Dollar Cost Averaging (DCA). It's a term you may have heard a businessman use on the radio, or you may be familiar with it if you've been investing for a few years.

As the old hands in finance will tell you, entering an unfamiliar market is usually very complicated. One is quickly caught up in the emotions, and the famous "Buy Low & Sell High" which seemed so obvious when looking at the price curves is quickly transformed into a "Buy High & Sell Low" which melts your capital and your mind.

We will therefore introduce you through this article a programmed investment method, and accompany you to use it in an intuitive way on Kryll.io . You will also understand that it is suitable for beginners as well as for more experienced investors wishing to invest large sums of money, and will constitute a superb alternative for diversifying your portfolio.

What is DCA?

Dollar Cost Averaging is an investment method that consists of investing a fixed amount of dollars (or any other currency, such as the Euro, for example, by automatic deposit through a sepa transfer) in a financial security at regular intervals, regardless of its price. This is a nice definition, but what does it mean in concrete terms?

An example is worth a thousand words, so let's take a concrete case.

The context

New to the crypto-currency world, I have $1000 that I want to invest in Bitcoin. The price goes up and down... So I don't know if the price will be higher in a month, but I'm convinced it will be in a few years.

The problem

How can I optimize my entry into Bitcoin? If I buy $1,000 worth of Bitcoin today and the price collapses tomorrow, then I'd better wait until tomorrow to buy! And if I finally wait until the next drop to invest and the price starts to soar, then I'll have missed the train again...

The solution

The DCA solves this problem. Since I can't predict the price in the short term, I'll just buy a fixed amount on a regular basis and smooth out my entry. Sometimes the price of Bitcoin will be high and I'll pay a bit more for it. In the end, the $1000 will be invested at an average price over time - in our case, for example, I could buy $100 worth of Bitcoin every month for ten months to reach my $1000 investment.

A money gainer

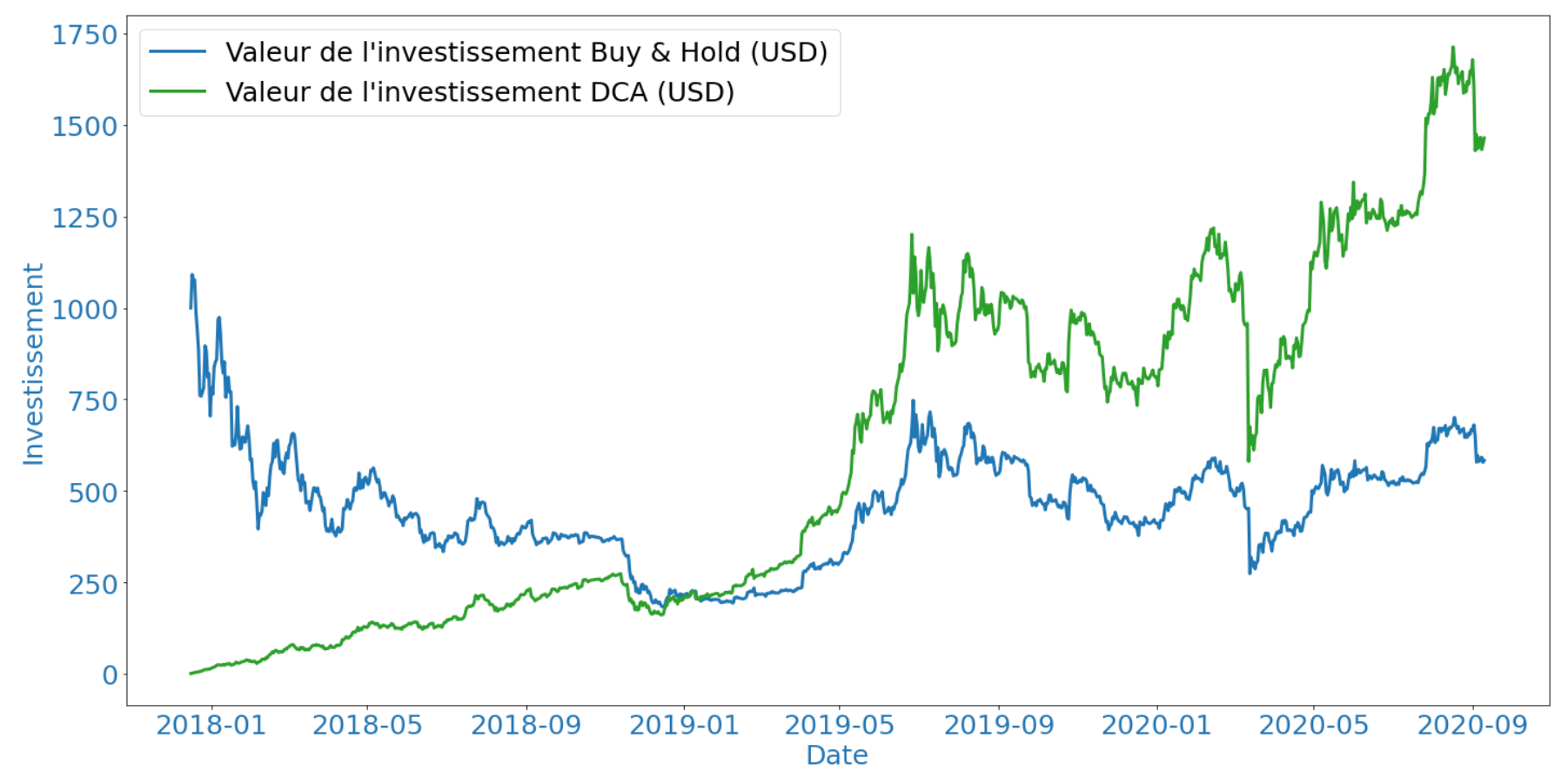

To illustrate the power of the DCA, here's a striking example: Let's say we started investing on top of the end of 2017, which was the worst time as Bitcoin was reaching its local peak.

If we had bought 1000 dollars worth of Bitcoin when it cost 20,000 dollars, we would still not have recovered our investment after almost 3 years, as we can see from the blue curve. On the contrary, we would still be losing a lot of money with only 600 dollars left.

Now let's turn to the case of DCA. If we had started to buy 1 dollar of Bitcoin per day from the same moment, 1000 days later (i.e. almost 3 years) we would have invested 1000 dollars, but our investment would have a value of more than 1500 dollars (green curve)!

Remember that this curve ends well before the start of the new Bull run, I let you imagine the rest...

The pluses

Performing your DCA on Kryll will also allow you to save on credit card fees or network fees that this type of service may incur, depending on the operator.Remember that the DCA is a technique also widely used by experienced investors because it allows them to invest large amounts of capital. Since the entry is smoothed out, potential losses are reduced, which suits both small and large institutional investors!

Saving time and peace of mind

In addition to being a particularly profitable investment strategy, Dollar Cost Averaging has two other major advantages over the long term: peace of mind and freedom!

Serenity

As you can see, the principle of the DCA is not to win quickly but to win gradually, over the long term. In terms of gains and losses, the DCA may make you win a little less, but it will also make you lose a lot less. In either direction, the movements are much less abrupt and ensure nice gains over the long term for the most patient. What a luxury to be able to keep a cool head and avoid futile concerns...

Freedom

All the rules for buying DCA are defined from the start and do not change over time. This may seem silly but it allows something precious in the world of investment: its automation on Kryll.io! What a luxury to be able to keep your free time to take care of your family or devote yourself to your passions...

That's a lot of information, let's take a moment to summarize.

If you set up a DCA to invest in Bitcoin over the next year:

- You use a strategy that is extremely hard to beat in terms of profits

- You stay cool with moderate changes in your capital

- You don't spend a second of your time in front of the curves once you've started

So what are you waiting for? Don't trade your life away!

The DCA with Kryll.io

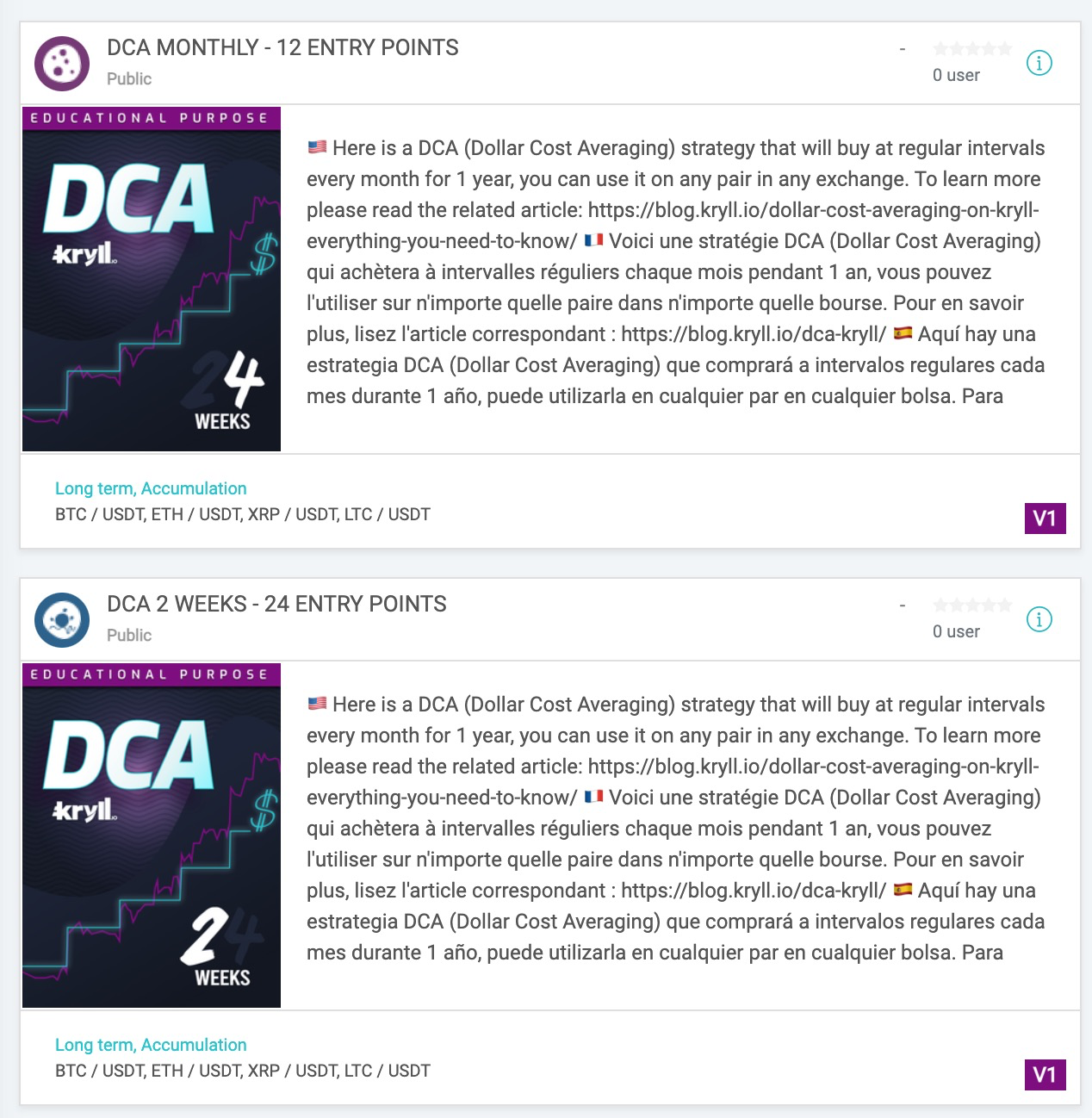

Now that you are convinced, let's see how to launch a DCA on Kryll.io. We have concocted two different strategies for you: a strategy that makes one purchase per month for 12 months, and one that makes one purchase every fortnight for 12 months.

To launch your DCA, all you have to do is choose the pair you want to invest in, select the exchange where your funds are located, enter the total amount allocated to your strategy and then launch it!

If you don't have the total capital you want to allocate to your DCA at launch, you can always opt for solutions with monthly debit to your bank card. However, beware of the fees! These will be much higher than the Kryll fees and can reach up to 10% depending on the operator.

2 free DCA strategies in the Kryll MarketPlace!

2 DCA strategies are available in the MarketPlace, they are free (you only pay the platform fees) and you can copy the source code to eventually make them evolve if you feel like it.

Conclusion

There is no right or wrong time to invest, there are only right strategies to adopt!

Happy trading!

Website : https://kryll.io

Twitter : @Kryll.io

Telegram EN : https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Discord : https://discord.gg/PDcHd8K

Facebook : https://www.facebook.com/kryll.io

Support : support@kryll.io