-Ray!

All you have to do is enter the name or address of a token to launch the complete analysis and get a clear and synthetic audit of the crypto of your choice.