Dynamic Support and Resistance Block - This block is a "conditional block" that is triggered when the price approaches, crosses or bounces off a Moving Average based on various criteria.

Reminder of the basics

A moving average (or moving average) is an indicator used to analyze the evolution of a time series, removing transient fluctuations in order to highlight longer-term trends. This average is called a moving average because it is recalculated continuously, using a subset of elements in which a new element replaces the oldest or is added to the subset.

There are several types, Kryll supports the following moving averages:

MA: The simple moving average is an unweighted moving average. This means that each day of the data set has the same importance and is equally weighted. At the end of each new day, the oldest data point is removed and the newest is added to the beginning.

WMA: The weighted moving average is similar to MA, except that it adds importance to more recent data points. Each point in the period is assigned a multiplier (the highest multiplier is assigned to the most recent data point and then decreases in order) that changes the weight or importance of that particular data point. Then, just like the SMA, as soon as a new data point is added at the beginning, the oldest data point is eliminated.

EMA: The exponential moving average is very similar to (and is a type of) the WMA. The main difference with EMA is that the old data points never leave the average. To clarify, old data points retain a multiplier (although it decreases to almost nothing) even if they are outside the length of the selected data series.

SMMA: The smoothed moving average compares recent prices to historical prices and ensures that they are weighted and considered equally. The calculation of this indicator does not refer to a specific or fixed time period, but rather uses all available data in the series for analysis. The smoothed moving average differs from the exponential moving average (EMA) in that it is generally used over a longer period.

To learn more we recommend the tutorials on Investopedia and on Tradingview wiki.

Block configuration

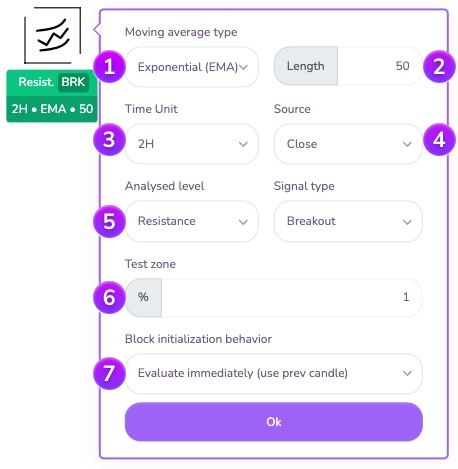

In the block parameters you can therefore configure your moving average constituting the dynamic support/resistance, as well as the price behavior condition from which you want to validate the block to move on.

Moving average type: Here you can specify the type of moving average you want to use: Simple (MA), Exponential (EMA), Weighted (WMA), Smoothed (SMMA).

Lengths: Specify here the length of your moving average. This is the number of candles that will be used for its calculation.

Time Unit: You can specify the Time Unit of the moving average on which you want the block to operate (ranging from minutes to months).

Source: Specify here the source of the candle data among the different options.

- Closing: Instantaneous value when the candle is closed.

- Opening: Instantaneous value when the candle opens

- Highest: Highest value of a candle

- Lowest: Lowest value of a candle

- hl2: Average between highest and lowest value of a candle

- hlc3: Average between highest, lowest and closing

- ohlc4: Average between opening, highest, lowest and closing

Analysis level: This is where you can specify the conditions for validating the block relative to the position of the price in relation to the moving average entered.

Two analysis modes are possible (consider the moving average as a support or as a resistance): The support analysis mode allows you to study the behavior of the price when it is above the moving average which then operates as a price holding zone. Conversely, the resistance mode of analysis allows you to study the behavior of the price when it is below the moving average, which then operates as a price blocking zone.

For each of these modes, 3 signals are available (test, break or rejection):

- Test: This signal triggers the block when the price enters the neutral zone, composed of a band around the moving average. The size of this zone is defined by the Test Zone parameter. For the condition to be valid, the price must close within the 'neutral zone' band.

- Breakout/Breakdown: This signal triggers the block when the price crosses the band around the moving average. The size of this zone is defined by the Test Zone parameter. In order for the condition to be valid, the succession of closing prices of the candles must cross from one side of the band to the other.

- Rejection: This signal is used to trigger the block when the price bounces on the band around the moving average. The size of this zone is defined by the Test Zone parameter. For the condition to be valid, the price must close inside the 'neutral zone' band and then return to close outside this zone on the side from which it originally came.

Test zone: Here you define the size in percentage (%) of the test zone around the moving average studied. You can thus bring more or less sensitivity to its triggering according to the analysis mode defined above.

Behavior at initialization: Here you can define the behavior of the block at its initialization. You can either wait for the current candle to close (option "Wait for next close"), or instantly evaluate the block conditions on the last closed candle (option "Evaluate immediately"). This last option is particularly useful to perform analysis on several time units in parallel or to analyze an indicator on a macroscopic time unit (12H / Daily / Weekly...) without blocking the strategy by waiting for a candle to close.

Join us on our Telegram and Discord groups as well as our other social networks to share your opinion and your feedback on the Kryll.io platform

Happy Trading,

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io