As Honoré de Balzac said: "The active investor must penetrate himself with this principle: he must learn to remain inactive". It is not the users of the Kryll.io platform who will contradict him! On the other hand, Mr. Balzac, allow us a little clarification on this maxim: the investor must rely on an effective strategy before allowing himself to remain inactive.

An effective strategy, as you may have guessed, is a winning strategy... but not only that! Every investor has already paid the price, investment or trading are disciplines that have an unfortunate tendency to play with our emotions. They can be positive, as after the explosion of the price of a nugget found during your in-depth research, or negative, as after refusing to sell because "it can still go up".

Kryll's strategy automation offers a wonderful brake on this emotional elevator: the rules are established at the launch and your investment plan will not suffer from your emotional impulses. It is therefore essential to take care in the elaboration of your strategy.

In order to do so, we present you today with three essential tools for all strategies:

- Take Profit to secure your profits

- Stop Loss to control your losses

- Trailing Stop, because yes it's true, "it can still go up"!

To best illustrate these three tools, let's start by creating a simple strategy.

An example of context

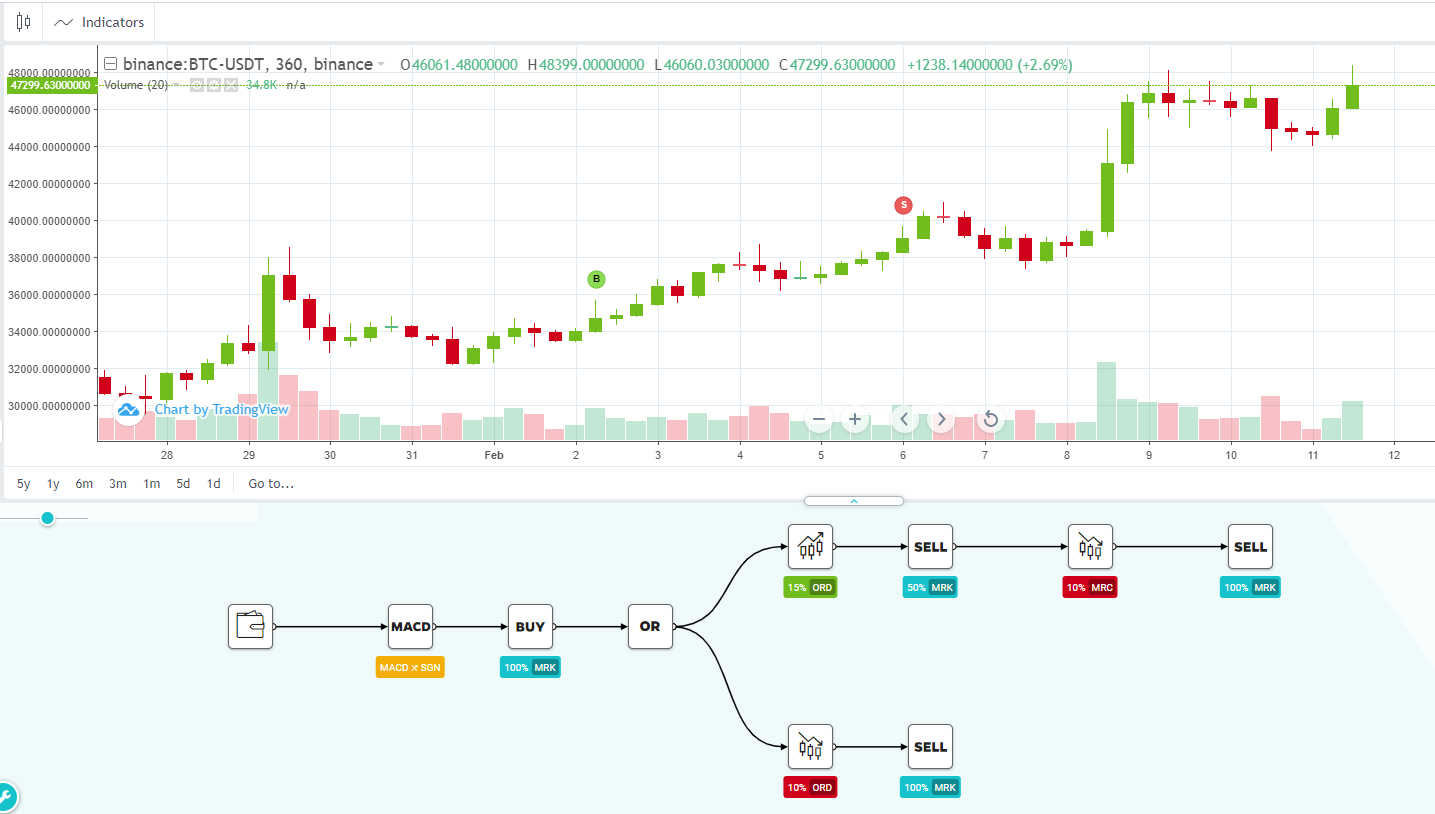

We are at the beginning of the year 2021, Bitcoin seems to be in good shape and Elon Musk continues to unleash the twittosphere with his sulfurous declarations. I read that the MACD indicator was rather effective on the BTC/USDT pair and I am now starting to develop my strategy.

If the signal line crosses its MACD upwards, a golden cross, I want to buy BTC with my USDT.

To do so, I placed a first "MACD" block with the appropriate parameters and then I added a "BUY" block.

The price goes up, so I have theoretically realized a capital gain... but for the moment this one is only virtual since I have not yet recovered anything on my initial investment.

Before perfecting this investment plan, a little essential reminder on how the strategies work. Visually, you can imagine the sequence of boulders as a river flowing down a mountain. Arriving at the first "MACD" block, the strategy waits until it meets its activation conditions before continuing on to the next block. By analogy, we can imagine that the river flowing down is blocked in a dam. When the conditions are met, we open this first dam and the water flows down until it is blocked in a second dam, here our "BUY" block. You see, it's as clear as crystal!

Come on, let's now resume the elaboration of our strategy.

Cash out your winnings with Take Profit

Knowing when to exit an investment by looking back is always easy. On the other hand, when it comes to live trading, things get more complicated! Let's remember: an effective strategy is a winning strategy. It is therefore essential to cash in your gains, even partially.

I therefore decide to add a rule to my strategy after the purchase: if the price goes up 15%, I want to resell part of my BTC in USDT to secure part of my investment. This operation is called a Take Profit.

To do so, I placed a first block "Price increase". Here I set the parameter "relative to : Price of the last transaction", my last transaction being simply my purchase of BTC. I then connected a second block "SELL" in which I chose to sell a portion of 50%.

That's it! So far my plan is going as planned and I have already made a profit on my investment. On the other hand, I'm starting to worry about the portion of BTC I have left. There are all kinds of news on social networks and they are not all good... What if the price of BTC collapses?

Stay in control of your losses with Stop Loss

To be a good investor, you have to be willing to lose. A profitable investor is an investor who manages to make the total amount of his gains exceed the total amount of his losses. To do so, it is necessary to minimize losses. The one who refuses to admit that he is wrong risks losing his entire investment thinking that he will eventually be right.

In the course of our career as investors, we are bound to make mistakes. Let's accept them without risk with Stop Loss! It will act as a safety barrier: if the price goes in the opposite direction to my prediction, I will recover the majority of my investment instead of letting it melt.

I decide to add a new rule to my strategy: if the price drops 10%, I close my position by selling all my BTCs against USDT.

To do this, I have slightly modified my strategy. I added an "OR" block to which I connected the Take Profit branch. In the same way, I connected a Stop Loss branch composed of the following string: a "Price Decline" block that I set to 10% of the price of the last transaction. I then connected a "SELL" block in which I decide to sell 100% of the remaining position, so that once the initial purchase is made, either the price goes up 10% and I sell 50% of my position, or the price goes down 10% and I cash in my losses by recovering 90% of my investment. That's great, even before launching my strategy, I can already set my maximum loss! So I can launch it serenely.

Well now that we've dealt with the case where things go wrong, let's move on to the third part of our tutorial. What if things went VERY well?

Allow yourself to dream with the Trailing Stop

Luckily, my analysis on the BTC course was good and my Stop Loss was not reached. And if the BTC price continues to climb towards the sky, wouldn't it be a shame to close my entire position and miss this great opportunity? No panic, we've thought of everything!

Sometimes prices can aget out of control and there is a valuable tool to maximize profits in these market configurations: the Trailing Stop, a clever mix of Take Profit and Stop Loss.

The Trailing Stop acts as a dynamic Stop Loss. Instead of cutting the position at a fixed price, for example 10% below the purchase price, it will cut the position at 10% below the maximum price reached by the market. It allows you to let your profits grow with the market growth and then cash them in if the market turns around.

A scheme is better than a long speech, here is a clear example.

I decide to launch a Trailing Stop with the following conditions: if the market falls by 10%, I close my position.

I now want to add a Trailing Stop to my previous strategy. After my first Take Profit, if the price continues to rise (by at least 1%) and falls by 10%, I sell my BTCs for USDT.

To do so, I added a "Price drop" block that I set to 10% in relation to the evolution of the market (reminder: for a Stop Loss, we would compare the price in relation to the last transaction). This way, the price can keep going up, up and up again! As long as it doesn't go down 10%, my profits will keep going up. Let's go to the BULL RUN!

To summarize we have built here a simple strategy:

- I buy BTC with my USDT at the next Golden Cross MACD

- I place a Stop Loss at 10% of my purchase price

- I place a Take Profit of 50% of my bet if the price goes up 15%

- I leave the remaining 50% in position with a Trailing Stop to secure the winnings no matter what!

This strategy is obviously very basic, but it has allowed me to illustrate the power of these three tools in your strategy development routine.

This strategy has been realized on Binance, but we remind you that other trading platforms are available on Kryll.io! For example, find our best strategies on Kraken, KuCoin, Bittrex or FTX and many others!

So, on your marks, get set, STRATEGATE!

Convinced? Join us now and get 30% off the platform for two weeks by clicking here!

Website: kryll.io

Twitter: @Kryll.io

Telegram EN:https://t.me/kryll_io

Telegram FR:https://t.me/kryll_fr

Discord:https://discord.gg/PDcHd8K

Facebook:https://www.facebook.com/kryll.io

Support:support@kryll.io