IMPORTANT: This article is about the old version of the Bollinger Band blocks available on the Kryll.io platform. You can find the updated documentation in this article.

Bollinger Bands® consist of a center line and two price channels (bands) above and below it. The center line is an SMA; the price channels are the standard deviations of the coin being studied. Please refer to this article for a complete explanation of this tool.

Bollinger Bands, how to use them in the Editor

In the pro mode you can develop your technical analysis and add the Bollinger Bands indicator.

How the Bollinger Bands block works?

This is a conditional block based on the %B indicator. This block allows you to trigger the sequence of actions of your flow according to the values of this indicator.

NOTE: This article is about the old version of the Bollinger Band blocks available on the Kryll.io platform. You can find the updated documentation in this article.

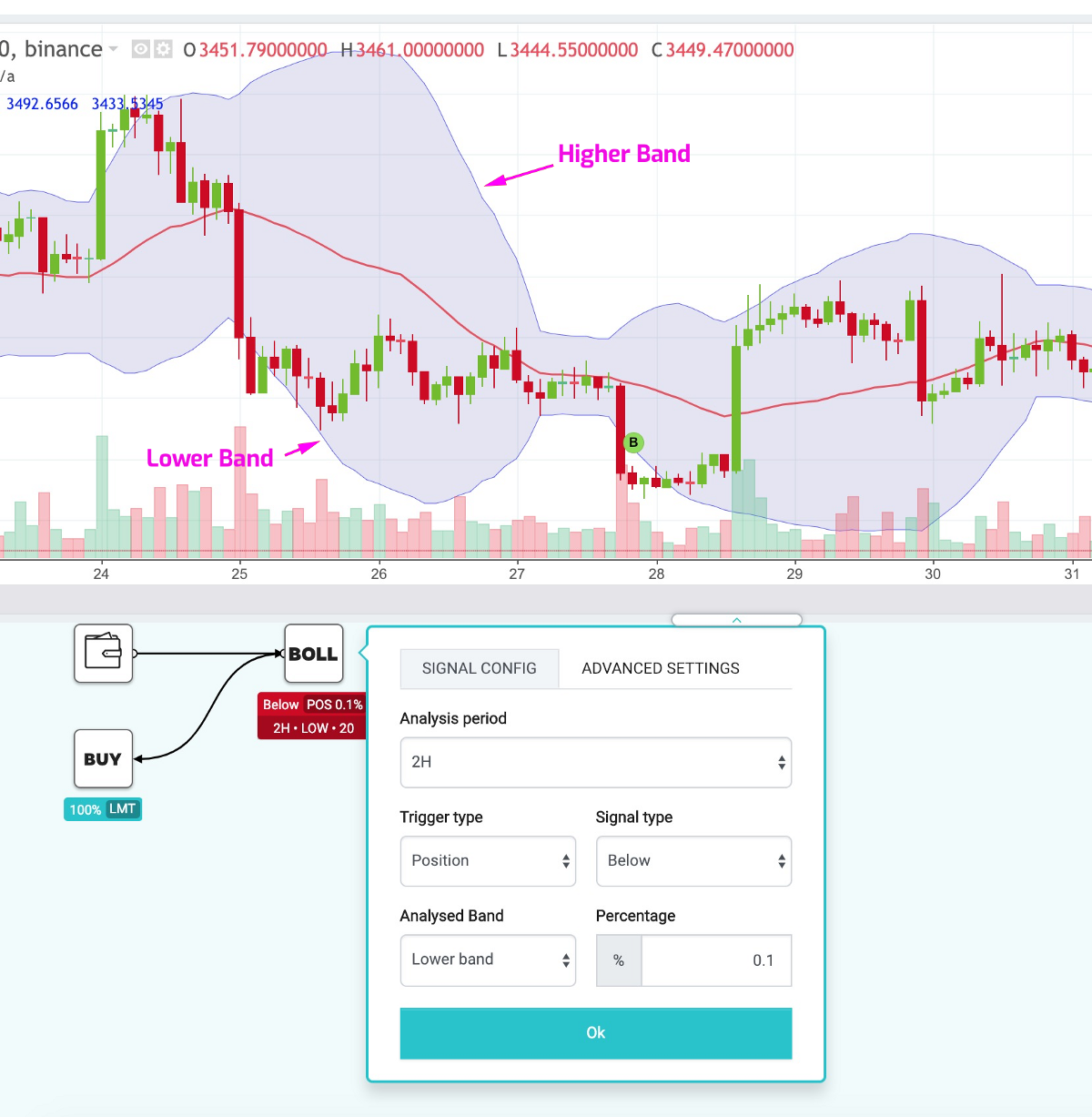

Analysis period: The period that BOLL will take into account (If you choose 4H, BOLL will use 4H candles).

Trigger type: Position or Crossover

— Position: Triggered when signal is above or below the analyzed band

— Crossover: Triggered when signal cross the analyzed band (middle, top or low)

Signal type: Define the type of signal to be analyzed, below or above selected band.

Analyzed Band: Select the type of band you want to analyze, the middle band (SMA), one of the 2 deviations band upper or lower.

Percentage: Minimum percentage to validate the Position, Crossover trigger.

Example

In the above image we can see that the BOLL block is triggered when the price goes under the lower BAND.

Because the signal type is Below, the trigger is Position (it could have worked with Crossover as well in this case) and we are analyzing the Lower Band, other bands are not analyzed in this example.

This Block can be really efficient combined with other block like MAs, more on Moving Average here.

There is a free strategy named “Super Bollingo” in the MarketPlace available using the BOLL, feel free to download it and to do your own experiments.

https://platform.kryll.io/marketplace

Conclusion

Bollinger Bands® do not constitute a standalone trading system. They are simply one family of indicators designed to provide traders with information regarding price volatility. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. He believes it is crucial to use indicators based on different types of data.

Happy Trading!

Be sure to follow us on all our social networks.

Our website: https://kryll.io

Twitter : @Kryll.io

Telegram : https://t.me/kryll_io

Discord: https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.zendesk.com