The Kryll Trading Terminal allows you to set up complex trades by simply scheduling your buy conditions, resale steps and stop-loss scenarios for your trades from an intuitive interface or directly from the Tradingview chart.

Retrouvez ce tutoriel en Français ici

Configure a Smart-trade

Suitable for novices and experts alike thanks to its many features, the Trading Terminal is the ultimate tool to enhance your manual trading.

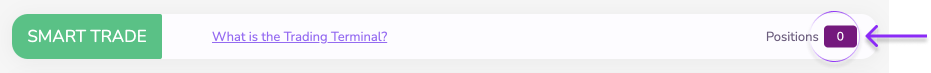

The Smart-trade button allows you to return to the terminal trading view when you are on the "Positions" view mode.

The Positions button allows you to see the status and configuration of your current and past trades.

The exchange and the pair you wish to trade on are selected here.

On this real time TradingView chart you will see your entry points, your profit taking zones and your stop-loss zones. These zones can be modified through the editing interface below the chart, but also directly on it. Simply move the label you wish to modify with your cursor and move it to the desired price level.

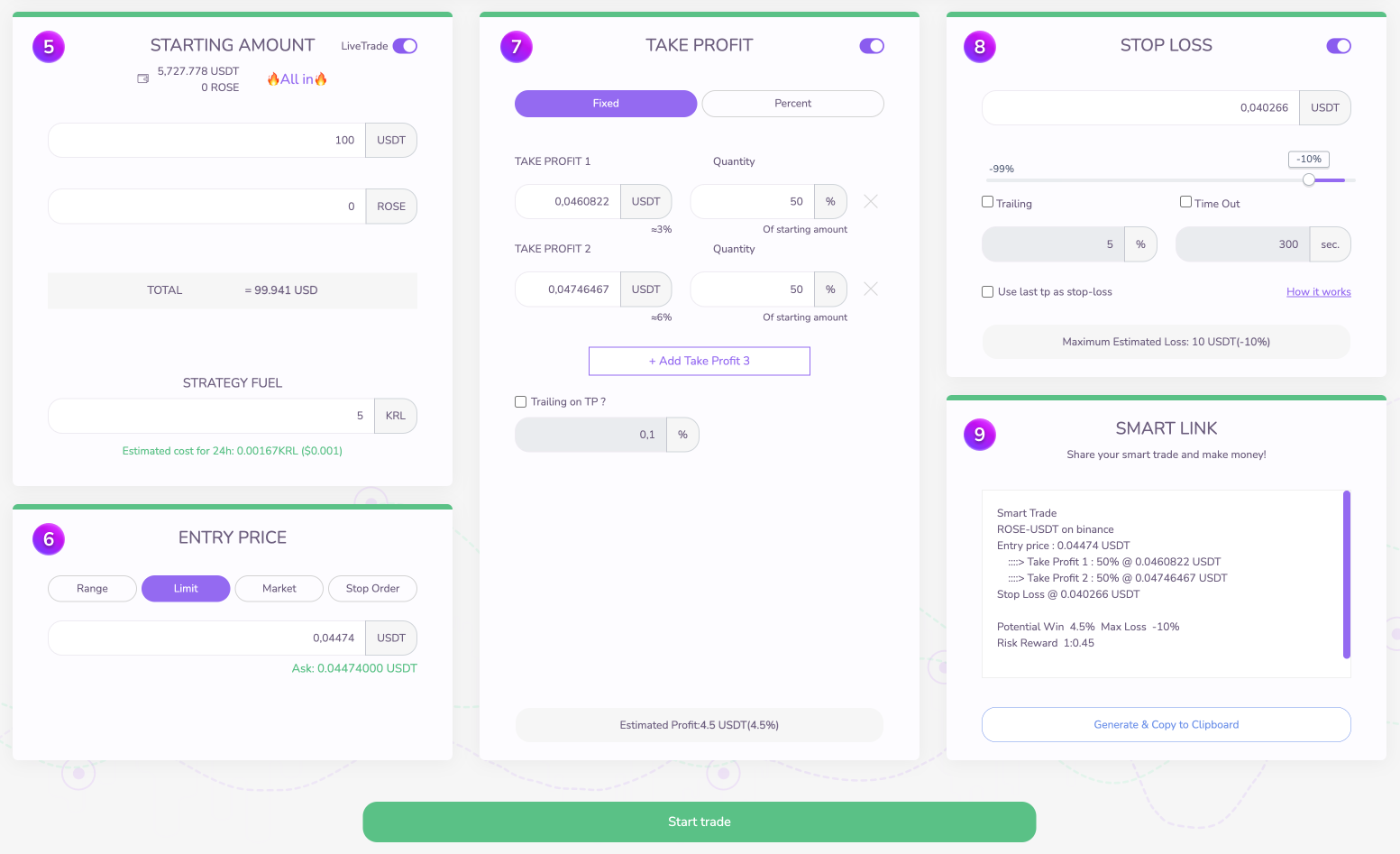

In the amount area you can define the amounts you want to allocate to the trade. It is also possible to allocate a part of already bought tokens to resell them on your future profit taking zones. Finally, specify the number of KRL you want to allocate to this trade to run the strategy.

It's time to set up your entry price if you haven't already done so on the TradingView chart. You will have the choice between entry at a defined price (Limit), entry at the market price (Market) and conditional entry on a zone (Stop Order - if the price reaches a certain zone). For added visibility, the best buy price (Ask) is available in real time.

Now it's the turn of the take profits to be defined: here you can activate up to 5 levels of take profits. There are two modes of Take Profit: these two modes allow to satisfy those who prefer targets in percentages as well as in real prices. For those who are more visual, you can move the Take Profit (and Stop Loss) lines directly on the chart!

Safety is the best weapon of an efficient trader, so activate your Stop Loss in this section. Several options are available:

- The first field is the value of your Stop-Loss in percentage and in exact value. If the price falls below this price, you will exit your position.

- You can choose to add a trailing stop to this stop-loss, in which case the trade will monitor the price and will be triggered if the price falls by the percentage defined since the entry of the position (purchase).

- For the more experienced, there is a Timeout option that will check if the price is still below your Stop-Loss after a certain time (expressed in seconds). A formidable weapon against stop loss hunters or "false breaks".

- Finally, in order to secure your gains, you can use the "Use last TP as stop-loss" feature. This way, every time the price touches one of your profit taking zones, the stop-loss is raised to the value of the previous zone. So, if the price touches your first TP, the Stop Loss will be moved up to your entry price; if it touches the second one, the Stop Loss will be moved up to the first profit taking zone etc...

The Smart Link section allows you to share a link to your smart-trade. When someone clicks on your link, it will automatically capture all your settings and they will just have to launch it. You will also receive a share of the fees that the user is charged, at no extra cost to them!

All you have to do is launch your trade and let the magic happen.

Tracking your positions

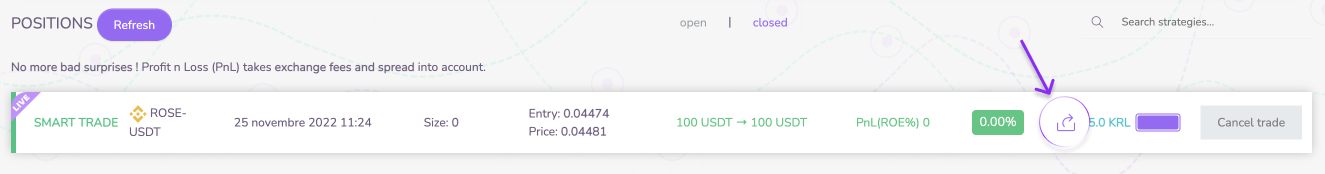

In order to track your current trades and study your past trades, go to the Positions page. On this page, you will find useful information about your open and closed positions.

By clicking on each of your positions, you can view the different parameters of this trade on the TradingView chart.

A function to share the results of your trades is available (the share icon) in order to share your success or failure with your community.

Good to know: A smart-trade is actually a pre-built kryll strategy. It will be visible in the running strategies tab and you will be able to study its source code. This is one way to learn how to use the Strategy Editor.

Feel free to join us on our Telegram and Discord groups as well as on our social networks to share your opinion and feedback on the Kryll.io platform.

Happy Trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io