Introduction

In the dynamic world of cryptocurrency, trading bots have emerged as powerful tools for traders. These automated systems, designed to execute trades on behalf of their users, are revolutionizing the way we interact with digital currencies. They offer the potential to maximize profits, minimize risks, and operate 24/7 in the volatile crypto markets. But how do they work? And more importantly, how can you leverage them to your advantage? This comprehensive guide will delve into the intricacies of crypto trading bots, shedding light on their mechanisms, benefits, and how to effectively utilize them in your trading strategy.

The key to success in the crypto realm lies not just in understanding these tools, but in strategically deploying them to navigate the ever-changing digital currency landscape.

Understanding Crypto Trading Bots

Definition and Purpose

Crypto trading bots are software programs designed to interact with cryptocurrency exchanges directly, placing buy or sell orders on your behalf based on the market data they analyze. These bots work by leveraging various forms of data, including trading volume, orders, price, and time, and applying this data to rules that traders set up within the bot. The primary purpose of these bots is to automate as much of the trading process as possible, eliminating the need for constant manual oversight and allowing traders to take advantage of market opportunities that may arise at any time.

Types of Crypto Trading Bots

There are several types of crypto trading bots available, each with its unique features and capabilities. Here are a few common types:

Technical Analysis Trading Bots: These bots are designed to analyze charts and execute trades based on predefined technical indicators. They save traders the time and effort of charting and can act almost immediately based on the metrics they observe. Some of the best performing technical trading bots for crypto are accessible on Kryll.io.

Arbitrage Bots: Arbitrage bots take advantage of price differences between different cryptocurrency exchanges. They buy low on one exchange and sell high on another, profiting from the price discrepancy.

Rebalance Bots: These bots help manage and rebalance a trader's portfolio according to their strategy and risk tolerance.

Market Making Bots: Market making bots place multiple buy and sell limit orders to profit from the spread. They contribute to market liquidity and can profit from even the smallest price fluctuations.

Remember, while crypto trading bots can offer numerous benefits, they also come with their own set of risks and challenges. It's essential to understand how they work and use them responsibly.

Market Data Analysis

The first step in the operation of a crypto trading bot is market data analysis. Bots are programmed to collect and interpret vast amounts of raw market data. This data includes price movements, trading volumes, on-chain metrics, and other relevant market indicators. The speed and efficiency of bots in this process far exceed human capabilities, enabling them to identify potential trading opportunities swiftly.

Signal Generation

Once the market data has been analyzed, the bot moves to the signal generation phase. Here, the bot uses the analyzed data to make predictions and identify potential trades. These signals are based on the predefined trading strategies set by the user, which can include technical analysis indicators, market trends, and other factors.

Market Risk Prediction

In the market risk prediction phase, the bot uses the analyzed market data to calculate potential market risks. This calculation is based on a predefined set of parameters and rules set by the user. Depending on the calculated risk, the bot decides how much to invest or trade.

Execution

The final stage is execution. Here, the bot uses APIs (Application Programming Interface) to execute buy or sell orders on the cryptocurrency exchange. These orders are based on the signals generated by the preset trading system. The bot can either execute these trades automatically or send signals to the user for manual execution.

Benefits of Using Crypto Trading Bots

Crypto trading bots offer several advantages over manual trading. One of the most significant benefits is their ability to operate 24/7. The cryptocurrency market never sleeps, and significant price movements can happen at any time. Bots can monitor the market continuously and execute trades even when the user is asleep or away.

Another advantage is the elimination of emotional trading. Human traders are often influenced by emotions such as fear and greed, which can lead to poor trading decisions. Bots, on the other hand, operate based on predefined rules and strategies, eliminating the possibility of emotional trading.

Furthermore, crypto trading bots can execute trades much faster than humans. In a volatile market like cryptocurrency, speed is crucial. A delay of even a few seconds can result in missed opportunities or increased losses. Bots can execute trades almost instantly, giving them an edge over human traders.

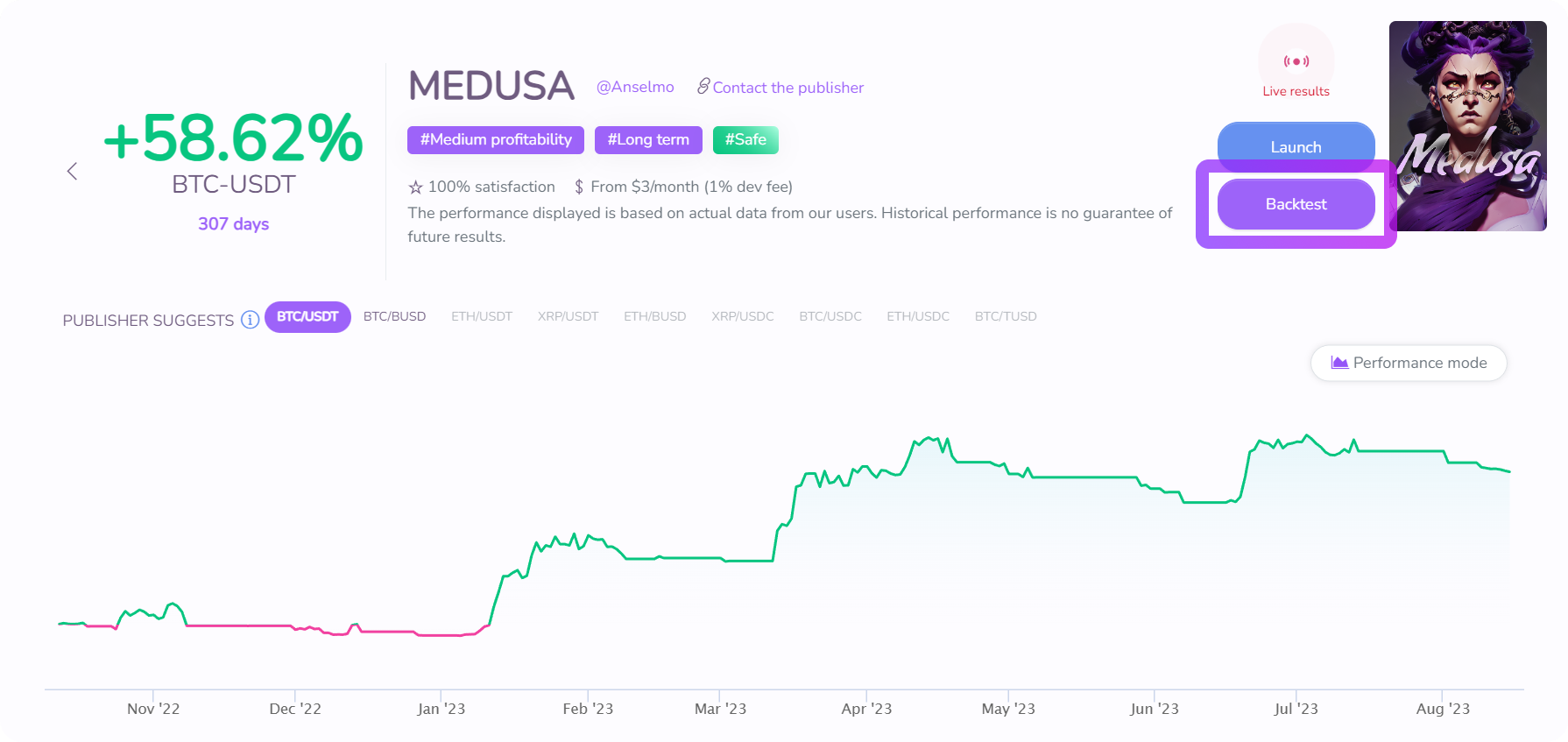

Lastly, crypto trading bots allow for backtesting. Backtesting is a process where trading strategies are tested on historical market data to determine their effectiveness. This feature allows users to refine their strategies before implementing them in live trading.

In conclusion, while crypto trading bots are not a guaranteed path to profits, they can be a valuable tool for traders. By automating trading processes, reducing emotional trading, and allowing for strategy backtesting, bots can potentially enhance a trader's profitability and trading efficiency. However, it's crucial to remember that successful trading also requires a deep understanding of the crypto market and sound risk management strategies.

Choosing the Right Crypto Trading Bot

Factors to Consider

User-friendliness: Ensure that you can understand and utilize the bot’s technology successfully. The interface should be intuitive and easy to navigate, even for beginners.

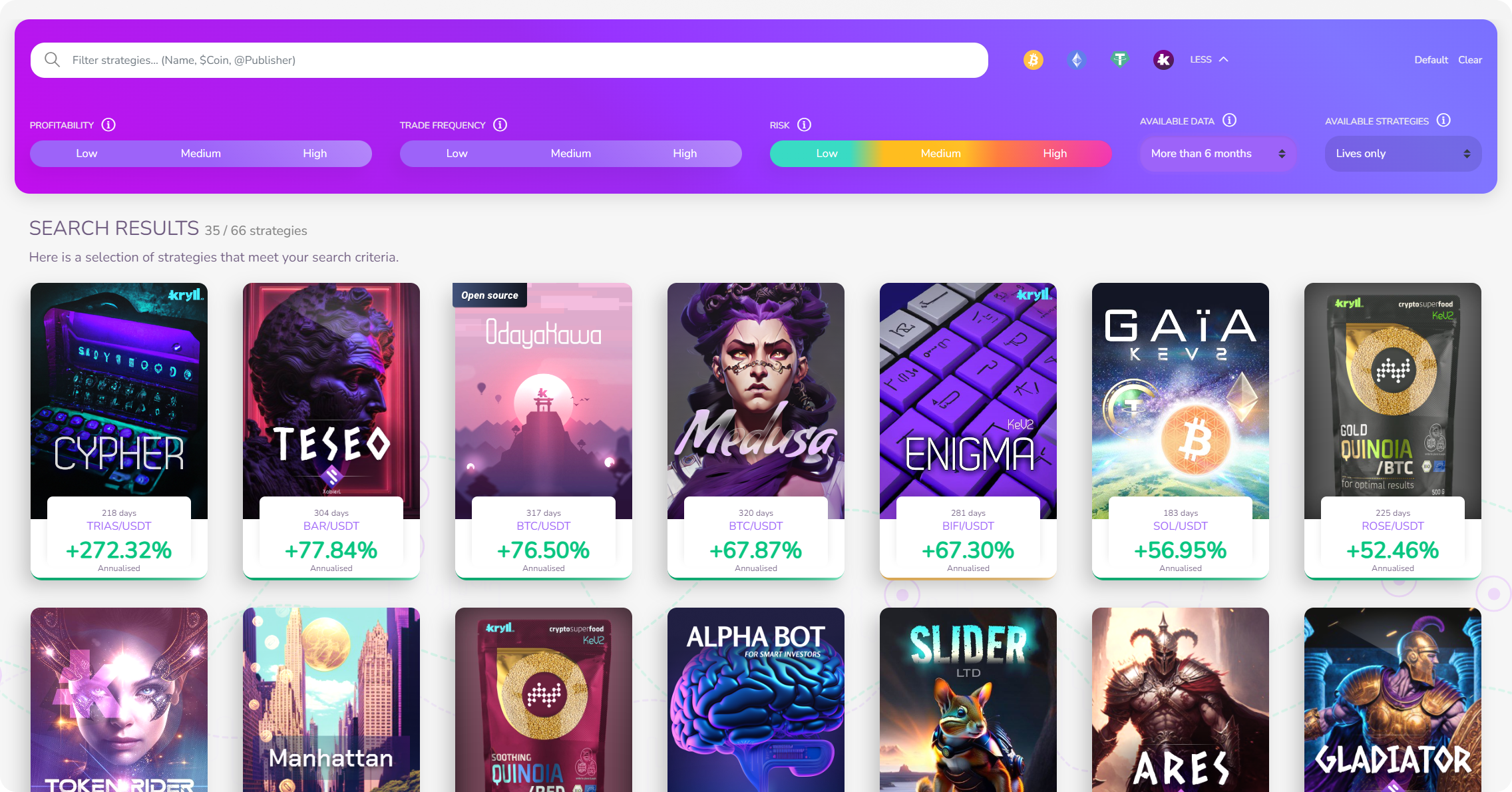

Strategies: The platform should offer a variety of trading strategies to meet your needs. If you're new to trading bots, you can find efficient trading bots on the Kryll platform

Cost: Look for a bot whose fees are clearly stated and upfront, with no hidden costs. Some bots charge a monthly, annual fee or have a pay as you go program.

Development Team: Do your research on the development team of the bot or platform—their contact information, support team, and website profile. A reliable and responsive team can be a significant advantage.

Reviews: Read the reviews. What are other users saying about the platform? User experiences can provide valuable insights into the bot's performance and reliability.

Popular Crypto Trading Bots

There are several popular crypto trading bots in the market. Some of these include:

Kryll.io: Kryll has topped the charts as a top crypto trading bot building tool and marketplace since 2017 and continues to deliver with its user friendly interface and vast array of tools that can be used by beginners and pros alike.

StoicAI: Known for its user-friendly interface and a variety of pre-programmed strategies, StoicAI is a good choice for both beginners and seasoned investors.

eToro: eToro is not just a crypto exchange but also offers a robust trading bot functionality.

Remember, the choice of a trading bot should align with your trading strategy, risk aversion, and technical expertise.

Setting Up a Crypto Trading Bot

Once you've chosen the right bot, the next step is setting it up. Here's a general guide on how to do it:

Connect your exchange or wallet to the trading bot: Most bots will provide a simple process to link your crypto exchange account or wallet to the bot. This usually involves generating an API key on the exchange and inputting it into the bot.

Select your strategy and allocate funds: Decide on the trading strategy you want the bot to implement. This could be anything from simple price threshold trades, trade frequency to more complex algorithmic strategies. Also, decide how much of your crypto should be managed by the bot.

Set the parameters: This involves setting the rules that guide how the bot will trade. These parameters can include things like the specific coins to trade, the price at which to buy or sell, and the volume of coins to trade at a time.

Review and launch: Review the rules you've set and make sure they align with your trading goals. Once you're satisfied, set the bot live.

Remember, setting up a crypto trading bot requires a good understanding of the crypto market and the specific bot's functionalities. Always start with small amounts until you're confident in the bot's performance.

Risks and Challenges of Using Crypto Trading Bots

While crypto trading bots offer numerous advantages, they also come with their own set of risks and challenges that users should be aware of.

Dependence on Bot Efficiency

The efficiency of a crypto trading bot is dependent on the accuracy of the strategy it is programmed to execute. If the strategy is flawed, the bot will make poor trading decisions, leading to potential losses. Therefore, it's crucial to thoroughly test a bot's strategy before deploying it for live trading.

Market Volatility

Crypto markets are highly volatile, and while bots can handle some aspects of this volatility, they cannot predict or react to all market changes. For instance, bots cannot predict news events or sudden market crashes. In such situations, a bot might continue trading based on its pre-set rules, which could lead to significant losses.

Technical Glitches

Like any software, crypto trading bots are not immune to technical glitches. If a bot experiences a glitch during a critical trading period, it could fail to execute trades properly, leading to potential losses.

Security Risks

Crypto trading bots require access to your cryptocurrency exchange account. This access is usually granted through API keys, which can be a potential security risk if they fall into the wrong hands. It's essential to ensure that the bot you're using has robust security measures in place like 2FA keys.

Conclusion

Crypto trading bots can be a valuable tool for traders, offering the ability to automate trading strategies and take advantage of market opportunities around the clock. However, they are not a guaranteed path to profits and come with their own set of risks and challenges. It's crucial for users to understand how these bots work, the strategies they employ, and the potential risks involved before diving in.

In the end, the effectiveness of a crypto trading bot will largely depend on the soundness of its underlying strategy and the user's understanding of how to properly configure and manage the bot. As with any investment strategy, it's always recommended to do thorough research and consider seeking advice from financial professionals before diving in.

Remember, while crypto trading bots can provide a significant advantage, they are not a substitute for a comprehensive and well-thought-out investment strategy.

Frequently Asked Questions

In this section, we will address some of the most common questions that users have about crypto trading bots.

Can I Create My Own Trading Bot?

Yes, it is possible to create your own trading bot. However, this requires a significant amount of technical knowledge and programming skills. The most commonly used programming languages for developing trading bots are Python and JavaScript. If you are not a skilled developer, it might be more beneficial to choose a pre-made crypto bot. If you don't have these skills, there are no-code Drag&Drop solutions like the Kryll strategy editor.

Do Crypto Trading Bots Cost Money?

Most crypto trading bots do come with a cost. Some charge a monthly, annual fee or charge as they are being used. It's important to understand the cost structure of the bot before you sign up. Make sure there are no hidden costs and that the fee is within your budget. Remember, the goal is to make money, not to spend it all on a bot. Kryll.io, for example, offers a transparent pricing model with no hidden costs.

How Do I Setup a Crypto Trading Bot?

Setting up a crypto trading bot varies between different bots, but they generally follow three simple steps. First, connect your exchange or wallet to the trading bot. Second, select the strategy you wish to implement and how much of your crypto should be managed by the bot. Third, review the rules chosen and set the bot live. Some bots, like Kryll.io, offer a user-friendly interface that makes the entire process easy, even for beginners.

Disclaimer

The information provided in this article is for informational purposes only and should not be considered as investment advice. Cryptocurrency trading involves risk, and it's possible to lose all your money in an instant if the market moves against you. It's recommended to conduct your own research and consult with a financial advisor before making any investment decisions. The use of trading bots does not guarantee profits and you should only invest what you can afford to lose.

Happy Trading,

Website: https://kryll.io

Twitter: @Kryll_io

Telegram EN: https://t.me/kryll_io

Telegram FR: https://t.me/kryll_fr

Telegram ES: https://t.me/kryll_es

Discord: https://discord.gg/PDcHd8K

Reddit: https://reddit.com/r/Kryll_io

Facebook: https://www.facebook.com/kryll.io

Support: support@kryll.io